2024 Celebrity Meme Coin: A Collective Flop?

Source: Decrypt

Compiled by: BitpushNews

Celebrities get involvedcryptocurrency早已不是新鲜事。早在 2013 年,童星出身的布洛克皮尔斯 (Brock Pierce) 就联合创立了 Blockchain Capital,开启了名人「下海」加密领域的先河。从美国前总统特朗普到明星林赛罗韩,各界名流纷纷涌入,试图在加密货币的浪潮中捞金。

然而,名人效应并非总是灵丹妙药。一些人利用自身影响力为加密项目站台,结果却往往不尽如人意。过去十年,美国证监会(SEC)就曾对十余起名人违规宣传加密货币的事件采取行动,金卡戴珊和拳王梅威瑟等人都因此受到处罚。更令人唏嘘的是,不少名人也深陷 FTX exchangeThe crash scandal almost destroyed the entire crypto industry.

If celebrities’ involvement in cryptocurrencies is still “old news”, then the “celebrity meme coins” craze that emerged in 2024 can be called “new news”. As meme coins replaced NFTs as the new favorite of speculators, a large number of celebrities followed suit, personally issuing their own meme coins, and even trying to create a new market around these coins.TokenCreate a business model.

In the past year alone, nearly a dozen European and American celebrities have launched their own meme coins.CommunityThe feedback was mixed, with more negative feedback than positive.

Traditional investors often think that Bitcoin investors have a higher risk tolerance, but Meme coin enthusiasts are the real risk takers - just like in the Wild West, withTokenPrices can surge or plummet in an instant.

This craze was most evident on the meme coin issuance platform Pump.fun, where Olympic decathlon champion Caitlyn Jenner launched her own meme coin on the platform, kicking off the celebrity meme coin craze.

Pump.fun 上发生过不少「毁三观」的故事。曾经有用户威胁说,如果不买他的 Meme 币,他就结束一条小金鱼的生命;另一个人扬言要一直坐在马桶上,直到他的代币市值达到 5000 万美元(当市值达到 1000 万美元时,他还真的剃掉了一条眉毛)。还有一些人做出了更加极端的举动,比如有一位小伙子竟然「自 fen ( 二声 )」了。

When Pump.fun was hot, in May 2024, Jenner teamed up with Trump, who was actively preparing for the election at the time, to issue his own token in a high-profile manner.

This move caused great controversy, and many people even suspected that Jenner's social account wassteal, or this is AI Deepfake scam. Even the founder of Pump.fun was surprised.

“I was going crazy,” Alon (not his real name), co-founder of Pump.fun, told Decrypt. He called it one of the craziest moments in the company’s short but wonderful history: “We tweeted that she released a coin, and then we were like, ‘Did she really release a coin?’ I had no idea what was going on. It was crazy.”

It turns out that the person behind Jenner’s “farce” was crypto promoter Sahil Arora, who signed a contract with Jenner to issueXiaobai Navigationtokens, and agreed to pay a $50,000 advance payment and a share of 80%'s revenue.

However, the collaboration soon turned into a farce. Jenner accused Arora of breach of contract and publicly vented his anger on Twitter: "F...k Sahil Arora! He cheated us!"

Jenner told Decrypt in May that Sahil Arora "disappeared" after showing her several wire transfers and owed her "a large sum of money." Arora did not respond to Decrypt's request for comment at the time.

But this is just the beginning.

After cooperating with R&B singer Jason Derulo to issue tokens, Derulo also publicly accused Arora of being deceived. Arora responded that all this was "part of the script." Since then, Arora has issued tokens for rappers Rich the Kid and Lil Pump, and these stars have also complained about similar experiences.

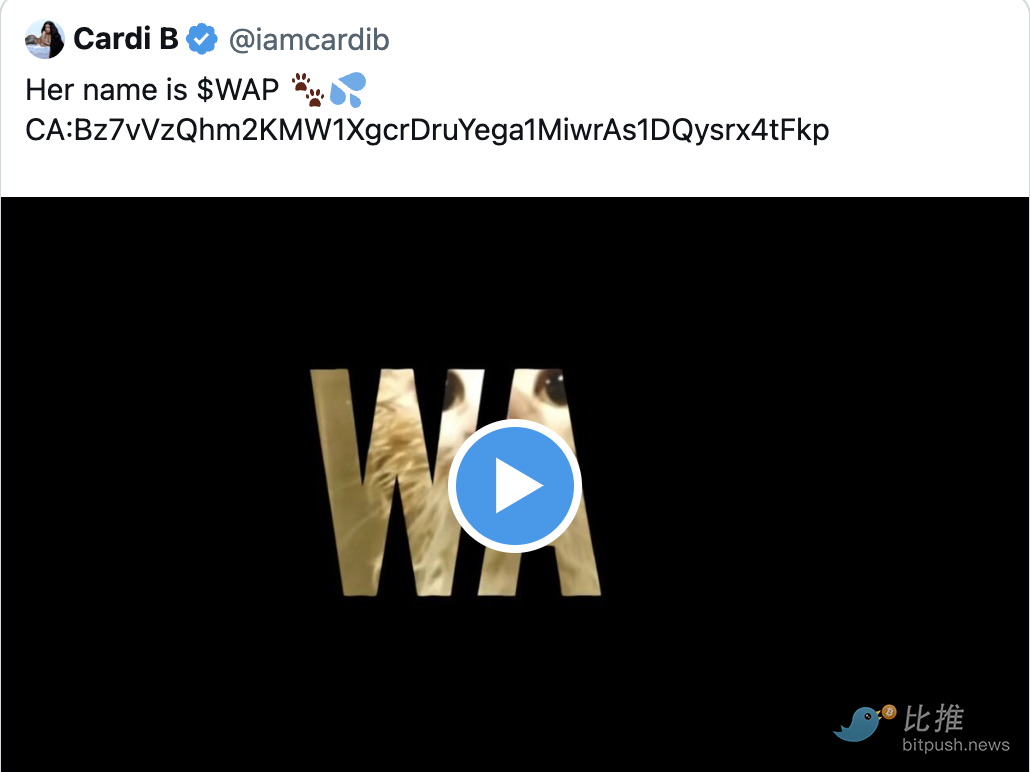

Subsequently, celebrities such as rapper Cardi B, Waka Flocka Flame and Sean Kingston also issued their own tokens, but did not publicly cooperate with Arora.

Data visualization company Bubbleworks published a long article on the social platform X to "blast" Arola, saying that he earned $30 million this year by issuing Meme coins on behalf of celebrities.

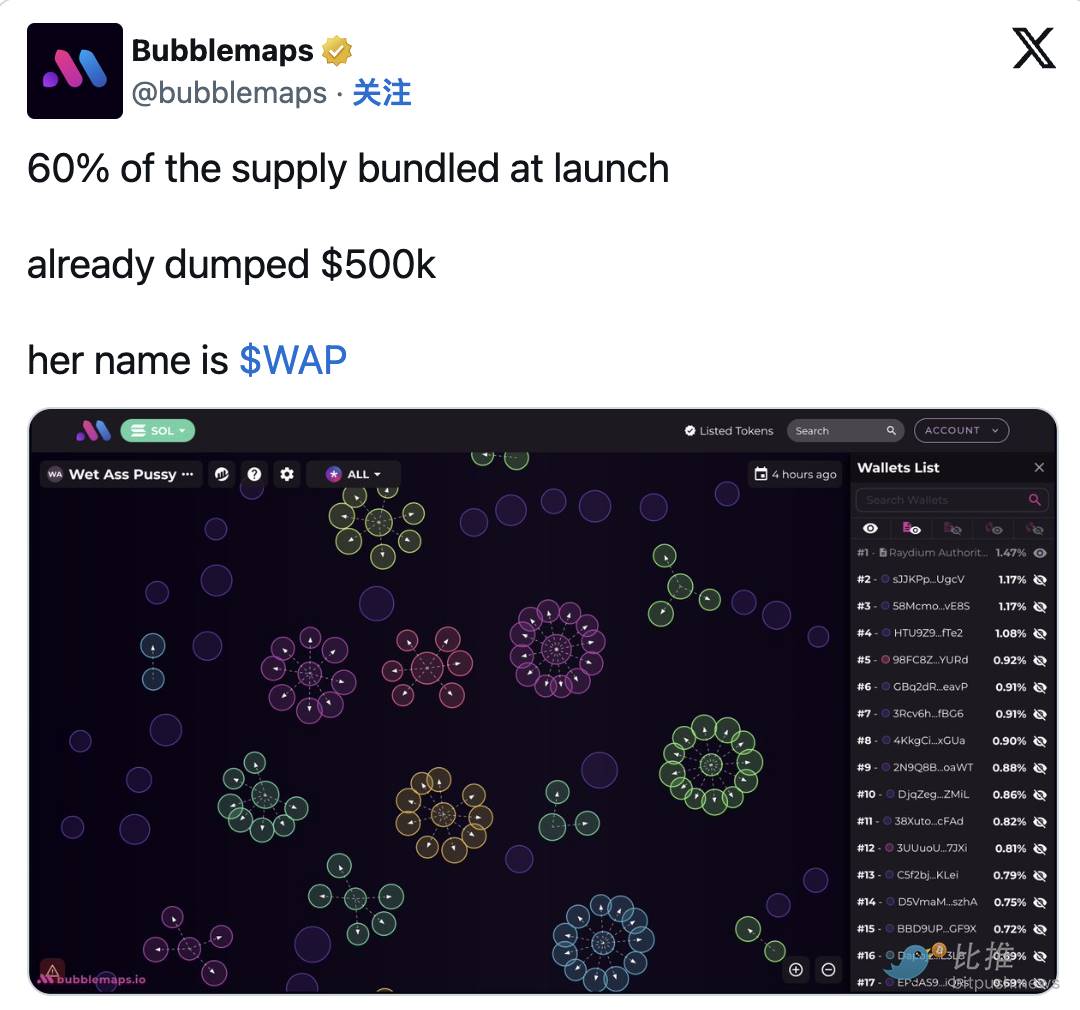

Nick Vaiman, co-founder and CEO of Bubblemaps, said in an interview with Decrypt: “Many tokens have obvious red flags from the beginning, such as high control, malicious manipulation, and obvious ‘leek cutting’ strategies.”

Of course, not all celebrity meme coin issuances ended in farce. Australian musician Iggy Azalea is an exception. Although her token MOTHER was questioned by Bubblemaps for being "sniped" by 20% of supply at the time of issuance, she claimed that she was unaware of it.

Bubblemaps’ on-chain detectives pointed out that only the tokens leaked in advancecontractThis is only possible if the address is given to an insider.

However, the tide of public opinion turned after Iggy Azalea participated in a Twitter Spaces event, demonstrated her understanding of encryption, and publicly criticized Arora.

“Once we found out she really knew what she was doing, we were very optimistic about her,” said Alon, the founder of Pump.fun. “It was a great feeling.”

A few months later, more and more celebrities launched tokens that then became shitcoins. Jenner even launched an Ethereum token, causing the price of her original Solana token to plummet.

So, what is the current status of these celebrity meme coins?

As of writing, Jenner’s Meme Coin on Solana is valued at just $357,000, while her Ethereum token is valued at just $139,000, well below their previous peaks of $42 million and $7.5 million, respectively.

Jason Derulo’s JASON token has fallen 97.8% from its peak, with a market value of $783,000;

Waka Flocka Flame's FLOCKA token fell by 99%, with a market value of only US$238,000; the bundled token WAP plummeted by 99.65%, with a market value of less than US$138,000.

Iggy Azalea told Decrypt: “Most celebrities who get involved in this have the worst intentions. I don’t think any of them really want to do crypto tokens. They just want to cash out quickly and walk away.”

As these tokens collapsed and celebrities left in droves, the first lawsuits followed. In November 2024, a group of investors filed a class-action lawsuit against Jenner and her agents, accusing her of misrepresenting her Solana meme coin and failing to register it as a security.

Jenner's team did not respond to Decrypt's request for comment.

Some cryptocurrency legal experts say more of these civil lawsuits are likely in the future. "We will see an uptick in lawsuits involving celebrity endorsements of meme coins," cyberlaw attorney Andrew Rossow told Decrypt. "Celebrities will increasingly be held accountable for their promotional activities and may even face broader legal liability for being the 'sellers' of these digital assets."

Digital asset attorney Carlo D’Angelo said: “Jenner’s lawsuit is a clear warning to any celebrity who thinks they can use their fame to over-promise and over-deliver Meme coins just to make a quick buck.”

Some crypto advocates believe that celebrity meme coins can help attract young people to crypto. For example, Arora once told Decrypt that he started the celebrity meme coin craze to make cryptocurrency more mainstream than ever before.

Nick Vaiman, founder of Bubblemaps, summed it up: “For a narrative to succeed, it needs universality, hope, and role models. It needs to be able to appeal to the masses and create real success stories to maintain hope and inspire others. However, celebrity crypto projects have failed to establish such a virtuous cycle and instead have become a predatory mechanism that extracts liquidity from retail investors and leaves everyone penniless.”

The article comes from the Internet:2024 Celebrity Meme Coin: A Collective Flop?

Technology companies have different attitudes towards Bitcoin. Written by: Gyro Finance The market was full of ups and downs last week. Everything was thriving on the policy side, expectations of interest rate cuts were increasing, and Trump's goodwill continued. But on the news side, some people were happy while others were worried. First, Google's quantum computer caused panic, and then Microsoft voted down the Bitcoin investment proposal, which temporarily cooled the market's FOMO. The mainstream currency...