Hand in hand with OLD MONEY, how does Elixir connect billions of dollars of institutional assets to enter DeFi?

Preface

In 2025, the Crypto industry continues to move towards the future that the market expects. Looking back from the hopeful present, we can't help but sigh that 2024 is a year of profound transformation for Crypto. This is not only reflected in the "crypto long bull" that brought institutional breakthroughs after the approval of the Bitcoin spot ETF, but also in the fundamental change in the attitude of traditional financial institutions towards crypto technology, which is directly reflected in market sentiment and prices. In addition, the successful victory of Trump, who is friendly to crypto at the end of the year, has given the market a shot in the arm.

In this wave of transformation, the most eye-catching is the movement of BlackRock, the world's largest asset management company, in the field of encryption. Its main investment is the on-chain money market fund of US short-term Treasury bonds. BlackRock USD Institutional Digital Liquidity Fund (BUIDL Fund)The scale exceeded 530 million US dollars, and the business scope also expanded to multiple networks such as Aptos and Arbitrum. The integration of DeFi and RWA has gradually become a trend that cannot be ignored.

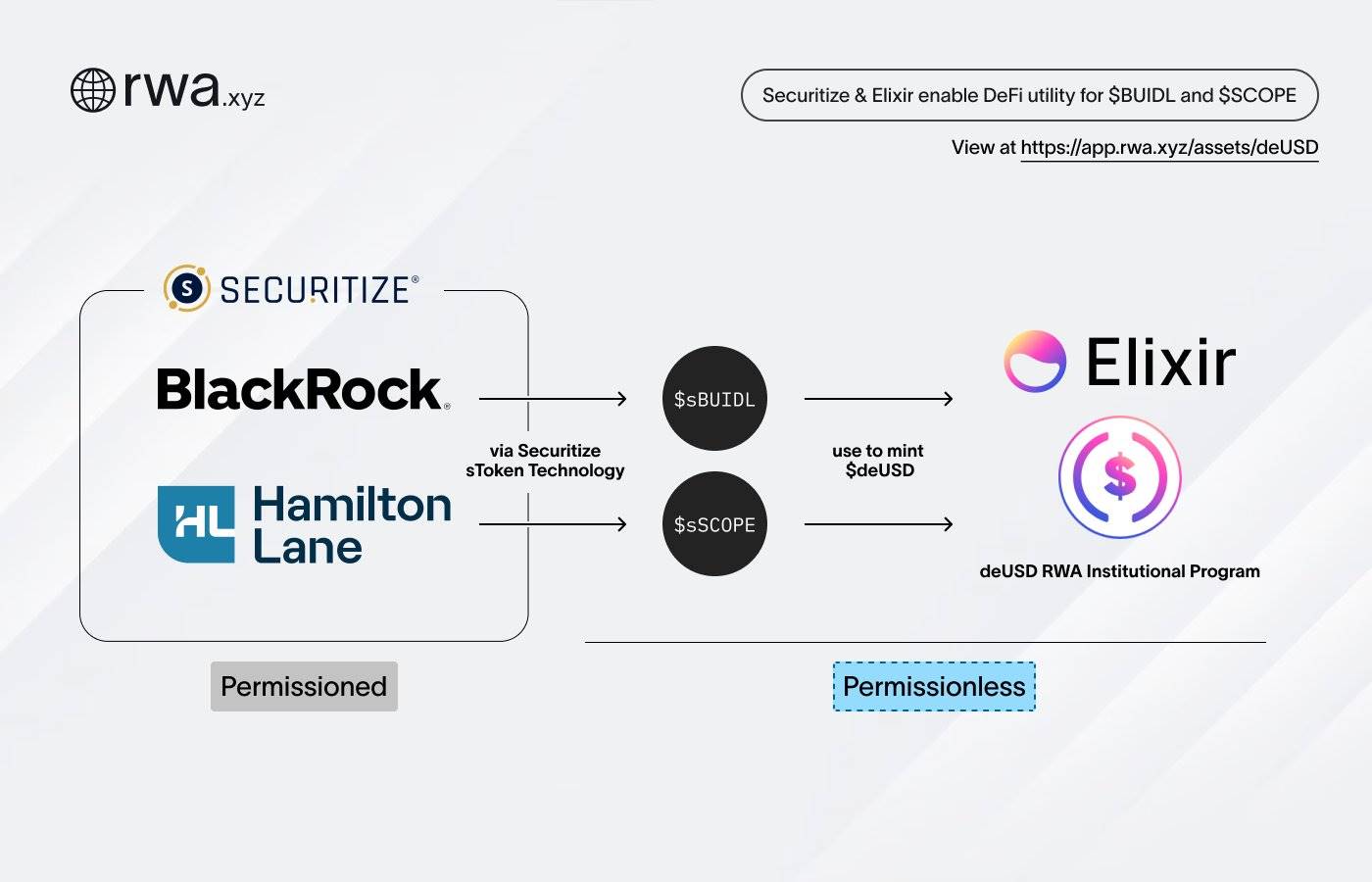

Recently, BlackRock has also continued to launch new practices based on this trend: BUIDL Fund, digital securities platform Securitize and DeFi infrastructure layer Elixir have reached a three-party cooperation to launch deUSD RWA Institutional Program, building a bridge to the DeFi ecosystem for institutional-grade RWA assets worth over US$1 billion.

Elixir, the bridge between BlackRock and the DeFi world, is not just an “assetTokenIt is not a "digital platform", but a complete infrastructure layer. Its core product deUSD not only solves the on-chain liquidity problem of institutional assets, but also ensures the assetSafetyWhile exploring the innovation and symbiosis of TradFi and DeFi, this attempt may open up a new feasible path for DeFi.

This article will explore the new direction of DeFi under the current market trend through an in-depth analysis of BlackRock’s new move and the key role played by Elixir as the infrastructure layer in this connection, and show readers the innovative path for traditional financial institution-level assets to enter the DeFi track.

Institutions are getting involved in DeFi. How does deUSD RWA work this time?

Of course, BlackRock is not the only asset management giant to join the deUSD RWA program. The entire framework also supports Hamilton Lane's SCOPE FundAnd other assets. Large institutions have already actively extended olive branches, so how to protect assets?SafetyThe top priority of this collaboration is to fully realize on-chain liquidity under the premise of ensuring stable and reliable blockchain. Elixir and Securitize cleverly address these key points of cooperation through innovative technical architecture.

Dual tracks in parallel: a perfect combination of income and liquidity

Through the unique two-tier architecture design of the deUSD RWA institutional program, the permissioned environment of traditional finance is cleverly connected with the permissionless ecosystem of DeFi.

Permission Environment: AssetsTokenThe starting point of

在第一层,BUIDL 和 SCOPE 基金通过 Securitize 的「sToken」技术进行初始代币化。这一过程基于 ERC-4626 标准,将传统金融资产转化为 $sBUIDL 和 $sSCOPE 代币。Securitize 的许可环境确保整个代币化过程符合监管要求,为机构级参与者提供必要的合规保障。

Permissionless environment: an extension of DeFi innovation

Tokenized assets enter Elixir’s permissionless environment, which is the second layer of the whole solution. Here, $sBUIDL and $sSCOPE holders can simultaneously:

-

Use its tokens to mint deUSD and gain liquidity in the DeFi ecosystem

-

Continue to enjoy the stable income brought by the underlying assets (such as US short-term Treasury bonds)

-

Participate in a wider range of DeFi applications without affecting the original income rights

The subtlety of this two-tier architecture is that it achieves complete risk isolation:

Obviously, Elixir has taken risk isolation into core consideration when designing deUSD RWA. The standardized interface of ERC-4626 vault provides a unified standard paradigm for asset valuation and risk monitoring.Xiaobai NavigationThe mechanism of decoupling rights and liquidity is adopted, and the original assets (such as the treasury bond income of BUIDL) are completely separated from the operations of the DeFi interaction layer.contract确保了收益权的独立性,即使 DeFi 端出现波动,也不会影响底层资产的安全。

-

Separation of income rights and liquidity: the original income flow remains unchanged at the Securitize level

-

Separation of environments: The permissioned environment ensures compliance, and the permissionless environment provides space for DeFi to flourish

-

风险的分离:即便 DeFi 端出现波动,也不会影响到底层 RWA 资产的安全性

How does Elixir, favored by BlackRock, support the entire chain?

It is no coincidence that Elixir has been favored by traditional financial giants such as BlackRock.

In the in-depth cooperation with BlackRock and Securitize, Elixir has demonstrated mature institutional-level service capabilities. The project team is composed of senior practitioners from top investment banks such as Goldman Sachs and Morgan Stanley, who are well versed in the business needs and compliance demands of traditional financial institutions.

With its deep accumulation in the field of DeFi infrastructure, Elixir has successfully provided institutions with complete asset management lifecycle support. From "DeFi liquidity integrator" to "one-stop RWA liquidity solution provider", this bridge connecting TradFi and DeFi can be said to be quite solid.

Building institutional-grade infrastructure

对于要进入 DeFi 的机构级用户,不仅需要满足传统金融机构对安全性和合规性的严格要求,还要确保系统具备足够的可扩展性和互操作性。基于对机构需求的深入理解,Elixir 构建起了一套完整的解决方案。

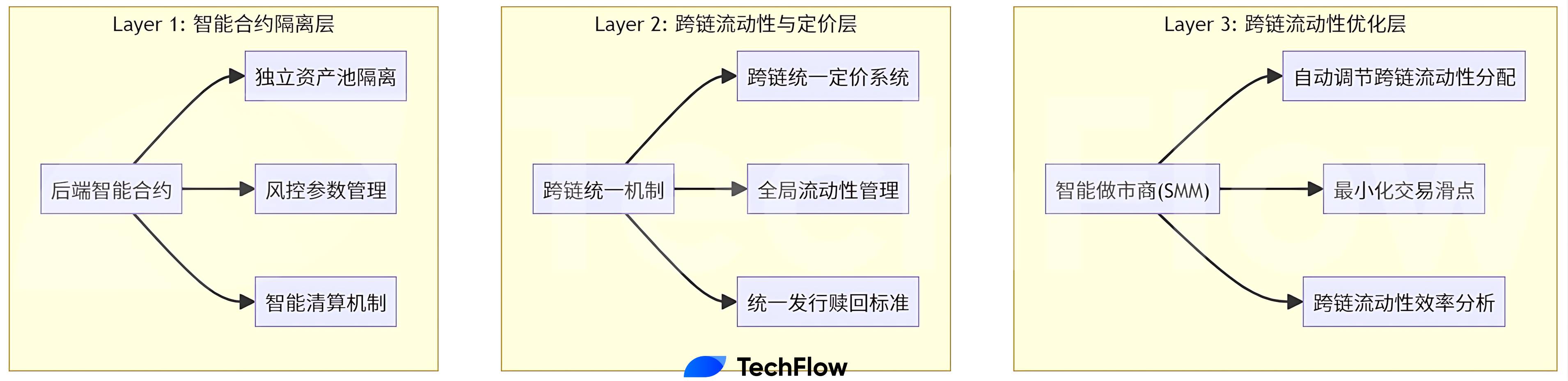

deUSD with three-layer security architecture

第一层是资产隔离层,通过智能合约实现机构资产的完全隔离,每个机构的资产池都有独立的风控参数和清算触发机制,确保了单个机构的风险事件不会影响整个系统的稳定性。

The second layer is the cross-chain liquidity and pricing layer. deUSD implements a unified cross-chain issuance and redemption mechanism, which can maintain unified pricing and liquidity management regardless of which chain the underlying assets are on.

The third layer is the cross-chain liquidity optimization layer, which automatically adjusts the liquidity distribution of deUSD on different chains through the smart market maker (SMM) algorithm to ensure the minimum slippage during cross-chain transfers. This innovation has enabled deUSD to achieve a stable trading volume of more than $800 million in the past three months.

Cross-chain interoperability architecture

At the same time, in order to support a wider range of institutional access in the future, Elixir, as an expert, has used its own accumulated resources in cross-chain and has been launched on mainstream networks such as ETH mainnet, Arbitrum, Avalanche, and Sei. In the future, it may integrate Movement, Optimism, Polygon and other ecosystems to achieve liquidity interoperability through a unified cross-chain bridge interface. This ensures that institutions have both cross-chain choices and capital interoperability efficiency.

Through deeply optimized technical implementation, Elixir has successfully established an institutional-level RWA infrastructure that is both secure, reliable, efficient and flexible. However, the innovative value of the technical architecture must ultimately be reflected through application scenarios. After a detailed analysis of the core asset deUSD of this cooperation, it is not difficult to find that the design concept of this system is in line with the current situation faced by institutional-level users in the DeFi field. From asset management to ecological collaboration, from single-chain deployment to cross-chain integration, deUSD is interpreting what is "institutional-level" DeFi infrastructure with its unique technical advantages.

Synthetic asset deUSD worth paying attention to

If Elixir's technical architecture is the skeleton of the entire project system, then deUSD is the heart that pumps blood for the entire system. As the core asset of the entire system, the specific design of deUSD itself is stable enough.

deUSD is a fully collateralized, yield-generating cryptocurrency backed by Elixir Network.Synthetic Dollar。其核心创新在于通过 stETH 抵押和 ETH 永续合约空头建立 delta 中性头寸,同时通过 MakerDAO Earn income from the USDS Treasury bond agreement.

Compared with traditional synthetic assets, deUSD has three significant advantages:

-

Fully decentralized

A strong validator network is the core of the Elixir protocol. The Elixir validator network consists of 13,000+ independent nodes distributed around the world, each of which participates in transaction verification and consensus mechanisms. The decentralized validator network has no single control point, ensuring that the protocol is free from any centralized form of intervention and control, and ensuring the transparency and security of the protocol.

-

Innovation risk management

Anyone can mint deUSD by pledging stETH. Each pledged stETH will be used to short an equal amount of ETH in the market. At the same time, the short position can also capture the positive market rate, bringing additional income to deUSD.

When the funding rate is negative, deUSD will dynamically adjust its asset composition ratio based on the balance of OCF (excess collateral fund, used to support the value of deUSD) to maintain price stability.

-

Ecosystem Integration

deUSD combines Elixir’s high-quality resources to integrate products andexchangeAbstracting it into a single income asset reduces the risk of different deUSD holdersBlockchain和交易所之间操作的复杂性,使其可以更方便地管理资产,Convert more institutions and individuals into potential liquidity providers. deUSD is like a pass in the Elixir cooperative ecosystem. Just use deUSD to participate in staking interactions on multiple platforms or even multiple chains, that is, to achieve multi-chain needs through Elixir.

Unlike many stablecoins, deUSD, as a synthetic dollar, does not maintain stability through 1:1 dollar reserves or centralized issuance, but achieves price stability through innovative financial engineering and decentralized mechanisms. This design not only provides higher capital efficiency, but also makes the integration of TradFi and DeFi more "Crypto Native".

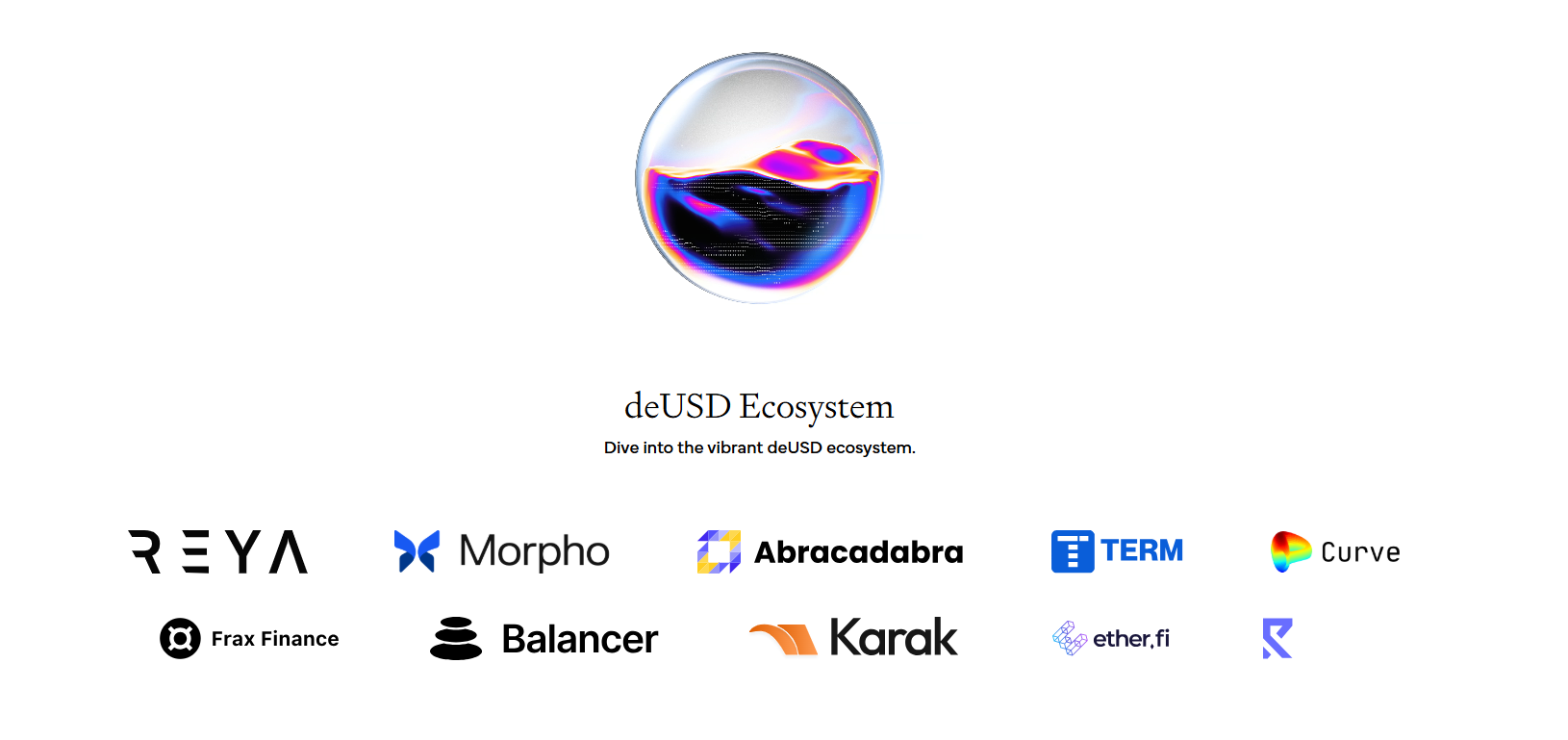

DeFi Collaboration to Undertake Liquidity

BlackRock’s “old money entering the market” action this time has quite representatively demonstrated the practicality of deUSD - combining security and profitability, and bringing the two-fish-one-dice experience that on-chain players love to financial gourmets who are willing to try new things.

In the DeFi ecosystem, which is already its forte, deUSD has even more room for development.

Through deep integration with mainstream DeFi protocols, deUSD has created a comprehensive liquidity supply system for institutional users. With the support of the liquidity optimization layer, institutions can participate in more complex DeFi strategies and achieve better returns while ensuring asset security.

Take Curve, the deUSD liquidity center, as an example:

Curve can deeply accept the large amount of institutional liquidity from RWA assets of deUSD - users can Curve deUSD Pool Deploy deUSD/USDC, deUSD/USDT, deUSD/DAI There are four major liquidity pools, deUSD/FRAX, and LP users can enjoy Curve & Elixir Apothecary Additional superimposed rewards: Elixir provides up to 5 times the Elixir Potions income for basic liquidity providers on Curve, and LP token staking can get 10 times the points income. Provide additional preferential treatment for RWA liquidity, and reap the benefits of DeFi.

Elixir vs Ethena: Two Paths to Institutional DeFi

Coincidentally, as the track gradually heats up, Ethena also cooperated with Securitize to launch the stablecoin USDtb, which is also supported by BlackRock BUIDL Fund. As both are institutional-level DeFi, will Ethena's solution collide with Elixir?

It is found that although Elixir and Ethena are both centered around the direction of TradFi+DeFi, they start from two different paths, and there are still some differences between them:

Different track selection

Ethena: Focusing on the stablecoin track

Ethena has chosen a relatively focused development path. The project uses BlackRock's BUIDL as the core supporting asset and launched the stablecoin product USDtb. This model has the following characteristics:

-

Backed by a single asset

-

The operating model is relatively simple and the risks are controllable

Elixir: Building a Complete Ecosystem

In contrast, Elixir takes a more comprehensive and systematic approach:

-

Building a complete RWA-DeFi infrastructure

-

Supporting innovation of diversified financial products

-

Building an open ecosystem

Technical Architecture

From the perspective of technical implementation, the two projects adopted different architectural designs.

Ethena's technical route:

-

Adopting a direct asset-backed model

-

The minting and redemption mechanism is relatively simple

-

Focus on the security and reliability of stablecoins

Elixir’s technical solution:

-

Build a multi-level asset management system

-

Realize cross-chain asset interoperability

-

Supporting the innovation and expansion of complex financial products

Market Positioning

Ethena positions itself as an institutional-grade stablecoin issuer, focusing on:

-

Simple and intuitive product

-

High security

Elixir positions itself as an RWA-DeFi infrastructure provider, emphasizing:

-

Ecosystem integrity

-

Product scalability

-

Diversity of institutional services

The different development paths of the two projects provide the market with a new perspective for thinking about the development of institutional-level DeFi. Whether to take a focused or platform-based route needs to be determined based on the project's own advantages and market demand. While ensuring security, how to balance innovation and practicality is the key.

Conclusion

BlackRock's big move is not just a simple attempt at asset tokenization, but also a starting point for the deep integration of TradFi and DeFi. Through Elixir's technological innovation and Securitize's compliance infrastructure, we see a mature institutional-level infrastructure layer that reasonably balances asset security and compliance while releasing the unique innovative vitality of encryption, proving that DeFi is not just a self-encircled area in the encryption field.

From the BUIDL fund to the deUSD RWA institutional program, and then to deep integration with DeFi projects such as Curve, this innovative path clearly demonstrates the feasibility of combining institutional assets with crypto assets. The two different development paths of Elixir and Ethena also provide valuable reference samples for the entire industry.

There is no doubt that with the entry of more traditional financial giants like BlackRock, the demand and development of institutional-level DeFi will enter the fast lane, and the concept of RWA will no longer be a simple concept hype. Whether it can maintain encryption natively while meeting the strict requirements of institutional users will become the new assessment standard of the project in this cycle. Elixir's practice undoubtedly provides the market with a development model worth looking forward to.

The article comes from the Internet:Hand in hand with OLD MONEY, how does Elixir connect billions of dollars of institutional assets to enter DeFi?

Related recommendation: Putin: Support BTC as a global reserve asset

Putin also criticized the US government, saying it used the dollar's dominance to further control other countries' currencies and thus influence their politics.cryptoSlate compiles Xiaobai navigation:BlockchainRussian President Vladimir Putin recently said that BTC and digital currencies are unstoppable, positioning them as the key to "reducing financial inefficiencies" and "increasing economic stability"...