Web3 project expansion dilemma: Why traditional user stickiness strategies don’t work?

Written by: DeFi Cheetah

Compiled by: Xiaobai Navigation Coderworld

This article aims to explain how the first principles of Web3 play a role in the different business models of Web3 and Web2. If you are a builder or coming from Web3 VC, this will be very helpful to you.

How does a successful Web3 model differ from a Web2 model?

i. The trust-minimized setting reduces the switching cost and loyalty of Web3 users, making it difficult for Web3 projects to expand their user base.

ii. The industry is open source, products are homogeneous, and network effects are weak.

iii. Lack of economies of scale: The costs currently borne by Dapp users do not decrease much with each additional user.

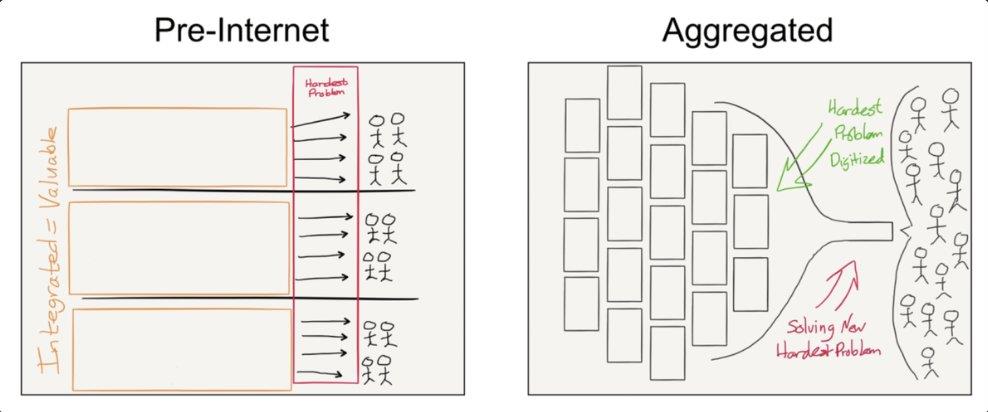

Many Web3 projects attempt to replicate the successful Web2 business model, bringing together suppliers, distributors, and users onto a single platform. This is a nod to the Aggregation Theory, and most successful Web2 businesses have simplified consumer markets, such as FB and Amazon.

Why are Web2 aggregators so successful?

a. User stickiness is a powerful weapon against competition.

b. Strong network effect, reducing user acquisition costs.

c) Economies of scale: The more users there are, the less each one pays.

This is not the case in Web3.

For a, with the development of aggregators, Web2 users are more sticky due to the higher customizability of services and brand recognition. Aggregators have more data to optimize user experience when operating their businesses. Users also find it risky to build trust and confidence in unknown new platforms.

in other words,In Web2, users must trust aggregators to provide excellent service discovery and curation by exercising good quality control over service providers. As a result, the platform has strong stickiness and the “winner takes all” phenomenon is obvious.

For example, online shopping has no guarantee of goods delivery, so most people choose Amazon because it has quality control and rating systems to ensure that sellers are legitimate. Coupled with Amazon's brand, the risk of default is much lower than that of sellers on unknown platforms. Therefore, more consumers choose to shop online on Amazon rather than easily turn to other new platforms.

But the protocols in Web3 are made by smartcontract作为信任最小化设置运行的,其中操作是透明的,由代码中的某些规则预先确定,并由智能合约自动化。因此,Switching costs are much lower in Web3, and brand recognition is much weaker.

For example, Uniswap does not take a cut of LP fees. Some argue that this is due to regulatory issues, but this is unconvincing. A more plausible explanation is that the Uniswap team knows that changes in fees could have a huge negative impact on its trading volume.

Therefore, rather than profiting directly from order flow, Uniswap prefers to use its first-mover advantage to expand horizontally and challenge current liquidity aggregators such as 1inch and CoWSwap by launching the intent-oriented architecture Uniswap X.

In addition to the fact that most transaction volumes do not come from natural persons, the cost for users to trust the new Web3 platform is not high because the operation is open to the public through the code, so everyone can know whether the new protocol is really effective; in contrast, Web2 aggregators hide how they work in the background. Some Web2 service providers need to take over users' assets in custody, requiring users to re-establish more trust in them, while in Web3, users interact with aggregators in a non-custodial manner. All of this reduces the switching cost for users.

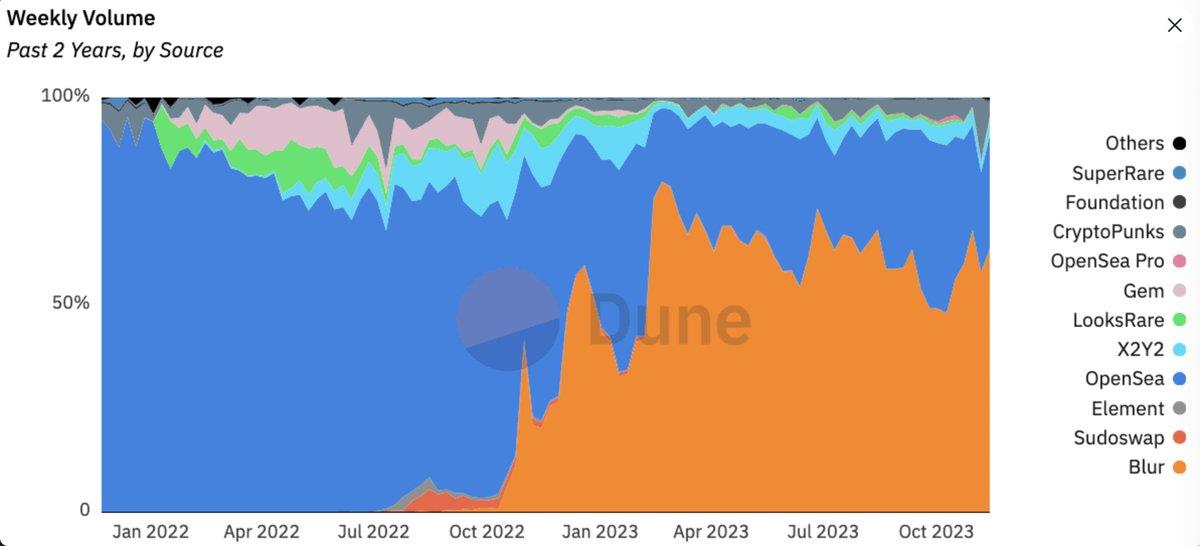

at the same time,In Web3Clever planningTokenIncentives can allow new entrants to overtake market leaders.This is how most successful protocols bootstrap initial total locked value (TVL) and users in Web3 and solve the cold start problem in Web3. Before Blur’s airdrop, Opensea was the market leader in the NFT market. But as we all know, Blur’s token incentive overturned Opensea’s dominance, forcing Opensea to make major adjustments to its reduced market share. It is unprecedented in Web2 for a newcomer to surpass the market leader.

In Web3, since user loyalty is lower and the relationship between aggregators and users is more dynamic, it is more difficult for protocols to scale. Competitors can perform "vampire attacks" or lower fees to remain competitive.

For b, as the user base grows in Web2 aggregators, more service providers are attracted to them, which in turn attracts more users as they become more valuable to users. Therefore, user acquisition costs decrease over time. But the dynamics of Web3 are very different.

in other words,Web2 Aggregators can create more value for users when they integrate more service providers onto their platforms.This product heterogeneity allows aggregators to differentiate themselves from other competitors in the market.

For example, as more small property owners join Airbnb, more travelers will become members because it can provide them with more apartment/accommodation options for their vacations. When the network effect starts to provide more value to users, Airbnb doesn’t have to spend as much to acquire users.

In contrast, even if more service providers are integrated into the Web3 aggregator,The network effect flywheel will not be in Web3 Xiaobai NavigationIt is easy to start in the market because the permissionless nature of Web3 leads to product homogeneity.: Most supply-side dApps are open source, universally accessible to aggregators, and provide similar value to users.

In fact, unless they continuously innovate and offer more advanced features, market leaders cannot offer users a very different product suite that newcomers can easily copy. Ongoing development and maintenance costs are a form of acquisition cost for Web3 aggregators.

For cross-chain bridges, they need to be in the newBlockchainAs the ecosystem emerges, it continues to add support for newBlockchainNot to mention token incentives as another form of cost to retain users. These recurring costs greatly reduce the network effects that Web3 aggregators are able to enjoy.

Users in Web2 can benefit from economies of scale because the more users there are, the less costs each user has to bear on average. This is because fixed costs are a significant portion of some aggregators’ expenses. Netflix is an illustrative example of economies of scale.

On Netflix, even with the same amount of on-demand video content, the more users there are, the less cost each user should bear, because the cost is already fixed. Therefore, more users reduces the cost. Again, this is not the case in Web3.

尽管在 Web3 中存在持续的研发和维护开销,但无论如何,用户仍然必须承担独立于规模经济的巨大可变成本——去中心化成本,为区块链状态的共识支付验证者费用。

EIP-4844 can help lower fees on DA, but the aggregator’s dominance and moat are weakened by congestion fees due to limited block space, which are not related to economies of scale. No matter how cheap 1inch is, users still have to pay more fees when the network is congested.

There is one exception:L2The more users there are, the less each user should pay.

L2 费用通常包括一个固定成本和一个变动成本:(i)在以太坊上发布区块的费用和(ii)运行排序器的费用。

Let's take Optimism as an example:

Assuming the gas price on Ethereum is 25 gwei and 1 ETH is 2k USD:

-

The one-time cost of deploying OP Stack on the mainnet = about 1 $ETH

-

Fixed cost of OP Stack, even if no transactions are running, (ii): ~0.5 $ETH per day

-

Variable cost (DA), (i): 0.000075 $ETH per transaction

After EIP-4844, assuming (i) is reduced by 10 times, that is, each Tx is reduced by about $0.015 + (ii) fixed cost, and 0.00001 $ETH (about $0.02) is used as the Tx markup to cover the fixed cost, 50k transactions per day are required to cover (i) + (ii) costs (before EIP-4844, the price of each Tx was about $0.17, and after EIP-4844, it was $0.03)

Assuming there is a positive correlation between the number of users and transactions, the more users there are, the more transactions there are, and the lower the Tx markup to cover L2 costs. But for most Web3 aggregators, economies of scale cannot be easily achieved as the number of users increases.

Therefore, by applying first principles to reduce the nature of the Web3 industry to its simplest dimensions and reasoning from there, what Web2 aggregators enjoy cannot be directly applied to Web3: user stickiness, network effects, or economies of scale. Token incentives, trust minimization, and permissionlessness are some of the fundamental principles that will reshape the Web3 business model.

The article comes from the Internet:Web3 project expansion dilemma: Why traditional user stickiness strategies don’t work?

赌博的过程是参与者投入法定货币,通过一些活动/玩法最终能够获得或大或小的法定货币,形成由钱到钱的闭环。 作者:邵诗巍 徐晓惠 引言 随着5G、区块链、VR等技术的发展,游戏领域也在由web2朝着web3Keep exploring. The Dao of Dragon is a national…