Trump team's "official" DEX CoW Protocol: a large-scale exclusive aggregator, with revenue of $6 million last year but still losing money

Author: Frank, PANews

Recently, the Trump family's crypto project World Liberty has increased its holdings of Ethereum and other assets. During the process of increasing holdings, almost all operations were completed through the CoW Protocol. It seems that the Trump family has a special love for this aggregator. In addition, Ethereum founder Vitalik and the Ethereum Foundation also frequently use the CoW Protocol when transferring and trading assets. However, for ordinary users, the CoW Protocol is obviously not as well-known as DEX products such as Uniswap and 1inch. Until recently, due to the use of the Trump family, the attention to the CoW Protocol has been raised to a higher level.TokenCOW also rose as high as 392% from November 6 to December 25 after Trump was elected.

The "OTC market" in DEX is favored by big investors

CoW ProtocolXiaobai NavigationFounded in 2020, it was incubated by the Ethereum infrastructure builder Gnosis team. Its founder Anna George is also the business director of Gnosis. From 2016 to 2017, Anna George served as a monitoring and evaluation expert for the United Nations.

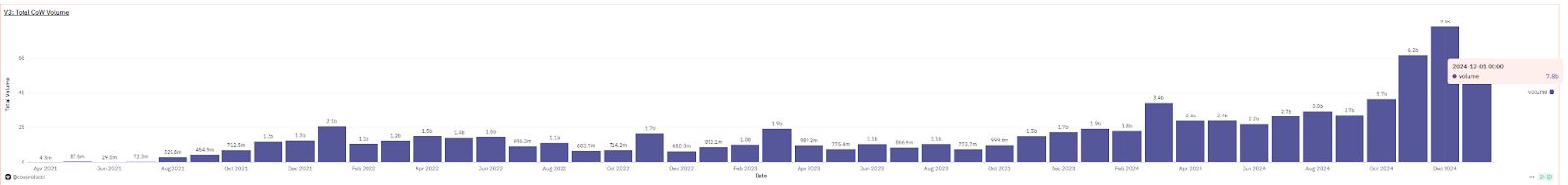

As of January 23, data showed that the number of daily active users of CoW Protocol has only reached more than 1,000 even after a significant increase. The number of daily users before was only a few hundred people per day. But in terms of cumulative trading volume, the cumulative trading volume of the project has reached 77 billion US dollars, which ranks seventh in the Ethereum ecosystem. In December 2024, CoW set a trading volume of 7.8 billion US dollars. Based on the daily active user volume of about 1,600 in December, the average monthly transaction amount completed by each user on CoW reached 4.87 million US dollars. From this point of view, CoW deserves its reputation as an exclusive trading pool for large households.

CoW Protocol has many technical features. In terms of effect, it mainly eliminates MEV and low transaction friction. The most characteristic core technical principle used is the "demand matching" mechanism. Regarding "demand matching", I will not give too much technical explanation here. In layman's terms, this mechanism is more like a kind of on-chain OTC market, which crosses the demand of AMM liquidity pool and directly matches two large users with the same demand for pricing transactions. In this way, the MEV and transaction wear on the chain are almost zero.

For users who trade millions or even tens of millions of dollars each time, this mechanism directly hits the pain point and can also minimize the impact on market prices. This also explains why the Trump family project World Liberty chose to use the CoW Protocol for asset allocation. At the same time, the Ethereum Foundation and Vitalik are also keen to use this project. The Ethereum Foundation has sold coins many times through CoW.

On the other hand, for ordinary users, the most important considerations may be transaction speed, the number of transaction categories, and flexible transaction pools. In contrast, the matching mechanism of CoW Protocol does not lead in these aspects. But it does not matter. For CoW Protocol, it seems to be designed for large users from the beginning.

The data has indeed improved, and we want to increase our income level

近期CoW Protocol受到World Liberty项目的利好,其治理代币COW从11月6日开始,价格价格一路飙升,由最低的0.25美元,最高涨至1.23美元。涨幅最大达到392%。

The COW token was launched as early as 2022, with the earliest opening price being about $0.8. In the following year, the price fell all the way, falling to a minimum of $0.062. It did not start to rise until 2023, but it hovered below $0.4 most of the time. It was not until September 2024 that Coinbase announced that it would introduce the CoW Protocol into the coin listing route. On November 6,Binance, Bybit and many othersexchangeCOW was launched on the same day. Interestingly, this day was also the day Trump won the 2024 US election.exchangeCOW has been added to the Trump series of related assets, and as soon as the election results came out, it immediately triggered market pursuit.

However, since Christmas, the price of COW tokens has been falling. As of January 23, its price has fallen to around $0.63. Calculated from the high point, the overall correction is close to 50%.

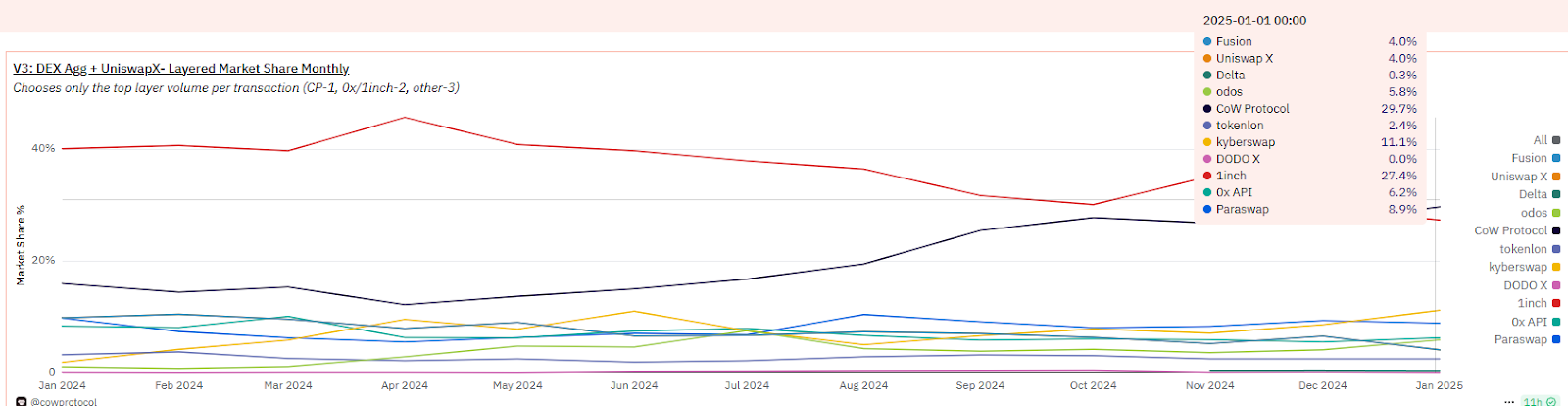

Apart from the traffic effect brought by the hot spots, the data performance of CoW Protocol itself has seen tremendous growth in recent months. The most obvious is the transaction volume. Since 2024, the monthly transaction volume of CoW Protocol has basically fluctuated between 2 billion and 3 billion US dollars. Starting in November, this figure began to surge to 6.2 billion US dollars, and in December it reached an all-time high of 7.8 billion US dollars. Throughout 2024, CoW Protocol's market share in Ethereum ecosystem aggregators has always been lower than 1inch, ranking second. On January 23, 2025, the data performance of that month has exceeded 1inch for the first time, ranking first. However, the final ranking of the two for that month may not be known until the beginning of next month.

January 22, Cow DAO在Snapshot上发布CIP-61提案,试图通过进一步规范CoW Protocol的收费模型和比例,实现更好的收入水平。据提案介绍,CoW Protocol在2024年共实现了约600万美元的收入,但仍未能达到盈亏平衡,当年开发成本(440 万美元)、赠款(70 万美元)和求解器奖励(520 万美元)。因此,Cow DAO希望通过这个提案,能够优化用户的交易执行价格,创造更多的额外价值以早日达到盈亏平衡,摆脱对外部资金的需求。

According to the official dashboard of CoW, the cumulative income of CoW DAO is 3,648 Ethereum, which is about 12 million USD at the price of 3,300 USD. In the Ethereum ecosystem, the income level of CoW Protocol ranks about 50th. As an aggregator that has been operating for 4 years and ranks among the top in terms of transaction volume, this income level is indeed low.

Coupled with the overall improvement in recent data, the CoW team obviously hopes to seize the current market opportunities and achieve new milestones. At present, the proposal has been successfully passed, but the discussion on social media is not very hot. The token market has not seen significant price fluctuations as a result. Perhaps, for the CoW team, capturing large users only requires targeted products and designs, but capturing the general public seems to be much more difficult. For ordinary users and token investors, complex proposal expressions seem far less affordable than a simple airdrop.

The article comes from the Internet:Trump team's "official" DEX CoW Protocol: a large-scale exclusive aggregator, with revenue of $6 million last year but still losing money

Trump hopes Bitcoin will reach $150,000 early in his presidency. Author: Xiaobai Navigation Coderworld Yesterday's Market Dynamics Microsoft shareholders vote against Bitcoin investment proposal According to Jinshi, voting results showed that Microsoft's major shareholders opposed the company's Bitcoin investment proposal on Tuesday. Microsoft's board of directors had earlier urged shareholders to reject the U.S. National Public Policy...