15 crypto projects have started a token repurchase trend. Is this a good way to save the market or a capital illusion?

Author: Nancy, PANews

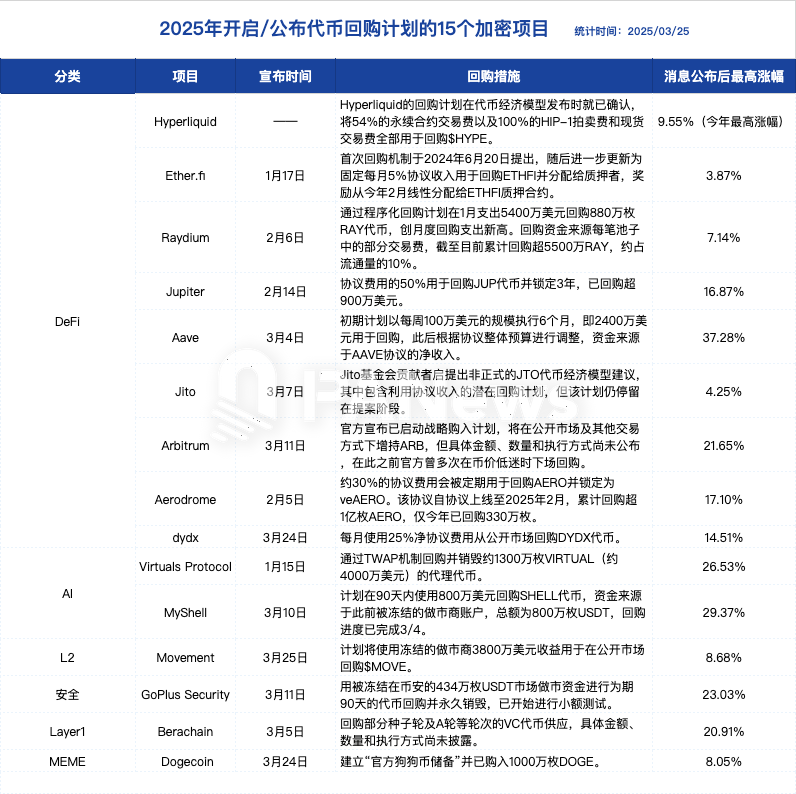

In recent months, the crypto market has continued to fluctuate downward, and investor confidence is on thin ice. As the market's sluggish sentiment continues to spread, a "buyback boom" has quietly emerged, and project parties are trying to boost market confidence with real money and drive the value of tokens to rebound against the trend. In this article, PANews counts 15 crypto projects that have launched or announced token buyback plans in 2025, among which the DeFi track is the most active. Among these projects, many buybacks are as high as tens of millions of dollars, but the transparency of execution is uneven, and in the sluggish market environment, the price reaction to the buyback stimulus is still mostly flat.

DeFi becomes the main force of token repurchase, and market reactions are divided

To some extent, buyback is not only a stopgap measure to save the market in the short term, but is also seen as an important strategic layout for projects to reshape the token economy and give long-term value.

Among the 15 crypto projects, DeFi is still the main force in token repurchases. A total of 7 DeFi projects have launched or plan to launch repurchase plans, including Hyperliquid, Ether.fi, Raydium, Jupiter, Aave, Jito and Arbitrum. This also reflects the urgent need for DeFi to optimize the token economic model. Of course, AI,Safety, Layer1, Layer2, MEME and other fields have also begun to gradually explore the repurchase mechanism.

In terms of repurchase scale, Hyperliquid, Raydium, Jupiter, Aave, Aerodrome and VirXiaobai NavigationThe repurchase of virtual Protocol is relatively strong. For example, Raydium uses part of the transaction fees in each pool for repurchase. So far, it has repurchased more than 55 million RAY, accounting for about 10% of the circulation. In January this year alone, it spent 54 million US dollars on repurchase, setting a new monthly repurchase expenditure record; Jupiter used 50% of the protocol fee to repurchase JUP tokens and locked them for 3 years. According to the protocol revenue last year, it is estimated that about 50 million US dollars will be used to repurchase JUP tokens. In just about one month, more than 9 million US dollars have been repurchased; Aave initially plans to carry out 6-month token repurchases at a scale of 1 million US dollars per week, that is, 24 million US dollars, and will adjust according to the overall budget of the protocol afterwards; Virtuals Protocol repurchased and destroyed about 40 million US dollars of VIRTUAL through the TWAP mechanism.

In addition, three projects affected by Binance's investigation of market makers also released repurchase plans. Movement will use the $38 million of funds recovered from market makers to repurchase MOVE within three months. In contrast, the repurchase scale of projects such as MyShell and GoPlus Security is relatively small.

From the perspective of execution, many crypto projects have already launched and continued to implement repurchase plans, showing high transparency and execution. For example, Hyperliquid has started to repurchase tokens since TGE. According to HYPEBurn data, as of March 25, more than 189,000 HYPE tokens have been destroyed, with a value of more than 3.026 million US dollars; Aerodrome has destroyed since the agreement went online, and has repurchased more than 100 million AERO tokens. However, the repurchase plans of some projects have not yet been fully disclosed or implemented, and there is a certain degree of uncertainty. For example, the repurchase plan proposed by Jito is still in the proposal stage, and Berachain only stated that there will be a repurchase arrangement, but has not yet disclosed the specific amount and execution method; Arbitrum officially announced that it has launched a strategic purchase plan and will increase its holdings of ARB in the open market and other trading methods, but the specific amount, quantity and execution method have not yet been announced. However, the official has repeatedly repurchased when the currency price is low during this period.

Judging from the market reaction, the repurchase plans of some projects have had a positive impact on the price of coins. From the highest increase since the release of the repurchase plan, Aave, MyShell and Virtuals Protocol have seen relatively significant increases. However, about one-third of the projects had a maximum increase of less than 10% after the announcement, and the market reaction was relatively flat. Of course, this differentiation may be related to the scale of the repurchase, the execution, the fundamentals of the project, and the overall market decline.

Behind the buyback craze, is it a value bet or a means of self-rescue?

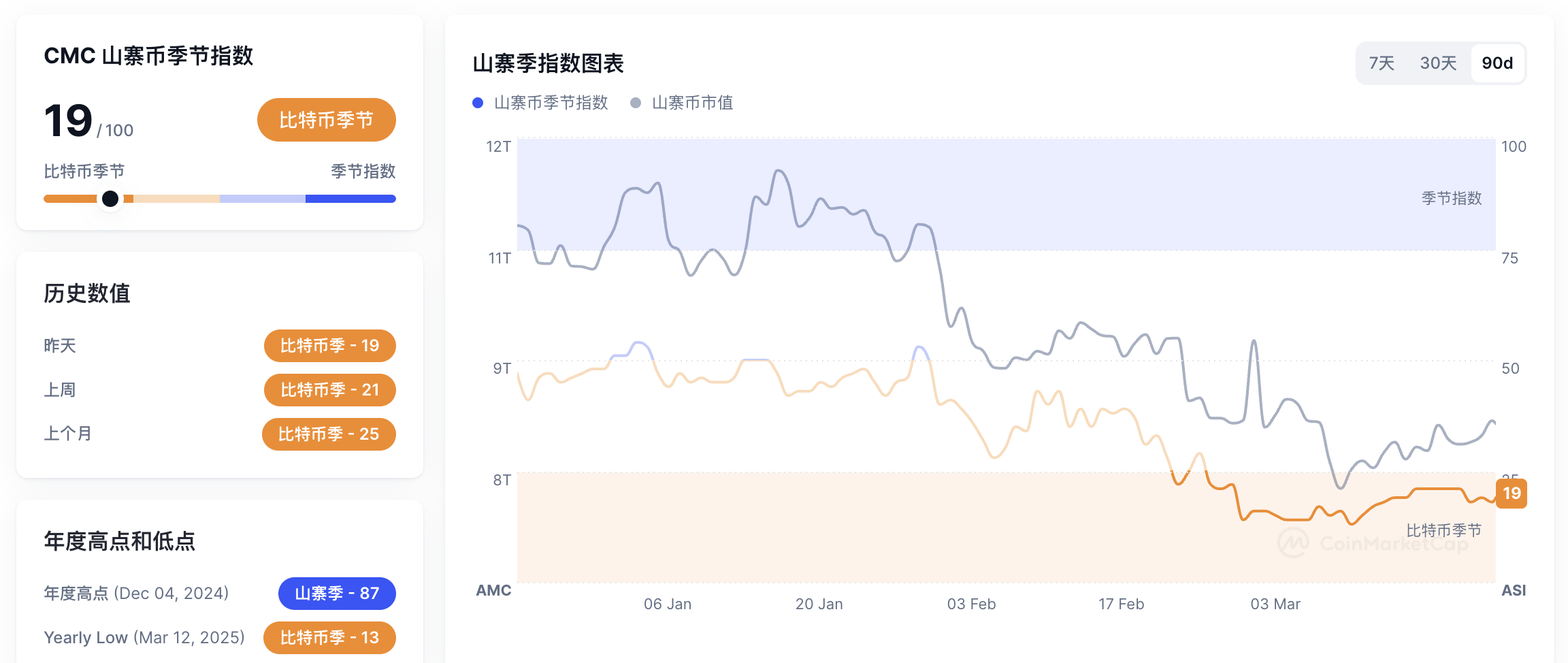

In this round of crypto cycle, Bitcoin's market share has long been on the top of the list, with a market share of more than 60%, while the market value of most altcoins has been cut in half, or even hit the bottom, which has repeatedly triggered discussions about whether the "altcoin season" will die out. Coinmarketcap data shows that as of March 25, the Altcoin Season Index fell to 19, a new low since December 4, 2024, and among the top 100 crypto projects by market value, only 19 outperformed Bitcoin.

Under the heavy pressure of the market, token repurchase has gradually become a standard strategy for many projects, but the market has different views. Supporters believe that repurchase is a reflection of the project's confidence in its own value and sends a positive signal; skeptics point out that repurchase must match the project's own growth capacity; there are even views that repurchase may become a tool for the project to "ship" or provide short-term liquidity, which is difficult to solve the core problem of development.

For example, in@qinbafrankIt seems that the strong liquidation of small coins in the past year is actually forcing the market to evolve further: either focus on the real value of innovation; or give up the fantasy of high valuation of the primary market and start from a low market value (so that the secondary market can also enjoy the dividends of growth instead of just analyzing the market); or projects with revenue will start to inject part of the profits and income into the token economic model to increase the value of each coin. This is a welcome start for the currency market. And crypto KOLSleeping in the rainI think that when all projects regard buyback as a solution to token price, buyback loses its meaning. It is more like seeking exit liquidity for shipment. Mindless buyback cannot solve the problem of sustainable development and growth. Buyback should serve the long-term development vision of the project. KOL@cryptowolfinIt is also pointed out that the key to price fluctuations is revenue growth and narrative, and repurchase itself cannot determine the long-term trend. When the market conditions are good, the project party may spend money to repurchase at high prices, resulting in extremely high costs. However, when the price of the currency falls and the income becomes worse, there is not enough money on hand, and there is no capital to innovate or adjust the strategy. The price of the currency will continue to fall. In the final analysis, what the project party should really do is to invest in growth and value distribution, rather than burning money at the wrong time.

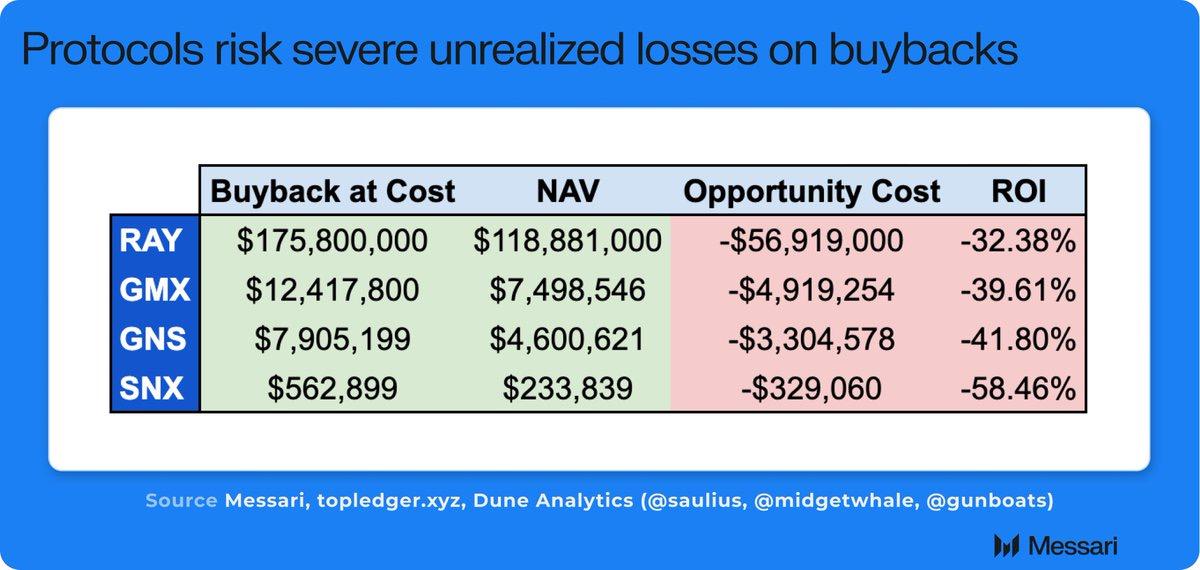

Messari ResearcherMONKRecent articles also pointed out that projects such as RAY, GMX, GNS, and SNX have previously repurchased millions of dollars worth of tokens through programmatic methods, but the current value of these tokens is significantly lower than the cost price. There are three major fallacies in the current programmatic token repurchases of various crypto projects: first, repurchases have nothing to do with price trends, which are mainly driven by revenue growth and narrative formation; second, when revenue is strong and prices rise, projects will consume more cash reserves to buy tokens at unfavorable prices; finally, when prices and revenues decline, projects lack the necessary funds to invest in innovation and restructuring, and even face large unrealized losses. Therefore, the current programmatic repurchase token strategies of crypto projects are mostly "improper capital allocation", and it is recommended that projects should focus on full growth or distribute actual value to holders in the form of stablecoins/mainstream coins.

Whether repurchase can be an effective means to boost the market or just a capital game, perhaps only time can tell. But for investors, the effect of the repurchase plan is not achieved overnight. In addition to paying attention to the repurchase amount, they should also pay attention to the long-term planning and actual implementation of the project.

The article comes from the Internet:15 crypto projects have started a token repurchase trend. Is this a good way to save the market or a capital illusion?