A new species of SocialFi: How does a 15-year-old dropout genius use Clout to recreate the internet celebrity economy?

Author: Luke, Mars Finance

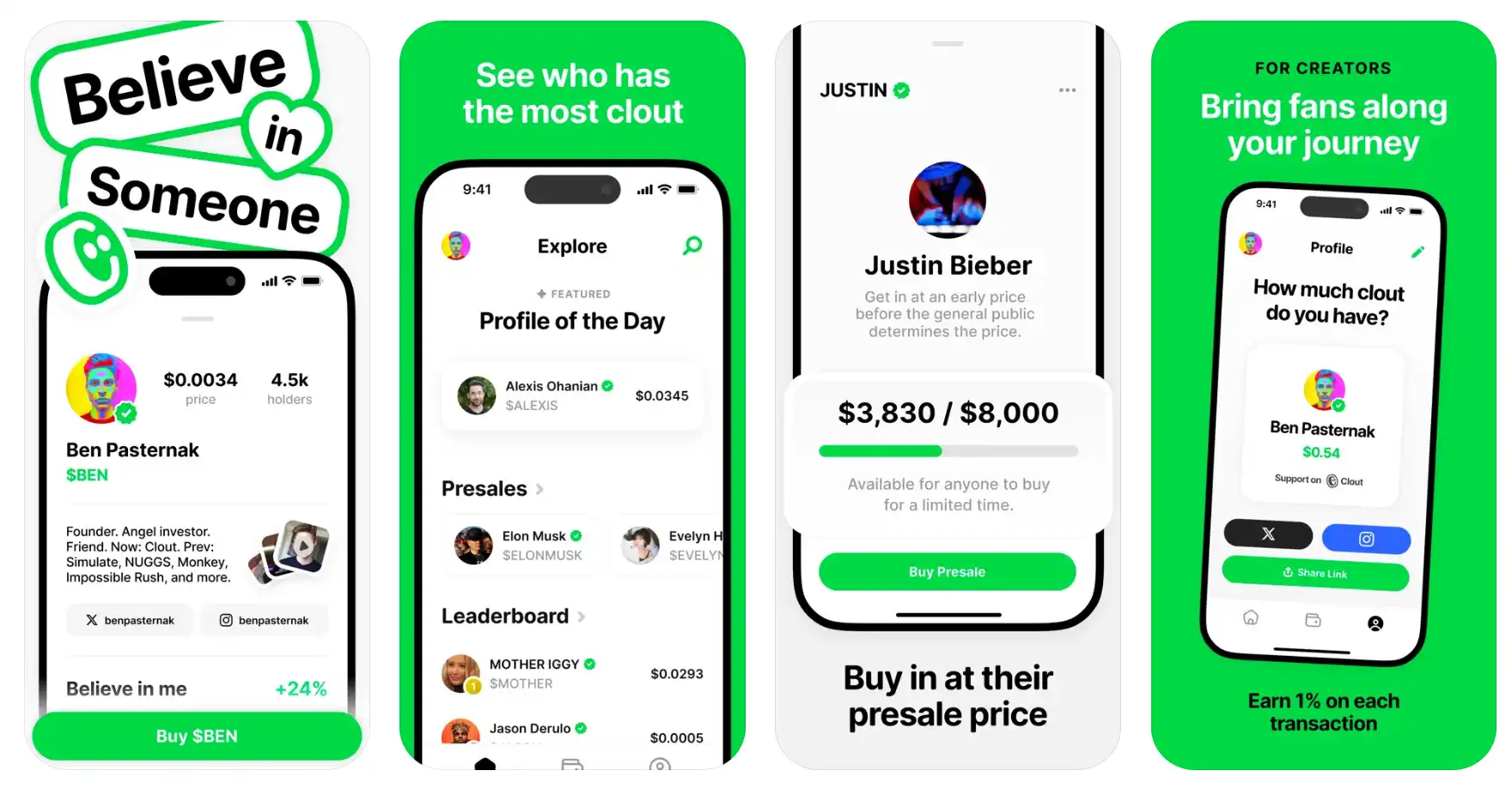

The long-dormant SocialFi track is making waves again, with an app called Clout rewriting the rules of "monetizing influence."

Today, this allows users to issue personalTokenThe platform was officially launched, and its firstToken$PASTERNAK's market value rocketed past $80 million in 5 hours (Note: As of press time, the market value of PASTERNAK is temporarily reported at US$38 million. The price of Meme tokens fluctuates greatly. The content shared in this article is only for learning and research, not as investment advice.), instantly became the focus of the crypto market. The operator behind the scenes, Ben Pasternak, is not an unknown person. This serial entrepreneur dropped out of school at the age of 15 to develop a popular social application and was selected as Forbes 30 Under 30 at the age of 25. He is trying to use Clout to inject crypto genes into the Internet celebrity economy.

It is worth noting that this experiment coincided with the golden window period of the celebrity token boom. Starting with the Trump family's series of tokens, social media influence is being quantified into tradable digital assets. The special thing about Clout is that it simplifies the complex coin issuance process to the same as creating a social account: binding social media authentication, credit card payment support, automatic allocation of internal and external trading mechanisms - this "Web2 Internet celebrity-friendly" design may be bringing a lot of fresh blood to the crypto industry.

What is Clout?

The essence of Clout is a bold genetic recombination experiment in the field of SocialFi. It cleverly stitches togetherFriendTech's social assetization logic and Pump.fun's low-threshold coin issuance mechanism, and eventually hatched a "net celebrity version of Nasdaq".

Mode decomposition:

1. FriendTech’s social fission gene

Just as FriendTech converts Twitter fans into private traffic, Clout further "chains" influence: creators issue personal tokens by binding X accounts (requires ≥ 10,000 real fans), and fans can obtain "financialized connections" with their idols by purchasing tokens.

2. Pump.fun’s Liquidity Enhancement

Drawing on Pump.fun’s minimalist coin issuance process, Clout allows creators to complete token creation within 5 minutes and control liquidity through internal and external market mechanisms: internal market pre-sales to build momentum (limited to transactions within the platform), and access to DEXs such as Raydium after the external market is opened, forming a closed loop of price discovery.

Operation path:

STEP 1: Create a username → bind X account → X tweet verification (viral marketing)

STEP 2: Enter the token name/symbol → Set the total issuance amount

STEP 3: The system automatically verifies the number of fans → pays the on-chain fee after approval → generates tokens

STEP 4: Fans pay by credit card/Apple Pay/cryptocurrencywalletDeposit funds to participate in the internal pre-sale

This hybrid model not only retains FriendTech's imagination of "social capital securitization", but also eliminates the encryption threshold through Pump.fun-style technology accessibility. While other platforms are still arguing about "which is more important, social or financial", Clout has already used a set of standardized production lines to push the Internet celebrity economy into the era of industrial mass production.

Who is the founder?

Ben Pasternak is a 25-year-old Australian. At the age of 15, he developed the game "Impossible Rush" which entered the top 20 of the US App Store. At the age of 17, he founded the youth social platform Monkey, which has more than 20 million users. At the age of 20, he turned to plant-based chicken nuggets NUGGS to occupy Walmart shelves. Now this entrepreneurial genius has entered the crypto field with Clout.

This seemingly jumping entrepreneurial trajectory actually hides a hidden logic line:Standardizing abstract valuesWhether it is packaging the social needs of teenagers into a video matching algorithm or reconstructing soy protein into "cyber chicken nuggets", Ben is always deconstructing complex systems and transforming them into scalable commodities. And Clout is a standardized meter he installed for "personal influence" - when a social media account passes the certification of 100,000 followers, the system automatically generates tokenscontractThe behavior of NUGGS factory pressing plant protein into the shape of chicken nuggets essentially shares the same industrial thinking.

The ultimate test product of this kind of thinking is the token named after him, PASTERNAK. As Clout's first case, it also received official support from Solana. The market value of the token exceeded 80 million US dollars within 5 hours of its launch, but it was clearly marked in the white paper that "the founder has 0 holdings". This deliberate divestiture of interest-related operations is like setting up a control group in a laboratory: when the founder is completely untied from the value of the token, is the market's enthusiasm a recognition of technical logic or a blind worship of celebrity IP?

Ben's ambitions obviously go beyond this. In a recent AMA, he compared Clout to "Wall Street + Hollywood in the Web3 era", trying to combine financial pricing with celebrity dreaming. However, history always repeats itself: in the 1990s, the star card trading market collapsed due to excessive speculation; in 2023, Friend.tech's tokenized social graph experienced a sharp rise and fall. When Clout equips each Internet celebrity with a mini money printing machine, perhaps it is more appropriate to ask: When traffic becomes a fixed asset on the balance sheet, will social media evolve into a more efficient value network, or degenerate into a financial reality show with the participation of all employees?

Analysis of the Celebrity Coin Launching Trend and Business Model

When Trump's MAGA token surpassed the valuation of his tech media group (DJT) with a market value of $50 billion, the crypto market was fully awakened - the capital mobilization power of celebrities has far exceeded the value carrying capacity of traditional physical assets. The emergence of Clout is like a turbocharger for this wave of "influence IPOs": it not only standardizes celebrity token issuance into an assembly line operation, but alsoFiat currency entry + enhanced liquidityThe double helix structure upgrades this encryption game into a national financial experiment.

1. Timing: The perfect storm for celebrity tokens

The crypto market at the beginning of 2025 is undergoing a paradigm shift from "technical narrative" to "cultural narrative". The wealth creation myths of the presidential family one after another have verified an underlying logic:Social media influence is programmable capitalClout keenly captured this trend and lowered the threshold for issuing coins to a very simple operation of "binding a Twitter account + 10,000 followers". Its convenience even made traditional financial IPOs seem cumbersome.

2. Genetic recombination: hybrid evolution of FriendTech+Pump.fun+Moonshot

Clout’s business model is essentially a three-strand synthetic organism:

FriendTech’s Social Capitalization:Inheriting the core of tokenizing fan relationships, Clout solves the liquidity fragmentation problem through standardized tokens (rather than fragmented keys). FriendTech's keys can only be traded within a closed ecosystem, while Clout tokens are automatically connected to DEXs such as Raydium after the internal pre-sale is completed, forming an open market price discovery mechanism.

Pump.fun's industrialized coin issuance:It absorbs the low threshold feature of creating tokens in 5 minutes, but achieves compliance upgrades through "identity authentication + legal currency entry". While Pump.fun users are still worried about the gas fee on the SOL chain, Clout's credit card payment channel has attracted a large number of Web2 influencers to join.

Moonshot’s liquidity migration logic:It is worth mentioning that Ben is an investor of Moonshot. Moonshoot designed a mechanism of "migration to DEX after market value meets the requirements". Clout improved it into a "dual-track system of internal and external markets" - internal market pre-sales accumulate initial liquidity, and PVP continues after the external market opens. There is also an expectation of listing on CEX in the future, forming a liquidity ladder from closed to open, avoiding the fate of tokens collapsing as soon as they are listed.

3. Advantages of the business model

Clout's revenue structure demonstrates differentiated competitiveness from traditional social platforms:

Creator side: Earn income through on-chain fees and 1% transaction fees. Compared with FriendTech's reliance on a single Key transaction commission, Clout's diversified charging model (such as internal market fees and external market liquidity sharing) is more adaptable to market fluctuations.

Investor side: The fiat currency deposit channel lowers the participation threshold and attracts Web2 users to pour in. This design is similar to how Alipay simplified the payment process by binding bank cards in the early days, bringing a large number of Web2 speculators to Web3.

4. SocialFi track catalyst

The rise of Clout may become a turning point for the SocialFi ecosystem. Its innovative mechanism directly hits the three major pain points of the industry:

Liquidity Dilemma:Traditional SocialFi platforms (such as Friend.tech) have lost users due to the fragmentation of token liquidity, while Clout has built a complete transaction chain from pre-sale to the secondary market through internal and external market linkage and CEX access.

User threshold is too high:加密原生平台依赖钱包操作,而 Clout 的邮箱注册和信用卡支付设计,将用户教育成本降至最低。这类似于微信支付通过扫码颠覆现金交易,让技术隐形于体验背后。

Imbalance between content and finance:Most SocialFi projects rely too much on token speculation, while Clout dynamically links the value of tokens with the content output of creators by binding real social media influence. This narrative of "influence as an asset" may give rise to more hybrid models similar to Substack's "subscription content + token incentives".

If Clout can continue to attract top KOLs and improve ecological tools (such as data analysis panels and DeFi staking protocols), it is expected to become an "infrastructure-level" application in the field of SocialFi. Just as Uniswap reshaped the DEX landscape through automated market makers, Clout may redefine the liquidity standards of social assets with a "personal token issuance protocol."

Conclusion: Clout’s future

In 2007, when YouTube launched its first creator advertising revenue sharing program, Silicon Valley critics mocked it as a "naive experiment in giving pocket money to amateurs." No one expected that this move would leverage a $100 billion creator economy - 17 years later, the monthly income of top YouTubers is enough to rival that of small businesses.

Clout's experiment is repeating this change in a more radical way: it attempts to upgrade YouTube's "advertising revenue sharing button" to a "personal IPO button." Fitness bloggers no longer need to wait for platform algorithms to allocate traffic, they can directly encapsulate the expectations of 100,000 fans into crowdfunding tokens; independent musicians do not have to let record companies take away 70% of their income, and the token increase brought by a hit video may be equal to the royalties of a platinum record.

The core contradiction of this experiment is actually a replica of the history of the evolution of the Internet:How to find a balance between openness and regulation, speculation and creation, short-term arbitrage and long-term value.The answer given by Clout is quite revealing - by "reducing friction through fiat currency entry, filtering bubbles through internal and external market mechanisms, and anchoring value through real social relationships", it attempts to carve out a well-cultivated experimental field in the Wild West of SocialFi.

Looking back at history, from PayPal unlocking online payments to TikTok reshaping content distribution, every technological equality is accompanied by the fission of the old order. Now, Clout is pointing the spearhead of the fission at the strongest fortress of social media:Pricing power in the attention economyIf it can resist the entropy increase of short-term speculation and truly build a value flywheel of "influence-token-practical scenario", perhaps we will eventually witness——

The Web3 declaration that was once considered a fantasy, “You are the IPO”, is nowXiaobai NavigationFrom the ramblings of crypto geeks to a tangible reality on every mobile phone screen.

The article comes from the Internet:A new species of SocialFi: How does a 15-year-old dropout genius use Clout to recreate the internet celebrity economy?

Who is the biggest winner of Pump.fun, who contributed a lot of fees and interactions? Written by: Frank, PANews Pump.fun has recently caused a public opinion crisis. The US law firm Burwick Law filed a lawsuit against Pump.fun and the fraudulent project owner on behalf of the white navigation investors who lost money on the platform...