PolyFlow PayFi Use Case: Optimizing Supply Chain Finance Through Blockchain

Global trade is a key driver of the modern economy, driving globalisation and technological progress. Standard Chartered Bank predicts that global trade will grow by $551t3t over the next decade, reaching $32.6trn by 2030. However, there are significant gaps in the availability of trade finance, particularly among small and medium-sized enterprises (SMEs) in developing countries.

This paper aims to analyze the financing needs in the global trade supply chain and exploreBlockchain和代币化技术如何应对这些挑战。通过观察 PolyFlow 供应链金融的实际应用,我们可以看到创新的 PayFi 场景是如何进一步增强供应链金融解决方案的。

-

What is Supply Chain Finance

The supply chain is a global, comprehensive and efficient organizational structure involving buyers, suppliers, manufacturers, distributors, retailers and end users from different countries, centered around core products or services. Supply chain finance is a financial service model based on the credit of core enterprises in the supply chain. It integrates data such as logistics, capital flow, information flow, and upstream and downstream enterprises.

Currently, the global supply chain finance market has exceeded 1 trillion US dollars and is expected to reach 3 trillion US dollars by 2025. Asia occupies the largest share of this market, accounting for more than 60%, while the market share of Europe and the United States is also growing steadily. The market for products and services such as accounts receivable factoring, supply chain loans and warehousing financing is expanding, showing a trend of diversified and personalized development.

passBlockchainTransforming supply chain finance

The supply chain finance market has huge value; however, the complexity of its value chain makes it difficult for all parties to synchronize information needs in a timely manner, resulting in inefficiency. Most importantly, this financing model relies heavily on the credit of core enterprises in the supply chain, making it difficult for small and medium-sized enterprises (SMEs) to participate.

Ironically, these SMEs are the ones that need financing the most. According to the International Finance Corporation (IFC), there are 65 million SMEs in developing countries with unmet financing needs. Although this important market segment is widely recognized, it has not received enough attention.

along withBlockchainAs tokenization technology matures, more and more projects are proposing innovative solutions for this neglected market segment. Blockchain technology has the potential to change the current supply chain finance landscape by enhancing market access and providing liquidity, transparency, and accessibility. In addition, it can simplify trade complexity, improve transaction process efficiency, and reduce information asymmetry.

Real-world examples of PolyFlow

Let’s take a deeper look at a PolyFlow supply chain finance scenario:

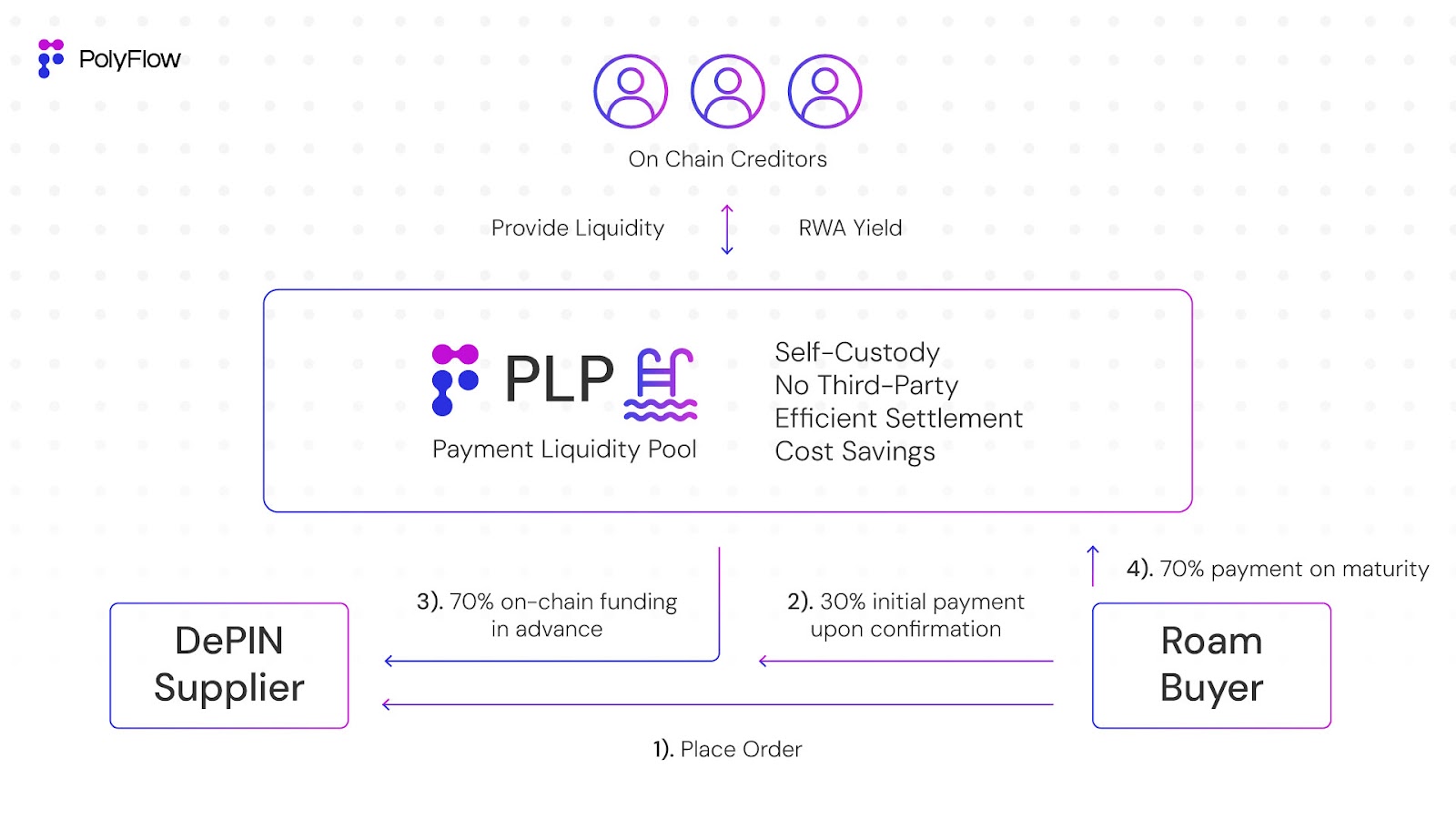

Buyers: Roam is a decentralized telecommunications operator that focuses on building a global open wireless network infrastructure using Web3 and Open Roaming technologies. It encourages users to participate in network development and data sharing through incentive mechanisms and innovative technologies. Roam provides users with a variety of high-performance DePIN router devices to promote network participation.

Supplier: The DePIN equipment supplier manages inventory based on Roam's orders and plans the production of DePIN equipment, usually with a production cycle of three months. In this scenario, Roam's $1 million order is not fully prepaid. Usually, 30% of the order amount is used as the initial payment.

Financing needs: DePIN equipment suppliers must start production after receiving an order. However, the initial payment is often not enough to cover the cost of raw materials, line startup, and completed production. Therefore, suppliers need to seek financing from banks with Roam's orders as collateral.

Reality Dilemma: The challenge is that Web3 projects like Roam, unlike traditional core businesses, often have difficulty obtaining bank credit or do not meet the bank's credit qualifications.

Solution: PolyFlow tokenizes Roam’s orders on the blockchain through its supported tokenized supply chain finance platform. This approach leverages on-chain liquidity to raise funds for suppliers based on Roam’s orders to meet their financing needs.

Therefore, this case creates a win-win situation for all parties. Roam only needs to pay the initial payment to place an order; by tokenizing Roam's accounts payable, DePIN suppliers can immediately obtain on-chain financing to support production; on-chain liquidity providers can participate in supply chain finance tokenized assets to earn returns. Ultimately, this innovative combination of supply chain finance and blockchain technology realizes the vision of PayFi.

The core role of PolyFlow

PolyFlow plays a key role in this supply chain finance scenario:

-

Creating liquidity: Traditional supply chain finance mainly involves financial institutions such as banks. In order to increase liquidity and improve operational efficiency, financiers need more diversified financing channels. Through PolyFlow's tokenization platform, suppliers' accounts receivable can be tokenized, enabling them to obtain liquidity through PolyFlow's payment liquidity pool. This approach meets the financing needs of suppliers while promoting efficient value transfer and capturing on-chain liquidity.

-

Credit transfer: Typically, supply chain finance is only open to core enterprises in the value chain, often excluding smaller SMEs. PolyFlow’s payment ID can help SMEs anchor the credit rating of buyers, enhance the overall resilience and liquidity of the entire supply chain, and help SMEs establish a credit system on the blockchain.

Supply chain finance assets are classified as private credit, traditionally only available to large institutional investors and high net worth individuals. Through PolyFlow's supply chain finance use case, liquidity providers can participate on-chain, incentivized by market-leading returns. Tokenization expands the investor base, heralding a new era of growth and efficiency. Ultimately, it promotes global economic development and contributes to a more sustainable and equitable financial landscape.

Looking ahead, the tokenization of trade assets offers multiple advantages to various participants and process links in the complex scenario of global trade, including 1) facilitating cross-border trade payments, 2) solving financing needs between trade participants, and 3) leveraging smartcontractImprove trade efficiency, reduce complexity and increase transparency.

PolyFlow is gradually enabling these advances.

Social Media

Learn more about PoXiaobai NavigationTo learn more about lyFlow and follow our latest developments, please follow our official channels.

Mirror| Global Community| Discord| Twitter/X| Website

contact us

support@polyflow.tech

The article comes from the Internet:PolyFlow PayFi Use Case: Optimizing Supply Chain Finance Through Blockchain

Bhutan has made a large investment in Bitcoin through its hydroelectric mining operations. Editor: far@Centreless Summary Bhutan’s Gelephu Mindfulness City intends to allocate digital assets such as BTC, ETH, BNB to its strategic reserves. Bhutan has made a large investment in Bitcoin through its hydroelectric mining operations…