SEC releases "new annex" to put pressure on Binance, "will defend its position"

Written by: Weilin

Editor: Wen Dao

U.S. Securities and Exchange Commission (SEC) v.BinanceThere is new progress in the case.

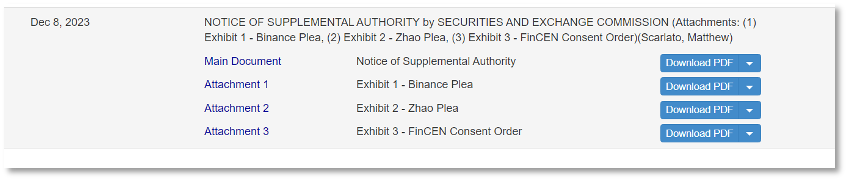

12 月 8 日,在美国法律文件网站 CourtListerner 上,币安与美国司法部、金融犯罪执法网络(FinCEN)等监管机构达成和解的三份详尽文件被公开,值得注意的是,提交者显示为 SEC,该证券监管机构并不在币安与美国监管部门和解的机构列表中。

In June this year, the SEC filed a civil lawsuit against Binance, accusing Binance of being an unregisteredexchange, illegally supplying and selling securities to U.S. investors, etc. The above three documents were officially included in the latest public appendix by the SEC. In the third document, the SEC also requested the judge to make a judicial determination on a series of "new evidence of guilt" in the settlement agreement.

The SEC’s “pressure” attitude is obvious. The agency has been rejecting Binance’s request to withdraw the lawsuit. In response, Richard Teng, the new CEO of Binance, responded in a Chinese article on December 12.CommunityIn response to the question, Binance will firmly defend its position. As the case is still under investigation, he did not respond further.

In these three documents released by the SEC, in addition to the fines and confiscations that are known to the outside world, the "influence of the ombudsman" on Binance, which the outside world is very concerned about, is also detailed in these documents.

The document shows that multiple departments under the U.S. Department of Justice and regulatory agencies such as FinCEN will exercise supervision over Binance in the next 3-5 years by hiring third-party monitors. Judging from the duties and qualifications of the monitors, they are not government officials, but are hired by Binance, and their work mainly involves anti-money laundering (AML) compliance and sanctions compliance.

Richard explained that the core responsibility of the inspector is anti-money laundering, which does not involve specific businesses such as Binance's online assets, and will not violate Binance's principle of protecting user information.

Third-party monitors supervise anti-money laundering and do not involve user information

After Binance reached a settlement agreement with the U.S. Department of Justice, onlookers were surprised by the high fine of $4.3 billion, while non-U.S. users were more concerned about whether the supervisors who would soon be stationed in Binance to exercise supervisory power would have an impact on Binance's listing of crypto assets and users' trading of crypto assets, and whether user data would be exposed to regulators.

12 月 12 日,币安 CEO Richard Teng 在中文社区的 AMA 中回应,监察员的核心职责是反洗钱,不会对币安上线加密资产、用户交易加密资产产生影响,不会干涉币安的产品创新,也不会对币安保护用户信息和数据的原则产生任何影响。

Richard explained that the monitor is not a U.S. government official, but a third-party person hired by Binance who meets legal requirements and must maintain independence. "The main responsibility is to see how well we do in anti-money laundering, whether we comply with legal requirements, and whether we implement every clause in the agreement."

He mentioned that Binance has invested a lot of money and resources in anti-money laundering over the years. "From the perspective of industry standards, it is already very advanced, but we don't have the final say. When independent monitors come in, they will see more objectively whether our efforts are as we said."

Regarding data and privacy issues, Richard emphasized that when any regulatory agency makes an investigation request to Binance, Binance will only cooperate with legitimate law enforcement requests or court orders.exchangeThe same rules apply to everyone.”

So, is what Richard said true? The three settlement agreement documents between Binance and the U.S. Department of Justice and other regulatory agencies released by the SEC on December 8 just gave a clear answer.

Three documents released on December 8

According to the agreement, Binance agrees to hire a third-party monitor to perform the obligations during the term specified in the agreement. Binance and the procuratorate will make every effort to complete the selection process of the monitor within 60 working days after the signing of the agreement.

Judging from this cycle, the Ombudsman will not start supervising Binance until next year. The term of office of the Ombudsman required by the Department of Justice will be three years from the date of appointment. The term of office of the Ombudsman required by FinCEN is five years, and the two may be the same person.

The documents show that the monitor’s primary responsibility is to evaluate and monitor the company’s compliance with the terms of the agreement, including the company’s compliance program, policies, procedures, code of conduct, systems and internal controls, as well as its anti-money laundering and U.S. sanctions compliance programs, to clearly address and reduce the risk of recurrence of the company’s misconduct.

In certain circumstances, the Ombudsman should immediately report possible misconduct directly to the Office, rather than to Binance. Possible misconduct includes:Safety, public health orSafety, or the environment; involves the Company’s senior management; involves obstruction of justice; or otherwise poses a significant risk.

The Ombudsman will also be responsible for evaluating and monitoring the implementation of the agreements, including Binance’s senior management’s commitment to and implementation of Binance’s anti-money laundering (AML) and sanctions compliance programs, and evaluating and monitoring Binance’s compliance with the settlement agreement with the Office of Foreign Assets Control (OFAC), the settlement agreement with the Commodity Futures Trading Commission (CFTC), and the settlement agreement signed between Binance and the Department of Justice.

Binance’s compliance commitments in the agreement include: policies, procedures and internal controls; customer and third-party relationships; anti-circumvention controls; cycle-based reviews; appropriate oversight and independence; training and guidance; comprehensive reporting and investigations; enforcement and discipline; and monitoring, testing and auditing.

Under the agreement, Binance will make every effort to provide the Ombudsman with access to information upon reasonable request from the Ombudsman, including the company’s “former employees, agents, intermediaries, consultants, representatives, distributors, licensees, contractors, suppliers, and joint venture partners.”

From this point, it can be seen that the supervisor's review authority does not involve the information of ordinary users. The document also mentioned that when the US Department of Justice and FinCEN launched an investigation into Binance, the evidence documents provided by Binance to the investigation department were based on the premise of "not violating foreign data privacy."

The three attachments added by the SEC to the lawsuit against Binance are more detailed than those previously disclosed by the U.S. Department of Justice, FinCEN and other agencies, and the content of the inspector partially confirms the statement of Binance CEO Richard. Strict supervision objectively resulted in at leastXiaobai Navigation Within 3-5 years, Binance's anti-money laundering and other compliance compliance is likely to reach a higher level in the industry.

Richard also shared the attitudes of some of Binance’s partners two weeks after the incident. “They think this is a good thing. Some partners were very conservative before, but now they are willing to cooperate with Binance. The benefits of compliance are emerging. Not only will it last long, but it will also lead to wider adoption of crypto assets.”

SEC puts pressure on Binance again, and it responds that it will "maintain its position"

In addition to the three documents themselves, the SEC requested the judge to make a judicial determination of a series of "new incriminating facts" in the settlement agreement in the third public document.

Obviously, the SEC wants to increase its persuasiveness in the case and hopes that the judge will declare the relevant facts to be true without formally submitting evidence. However, the outcome depends on the court's judgment on this civil lawsuit.

On June 5 this year, the SEC filed 13 charges against Binance, including that Binance sold unregistered BNB and BUSD. Token、Simple Earn 和 BNB Vault 产品及其质押计划。SEC 还表示,币安未将其 Binance.com 平台注册为交易所或经纪商结算机构。

Judging from the content of the accusation, the core issue is whether Binance has violated US securities laws.

在 12 月 12 日的币安社区 AMA 中,Richard 因「案件仍在调查中」未对此案作更多评价,但他表明了态度,「币安一定会坚决维护自身的立场」。

Previously, Binance and its then-CEO Zhao Changpeng filed a motion in the U.S. District Court in September, seeking to dismiss the lawsuit, arguing that the lawsuit filed by the SEC exceeded its authority, mainly because the SEC did not provide any evidence before the accusation.cryptocurrencyIndustry clearly guides, in attempting to claimcryptocurrencyIn the process of assuming regulatory power over industry, the SEC has distorted the letter of securities law.

On November 7, the SEC launched a counterattack against Binance’s motion to dismiss the lawsuit, stating that no court had adopted Binance’s “misinterpretation of the law.” The SEC accused Binance of “never complying” with federal securities laws and asked the court to dismiss Binance’s motion to maintain the securities legal system.

The "fight" between the SEC and Binance is still ongoing. In fact, in addition to Binance, many companies in the crypto asset industry have been sued by the SEC for "securities" issues, including Ethereum (which was ultimately not identified as a security), Ripple, TRON, and even the US-based crypto asset trading platform Coinbase. Like the SEC v. Binance case, this case is still being resolved.

Judging from the cases that have been concluded, most of the SEC's lawsuits are civil cases, and most of them end with settlements and fines. It is worth noting that the SEC is not included in the series of settlement agreements between Binance and US regulators.

In this regard, He Yi, the co-founder of Binance who also participated in the AMA, said that whether facing the investigation of the Ministry of Justice or the prosecution of the SEC, Binance has a dedicated legal department and lawyers to handle it. When evaluating the impact of regulation, "lawyers also generally believe that the (influence) of the Ministry of Justice is greater because it has the power of criminal punishment, while the SEC's lawsuit is a civil liability."

Richard and He Yi, the new partners of Binance, both seem to be optimistic about the SEC's lawsuit, but the direction of the case will still have to wait for the decision of the U.S. District Court.

Binance, which has reached a settlement with US regulators, has made further repairs to its data.

Binance ChainwalletTotal assets returned to pre-incident levels

DefiLlama data shows that Binance ChainwalletTotal assets are US$73.471 billion, up 15% from US$63.504 billion on November 21, the day the "settlement" was disclosed, and have returned to the level before the incident.

The article comes from the Internet:SEC releases "new annex" to put pressure on Binance, "will defend its position"

Related recommendation: 2023 is not the end of Dubai Web3, but the beginning

Like Singapore, Dubai, as a Web3 Hub, has world-class infrastructure and a sound financial industry, as well as a clear regulatory framework. "Five years ago, when I came to Dubai, there was no ecosystem. Now there are projects, money, exchanges, and communities," said a Crypto entrepreneur who has lived in Dubai for six years. 1. Dubai Web3 …