HTX Ventures Managing Partner Edward Chen attended the Korea 2023 STO Summit: In 2030, the Korean STO market is expected to reach 367 trillion won

On November 10, Edward Chen, managing partner of HTX Ventures, attended the 2023 STO Summit in Korea and delivered a keynote speech on STO Insights & Potential. The speech focused on Security Token Offering (SecuritiesTokenThe development of the securities industry in Asia, including securities-related transaction regulation, future potential and challenges, key areas of growth, and potential investment opportunities in 2024.

As the STO/RWA field becomes more popular, HTX Ventures has also invested considerable attention and research in it.

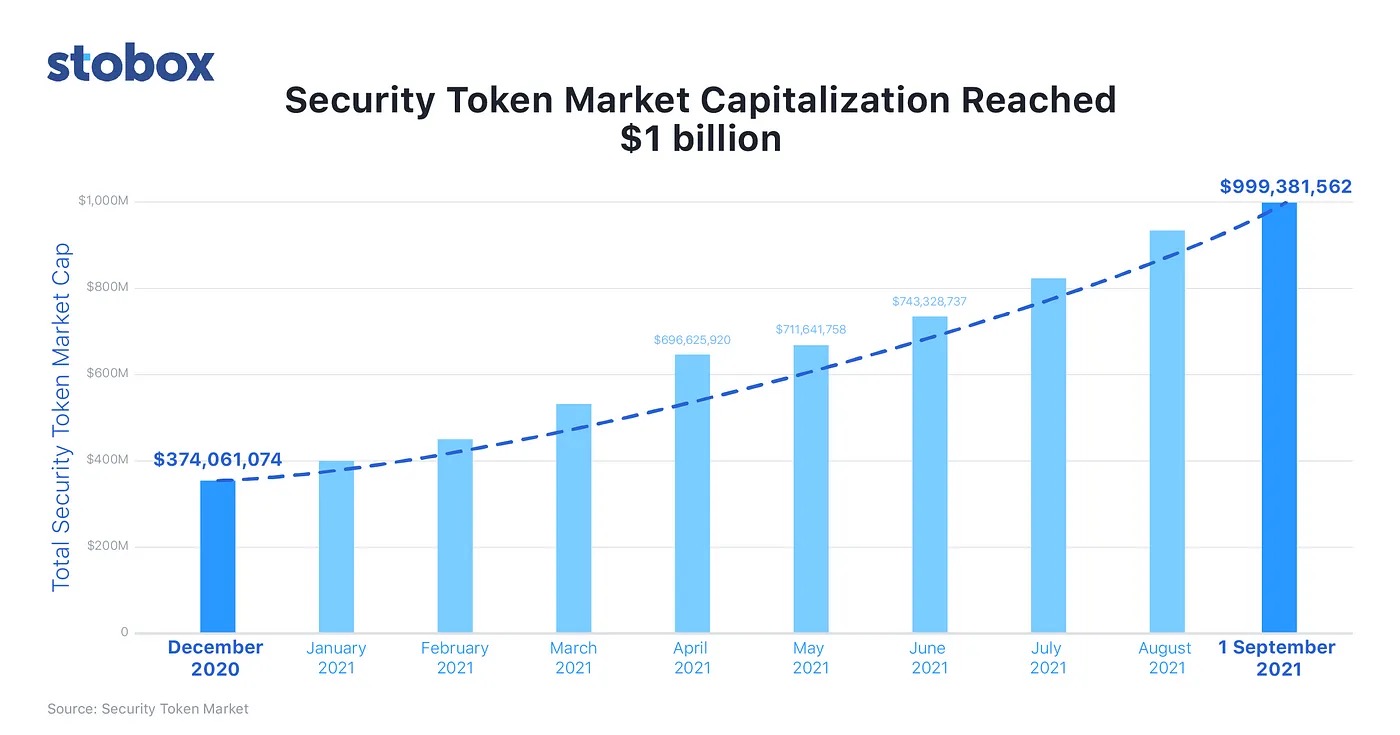

The STO market has huge potential and is growing rapidly

根据STO市场的数据,2020年12月至2021年9月,STO市值已从3.74亿大幅增长至估计的10亿,增长率为2670%。这种势头在2022年继续存在。2021年4月至2022年4月,STO交易量增加386%,其市值增长了2650%。2022年5月,证券化代币资产的总市值在一年内增长了20倍,未来一年内或将超过190亿美元。到2030年,韩国STO市场有望达到367万亿韩元(2870亿美元)。

*Image from STOBOX

Edward Chen在演讲中分析了STO的优点和局限性,优点包括灵活性、技术进步、积极的代币经济、完全在监管下运作、高可组合性等。

-

flexibility: Multiple issuers or individuals can also achieve the purpose of asset refinancing more flexibly. Issuers can broaden financing channels and cover more investors.

-

skill improved:useBlockchainRealize cross-regional communication.contractIt can be used to conduct automated transactions, and even facilitate cross-border settlements for enterprises and meet more payment scenarios.

-

Active Token Economics:Tokens have the functional role of economic incentive mechanisms and can redefine property rights and production relations.

-

Fully regulated operation:Effectively prevent fraud and market manipulation, and fundamentally guarantee the interests of investors and fair trading.

-

High composability:STO and DeFi and STO and NFT, etc.

Limitations of STOs:

-

Securitized assets are subject to increasing regulation, making the management process complex.

-

STO platforms must constantly keep up with changing regulations.

-

Regulations in some areas may restrict who can invest in STOs, thereby controlling the number of investors.

Throughout the Asia-Pacific region, the STO ecosystem is developing but is still in its early stages. From a technology perspective, North America continues to lead, with many excellent products and technologies originating from the region. The potential of the Korean market should not be underestimated, especially with its unique Korean culture and gradual relaxation of regulations.

Japan's STO market is the most active market in Asia. From 2019 to 2022, traditional financial companies have been deployed in the STO field, including large securities companies and banks. The types of Japanese STO include corporate bonds, credit card bonds, real estate, carbon emissions, etc. JPX (Japan Exchange Group) will launch the STO market in 2025.

Both are real assets: Differences between STO and RWA and future predictions

Edward Chen pointed out in his speech that the main difference between STO (Security Token Offerings) and RWA (Real World Assets) lies in their focus and scope.

1. STO focuses on the securities sector, emphasizing issuance andBlockchainOn the other hand, RWA includes a broader scope, tokenizing various real-world assets, including both assets with monetary value and non-monetary value.

2. STO emphasizes the compliance of the securities industry and investor protection. On the other hand, RWA focuses on introducing various real-world assets intoBlockchain, providing more liquidity and channels for value exchange.

3. In the last cycle around 2017-2018, when the concept of DeFi was not yet prominent, the STO narrative was mainly centered around equity issuance, such as issuing company shares or equity-like assets, without delving into bonds. However, RWA discussions often centered around assets such as U.S. Treasuries or fixed-income assets.

Therefore, the two concepts belong to different eras and cycles, resulting in significant differences in their narratives and contexts. In conclusion, STO can be seen as a limited implementation of RWA.

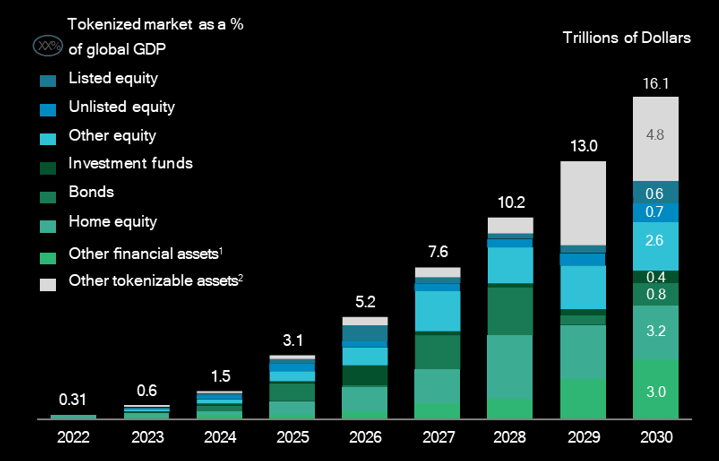

Based on the data, Edward Chen made rational predictions on the future trends of STO in his speech.

*Source: Relevance of onchain asset tokenization in crypto winter

1. Between April 2021 and April 2022, STO transaction volume increased by 38%Xiaobai Navigation6%, while their market value increased by 2650%. In May 2022, the total market value of securitized token assets increased 20 times in one year, and may exceed US$19 billion in the next year.

2. Tokenized assets will see increasing adoption across industries, such as real estate, investment funds, bonds, and stocks. In addition, their utilization is expected to expand to more unconventional assets, such as patents.

3. Tokenized assets grow massively 50 times from 2022 to 2030. Their value rises from $310 billion to $16.1 trillion.

4. By 2030, securitized token assets will account for approximately 10% of global GDP in a decade.

5. STOs are more popular than ICOs due to their improvedSafetyThe number of related companies is growing every year, and more and more STO projects have successfully raised millions of dollars.

6. Europe is expected to see an STO boom in the next five years. Researchers estimate that by 2026, the market size of European digital assets will exceed 1 billion euros.

Moreover, since STO providesSafetyAnd transparent investment and fundraising channels, among the industries that have accepted the STO trend are real estate, gems and metals, natural resources, and private equity projects. Taking real estate as an example, the STO solution is to tokenize real estate assets, facilitate the process of purchasing real estate shares, and make it easier for small investors to participate in real estate investment. For companies, STO is an effective way to raise funds, attract global investors, and provide investors with greater liquidity and transparency. It is a win-win solution. It is estimated that 89% of trading security tokens are allocated to real estate, and by 2026, the global real estate market is expected to reach US$5388.87 billion, with a compound annual growth rate of 9.6%.

Edward Chen shared several potential opportunities for RWA in his predictions for the future:

Decentralized stablecoins and fixed-income assets are the main categories in RWA, and there is more room for future development.

As equity RWAs gain more attention, government bond RWAs will become mainstream.cryptocurrencyCommunityrecognized in.

There is a demand for tokenization of real estate and carbon emission trading, but compliance remains a major challenge.

Token standards will be diversified, ERC-20 may not be the mainstream in the future, NFT notes, RETI collectibles and other fields will appear.

More projects will provide space for infrastructure and RWA services.

Regulation in Hong Kong and Singapore may have contributed to the RWA boom.

Regarding RWA, it is worth noting the BTC ETF, which has become a key milestone in the development of RWA. Since 2023, 8 major financial institutions have submitted spot Bitcoin ETF applications to the US SEC. The approval of the Bitcoin spot ETF is inevitable. Once approved, it will be a critical moment in the development of RWA. Trillions of capital will enter the RWA market, allowing traditional financial institutions, traditional family offices and funds to recognize and invest in Bitcoin, and enhance the mainstream credibility and acceptance of Bitcoin investment.

A bright spot in the RWA space is the tokenization of US government bonds. The tokenized trading volume of this US government bond is $697 million, with an annual yield of approximately 5.25%. Decentralized stablecoins and fixed-income assets still dominate. For example, MakerDAOIt is currently the undisputed leader in the RWA field, with a total business size of US$32.8 billion, and protocols from RWA account for more than 65% of MakerDao's revenue.

At the end of the speech, regarding the future of STO, Edward Chen also analyzed the success factors of STO. Although STO provides important business opportunities and financial innovation, markets, investors and issuers for the financial industry, its structure is still in its early stages. Looking ahead, many factors will affect its ultimate success. These factors include the STO ecosystem and stakeholders, laws and regulations, trading platform reputation, and investor education.

HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation and research to identify the best and most promising teams in the world. As a pioneer in the industry for 10 years, HTX Ventures explores, reveals and assists the industry's cutting-edge technologies and emerging business models, provides financing, resources and strategic consulting for projects, and jointly develops the blockchain ecosystem.

To date, HTX Ventures has achieved a 60-fold return on investment, with investments covering more than 20 countries and regions, more than 120 fund partners, and has supported more than 200 interdisciplinary projects, of which 60%’s project was eventually launched on Huobi HTX.

Huobi HTX will continue to pay attention to and support the development of the RWA industry together with its investment department, and provide professional guidance and consulting, extensive resource networks, liquidity pools and users to portfolio projects.

The article comes from the Internet:HTX Ventures Managing Partner Edward Chen attended the Korea 2023 STO Summit: In 2030, the Korean STO market is expected to reach 367 trillion won

YGG投资的游戏资产在2022年一整年下有了较大的缩水,其投资风格逐渐转向谨慎。 项目概要 YGG所处的赛道为链游公会赛道。 由于Gamefi赛道在2021年的崛起,Axie Infinity的爆火引发了区块链玩家的打金狂潮,但对于大多数低收入国家的游戏玩家来…