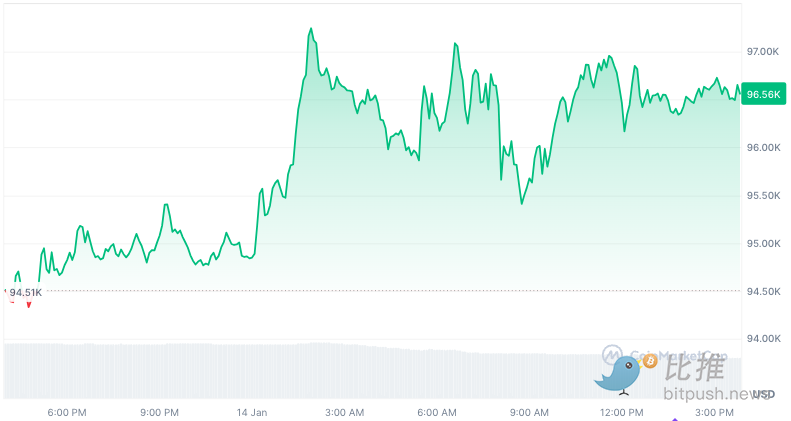

PPI data is a timely relief, Bitcoin breaks through $96,000

Written by: BitpushNews

After the release of the U.S. Producer Price Index (PPI) data, Bitcoin continued to rebound to above $96,000, with an increase of 2.5% in the past 24 hours. Among the mainstream altcoins, XRP and DOGE led the gains with increases of 6% to 7%.

The report shows that the US PPI rose by only 0.2% month-on-month in December, lower than the 0.4% in the previous month and also lower than the consensus forecast of 0.4% by economists.Xiaobai NavigationThe Consumer Price Index (CPI) is a forward-looking indicator that plays an important role in the overall inflation level. The cooling of the PPI is a positive signal for the Fed's next move.

前一天,《华盛顿邮报》报道称,接近特朗普新政府的消息人士透露,当选总统将在上任后发布与加密货币相关的行政命令。这些命令预计将解决所谓的「去银行化」问题,并扭转有争议的 SAB 121 政策,该政策限制银行为加密货币公司提供服务。

Cryptocurrency billionaire and Galaxy Digital founder Mike Novogratz mentioned last year that SAB 121 was one of the policies of the Joe Biden era and that the policy would be quickly repealed after Trump took office.

Crypto markets rallied following a Washington Post report that Trump’s willingness to support a crypto legislative strategy early in his presidency was driven by a group of Silicon Valley moguls, including A16Z general partner Marc Andreessen.

Derivatives market indicators show market volatility

Derivatives market data show that the volatility of Bitcoin and other cryptocurrencies is expected to continue to rise. The short-term implied volatility of Bitcoin options remains high, while the VIX index, which measures the volatility of the US stock market, also remains at a high level, indicating that the overall market uncertainty has increased.

According to Deribit data, the first Bitcoin options expiration date this year is January 24, two days after Trump's inauguration. The market is slightly optimistic about this point in time, and the demand for call options is relatively high. Among them, the call option with a strike price of $99,000contractQCP Capital analysts believe that derivatives market data show that market volatility will continue in January.

K33 Research had previously predicted that Inauguration Day could be a good opportunity to sell, but the recent widespread decline in the stock market and digital assets has caused it to adjust this view. The agency said that while the appeal of selling on Inauguration Day has weakened, the market still needs to pay close attention to price movements next week. The report stated: "While our previous monthly outlook favored selling on Inauguration Day, the attractiveness of this strategy has been greatly reduced given that both the stock market and Bitcoin have recently hit two-month lows. The S&P 500 filled the post-election gap yesterday, and Bitcoin also hit a two-month low. De-risking operations will depend entirely on next week's price movements, and their impact will be short-lived as we are optimistic about Trump's long-term impact on BTC."

Cryptocurrency research firm 10x Research said in a report that "lower-than-expected inflation data could trigger a rise in Bitcoin" as the Federal Reserve considers the impact of inflation.

Geoffrey Kendrick, head of digital asset research at Standard Chartered Bank, said in a research note on Jan. 14 that Bitcoin is currently under pressure from macro risks and any pullback below $90,000 represents a “medium-term” buying opportunity.

“If we do retest this level (if it breaks below $90,000 I would expect a drop to below $80,000), I would view it as an excellent medium-term buying opportunity,” the report said. Despite the short-term risks, Standard Chartered reiterated its long-term price target for Bitcoin of $200,000 by the end of 2025.

Crypto traders should be accustomed to short-term pullbacks during the bull market. Fundstrat co-founder Tom Lee said on CNBC's "Squawk Box" that the price of Bitcoin may pull back to $70,000, then set a new high, and eventually reach between $200,000 and $250,000 by the end of the year.

The article comes from the Internet:PPI data is a timely relief, Bitcoin breaks through $96,000

Stripe believes that stablecoins have potential and are the perfect medium to achieve a smooth and efficient process of asset conversion. Written by: IOSG Ventures 1. Stripe's largest acquisition Bridge What does it mean for the crypto industry? Stripe is one of the world's largest online payment service providers and processors. The platform uses its open...