PolyFlow PayFi Use Case: Innovative PayFi Solution Built for DePIN Network

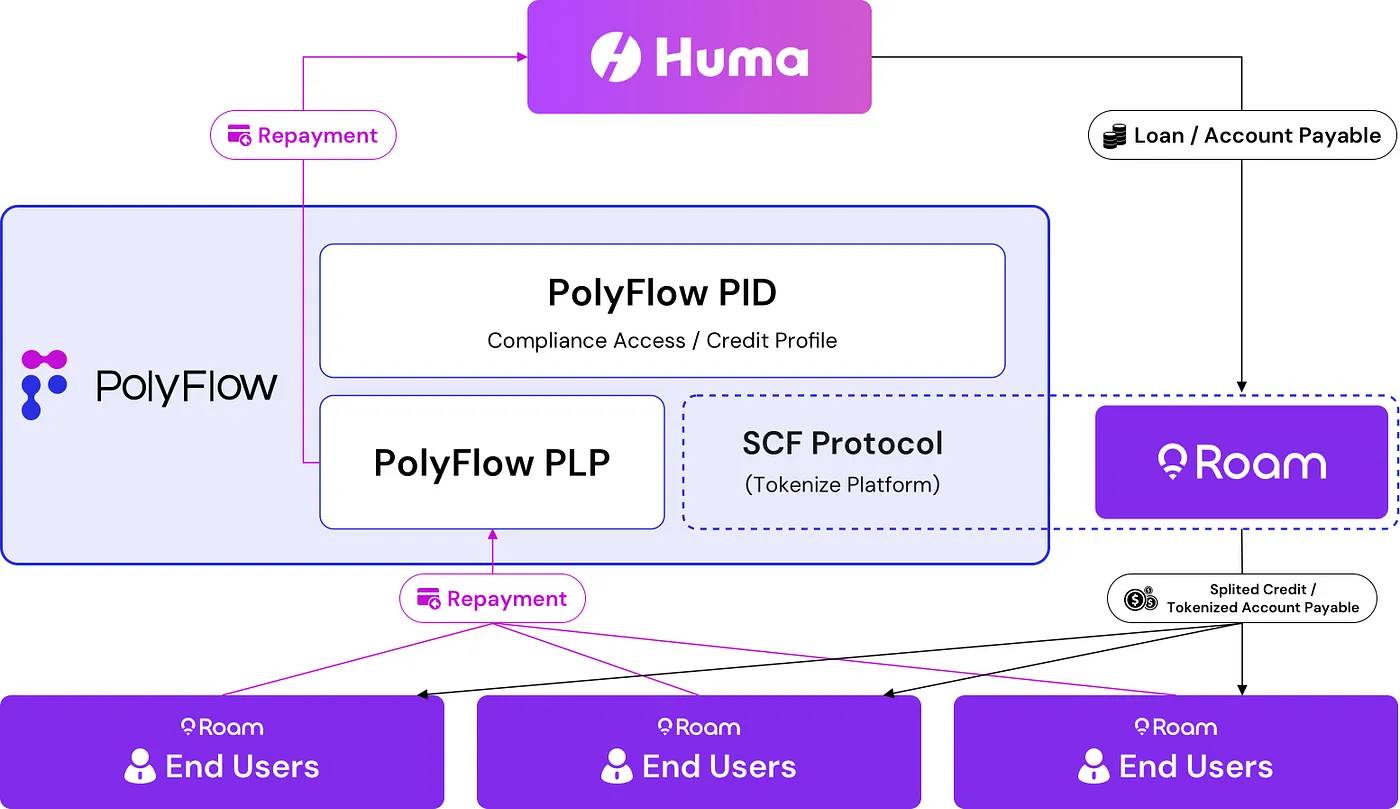

The first PayFi + DePIN project collaboration between PolyFlow, Roam, and Huma Finance demonstrated a groundbreaking PayFi use case that not only enhances PayFi for consumer applications, but also significantly promotes the development of the decentralized physical infrastructure network (DePIN) industry.

In this use case, PolyFlow breaks through the traditional limitation of providing credit only to institutions and promotes the direct flow of institutional credit to individual users of the project. This enables end users of the DePIN project to obtain loans for DePIN devices with only a down payment, thereby lowering the entry barrier and allowing users to actively participate in the development of a decentralized global operator network.

Let’s dive into the details.

Innovative use case: DePIN Finance

This is different from PolyFlow’s supply chain finance use case, which uses DePIN’s supplier receivables toTokenDePIN’s use case goes a step further by enabling suppliers to obtain liquidity through PolyFlow’s payment liquidity pool and optimize suppliers’ working capital.

In the traditional supply chain finance model, buyers repay the creditor the remaining funds before the due date, but this new DePIN finance approach uses PolyFlow’s payment ID and its credit function to perform a credit check on the buyer’s accounts payable.TokenIt transfers the payment obligation to the buyer’s end user, which is a major breakthrough in payment responsibility and liquidity management.

Roam is a decentralized telecommunications operator that focuses on building a global open wireless network infrastructure using Web3 and Open Roaming technologies. It encourages users to participate in network development and data sharing through incentive mechanisms and innovative technologies. Roam provides users with a variety of high-performance DePIN router devices to promote network participation.

In this DePIN Finance case, Roam obtained a loan from creditor Huma Finance through its low-risk yield product supported by growth and mining revenue, with interest paid in Roam tokens, providing a generous return.

PolyFlow tokenizes Roam’s accounts payable through its supply chain finance tokenization protocol, thereby allocating Roam’s credit to its DePIN mining end users, enabling them to indirectly obtain loans from creditors’ funds using their mining earnings as collateral.

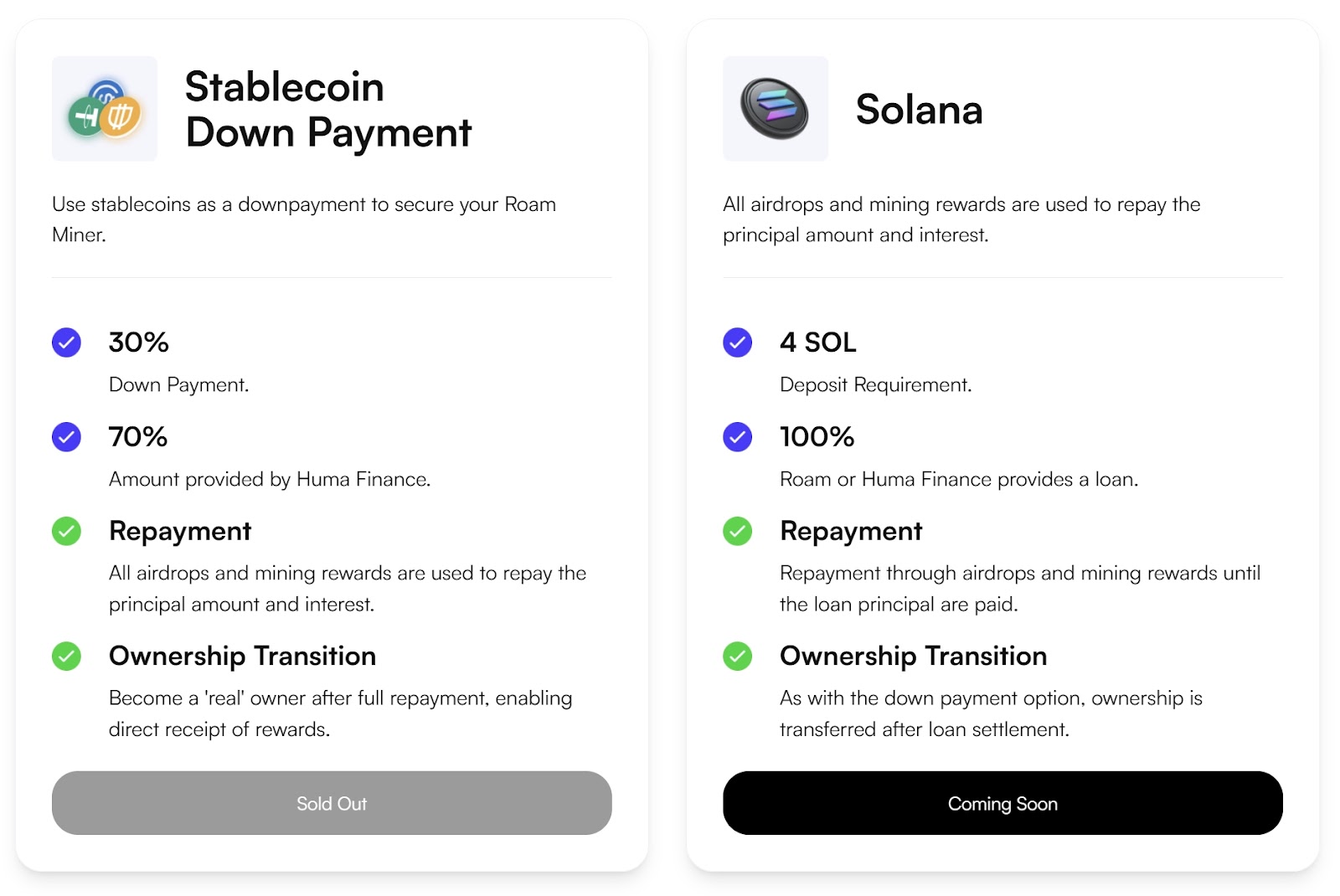

Therefore, Roam's personal mining end users can pay a down payment of 30% to purchase a DePIN device and start mining, and then repay creditors with the income generated through Roam's DePIN device when due.

Make Buy Now, Pay Never a reality

Driven by PolyFlow's innovative approach, the concept of "Buy Now, Pay Never" has become a reality. Roam mining end users can choose a loan method and get a DePIN device by paying a simple 30% down payment using USDC or SOL deposits. The remaining 70% loan balance will be repaid through the revenue generated by Roam's growth.

For mining end users, the "Buy Now, Pay Never" model provides a convenient and affordable purchase option, allowing actual consumption without compromising the growth of investment assets. For the DePIN project, it attracts a wider customer base and promotes the development of decentralized networks.

The core role of PolyFlow

PolyFlow is at the heart of this DePIN financial use case, providing the necessary transaction management tools. Its Payment Liquidity Pool (PLP) enables decentralized payments for DePIN device purchases and the “buy now, pay never” method through supported payment gateways, while also supporting its supply chain financing tokenization protocol, connecting institutional funds with individual mining end users.

Payment ID (PID) Exploitation by PolyFlowZero knowledge proofTechnology empowers mining end users to establish on-chain KYC capabilities and build strong credit profiles. By implementing a cutting-edge ZK compliance framework, PolyFlow seamlessly ensures regulatory compliance while protecting user privacy. In addition, users' active transaction behavior helps to establish a verifiable trust layer and enhance their creditworthiness. This innovative approach promotes a virtuous cycle of value generation, providing end users with an upward spiral of trust, utility, and growth within the PayFi ecosystem.

For Roam, this accelerates the deployment of infrastructure and strengthens the efficiency of the decentralized network. For Huma Finance, this provides a low-risk yield product supported by Roam’s growth and mining revenue, with rewards in Roam tokens, and strong investment potential.

PolyFlow leads the development of PayFi

For PolyFlow, the mission is clear: to build a bridge between traditional systems andBlockchainAs the basic PayFi infrastructure, PolyFlow uses advancedBlockchainTechnology drives innovative applications, accelerates adoption, and guides users toward a new financial paradigm. It is consistent with the original vision of the Bitcoin white paper and unleashes the full potential of Web3.

Social Media

To learn more about PolyFlow and follow our latest developments, please follow our official channels.

Mirror| Global Community| Discord| Twitter/X| Website

contact us

support@polyflow.tech

The article comes from the Internet:PolyFlow PayFi Use Case: Innovative PayFi Solution Built for DePIN Network

IBC’s strategic entry into the PayFi space will bring greater development potential to this sector. Led by entrepreneur and influencer Mario Nawfal, the internationalBlockchainConsulting Group (IBC Ventures) and Citizen Journalism Network Accelerator, etc…