The US CBDC is encountering obstacles and is difficult to launch. Is this good or bad for USDT?

Author:Terry

On November 1, PayPal received a subpoena from the enforcement department of the U.S. Securities and Exchange Commission (SEC) regarding PayPal's USD stablecoin. The highly anticipated PYUSD seems to have been shrouded in the troubles that Facebook faced when it launched Libra.

At the same time, with the continuous diversification of global stablecoins, countries are also actively researching and launching central bank digital currencies (CBDCs). Among them, the trends at the US regulatory level have attracted global attention. However, not long ago, Representative Tom Emmer of the U.S. House Financial Services Committee proposed a "CBDC Anti-Surveillance State Act" aimed at preventing the Federal Reserve from issuing central bank digital currencies (CBDCs) directly to individuals and preventing the Federal Reserve from indirectly issuing CBDCs through intermediaries.

The Fed and Congress: The conflict over regulation and privacy

After Facebook (now Meta) released the white paper of its private digital currency plan Libra in June 2019, it was, to some extent, a catalyst that forced central banks to speed up their original digital currency plans, greatly stimulating the interest of central banks in various countries in CBDC and the global stablecoin system.

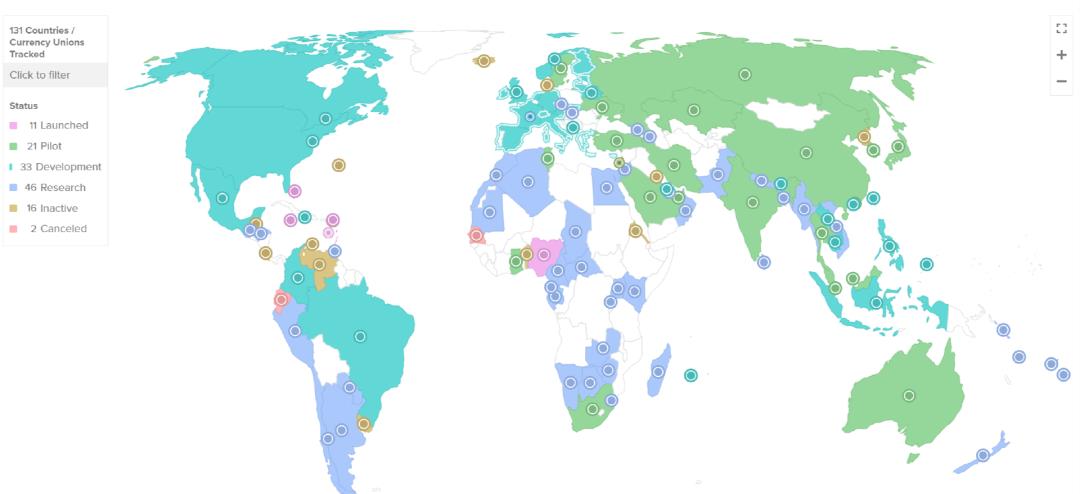

According to Atlantic Council statistics, there are 131 countries in the world.(accounting for more than 90% of global GDP)CBDCs are being exploredHowever, among the four developed countries with the largest central banks (the Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England), they are relatively cautious, and the progress of CBDC in the United States is even lagging behind.

In short, the US regulatory authorities have not yet reached a unified consensus on whether to launch CBDC, and the biggest disagreement lies in different positions:

U.S. congressmen have expressed opposition more from the perspective of privacy and financial freedom, and have repeatedly stated that "CBDC is a government-controlled programmable currency. If it is not designed to mimic cash, it may give the federal government the ability to monitor and restrict Americans' transactions."

Regulatory agencies such as the Federal Reserve and the SEC are more concerned with the significant impact of CBDC on the payment and settlement system and the regulatory dimension of on-chain stablecoins.

As Federal Reserve Chairman Powell said at a congressional hearing on September 28, "There is a lot of private innovation, much of which occurs outside of regulation. When it comes to the public's money, we need to ensure that there is appropriate regulation. And currently there is indeed no regulation in some cases."

At the same time, he said the Fed is "actively evaluating whether to issue a CBDC, and if so, in what form.", and talked about CBDC, stablecoins andcryptocurrencyThe report will be released soon, which means that the United States is still in the early stages of evaluation and research on its own CBDC, and has not yet determined a specific technical solution for the adoption plan.

However, although the U.S. government has not yet reached a consensus on issuing digital dollars, in fact, the digitization of the U.S. dollar on the blockchain has gone a long way with the help of the U.S. dollar stablecoin.The US dollar stablecoin is now a de facto digital tool for the US dollar.

Tether、Circle,美元数字化的推手

The sudden emergence of Libra made many people exclaim that the "digital dollar" era has arrived, but most people did not expect that it would be almost its only highlight moment.

Since then, Libra has continuously shrunk and adjusted its vision under regulatory pressure. The explosive growth of dollar-centered stablecoins in 2020 can be regarded as another way to take over Libra's large-scale experiment with the "digital dollar."

In particular, USDT and USDC have become alternatives to the US dollar for many users in global application scenarios such as cross-border payments.As of November 3, Coingecko data showed that the total circulating market value of USDT has exceeded US$85 billion, setting a record high.

Even as USDT continues to grow, it's not only going to serve the retail and consumer market, but it's obviously currently serving a lot of medium and large companies internationally.

At the same time, Tether's exposure to U.S. Treasuries reached $72.5 billion, making it the top 22 buyer in the world, higher than the United Arab Emirates, Mexico, Australia, Spain and other countries. Circle also holds more than $30 billion in U.S. Treasuries. Tether and Circle have almost become the spokespersons for the Federal Reserve in the crypto industry.

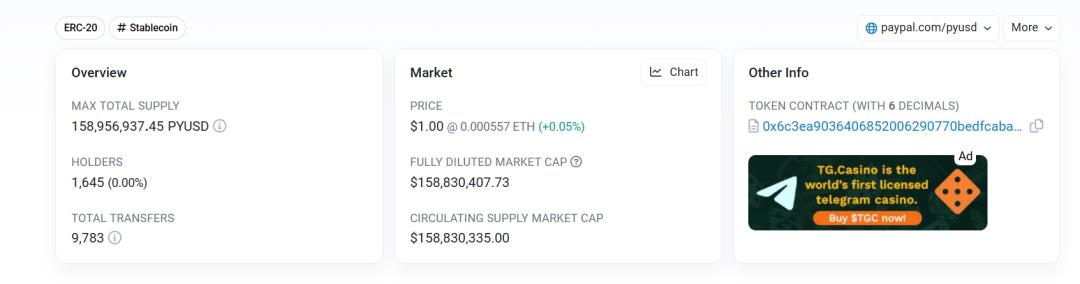

It is worth noting that the total issuance of the US dollar stablecoin PYUSD launched by PayPal has been hovering around 40 million US dollars for many days. Since October, it has resumed printing money. As of the time of writing, it has exceeded 150 million coins and is listed on mainstream exchanges such as Coinbase and Kraken.exchangeonline.

As a well-known traditional payment giant, PayPal's every move in the field of stablecoins not only brings new variables to the originally fixed stablecoin market, but also undoubtedly has a huge traffic effect. At the same time, it is also destined to once again focus the attention of regulators, just like Facebook's Libra that failed midway.

In general, as the largest third-party payment institution in the United States, PYUSD is destined to bring long-term benefits to the crypto market, especially its choice of issuance based on Ethereum, which further pushes the vision of Ethereum as a global settlement layer forward.

Stablecoins & CBDCs?

However, the continuous expansion of stablecoins has both advantages and disadvantages for the digitalization of the US dollar, and may bring some potential risks and challenges:

On the one hand, as stablecoins are widely used, their impact on the existing financial system is increasing., the combined volume of USDT/USDC has exceeded 100 billion US dollars, and may even cause systemic risks;

On the other hand, stablecoins still lack direct supervision to some extent.If it is used as a tool for illegal activities such as money laundering and fraud, it may also cause certain damage to the financial order;

This leads to some underlying differences and characteristics between CBDC and stablecoins. The first thing that needs to be made clear is thatCentral Bank Digital Currency (CBDC) andBlockchainThere may not be much correlation, because all CBDCs are definitely centralized systems.

Taking China's digital renminbi (DCEP) as an example, it is clear that it does not adopt the current mainstream public chain architecture, and adopts a two-tier operation model in terms of operation mechanism. The central bank acts as the first layer, first exchanging DCEP to specific commercial institutions such as commercial banks, and then commercial banks or specific commercial institutions act as the second layer, responsible for meeting the needs of individuals and enterprises to open digitalwallet, and the public demand for exchanging DCEP. This design is basically similar to the current centralized issuance mechanism of cash.

所以将来美联储如果发行 CBDC,那与现有的 USDT、USDC、PYUSD 或 DAI 等链上稳定币就是不同的两类物种——CBDC relies more on the existing traditional financial system for issuance and operation, allowing banks and financial institutions to access the digital currency system.

This actually means that CBDC is a more controllable and centralized digital dollar. To some extent, it does not directly compete with on-chain stablecoins. Especially at a time when all countries are vigorously researching and launching CBDCs, cross-system exchange of CBDCs between different countries is still in its early stages, and the convenience is certainly not comparable to that of USDT and other basic currencies.Xiaobai NavigationA stable currency based on the global public chain.

Therefore, there may be a complementary relationship. For example, on-chain stablecoins are responsible for cross-border payments and settlements, and CBDC realizes digital currency management of the financial system by forming various financial products based on digital currencies.

But on the other hand, with the continuous development of digital currencies such as stablecoins and Bitcoin, a more "controllable" CBDC can actually help the central bank cope with the challenges of third-party payments and private digital currencies, better maintain the stability of the financial market, and ensure the international status of the US dollar. In addition, it can also increase the transparency of the financial system and reduce the possibility of illegal activities.

Therefore, in this situation, the necessity for the Federal Reserve to launch CBDC is becoming increasingly apparent. In particular, how to balance the advantages and potential risks of stablecoins and how to formulate corresponding regulatory policies will be issues that need to be explored in depth in the future.

summary

The issuance of CBDC by the Federal Reserve is still unknown at present, because if there is no legal definition, what the central bank issues is only stablecoin, not real central bank digital currency, so this requires consensus between the Federal Reserve and the US administrative and legislative levels.

However, with the continuous expansion of on-chain stablecoins such as USDT and USDC, and the giants behind Libra and PYUSD continue to make moves, I believe that financial regulators will act quickly. This is for the sake of innovation and the future.

The article comes from the Internet:The US CBDC is encountering obstacles and is difficult to launch. Is this good or bad for USDT?

This article analyzes the overview, ecology and future development of RaaS, hoping to gain a glimpse of the future from point to line, from line to surface. Author: Cynic Leo TL;DR BlockchainThere is an impossible triangle inSafety, decentralization and scalability cannot be achieved at the same time. Bitcoin and Ethereum chose the former two, but did not support the latter enough, and the short-term...