A complete guide to using sBTC | Analyzing the sBTC ecosystem from the aspects of mechanism, benefits, use cases, etc.

Written by: Maggie

From a certain perspective, Bitcoin, with a volume of 2.1 trillion US dollars (the latest Coingecko data as of December 18, 2024), is the largest "sleeping capital pool" in the crypto world.

Unfortunately, most of the time it neither brings benefits to holders nor injects vitality into the on-chain financial ecosystem. Although there have been many attempts to release the liquidity of Bitcoin assets since the start of DeFi Summer in 2020, most of them are just reinventing the wheel, and the overall BTC capital inflow attracted is very limited, and it has never really been able to leverage the BTCFi market.

In this context, sBTC, which has just been launched on the Stacks mainnet, is a L2 1:1 Bitcoin-backed assets, dedicated to leveraging BitcoinSafetyThe Bitcoin economy will be completely revitalized through the use of 100% Bitcoin finality and fast transactions, freeing up BTC capital and opening up new use cases.

目前 sBTC 由 BitGo、Asymmetric 和 Ankr 等机构组成的大规模签名人网络运营,有望成为去中心化程度最高的 L2 比特币资产之一,为 DeFi、dApps 等领域带来前所未有的机遇,本文就将进一步探讨 sBTC 的具体运行机制与相对优势。

How does sBTC work?

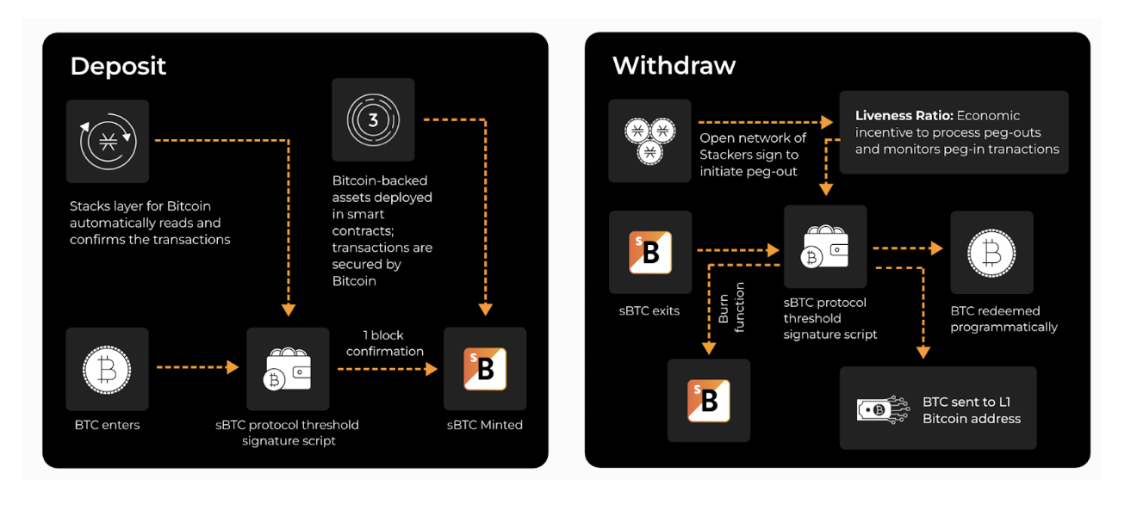

Users first deposit BTC into a multi-signature protocol monitored by Stacks’ decentralized signatory group through a Bitcoin mainnet transaction.

After BTC is deposited, sBTC is minted on Stacks, and users can interact with DeFi dApps.

Users can use Bitcoin DeFi without noticing. For example, Zest Protocol will support mainnet BTC deposits and automatically convert them to sBTC. In the future, sBTC is expected to become the transaction fee on Stacks.Token, further improving the user experience.

Will there be a deposit limit for sBTC?

At this stage, deposits are capped at 1,000 BTC to allow for controlled testing and gradual hardeningSafetysex.

In the early stage, only deposits are supported, and withdrawals are temporarily unavailable.

Does sBTC generate income?

Imagine earning Bitcoin income just by holding BTC.

No need for staking, no points, no complicated process, just hold BTC to get rewards.walletConnect to https://bitcoinismore.org/ (launched at 22:00 on December 17, Beijing time) and you will receive an annualized Bitcoin reward of 5%.

Now, this is possible through the sBTC rewards program. Early users can earn BTC rewards simply by holding sBTC, and the rewards will be distributed in the form of sBTC.

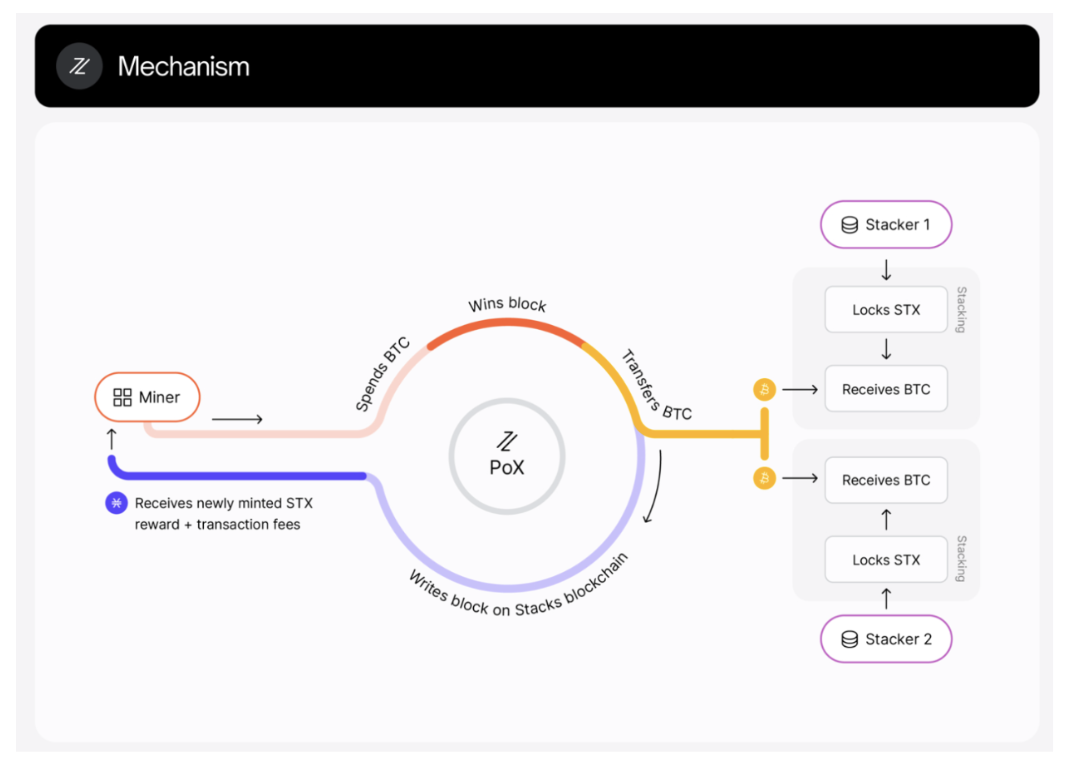

The sBTC rewards program is supported by stackers who “Stack” STX.

When staking STX, stakers receive BTC through Stacks’ consensus mechanism. To enable the sBTC rewards program, these stakers contribute the corresponding proof-of-transfer BTC rewards to the sBTC reward pool.

BTC from the reward pool will be directly deposited into a smartcontract,该合约将 BTC 存入 sBTC,并按比例将奖励分配给 sBTC 持有者。该协议每天会对用户的 sBTC 持有量进行快照,并每两周分配一次奖励——这是一个 PoX 周期的长度。

The current estimated annualized BTC reward is 5%, and rewards will be distributed every two weeks.

sBTC key features:

Where can sBTC be used?

Multiple DeFXiaobai Navigationi Protocol will support sBTC, allowing users to earn additional benefits on top of 5% APY:

-

Liquidity Pool: Users can deposit sBTC into Bitflow’s liquidity pool to facilitate transactions and receive a share of transaction fees.

-

收益耕作:流动性提供者可以将其 LP(流动性提供者)代币质押到收益耕作项目中,以赚取额外奖励,这些奖励通常来自于交易活动或平台激励。

-

Early prediction: Deploying sBTC could bring additional annualized returns of 10%-30%.

-

Bitflow Runes AMM

-

Bitflow 推出了 Stacks L2 的 Runes AMM(自动做市商),用户可以将 Runes 带到 L2,享受更好的用户体验。

-

sBTC will be available on the first day of the Zest Protocol lending market launch.

-

Zest Protocol will launch an enhanced yield campaign on the first day of launch, offering BTC yields of up to 10% for the sBTC provided.

Zest will also unlock more DeFi strategies related to sBTC, such as:

-

Deposit sBTC and earn up to 10% annualized BTC income;

-

Borrow USDh stablecoins using BTC (or other stablecoins) as collateral and exchange them for USDh;

-

Convert USDh to HermeticaStake and earn up to 25% annualized returns.

Reminder: Hermetica’s DeFi protocol offers USDh, the first yield-generating stablecoin backed by Bitcoin.exchangeFunding payments for perpetual contracts are generated continuously and paid daily.

sTXBTC It is a new liquid staking token that users can apply to the Stacks DeFi ecosystem. Users holding this token will earn up to 10% annualized returns through staking rewards, which will be paid directly to users in the form of sBTC.walletmiddle.

-

Liquidity provision: Users can provide sBTC to Velar’s liquidity pool, facilitate transactions and earn a share of transaction fees generated by the platform.

-

Yield Farming: By participating in the yield farming project, users can stake the liquidity provider (LP) tokens obtained by providing sBTC liquidity to earn Velar’s native tokens or other incentive rewards.

-

Staking: If Velar offers a staking option for sBTC, users can lock their sBTC in a staking contract to earn rewards, such as additional tokens or a percentage of revenue for supporting network operations.

-

Velar will launch its own incentive program, allowing users to earn Velar’s native token VELAR by deploying sBTC into its DEX pool.

Arkadiko– USDA Stablecoin

-

Arkadiko will allow sBTC as collateral in its protocol via a governance vote, enabling users to borrow USDA or other assets against their Bitcoin holdings.

ALEXDEX

-

Users can deposit sBTC into ALEX's liquidity pool and pair it with other assets such as STX or stablecoins. In this way, they provide liquidity for the platform's transactions and earn a portion of the transaction fees from the pool.

-

ALEX will provide additional reward income through its native token ALEX as part of the Surge event. This means that in addition to the 5% annualized income of the sBTC reward program, users can also earn additional ALEX token rewards by providing sBTC liquidity.

Granite– Lending protocol (not yet launched)

-

Borrowers can obtain stablecoin loans by posting Bitcoin as collateral, while liquidity providers earn returns by providing stablecoins to the protocol.

-

Borrowing: Users can borrow stablecoins using sBTC as collateral and then use it in various DeFi strategies to earn a yield.

-

Liquidation Participation: Users can act as liquidators and earn income through the liquidation process by paying off part of the undercollateralized loans, receiving collateral and rewards.

Granite currently has a waiting list to allow early access to users who sign up early. Eventually, the system will introduce a points system with additional benefits, giving early sign-ups a significant advantage.

Granite Waiting List

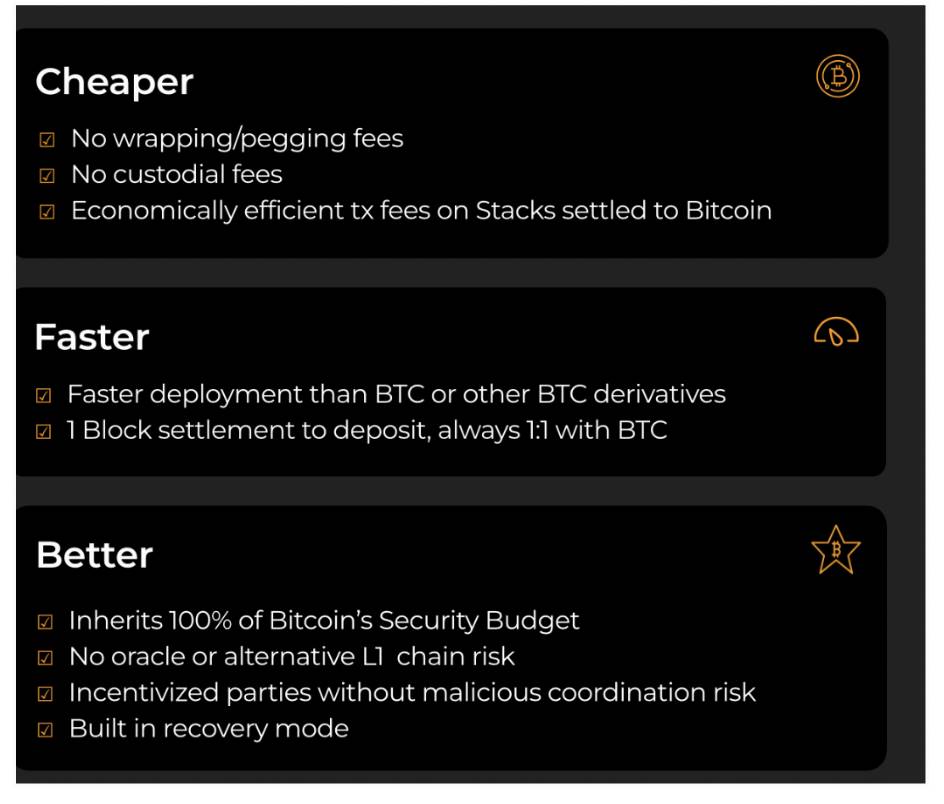

What is the difference between sBTC and other BTC assets?

These BTC assets typically require sending BTC to an intermediary, or relying on a trusted alliance of signers/small multi-signature organization.

sBTC will initially rely on 15 signatories, including enterprise-level institutions such as BlockDaemon, Figment, Luganodes, and Kiln, to handle the anchoring and unlocking of assets. Over time, this responsibility will be gradually transferred to all Stacks signatories, allowing anyone to participate in the network.SafetyIn the process of blockchain and decentralization, BitGo, Aptos Foundation and others are also expected to join the process.

In addition, thanks to the design of Stacks, sBTC will achieve Bitcoin finality of 100%, which means that transactions on the Stacks layer will be as irreversible as Bitcoin.

Reminder: The signer is responsible for verifying and approving each produced block; anyone who stakes enough STX can become an independent signer, similar to the concept of a validator.

Additional Information:

1) sBTC related information:

sBTC 网站:https://www.stacks.co/sbtc

sBTC documentation: https://docs.stacks.co/concepts/sbtc

sBTC Deck: https://www.stacks.co/sbtc-deck

2) Nakamoto upgrade information:

Nakamoto website: https://www.nakamoto.run/

Documentation: https://docs.stacks.co/nakamoto-upgrade/nakamoto-upgrade-start-here

The Nakamoto upgrade is critical because it brings:

-

Fast blocks (reduced from the current 10 minutes to less than 1 minute, optimization is still in progress)

-

100% Bitcoin Finality

Fast blocks: Fast blocks bring a Solana-like trading experience and Bitcoin DeFi interaction, greatly improving the overall user experience of interacting with Stacks L2.

Stacks’ DeFi ecosystem has grown rapidly this year, and now it only takes seconds to apply DeFi strategies, making it easier for users to join and retain quickly.

在 Nakamoto 硬分叉之前,Stacks 的区块是与比特币区块同步结算(平均 10 分钟),这使得链的速度较慢,无法满足 DeFi 活动的需求。这个限制现在已经不存在了。相反,Stacks 的区块现在可以在几秒钟内完成,并且性能提升定期进行。与此同时,一旦比特币区块结算,Stacks 仍然依赖比特币的安全性。

100% Bitcoin Finality: With the Nakamoto upgrade, transactions occurring on Stacks L2 will utilize Bitcoin’s 100% security budget, which means that once Bitcoin’s subsequent blocks are settled, Stacks’ transactions will also be irreversible like Bitcoin.

Instead of a single Stacks block being tied to a single Bitcoin block, Bitcoin blocks are now tied to a miner’s term, during which they mine multiple Stacks blocks, which settle within a few seconds.

There are currently 50 signatories, including enterprise-level institutions such as BitGo, Aptos, Luganodes, and Kiln, who are responsible for verifying and approving the blocks generated during the term of each miner.

Fast block times and Bitcoin finality make Stacks the most secure and scalable Bitcoin L2, with operations supported by a decentralized network of signers and the future enabling decentralized liquidity of Bitcoin through the upcoming sBTC upgrade.

3) Stacks Data Analysis Platform:

Signal 21: https://signal21.io/

DefiLlama: https://defillama.com/chain/Stacks

Stacks Block Explorer: https://explorer.hiro.so/

The article comes from the Internet:A complete guide to using sBTC | Analyzing the sBTC ecosystem from the aspects of mechanism, benefits, use cases, etc.

related suggestion: AI The wave is sweeping the blockchain game sector, an article to review AI + GameFi Head Project

马斯克将启动 AI 游戏工作室,再添一把柴。 撰文:Asher,Odaily 星球日报 继 AI+Meme 热潮后,AI+GameFi 也将迎来新一轮行情? 昨晚,马斯克在 X 平台发文表示,太多游戏工作室被大型企业所拥有,xAI (马斯克的人工智能初创公司,…