Can DeFAI, which deeply integrates DeFi and AI, give birth to a new wave of AI Agents?

Author: YBB Capital Researcher Ac-Core

1. What story does DeFAI tell?

1.1 What is DeFAI

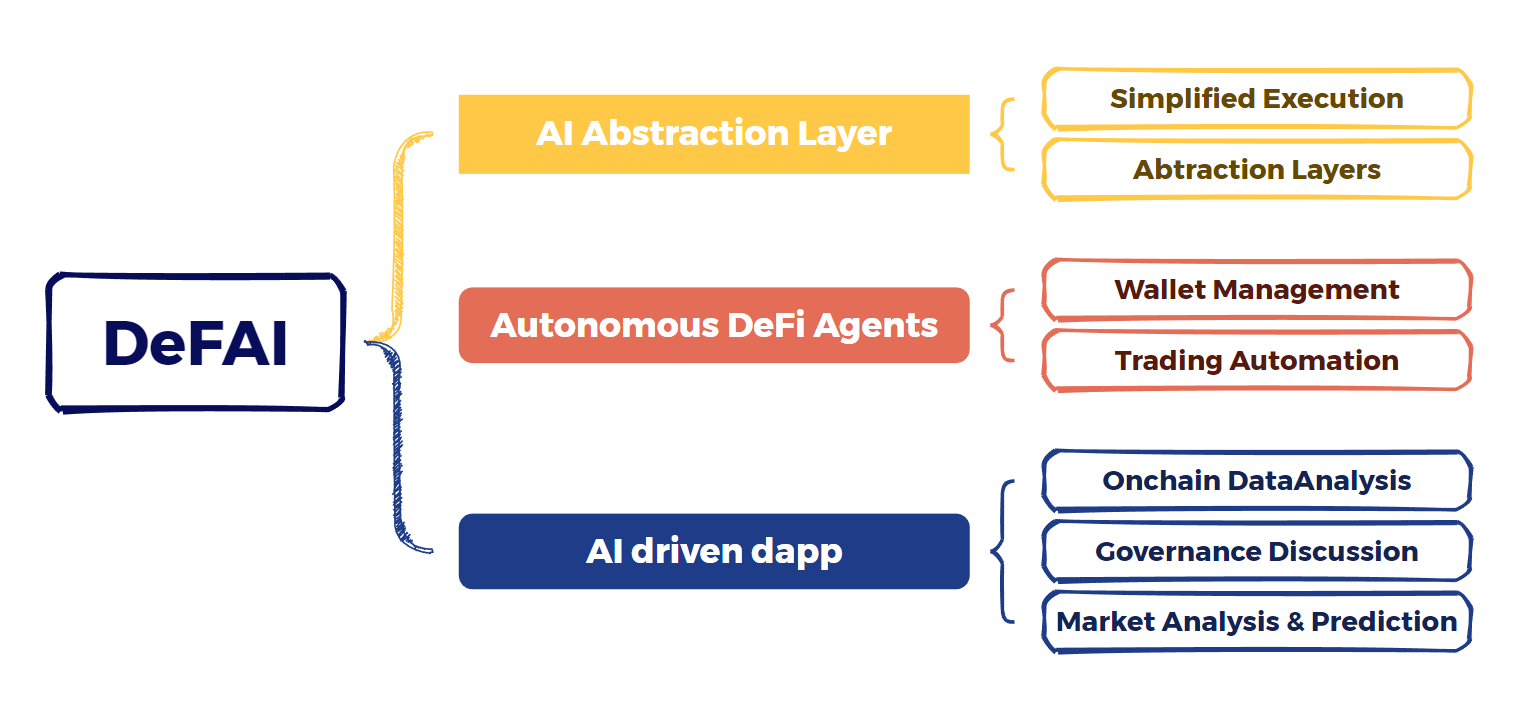

DeFAI is AI+DeFi in a succinct way. The market has hyped AI over and over again, from AI computing power to AI Meme, from different technical architectures to different infrastructures. Although the overall market value of AI Agents has generally fallen recently, the concept of DeFAI is becoming a new breakthrough trend. The current DeFAI can be roughly divided into three categories: AI abstraction, autonomous DeFi agent, and market analysis and prediction. The specific divisions in the categories are shown in the figure below.

Image source: self-made by the author

1.2 How DeFAI works

In the DeFi system, the core behind AI Agent is LLM (Large Language Model), which involves multi-level processes and technologies, covering all aspects from data collection to decision execution. According to the research of @3sigma in the IOSG article, most models follow the principles of data collection, model reasoning, decision making, hosting and operation, interoperability,walletThese six specific workflows are summarized below:

1. Data Collection:The first task for an AI agent is to gain a comprehensive understanding of the environment in which it operates. This includes acquiring real-time data from multiple sources:

● On-chain data: obtain real-time data through indexers, oracles, etc.BlockchainData, such as transaction records, intelligencecontractStatus, network activity. This helps Agents keep in sync with market dynamics;

● Off-chain data: Obtain price information, market news, and macroeconomic indicators from external data providers (such as CoinMarketCap, Coingecko) to ensure that the Agent understands the external conditions of the market. This data is usually provided to the Agent through an API interface;

● Decentralized data source: Some agents may obtain price oracle data through decentralized data feed protocols to ensure the decentralization and credibility of the data.

2. Model Reasoning:After data collection is complete, the AI Agent enters the reasoning and calculation phase. Here, the Agent relies on multiple AI models for complex reasoning and prediction:

● Supervised and unsupervised learning: By training on labeled or unlabeled data, AI models can analyze the behavior of markets and governance forums. For example, they can predict future market trends by analyzing historical trading data, or infer the outcome of a voting proposal by analyzing governance forum data;

● Reinforcement learning: Through trial and error and feedback mechanisms, AI models canXiaobai NavigationAutonomous optimization strategy. For example,TokenIn trading, AI Agent can determine the best time to buy or sell by simulating multiple trading strategies. This learning method enables the Agent to continuously improve under changing market conditions;

● Natural Language Processing (NLP): By understanding and processing user natural language input, Agents can extract key information from governance proposals or market discussions to help users make better decisions. This is especially important when scanning decentralized governance forums or processing user instructions.

3. Decision Making:Based on the collected data and the results of reasoning, the AI Agent enters the decision-making stage. At this stage, the Agent not only needs to analyze the current market situation, but also make trade-offs between multiple variables:

● Optimization Engine: Agent uses the optimization engine to find the best execution plan under various conditions. For example, when providing liquidity or arbitrage strategies, Agent must consider factors such as slippage, transaction fees, network latency, and fund size in order to find the optimal execution path;

● Multi-agent system collaboration: In order to cope with complex market conditions, a single agent is sometimes unable to fully optimize all decisions. In this case, multiple AI agents can be deployed, each focusing on different task areas, to improve the decision-making efficiency of the overall system through collaboration. For example, one agent focuses on market analysis, and another agent focuses on executing trading strategies.

4. Hosting and Operation:Since AI Agents need to process a lot of calculations, they usually need to host their models on off-chain servers or distributed computing networks:

● Centralized hosting: Some AI agents may rely on centralized cloud computing services such as AWS to host their computing and storage needs. This approach helps ensure the efficient operation of the model, but it also brings potential risks of centralization;

● Decentralized hosting: In order to reduce the risk of centralization, some agents use decentralized distributed computing networks (such as Akash) and distributed storage solutions (such as Arweave) to host models and data. Such solutions ensure the decentralized operation of the model while providing persistence of data storage;

● On-chain interaction: Although the model itself is hosted off-chain, the AI Agent needs to interact with the on-chain protocol in order to perform intelligentcontractfunctions (such as trade execution, liquidity management) and managing assets. This requiresSafety的密钥管理和交易签署机制,如MPC(多方计算)钱包或智能合约钱包。

5. Interoperability:The key role of AI Agent in the DeFi ecosystem is to interact seamlessly with multiple different DeFi protocols and platforms:

● API integration: Agents connect to various decentralizedexchange, liquidity pools and lending protocols to exchange data and interact with each other. This allows Agents to access key information such as market prices, counterparties, lending rates, etc. in real time and make trading decisions accordingly;

● Decentralized messaging: To ensure the synchronization between the Agent and the on-chain protocol, the Agent can receive updates through decentralized messaging protocols such as IPFS or Webhook. This allows the AI Agent to process external events in real time, such as voting results of governance proposals and changes in liquidity pools, and adjust strategies accordingly.

6. Wallet management:AI agents must be able toBlockchainIt performs actual operations on the blockchain, and all of this relies on its wallet and key management mechanism:

● MPC wallet: Multi-party computing wallet divides the private key among multiple participants, allowing AgentSafety地进行交易而无需单点密钥风险。例如,Coinbase Replit的钱包展示了如何利用MPC实现安全的密钥管理,这使得用户可以在保持一定控制的同时,委托AI Agent进行部分自主操作;

● TEE (Trusted Execution Environment): Another common way to manage keys is to use TEE technology to store private keys in a protected hardware enclave. This approach enables AI Agents to conduct transactions and make decisions in a completely autonomous environment without relying on third-party intervention. However, TEE currently faces problems with hardware centralization and performance overhead, but once these problems are solved, fully autonomous AI systems will become possible.

1.3Origin of the sect?fromintentionarriveDeFAI

Image source: self-made by the author

If DeFAI’s vision is to enable users to manage their portfolios autonomously through AI agents and various AI platforms, making it easy for everyone to participate in crypto market transactions, does this vision naturally remind us of the concept of “intention”?

Let's review the concept of "intent" first proposed by Paradigm. When we trade normally, we need to specify a clear execution path, just like exchanging Token A for Token B on Uniswap, but in the intent-driven scenario, the execution path is matched and finally determined by the solver and AI. In other words: transaction = I specify the execution method of TX; intent = I only want the TX result but don't care about the execution process. From the rearview mirror perspective, DeFAI's narrative is not only close to the ultimate concept of AI Agent, but also perfectly catches up with the vision of realizing intent while fitting AI. Overall, DeFAI is more like a newly added path for intent.

To be realized in the futureBlockchainThe ultimate version for large-scale application will be: AI Agent + Solver + Intent – Centric + DeFAI = Future?

two,DeFAI related projects

Image source: self-made by the author

2.1 Griffain

@griffaindotcom $GRIFFAIN: 是一个结合AI Agent与区块链的创新平台,能够帮助用户去发行AI Agent,重点是创建一个强大且可扩展的去中心化金融(DeFi)解决方案,支持无缝的代币互换、流动性提供和生态系统增长。可轻松管理钱包、交易和 NFT,并自动执行 Memecoin 发行和空投等任务。

2.2 Hey Anon

@HeyAnonai $ANON: is an AI-driven DeFi protocol that simplifies interactions, aggregates real-time project data, performs complex operations through natural language processing, and facilitates the user's DeFi abstraction layer. DWF Labs announced support for the DeFAI project Hey Anon through its AI Agent Fund, and launched Moonshot on January 14.

2.3 Orbit

@orbitcryptoai $GRIFT: Simplifies the complex DeFi interface and operations, lowering the threshold for ordinary people to participate.

目前已经支持与(EVM与Solana) 100 多个区块链和 200 多个协议,代币 GRIFT 用于为平台注入活力。

2.4 Neur

@neur_sh $NEUR: is an open source full-stack application that brings together LLM models and blockchain technology capabilities, designed specifically for the Solana ecosystem, using the Solana Agent Kit for seamless protocol interaction.

2.5 Modenetwork

@modenetwork $MODE: It positions itself as the central platform for AI x DeFi innovation in Ethereum Layer2. Holders can stake MODE to obtain veMODE, thereby enjoying the airdrop of AI agents, and is committed to becoming a DeFAI Stack.

2.6 The Hive

@askthehive_ai $BUZZ: Built on Solana, it integrates multiple models including OpenAI, Anthropic, XAI, Gemini, etc. to realize complex DeFi operations such as trading, staking, and lending.

2.7 Bankr

@bankrbot $BNKR: It is an AI-drivencryptocurrencyPartner, users can easily buy, sell, exchange, place limit orders and manage wallets by just sending a message, and plans to add token exchange and on-chain tracking functions in the near future. The vision is to enable everyone to use DeFi and realize automated transactions.

2.8 HotKeySwap

@HotKeySwap $HOTKEY: Provides a complete set of DeFi tools including AI-driven DEX aggregator and analysis tools, cross-chain transactions, and supports cross-chain transactions and analysis.

2.9 Gekko AI

@Gekko_Agent $GEKKO: An AI agent created by Virtuals Protocol, focusing on providing comprehensive automated trading solutions, an AI agent specifically made for prediction markets. The automated trading strategies for GEKKO tokens include automatic rebalancing, yield harvesting, and the ability to create new token indexes.

2.10 ASYM

@ASYM41b07 $ASYM: Provides AI-driven DEX aggregator and analytical tools to identify high ROI opportunities and settle the generated profits in $ASYM.

2.11 Wayfinder Foundation

@AIWayfinder $Wayfinder: An AI full-chain interactive tool launched by the card game chain game Parallel to help Agents navigate in the on-chain environment, execute transactions and interact with decentralized applications.

2.12 Slate

@slate_ceo $Slate: It is a general AI agent and agent connection infrastructure layer, which uses natural language commands and translates them into on-chain operations, focusing on the execution of automated trading strategies, buying or selling under specific conditions, making on-chain operations as simple as thinking.

2.13 Cod3x

@Cod3xOrg $Cod3x: Solana AI hackathon project, providing code-free development tools to build agents that can automate DeFi strategies. Its Agentic Interface is a tool that can perform complex operations using only intent expressions.

2.14 Almanak

@Almanak__ $Almanak: 一种具备自我学习能力、可以自主执行任务的AI Agent,利用基于代理的建模来优化 DeFi 和游戏项目,使命是利用数据科学和交易知识来最大化协议的盈利能力,同时确保其经济安全。

2.15 HIERO

@HieroHQ $HTERM: A multi-chain smart tool for Solana and Base networks that allows users to use natural language commands to autonomously complete transactions, including buying and selling tokens, performing simple token analysis, etc.

3. What system will the AI Agent end up in?

Image source: self-made by the author

Every moment counts, and DeFAI projects are springing up like mushrooms after rain. After Bitcoin fell sharply to below $90,000 on January 13, the next day, according to Coingecko data, DeFAI-related tokens rose by 38.73% against the trend, among which $GRIFT, $BUZZ and $ANON rose the most. However, it is worth thinking about how AI Agent should go in the financial direction. The current crossroads point to Game on the left and DeFi on the right.

3.1 Game to the left:

M3 (Metaverse Makers _) (@m3org) is perhaps the most promising representative. The project is a group of artists and open source hackers suspected to be behind ai16z.CommunityThe core members of the team include JIN (@dankvr), Reneil (@reneil1337), Saori (@saori_xbt), Shaw (@shawmakesmagic), etc. However, the biggest practical obstacle for Game is that in the Web2 market, which is rich in manpower and resources, there has never been a truly popular AI game. The highly anticipated "Phantom Beast Palu" in January 2024 caused controversy about whether to adopt AI design because of its development efficiency far exceeding that of ordinary people, but the CEO eventually denied this statement. In addition, the game itself requires a long development cycle. Compared with DeFI to the right, AI Game seems to require more market enthusiasm.

3.2 DeFi to the right:

The project market capitalization ranks $GRIFFAIN, $ANON, $OLAS, $GRIFT, $SPEC, $BUZZ, $RSS3, $SNAI, and $GATSBY, among which the combined market capitalization of GRIFFAIN and ANON accounts for 37.29% of DeFAI's total market capitalization.

GRIFFAIN: Built on Solana, it currently ranks first in the DeFAI market value ranking with a market value advantage of $457M and 103,000 followers on Twitter. Its core function is to complete pointed transactions and fast transactions by generating wallets. Currently, it can cost 0.01 Sol to complete the NFT casting of The Agent Engine.

Hey Anon: It adopts a multi-training mode and currently supports different public chains such as Sonic Insider, Solana, EVM, opBNB, etc. The sudden sprint of $ANON is entirely driven by the halo of its founder Daniele (@danielesesta), who is also the founder of Wonderland, Abracadabra and WAGMI. The traffic alone has injected a lot of vitality into $ANON. Hey Anon, as his next entrepreneurial project, is currently ranked second with a market value of $248M.

IV. Summary

The emergence of DeFAI is not accidental. The core feature of blockchain is to adapt to strong financial scenarios. Currently, both GameFAI and DeFAI have shown comparable market potential. In the left direction of Game, there may be a continuation of the inheritance metaverse in the future. With the help of AI, virtual property, roles, economy and other aspects can be managed. The AI Agent's reproduction of Meme elements can be used to achieve the autonomy and prosperity of the self-evolving metaverse.

DeFi will inevitably move from passionate emotional speculation to an end point oriented to actual value. The value of AI Agent cannot rely on issuing Memes to cater to market trends, but the continuation of the AI Agent story must be supported by DeFi-like income nesting dolls. The victorious king will not always wear armor, and the final result of market competition is worth looking forward to.

The article comes from the Internet:Can DeFAI, which deeply integrates DeFi and AI, give birth to a new wave of AI Agents?

The dual limitations of landing scale and user cost. Source:cryptoSlate Compilation: Blockchain Knights It is perhaps no surprise that Internet login systems are as old as the Internet itself. In the 1960s and 1970s, as the first computer networks were formed, the need for user authentication emerged. ARPANET, the predecessor of the Internet, was launched in 196…