friend.tech Economic model expansion: What kind of price curve does SocialFi need?

Written by: Loki

1. Pricing curve comparison & the cost of changing the slope

Since October, the competition landscape of Socialfi has gradually become clear, and some competing products have gradually faded out of the market. Looking back at the development process of Friend.tech, the economic model (especially the pricing curve) has played a very critical role. Specifically, the pricing curve of FT has the following characteristics:

-

The positive or negative nature of the difference ensures that the price continues to rise as the number of people increases, and the increase is getting faster and faster, ensuring that the people in the front make money;

-

16000 To achieve a relatively reasonable community scale carrying capacity;

-

As the number of people increases (especially after 100–200), the curve becomes steeper, price fluctuations are higher, and the carrying capacity gradually decreases;

-

The leftmost part of the curve is the most profitable buying range at present, but this part of FT is monopolized by Bot, constituting a form of income similar to "MEV".

For more detailed instructions, please refer to:Friend.tech Economic Model Explained: Game Theory, Expected Value, and the Illusion of the Demand Curve

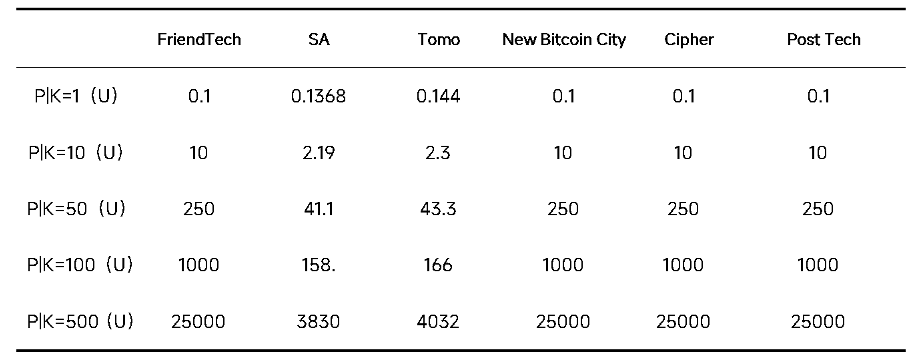

In terms of competitors, Cipher, PostTech and NewBitcoinCity completely retain the FT formula. All protocols are still constructed in the form of quadratic functions, retaining the characteristics of first-order derivative>0; second-order derivative>0; third-order derivative=0. This characteristic will ensure the FOMO/ make moneyThe effect continues.

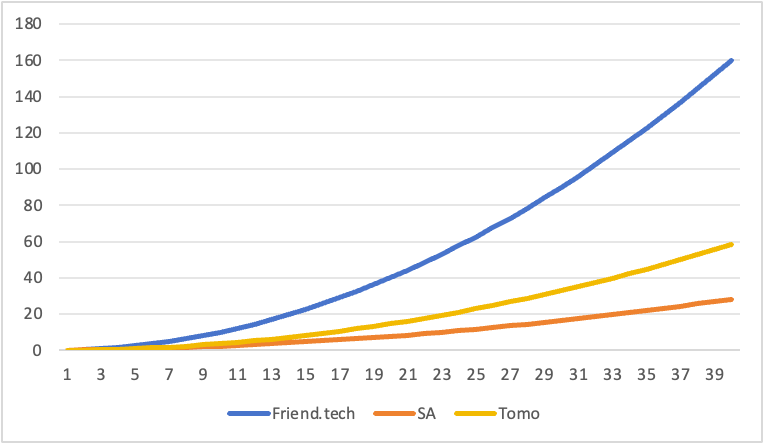

The curve changes of New Bitcoin City are mainly due to the changes in the base currency and the price of BTC, while SA and TOMO have made some adjustments to the form of the curve. SA adds a linear term and a constant term on the basis of the quadratic term (K), and reduces the coefficient of the linear term. This change will theoretically make the curve flatter (slower rise) and the initial price rise, but since the constant term of SA is very small, this change is not easy to detect. Tomo's change is simpler, just reducing the coefficient of the quadratic term by about 73%.

It can be seen that SA and TOMO have essentially changed the growth rate of the curve. Based on this change, with the same supply of keys, the prices of SA and TOMO will be lower, with SA's price level roughly maintaining between 15%-20% of FT, and TOMO's price being 37% of FT.

In general, this change is not very innovative, and the more moderate price is a double-edged sword for copycat platforms.on the one hand,FT provides a valueIt is reasonable that the price of the same player's Key on the imitation disk is lower than that of FT. Lower prices will bring better acceptance and greater user carrying capacity. But on the other hand, a flatter curve means a worse wealth effect, which is one of the key factors for FT to attract hundreds of thousands of users.

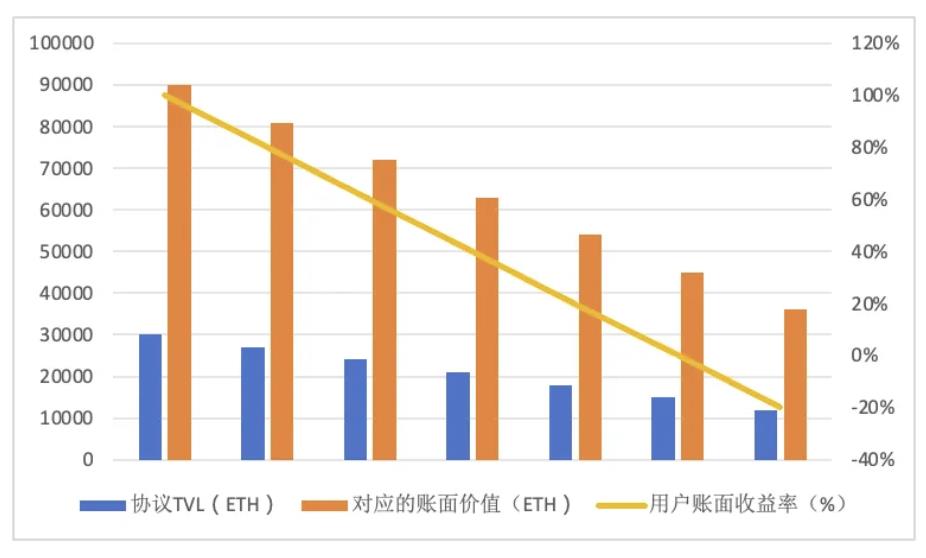

Of course, the steep price curve is not without cost. The other side of the upward spiral is the downward spiral. In the past week, the TVL of Frien.tech dropped from 27,000 ETH to 21,000 ETH, a decrease of less than 20%, but the price collapse and 33 betrayal it brought about are far more than that.

2. FT’s Gray Rhino: Net Capital Outflow

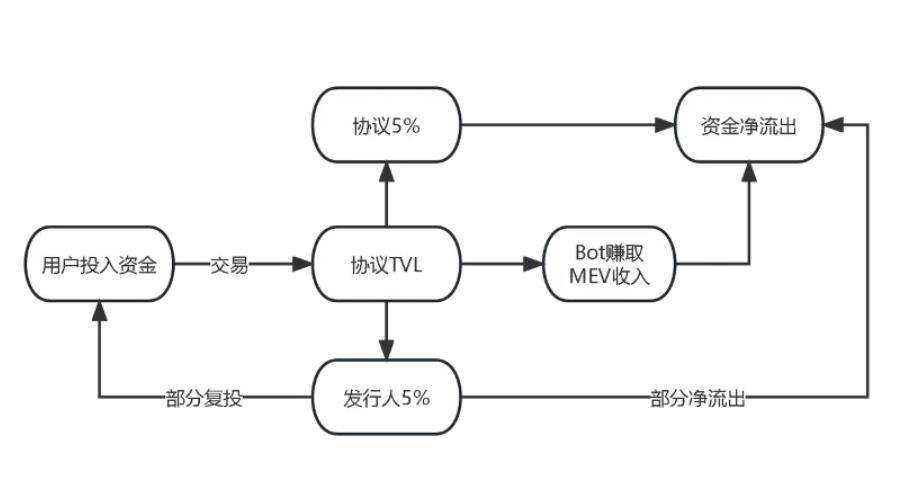

FT’s Bot and high fees are problems that everyone can see, and the net outflow of funds they bring is killing Friend.tech.As shown in the figure below, Friend.tech's TVL is entirely derived from user deposits. If the PnL generated by user transactions and the royalties earned by the issuer are not withdrawn but used for continued investment, the money will still remain in the agreement. However, the "MEV income" earned by the Bot and the handling fees earned by the agreement will directly become net outflows of funds.

The "MEV income" earned by Bot is difficult to quantify, but the entry of DWF founder AG into FT in September is a typical case. The first purchase price displayed on the FT front end is 0.4ETH, which means that Bot directly bought 80+ Keys at an average price of 0.135E. These Keys were sold one after another within the next 48 hours, with transaction prices of 1.1E-1.5E. Based on this estimate, Bot earned about 100ETH in AG's Room, and all these profits came from the losses of users.

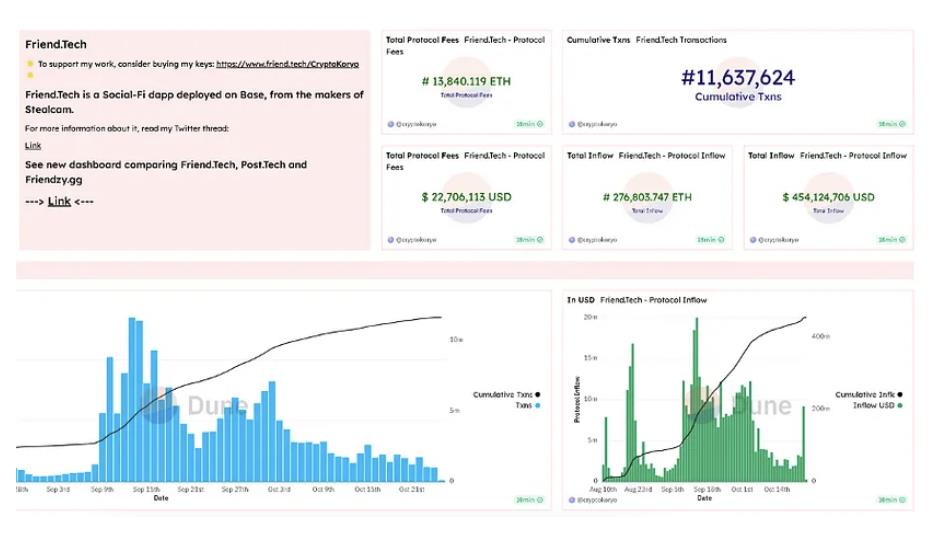

The handling fee is easier to quantify. According to DUNE data, as of October 25, the cumulative handling fee attributable to the project was 13,840 ETH. Based on the highest TVL of 27,000 ETH, the cumulative ETH deposited by users is at least 40,000 ETH. Even if we do not consider the Bot MEV income, the net withdrawal of KOL royalties, and the net outflow caused by fake account scams,FT has earned more than 30% of users' principal, and this is the result of just three months.

When TVL rises, users don’t feel it so strongly. But once TVL goes down or even sideways, the impact will become extremely strong. The net outflow from protocol pumping, Bot MEV income + KOL royalty net withdrawal + fake account scams are all caused by [non-transactions]. If we estimate the last three items at 5,000 ETH (this value is already very conservative), then the total cumulative deposit of users is 45,000 ETH.

As mentioned in previous articles, the book value of Key is about three times the real TVL. So when TVL is 27,000 ETH, the book value of Key is about 81,000 ETH. Compared with the principal of 45,000 ETH, the user has obtained an average positive return of 80%. When TVL drops to 21,000 ETH, the book value of all Keys drops to 63,000 ETH, and the average return of users drops to 40%. It can be seen that the book rate of return of Key is leveraged. If TVL continues to drop to 15,000E, the total book value of the user will be equal to the total invested principal. If transaction fees and bid-ask spreads are taken into account, the user will enter an overall loss state.

At present, the collapse of FT's 33 consensus has already shown a trend of being transmitted to Tomo. If the high pumping of the protocol + bot continues, it will only be a matter of time before FT and other SociaFi collapse, and with the decline in book yields, the collapse trend will accelerate. We had hoped that Friend.tech would solve the protocol pumping and bot problems, but it seems that no changes have occurred. In addition, the recent changes in the points rules have objectively led to transactions by users who brush points, further increasing transaction friction; and the founder 0xRacer also withdrew the high fees earned by his own key.

3. How can the curve be improved?

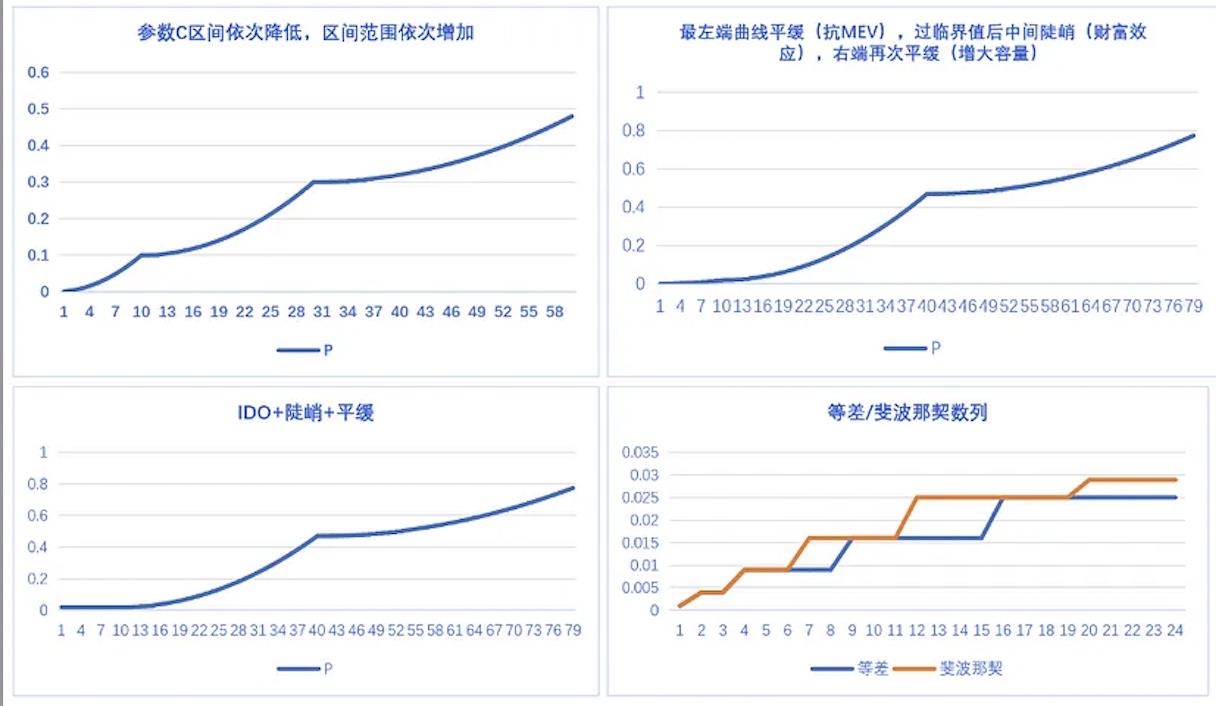

Thinking further, if we still keep the form of P = K/C + D (C and D are both constants), the following factors need to be considered when setting the pricing formula:

- Curve growth rate & price

The faster the growth rate, the more FOMO there is, which is mainly achieved by increasing the constant C. Competitive products generally reduce the growth rate to make the curve smoother. However, the starting point of this approach is mainly to maintain the [low price] of Key. The TVL of the imitation disk will be greatly different from that of FT, so it is more reasonable to have a lower price for the same holder.

- The number of people that the community can accommodate

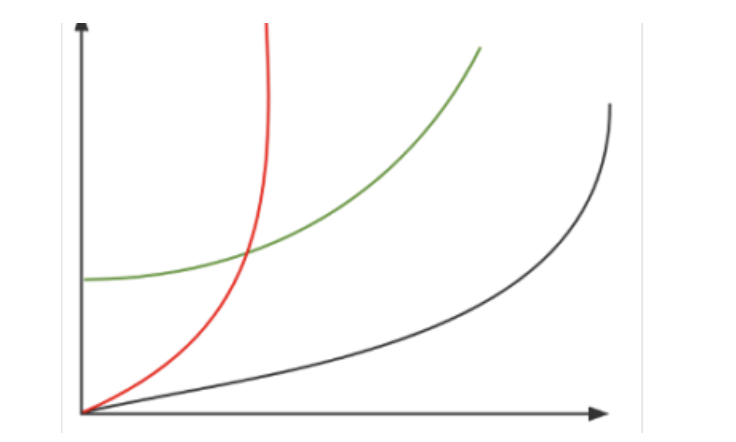

The growth rate of the curve will also determine the upper limit of the community capacity. If a higher capacity is required, the curve needs to be flatter:

(1) Increase the constant C

(2) Set the piecewise function, the last few segments are smoother

(3) It is necessary to calculate the corresponding ratio of P and FT-Key’s P under the same X condition.

MEV value at the far left of the curve

- Solve the "MEV problem" of being attacked by bots

(1) Add a positive intercept term D to make the initial price > 0 (Tomo sets D but the value is very low and can be ignored). This approach also has disadvantages: it leads to a decrease in the multiple of the wealth effect.

(2) Add a flat or horizontal curve at the far left

(3) Fixed price IDO (pre-sale system, the difference between 2 is that one is first come first served and the other is fair sale)

(4) Allowing homeowners to pre-order

From the curve shape, there are two types of improvement ideas. One is to directly change the parameters of C and D. This is also the most common improvement method at present. By changing the constant D, the MEV problem can also be solved to a certain extent.

The second form is to set a piecewise function.This approach canXiaobai NavigationDifferent parameters can be set in different price ranges to achieve different purposes. For example, a relatively flat curve or even a horizontal curve can be set in the first half of the curve to complete the anti-MEV or IDO-like launch. The IDO mode is of positive significance in solving Bot MEV and issuance failure (which is more prominent on Tomo).

This also comes at a cost. If a flat curve is used on the left end, the wealth effect of the opening will be greatly weakened, and the amount of supply on the left end needs to be further considered. Excessive supply may consume potential buying or wealth effects.

4. Besides KOL, what else can Key carry?

An objective fact is that the "services" or "information" provided by most Room Owners are not enough to support the value of the Key, or the price of the Key is generally overestimated. The reason for this problem is that Friend.tech's speculative demand and score-brushing demand confuse the real utility demand, and FT and copycat platforms also choose the price curve based on business purposes.

Most people only use Key as a socialToken, but in fact Key can represent any asset.Friend.tech has given us an idea: to introduce the issuance and trading of assets as "Fi" into "Social" to complete the final closed loop of SocialFi. For FT and most imitation platforms, Key represents the personal brand or personal reputation of KOLs, but this does not mean that SocialFi is like this. Even if it is still based on FT, any asset can be put into Key, such as the equity of Web3 projects orToken(Some people have already done this), in this case, the key represents the token or shares; or using FT to complete IDO, the key represents the investment share or future claim rights (maybe there will be projects doing this soon).

At present, the functions of FT and imitation disks are too simple and cannot meet some derivative needs well. Another idea is to introduce [asset issuance] into existing Web3 social/content products (such as DeBox, CrossSpace, etc.). For example, DeBox is positioned as the most native DAO The governance platform has currently built a DID-based system covering chat, dynamics,CommunityDeBox is a social platform with multiple functions, and provides functional components such as voting, proposals, token authorization detection, and transactions. With enough users, strong enough social connections, information, management tools, and trading tools, DeBox currently has 1.5 million registered users, more than 100 million daily messages, and extremely high scalability in terms of functions. It is naturally suitable for introducing an effective asset issuance solution and an economic model and price curve that are adapted to the business type.

DeBox Interface

The assets here include but are not limited to specific content, decentralized groups, and even MEMEs that have no substantive meaning but have the common will of the group;A series of social tools and infrastructure will then provide services for these assets, and the value of Key will truly complete the closed loop.

In the end, the biggest difference between Fi and Ponzi is whether the asset exists and has value, and we can never ignore this.

The article comes from the Internet:friend.tech Economic model expansion: What kind of price curve does SocialFi need?

As the global demand for decentralization continues to grow, Israel's Web3 sector will continue to attract more investment and entrepreneurs, becoming one of the world's leading Web3 innovation centers. Israel is slowly becoming a Web3 startup nation, and the country's growingBlockchainHundreds of new jobs have been created in the ecosystem. Israel’s vibrant startup scene has made it a world…