The truth about liquidity: 2024 exchange listing effect research report

1. Research Introduction

1.1 Research Background

Since the beginning of this year, the market has been optimistic about high fully diluted valuations (FDV)但低流通市值(MC)的VC代币引发了广泛讨论。随着2024年新发行的代币,MC/FDV比率降至过去三年的最低水平,这表明未来将有大量代币解锁进入市场。尽管初期流通量较低,市场在短期内可能会因为需求增加而推动价格上涨,但这种上涨缺乏持续性。一旦大量代币解锁并进入市场,供应过剩的风险加剧,投资者开始担忧这种市场结构可能无法为价格上涨提供持久的支持。

Therefore, many investors' interest began to shift from theseVC tokens turn to Meme coins. The characteristic of Meme coins is that most of the tokens have been fully unlocked at the time of TGE, with a high circulation rate and no selling pressure caused by future unlocking. This structure reduces the supply pressure in the market and gives investors more confidence. The MC/FDV ratio of many Meme coins at the time of issuance is close to 1, which means that holders will not face dilution due to further issuance of tokens, providing a relatively stable market environment. As the understanding of the risks of large-scale token unlocking deepens, investors' interest has gradually turned to these Meme coins with higher liquidity and lower inflation rates, although these tokens may lack practical application scenarios.

In the current market landscape, investors must be more cautious in choosing tokens. However, when selecting tokens, it is often difficult for investors to independently evaluate the value and potential of each project.At this time, the exchange's screening mechanism becomes the key.As a direct push of token assets to users"Gatekeepers", centralized exchanges not only help verify the compliance and market potential of tokens, but also play a role in screening high-quality projects. Although there is another voice in the market that on-chain transactions will exceed CEX transactions. But Klein Labs believes that the market share of centralized exchanges will not be taken away by on-chain transactions. The smoothness of CEX transactions, centralized responsible asset custody, the establishment of user habits and mentality, liquidity barriers, and the compliance trend of global supervision will make the transaction share in CEX exceed the transaction share on the chain for a long time.

Then, the question that follows is, how do centralized exchanges screen and decide to list among many projects? How is the overall performance of the currencies that have been launched in the past year? Is the performance of these launched tokens related to the selected exchanges?

In order to answer these questions of concern to the market, this study aims to explore the listing situation of major exchanges and analyze their actual impact on the token market performance, focusing on the changes in trading volume and price fluctuations after listing, in order to identify the impact of different exchanges on the market performance of currencies after listing.

1.2 Research Methods

1.2.1 Research subjects

We will exchangeCombining the region and the market, mainlyDivided into three categories:

magnificentCreated by people, facing the world:Binance, Bybit, OKX, Bitget,KuCoin,Gate, etc.mainFounded by ChineseinvestA well-known exchange that caters to the global market.peopleThere are a large number of exchanges. To facilitate research, the selected exchanges have different development characteristics. The exchanges that were not selected also have their own advantages.

South KoreaCreate, local-oriented:Bithumb,UPbitEtc. Mainly targeting the Korean domestic market.

USACreated for Europe and America:Coinbase, Kraken, etc. US exchanges,mainForEurope and AmericaMarket, usually affected byStrict supervision by SEC, CFTC, etc.

Exchanges in other regions such as Latin America, India, and Africa have lower trading volumes and liquidity than5%, therefore no in-depth analysis is conducted in this research report.

We selected the above10 representative exchanges are analyzed for their listing performance, including the number of listing events and their subsequent market impact.

1.2.2 Time Range

Main focus on tokensAfter TGENo.1 day, 7 days before and 30 days beforeAnalyze the price changes, trends, fluctuation patterns and market reactions of the following reasons:

- existOn the first day of TGE, new assets are issued and trading volume is highly active, reflecting the immediate market acceptance. It is greatly affected by the rush to buy and FOMO sentiment, and is a critical stage for the initial market pricing.

- Price changes in the first seven days after TGE can capture the market’s short-term sentiment toward new tokens and initial recognition of project fundamentals, measure the sustainability of market enthusiasm, and return to the reasonable initial pricing of the project.

- The first 30 days after TGE will focus on observing the long-term support of the token, the cooling of short-term speculation, the gradual withdrawal of speculators, and whether the token price and trading volume are maintained, which will become an important reference for market recognition.

1.2.3 Data Processing

This study uses a systematic data processing method to ensure the scientific nature of the analysis. Compared with the common research methods on the market, this study is more intuitive, concise and efficient.

The data in this research report mainly comes from TradingView covers the price data of newly launched tokens on major exchanges in 2024, including the initial listing price, market prices at different time points, trading volumes, etc. Due to the large number of sample points, this large-scale data analysis helps reduce the impact of single abnormal data on the overall trend, thereby improving the reliability of statistical results.

( I) Multivariate Overview of Coin Listing Activity

This study uses a multivariate analysis method to comprehensively consider factors such as market conditions, transaction depth, and liquidity to ensure the comprehensiveness and scientificity of the results. We compared the average rise and fall of new coins on different exchanges and conducted in-depth analysis based on the market positioning of the exchanges (such as user base, liquidity, and listing strategy).

( II) Average value to judge overall performance

To measure the market performance of a token, we calculated its percentage change relative to its initial listing price (Percent Change), calculated as follows:

Considering that extreme situations in the market may affect the overall data trend, we have excluded the previous The extreme outliers of 10% and post-10% are calculated to reduce the interference of occasional market events (such as sudden positive news, market manipulation, and liquidity anomalies) on the statistical results. This processing method makes the calculation results more representative and can more accurately reflect the real market performance of new coins on different exchanges. Subsequently, we calculate the average of the increase and decrease of new coins on each exchange to measure the overall performance of the new coin market on different platforms.

(III) Coefficient of variation to determine stability

Coefficient of variation (Coefficient of Variation (CV) is an indicator to measure the relative volatility of data. Its calculation formula is:

in,is the standard deviation, and is the mean. The coefficient of variation is a dimensionless indicator that is not affected by the data unit and is suitable for comparing the volatility of different data sets. In market analysis, CV is mainly used to measure the relative volatility of prices or returns. In exchange or token price analysis, CV can reflect the relative stability of different markets and provide investors with a basis for risk assessment. The coefficient of variation is used here instead of the standard deviation because the coefficient of variation has a higher applicability than the standard deviation.

2. Overview of Coin Listing Activities

2.1 Comparison between exchanges

2.1.1 Number of listed coins and FDV preference

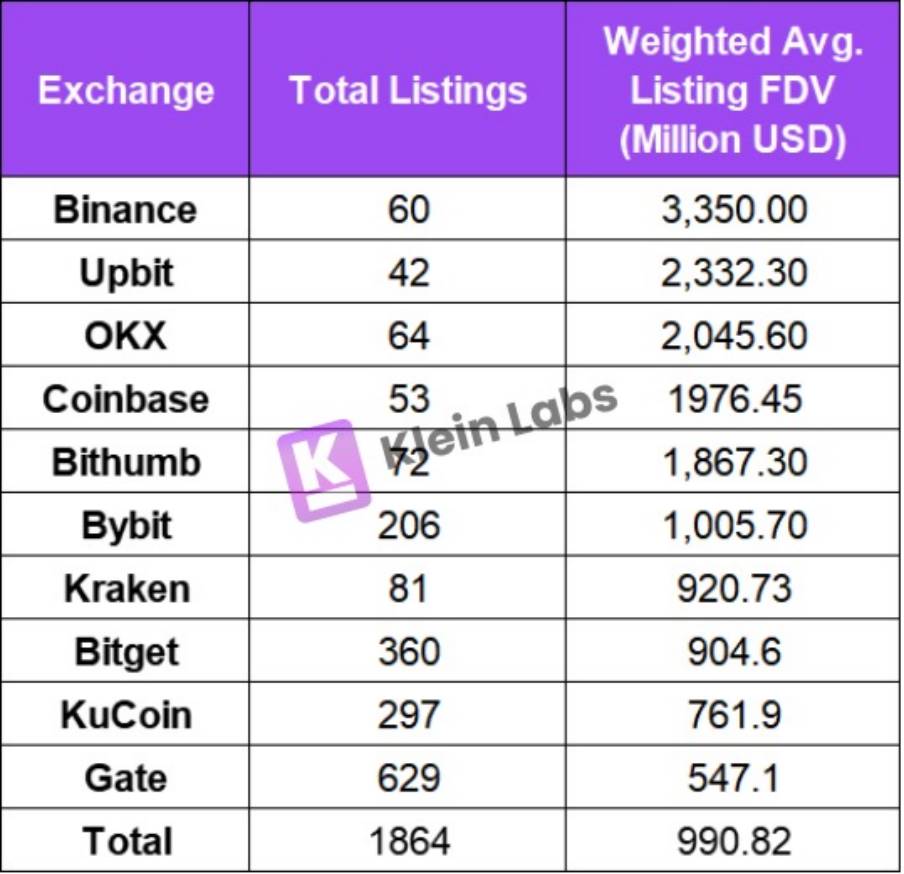

picture:Overview of Coin Listing Events in 2024

We found that: from the overall data, the top exchanges (such asBinance,UPbit,The number of coins listed on Coinbase is generally less than that on other exchanges. This reflects that the different positions of exchanges affect their coin listing styles.

From the perspective of the number of listed coins, Binance, OKX,UPbit,Coinbase has stricter listing rules, with fewer listings but larger scale; while exchanges such as Gate list new assets more frequently, providing more trading opportunities. Data shows that the number of listings is roughly negatively correlated with FDV, that is, exchanges that list more high-FDV projects usually have fewer listings.

CEXs use different strategies to prioritize listings, focusing on different fully diluted valuation (FDV) tiers. Here we classify projects based on their different FDVs to better understand the exchange listing criteria. When valuing tokens, we often consider MC and FDV, which together reflect the valuation, market size, and liquidity of tokens.

- MC only calculates the total value of currently circulating tokens and does not take into account tokens that will be unlocked in the future. Therefore, it may underestimate the true valuation of the project, especially when most tokens have not yet been unlocked, which can be misleading.

- FDV is calculated based on the total amount of all tokens, which can more comprehensively reflect the potential valuation of the project and help investors assess future selling risks and long-term value. For projects with low MC/FDV, FDV has limited short-term reference significance and is more of a long-term reference.

Therefore, when analyzing newly launched tokens,FDV is more relevant than Market Cap. Here we choose FDV as the standard.

In addition, from the perspective of the attitude towards first-time projects, most exchanges usually adopt a balanced strategy, that is, taking into account both first-time and non-first-time projects, but usually have higher requirements for non-first-time projects because first-time projects will bring more new users.Two Korean exchanges UPbitand Bithumb mainly focuses on non-first-time coin listings.Compared with the first issue, non-first issue listing can reduce the risk of screening and avoid the market fluctuations and initial liquidity problems in the first issue. At the same time, compared with the first issue, the project party does not need to bear too much pressure of market promotion and liquidity management, and the non-first issue listing can promote growth with the existing market recognition.

2.1.2 Track Preference

Binance

2024年,Meme币数量仍然占比最多。Infra与DeFi项目占比较大。RWA 和 DePIN 赛道在 Binance 上币数量相对较少,但整体表现较好。其中USUAL 现货最高涨幅达 7081%。尽管 Binance 在这些领域的上币选择较为谨慎,但一旦上线,市场反应通常较为积极。在下半年,Binance在AI赛道的上币偏好明显向AI Agent代币倾斜,其占比在AI类项目中最高。

In 2024, Binance prefers the BNB ecosystem. For example, the launch of projects such as BANANA and CGPT shows that Binance is strengthening its support for its own on-chain ecosystem.

OKX

OKX also has the largest number of Meme tokens, accounting for about 25%. Compared with other exchanges, it has more tokens listed in the public chain and infrastructure tracks, accounting for a total of 34%. This shows that in comparison, OKX is more focused on underlying technology innovation, scalability optimization andBlockchainEcologically sustainable development.

In the emerging track,OKX has only launched 4 AI tokens, including DMAIL and GPT, 3 new tokens in the RWA track, and only 3 in the DePIN track. This reflects that OKX is relatively cautious in its layout in relatively emerging tracks.

UPbit

UPbitThe biggest feature of the coin listings in 2024 is that the track coverage is wide and the token performance is generally good. In 2024, UNI and BNT were launched on the DEX track. This shows UPbitThere is still great potential and room for development in the listing of popular assets. Many mainstream or high-market-cap tokens have not yet been listed, and support may be further expanded in the future.At the same time, this also reflects UPbitThe review of listed coins is relatively strict, and they tend to carefully screen assets with long-term potential.

existUPbitIn terms of price, the tokens in each track have seen significant increases.Tokens of PEPE (Meme), AGLD (Game), DRIFT (DeFi), SAFE (Infra) and other tracks have seen significant increases in the short term, with the highest reaching 100% or even exceeding 150%. UNI increased by 93.5% on the 30th day after its launch compared to the first day. This reflects the popularity of Korean users in theUPbitThe online projects have extremely high recognition.

In addition, from the perspective of the public chain ecology,Solana、TON等公链生态较为受宠。此外,交易所正逐步加深对自身区块链生态的支持。For exampleBinance's associated BSC and opBNB chains continue to strengthen their support for their own chain ecosystems. Similarly, Coinbase's Base has also become its key support target, with Base projects accounting for nearly 40% of all new currencies launched in 2024. OKX continues to make efforts in the layout of the X Layer ecosystem.also,Kraken 计划推出的 L2 网络 Ink 进一步表明,头部交易所正积极推进链上基础设施建设。

Behind this trend is the fact that exchanges haveThe exploration of the transformation from "off-chain" to "on-chain" has not only expanded the business scope, but also strengthened its competitiveness in the DeFi field. By supporting projects on its own chain, exchanges can not only promote ecological development, but also improve user stickiness and obtain higher returns in the issuance and trading of new assets. This also means that in the future, the exchange's listing strategy will be more inclined to projects within its own ecosystem to enhance the activity and market influence of its blockchain network.

2.2 Time Dimension Analysis

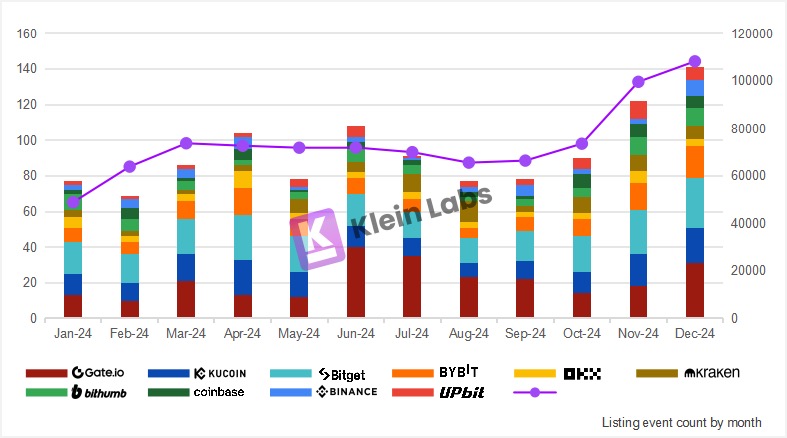

(Figure: Number of coins listed on different exchanges each month)

- The increase and decrease trend of the number of coin listing eventsThe rise and fall of BTC prices are highly consistent.There were more coin listing events during the BTC rise period (February to March and August to December), while the number of coin listing events decreased significantly during the BTC sideways or falling period (April to July).

- Top exchanges (Binance,UPbit) are less affected during bear markets, its coin listing share has expanded during this period, showing stronger market dominance and anti-cyclical ability.

- The number of coins listed on Bitget is relatively stable and is less affected by market fluctuations, while the pace of listing coins on other exchanges fluctuates greatly.This may be related to its more balanced coin listing strategy.

- Gate and KuCoinHigher frequency of listingHowever, the number of listed coins fluctuates greatly with market conditions, indicating that these exchanges may rely more on the higher liquidity of new projects in a bull market to attract users.

3. Trading volume analysis

3.1 Overall trading volume of different exchanges

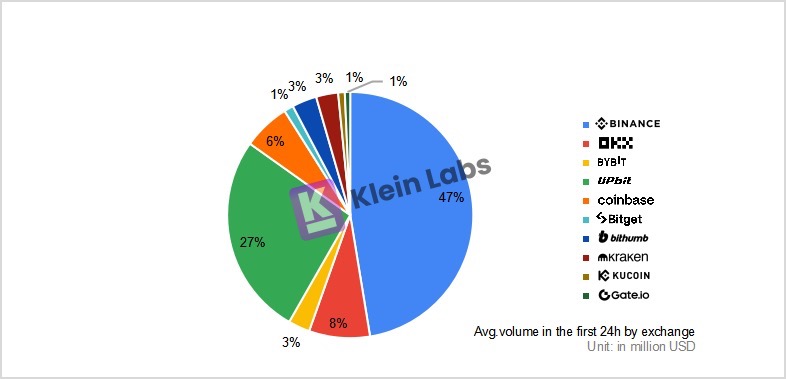

(picture:Average trading volume of each exchange project in 2024 within 24 hours after TGE)

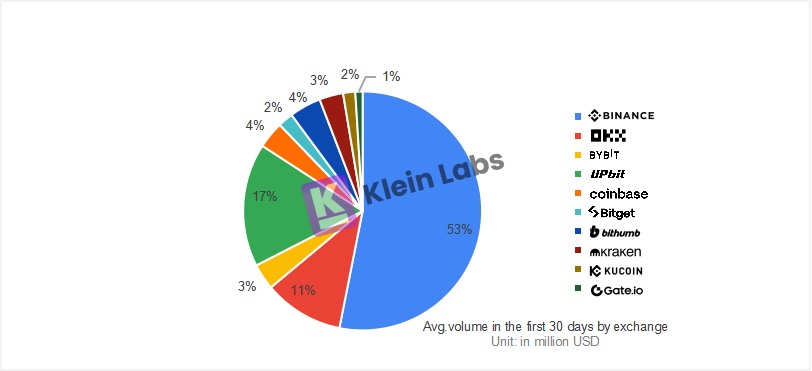

(picture:Average trading volume of each exchange project 30 days after TGE in 2024)

- UPbitListing on the currency The trading volume in 24 hours accounted for a very high proportion, even more than half of Binance, showing its strong appeal in the short-term market and obvious liquidity influx. Although the proportion decreased slightly after 30 days, it still maintained a high market share, even close to the total share of the three top exchanges OKX, Coinbase, and Bybit, indicating that UPbitIt occupies an extremely important position in the coin listing market.

- Binance and OKX's trading volume has grown steadily, and their 30-day market share is still leading, showing strong market recognition and liquidity depth. Binance accounted for 47% in 24 hours, and increased to 53% after 30 days, indicating its long-term market dominance, while OKX also maintained a high share after 30 days.

- Bybit has good and stable performance in both short-term and long-term trading volumes. Bithumb’s market share rose slightly after 30 days, indicating that it was able to not only retain early trading volume but also attract more liquidity.This shows Bithumb’s competitiveness in the coin listing market has increased.

Although Korean exchanges are known for their preference for non-IPO projects, as the above data shows, these projects can still generate very strong trading volumes. The core reason why Korean exchanges’ non-IPO projects can generate such a large trading volume is due to their unique market environment:

The closed nature of the Korean trading market and the concentration of liquidity

- Market closure:Because South KoreaThe KYC policy is relatively strict, and overseas users are basically unable to directly use Korean exchanges. This regional isolation has led to a relatively closed trading ecosystem in the Korean market; a large number of local users are accustomed to buying and selling on Korean exchanges. Therefore, the internal liquidity of the Korean market is more concentrated.

- Exchange Monopoly:The Korean crypto market is highly monopolistic.UPbitCurrently occupied 70%-80%'s Korean encryption market share remains the industry leader. UPbitAfter establishing a leading position,Bithumb’s original No. 1 position was replaced, and its market share dropped to 15%-20%. South Korea’s trading volume and liquidity gathered towards the top platforms, showing a strong capital concentration effect.

Therefore, even though a token is not listed for the first time on the global market, its trading in the Korean market will still show similarThe "first release" effect has attracted a large amount of market attention and capital inflows.

South Korea’s Crypto Market’s High Ownership Rate and Capital Advantage

- High Penetration of Crypto Assets:South Korean investors hold a very high proportion of cryptocurrencies, far higher than other major markets.According to statistics in November 2024, the number of people holding cryptocurrencies on Korean exchanges exceeded 15.59 million, equivalent to more than 30% of the total population of South Korea. Many Koreans already hold a large amount of crypto assets and prefer digital assets in their investment choices. With a population of 0.6% worldwide, South Korea contributes 30% of the world's cryptocurrency trading volume.

- Adequate social capital:In addition, South Korea isDeveloped countries with higher GDP have more abundant overall social capital and huge investable funds, which makes the crypto market have sufficient liquidity.

- There is little room for young people to survive in traditional industries:South Korea is a capitalist country dominated by chaebols. Young people face great employment and living pressures, and the solidification of social classes has intensified their desire for wealth appreciation channels.3.08 million young people aged 20-39 participate in virtual currency transactions, accounting for 23% of the total population in this age group.

EndingBy November 2024, South Koreans' total holdings of cryptocurrencies had increased to 102.6 trillion won (about US$69.768 billion), and the average daily trading volume had also climbed to 14.9 trillion won (about US$10.132 billion).UPbitexistIn the fourth quarter of 2024, it became the CEX with the fastest growth in trading volume, increasing from US$135.5 billion to US$561.9 billion, a month-on-month increase of 314.8%. This growth reflects the strong demand for crypto assets in the Korean market, and further confirms the trend of high trading volume of Korean exchanges in non-first-time projects.

4. Price performance analysis

4.1 Price performance by exchange

4.1.1 Overall performance of coin prices on various exchanges

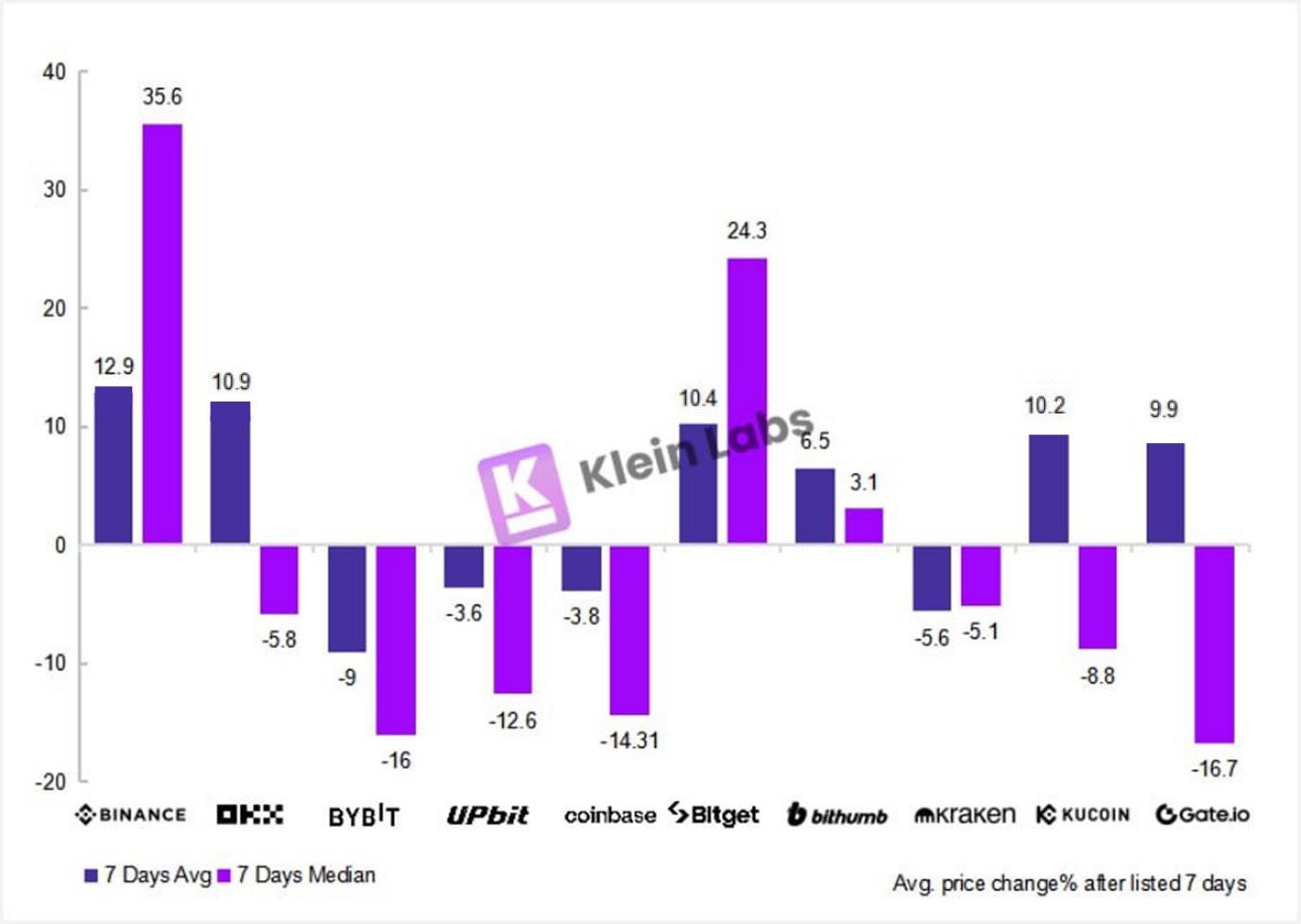

(Figure: Various exchangesComparison of the mean and median trading volume price in the 7 days after TGE)

- Binance performed the best, with both the mean and median standing out.The top three average values are:Binance, OKX, Bitget,inAlthough the average value of OKX is positive, the median is negative, indicating that the price fluctuations of rising tokens are large, the price fluctuations in the short term are very drastic, and the outliers are obvious.Bitget performed relatively well and was closest to the two major exchanges among other exchanges. At the same time, its median increase ranked second among all exchanges, second only to Binance, and showed a relatively high positive value, which shows that the token prices on Bitget showed a strong and positive upward trend overall.

- Among medium-sized exchanges,Bithumb, Gate,KuCoinAll three performed relatively well.in,Bithumb has a relatively balanced price performance, with the smallest difference between the absolute value and the median, indicating that the price fluctuation is small and the performance is stable.KuCoin,The median of Gate is negative and the absolute value is high, which means that the token has a low winning rate and there may be more rising outliers causing interference.

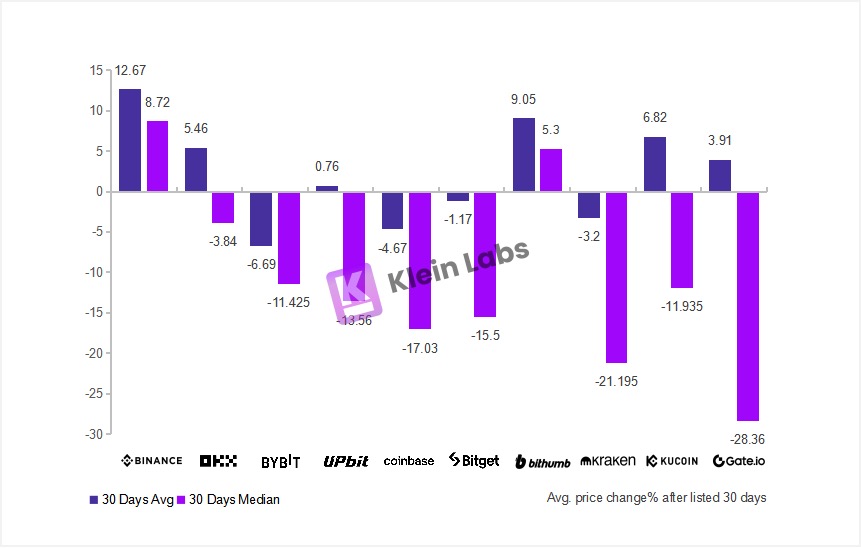

(Figure: Various exchangesComparison of the mean and median trading volume price in the 30 days after TGE)

- ToIn the 30 days, the median fell overall, which means that after 30 days, especially for tokens with poor liquidity, some speculative funds in the market withdrew a lot, the selling pressure increased, the buying support was insufficient, and the price fell. Gate may have caused large fluctuations in the new coin market and insufficient liquidity due to the excessive number of listed coins. This shows that the platform failed to attract enough stable capital inflows, too many tokens dispersed liquidity, and the balance between buyers and sellers was broken, causing a sharp drop in prices.

- Binance was less affected, with a slight decrease in the average value, indicating that its listed tokens still maintained strong market support and stable trading volume 30 days later, and some tokens still have room for growth. As a top exchange, Binance, with its huge market liquidity and broad user base, can maintain a high level of token prices on its platform even if the overall new coin market declines after 30 days.

- Among medium-sized exchanges,Bithumb is the only exchange that rose after 30 days, and both the 7-day increase and median are positive. This shows that Bithumb has successfully attracted funds with good market liquidity and stability, showing strong resistance to decline and market appeal. It may be because Bithumb's small amount of listings allows it to concentrate liquidity and maintain strong market activity, allowing newly listed tokens to perform better in price.

4.1.2 Monthly coin price performance of each exchange

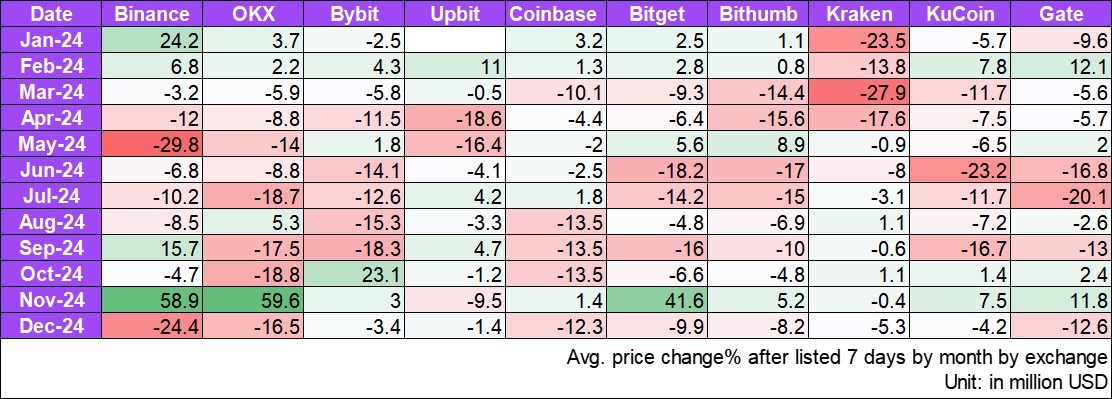

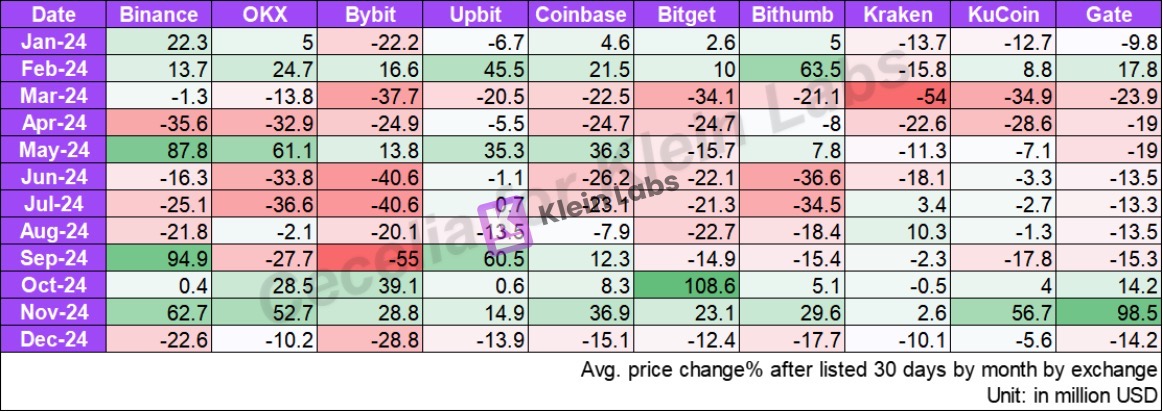

(Figure: Various exchanges7 days after TGE, price changes per exchange per month)

(Figure: Various exchanges30 days after TGE, price changes per exchange per month)

- Binance and UPbitThe price advantage is obvious and it is greatly affected by market sentiment.Binance and UPbitThe listed coins perform well when the market is good, for example In May and September, Binance's 30-day gains reached 87.8% and 94.9% respectively.UPbitThere was also an increase of 60.5% in September, showing a strong price advantage, but it was more volatile, with significant declines in April and July, and was significantly affected by market sentiment.

- The overall market situation has a significant impact on the trend of tokens. Tokens listed on top exchanges will see greater gains during a bull market, while mid-sized exchanges are more likely to see sharp declines during a market downturn. Bybit and OKX fell by -40.6% and -36.6% respectively in July 30 days, while Kraken and KuCoinexistThe overall performance after 7 days was also weak, especially Kraken, which fell to -23.5% and -27.9% in January and March respectively.

4.2 Fluctuation of price fluctuations

In the previous section, we used the average value to reflect the overall rise and fall. Next, we use the coefficient of variation to reflect the fluctuation of sample data around the above average rise and fall. If the coefficient of variation is small, it means that the data distribution is relatively concentrated, the rise and fall of most tokens are close to the average level, the market performance is relatively stable, and the price fluctuations after the exchange is listed are more predictable; conversely, the price trend after the exchange is listed is more uncertain;

Next will1-day and 30-day price analysis:

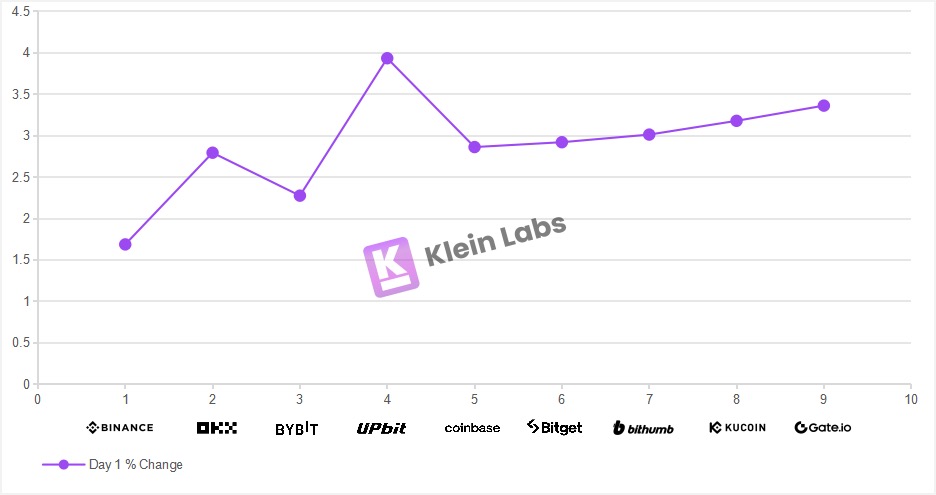

(Figure: Coefficient of variation inChanges on the first day after TGE)

- Binance has the lowest coefficient of variation, indicating that the first-day fluctuations of its listed tokens are relatively small and its market performance is the most stable.UPbitThe coefficient of variation is the highest, and the volatility on the first day is large, but combined with the previous average value analysis, it is estimated that the overall market is likely to show a general upward trend.

- The coefficient of variation of medium-sized exchanges (from left to right along the coordinate axis) shows a linear growth trend.From the lowest coefficient of variationBitget, to the one with the highest coefficient of variationGate.Indicates the market performance of the listed coins on these exchangesFrom the more stablegradually tends to higher uncertainty,From relatively low short-term investment risk to gradually increasing.

- Bybit has a low coefficient of variation, which is closest to Binance, indicating that its market volatility is relatively controllable. However, considering that Bybit has a large number of listed coins, it can still maintain a low coefficient of variation, indicating that the overall quality of its listed projects is high, and there are no large-scale high-volatility coins. In addition, this also reflects that Bybit may be more inclined to tokens with stronger stability in its coin screening strategy, thereby reducing the sharp fluctuations in the market in the short term.

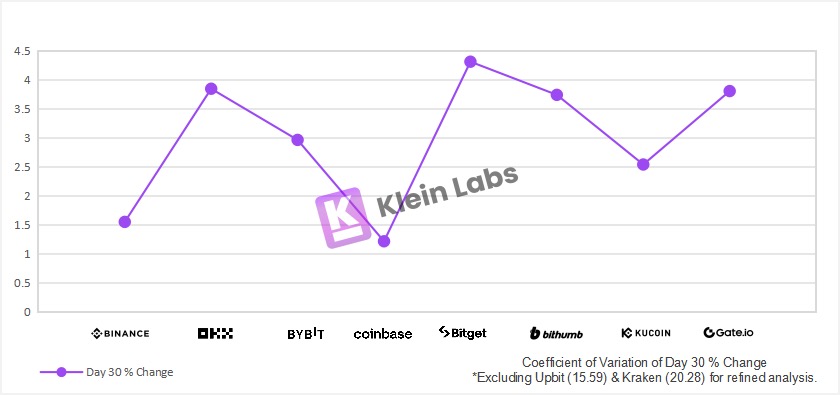

(Figure: Coefficient of variation inChanges on day 30 after TGE)

- from Day 30: From the coefficient of variation,UPbitexist The high coefficient of variation after 7 and 30 days indicates that the price fluctuation of its trading pair is significant and the market liquidity is high.UPbitThe average value of the trading pair is positive, and the price drops slowly, which indicates that the market is relatively active, the liquidity depth is strong enough, and the overall market is healthy.UPbitIn this respect, it has a great advantage over other exchanges.

- Binance and Coinbase are still relatively stable exchanges. Binance has maintained a relatively stable growth throughout the cycle, while Coinbase's fluctuations between 7 and 30 days tend to be stable, indicating that its token market is more inclined to long-term stable development rather than short-term drastic fluctuations.

- Medium-sized exchanges (such as Bitget, Bithumb, Gate,KuCoin) in the The 30-day coefficient of variation has increased significantly, indicating that after the withdrawal of short-term arbitrage funds, liquidity has decreased, leading to increased price fluctuations. The market is still dominated by short-term funds, with a low proportion of long-term funds and weak overall stability. Bitget, in particular, has high activity but high volatility risk.

5. Summary of highlights

5.1 Data Conclusion

After the above research and data, we draw the following conclusions:

1. The choice of exchanges to list coins has a significant impact on the performance of listed coins

Generally speaking, exchanges with fewer listed coins and stricter rules usually have better price performance after removing extreme outliers. However, the overall Bitcoin trend, regional market environment and user characteristics will also affect the performance of listed coins.

Exchanges with a large number of listed coins do stand out in the short-term average performance, but in the long run, more listed coins will cause liquidity to be more dispersed.There may be a bigger decline after 30 days, and the price stability will be lower.

2. When the market is good, top exchanges often have a greater growth advantage than medium-sized exchanges

However, from another indicator, the average increase in the major top exchanges isThe performance of the increase in 7 days and 30 days varies, but the overall performance is positive. Binance has the best feedback in various price indicators. OKX has greater volatility in the medium and long term. Among the top exchanges,UPbitThe performance of is the most moderate, which may be due to the greater liquidity depth.UPbitIn fact, the token can reach extremely high fluctuations within the first day of listing. However, since this study counts the final closing price on the first day, these outstanding performances may not be recorded.Bitget and Bithumb performed relatively well, with Bitget performing stably and Bithumb performing well in some price indicators.

3. Advantages of the Korean market and the effect of listing

The Korean market has a unique market environment with high trading volume and good liquidity. The tokens can quickly attract funds after listing. Although the price fluctuated greatly in the early stage, it showed an overall upward trend.The price fluctuations are still violent after 7 and 30 days, which shows that in the Korean market, the listing of tokens will have a longer development cycle and higher attention.

4. The impact of exchange screening processes on token performance and market stability

During the data processing, we found that some exchanges had significantly more outliers, indicating that the token screening and review process is critical to post-listing performance. Outliers usually reflect that the token price deviates from expectations and may be affected by factors such as market manipulation or project risk. Exchanges that frequently have outliers may be more lax in the screening process, resulting in unstable tokens entering the market and increasing the risk of price fluctuations. Therefore, the token screening process of the exchange directly affects the market performance of the token and the overall market stability.

5.2 Exchange Performance

Binance & OKX

It performs well in all indicators, but in the long run,Binance has an advantage in terms of stability. Binance's market performance is relatively stable, able to maintain continuous growth, and has low volatility. In contrast, OKX is more stable in terms of market volatility.Xiaobai NavigationIt is larger than Binance in terms of size, but it is almost on par with Binance in many indicators.

UPbit& Bithumb

UPbitand Bithumb is one of the two leading cryptocurrency exchanges in South Korea, and its performance is generally outstanding. UPbitIt has consistently maintained a high ranking among global exchanges.As one of the earliest exchanges established in South Korea, Bithumb has performed very well in some tokens. The extremely high enthusiasm for cryptocurrency trading in the Korean market has led to a large amount of capital pouring into local exchanges, bringing higher liquidity and trading volume. Due to the high liquidity depth and the large number of funds dispersed among Korean retail investors, price changes will not be too obvious in the medium and long term. However, focusing on shorter-term intra-hour transactions, the trading volume and price fluctuations of Korean exchanges are higher than those of other exchanges at the same level. Since this study mainly studies the price changes of tokens 1 day, 7 days and 30 days after listing, it may not fully reflect the outstanding performance of Korean exchanges.

It is worth noting thatUPbitand Bithumb has a clear regional advantage of "Kimchi Premium". After certain tokens are listed on Korean exchanges, their prices are usually higher than other exchanges around the world by a certain percentage in the short term.UPbitandBithumb brings advantages that other exchanges around the world cannot match.

Bybit

As one of the top exchanges, it has strong liquidity depth and rich experience in listing coins, and can provide a stable trading environment. Bybit experienced a large-scalestealcurrency incident, but with its timely and effective public relations handling andSafetyBybit took appropriate measures to deal with the challenges, demonstrating its ability to cope with the challenges as a large exchange. In contrast, many small exchanges often lack the ability to cope with such challenges. Bybit's response strategies in risk control and public relations are also very appropriate, especially in terms of sufficient financial funds, which quickly restored the trust of users and continued to maintain its competitiveness in the market.

Bitget

The performance is particularly outstanding among medium-sized exchanges.The development speed is relatively fast.Bitget is in the transition stage towards becoming a first-tier exchange and tends to implement a more stringent coin listing mechanism.The platform is onlineMoreNew coin,It provides investors with a wider range of choices.According to the average data,The overall performance of listed tokens is good,And the currencyPositive price movementPerformanceFar beyond the same level platform.Quality ProjectsBitgetAs preferences gradually emerge, the platform remains prudent in project screening and achieves more accurate selection of the best through a two-way incentive mechanism.Overall,Bitget’s market performance is between the top exchanges and the average level of mid-sized exchanges.goodPricePerformanceand market recognition. Compared with exchanges of the same level,BitgetsuperiorThe price fluctuation of tokens is relatively stable, showinghighresilience, thereby maintaining strong market competitiveness and user trust.

Gate

It is rising rapidly. With its high proportion of listed coins and its innovative listing strategy,Gate's data performance in 2024 is relatively outstanding. Not only has the transaction volume gradually increased, but the token price has also increased significantly. Gate has successfully attracted a large number of emerging projects, significantly improved its market competitiveness, and continuously expanded its influence in the crypto market. Gate has performed outstandingly in the Meme track, and has also set up an innovation zone to provide exclusive sections for newly launched tokens. With keen market insight, it has successfully launched a number of popular tokens, attracting a large number of investors. Its innovative listing strategy and precise project screening have helped the platform quickly expand its ecology, improved user stickiness, and promoted the growth of trading volume and liquidity.

KuCoin

In addition to the listed coins that are the focus of this report,KuCoinSignificant progress has been made in compliance,KuCoinThe U.S. Department of Justice (DOJ) reached a settlement, the result isKuCoinand its new leadership team for the future.KuCoinIt is also actively acquiring relevant licenses, especially in Australia and India., and is also actively making plans in Europe, Türkiye and other places.KuCoin has applied for a license in Austria in compliance with the Markets in Crypto Assets Regulation (MiCAR) through KuCoin EU Exchange GmbH. At the same time, KuCoin is also the first global cryptocurrency trading platform in India to comply with the regulations of the Financial Intelligence Unit (FIU). By promoting compliance and regional expansion, KuCoin is expected to attract more potential users, promote trading volume and price growth, and create favorable conditions for its continued growth in the future.

Coinbase & Kraken

As the largest exchange in the United States, it has strong liquidity and deep markets.Coinbase的谨慎上币策略叠加美国较严格的加密货币监管政策,导致平台上币数量相对较少,但也具有较高的安全性与稳定性。说明Coinbase对待新项目,尤其是Meme币等高风险资产,采取了保守的上线策略。但是从价格表现上来看,在选择追求稳定,长远的发展同时,也错过了较多的上涨机会。KrakenIt is well-known for its security and is subject to strict regulation, resulting in fewer products and services than other exchanges.

6. References

1. Animoca Brands Research on 2024 Listing Report

https://research.animocabrands.com/post/cm71o17u2t6f107mlc6v09ujq

2.Low Float & High FDV: How Did We Get Here?

https://www.binance.com/en/research/analysis/low-float-and-high-FDV-how-did-we-get-here

3. CoinGecko2024 Annual Crypto Industry Report

https://www.coingecko.com/research/publications/2024-annual-crypto-report

4.국내코인거래소총투자자1천500만명첫돌파…11월60만명↑

https://www.yna.co.kr/view/AKR20241224079900002

The article comes from the Internet:The truth about liquidity: 2024 exchange listing effect research report