Analyzing the new decentralized gambling tool: f(x) project risk research

Preface

cryptocurrencyThe four-year cycle of the market is really amazing. Every time I think it’s different, but the result is always “this time is the same!” I never like to predict the market, I don’t like to buy altcoins, and I don’t like to leverage and speculate in coins, but even so, I still can’t escape the harvest of each bear market. There is no other reason. As long as there is a little greed in your heart, even if you don’t like it, you still can’t help but do it, and you will still fall into similar traps, just like the altcoin project crowdfunding in 2013, the ICO in 2017, and the ICO in 2020. defi In summer, and during the two sharp declines in 2021, he even actively liquidated his CDP to survive.

In my opinion, how to imprison one's greed through technical means defi The pre-set rules cage is the only way to escape from it.cryptocurrencyInfinite loop, and the right way to make your wealth grow steadily. This kind of pure mathematical deduction and code implementation can make the function of a financial protocol run automatically, which is really a wonderful thing. @aladdindao's series of products all follow the same idea. Interested readers can refer to my previous article.

https://mirror.xyz/darkforest.eth/gQuWj8-HKOxmCPKdx9etmCPGSylXWmXSVjRm-C_G2wE

作为@aladdindao 出品的第四个产品——f(x),他通过运用几个简单的数学等式,就为以太坊的 defi 生态贡献出了一种全新的产品,一种类似于金融领域的 tranche 的结构化产品。他将底层资产 stETH 拆分成一定数量的类稳定币产品 fETH 和高波动高收益的杠杆类产品 xETH。

These two native assets based on Ethereum correspond to two demands that exist simultaneously in the market: hedging demand and leverage demand.

1. Leverage demand scenario

Assuming that the market is at the end of the bear market and the beginning of the bull market, this means that underlying assets such as Ethereum will have a relatively certain increase in the next few years. For those who hoard coins, all they need is patience. But for leveraged players, since I believe that the market will have this certainty, why not play big, add a little leverage, and bet on the future.

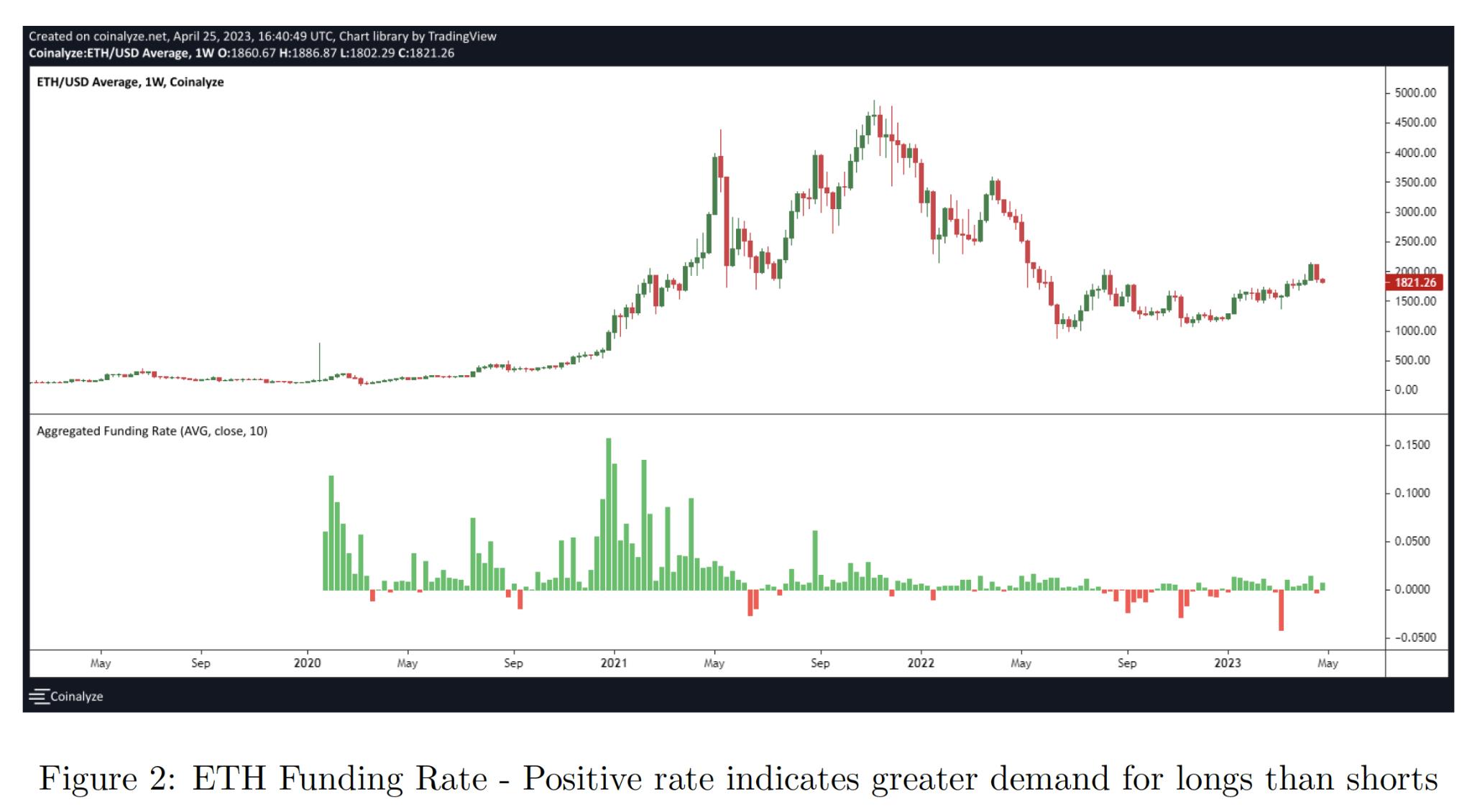

But we all know that there are often short-term tragic declines in the process of a bull market. The hurdle that leveraged players cannot overcome is the darkness before dawn. You may not be able to survive and see the sun the next day.exchangeSustainabilitycontractMost of the time, funding rates are charged on long positions, and it is unknown whether your earnings can withstand the funding rates.

But if there is such a product now, it can allow you to hold leverage while avoiding the risk of liquidation that may come at any time. The best thing is that the funding rate is zero or even negative, and the holding cost is very low. Then, do many coin hoarders also want to add a little leverage to expand their profits?

2. Risk-averse demand scenario

On the other hand, if it happens to be a bull market now, the price of the currency is soaring, and you have an obvious need for hedging, but you are unwilling to switch to stablecoins and completely lose the possible growth in the future.Xiaobai Navigation When there is FUD, what you need is fETH, a native asset based on Ethereum without the external risk of RWA ("Real World Assets") to reduce the overall volatility of your assets.

https://mirror.xyz/darkforest.eth/7O4rGUDHCMwA45m33zUYYwnjw3jl1rps8mgxRCcgZbY

Suppose the price of Ethereum plummeted by 90% after you minted fETH (it’s scary to think about), but the fETH you held only made you lose 9%, and you avoided a super bear market. This operation can be called a perfect escape strategy under the principle of “not giving up the last penny”.

I am a little tempted by this. After all, for cryptocurrencies, the original assetsSafetyThe security level is much higher than that of various mining LP packaged assets. But for me who has experienced countless setbacks, there is no agreement that has only benefits and no costs. I need to have a complete understanding of the risks of this agreement before I can make a real decision.

f(x) Three Soul-searching Questions

How does the f(x) protocol achieve asset volatility grading? How stable will the system be in extreme market environments? Where is the boundary of system collapse?

1. Volatility Grading Principle

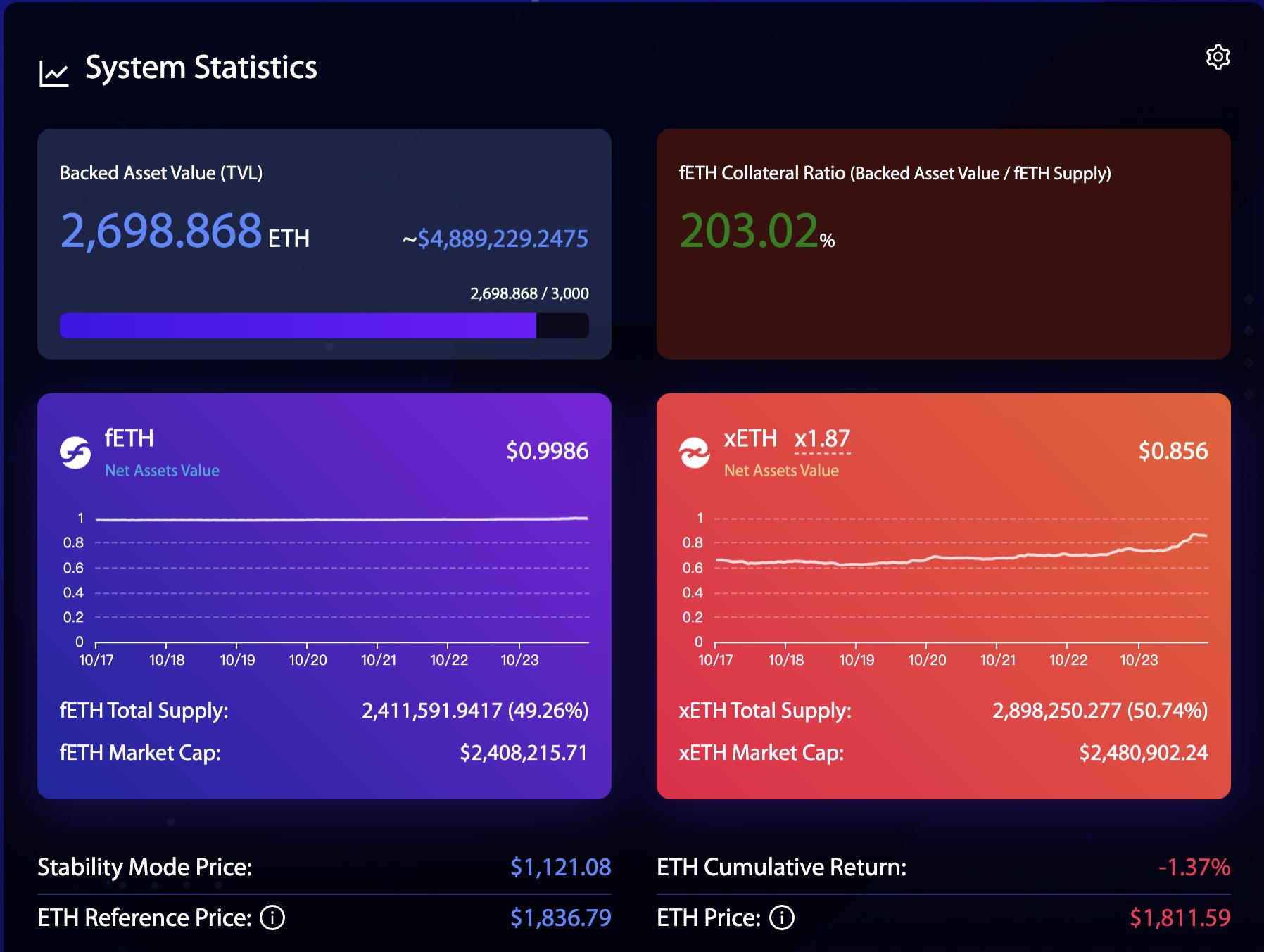

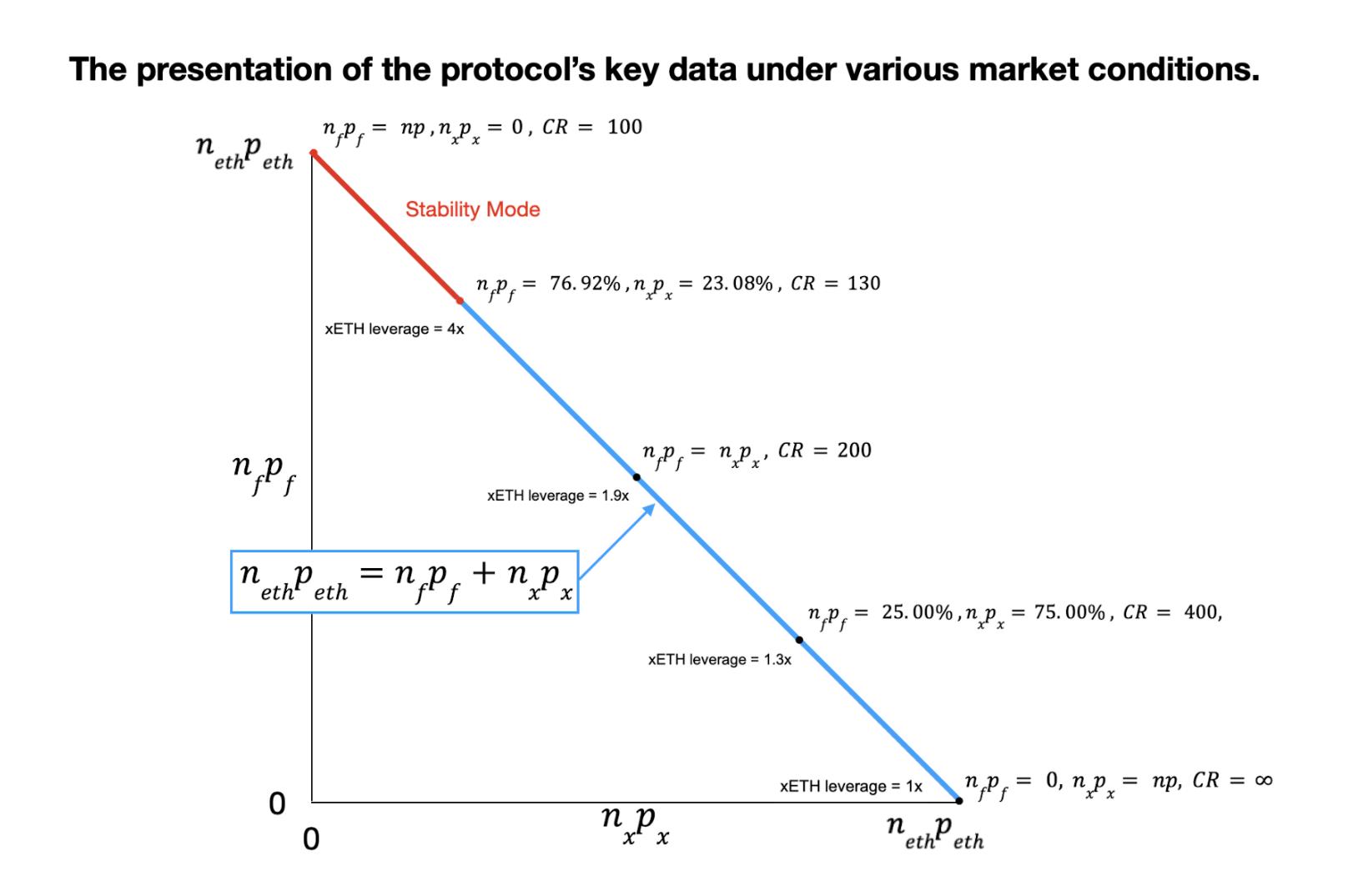

To understand the f(x) protocol, it is important to read the following dashboard. The underlying asset ETH is converted into stETH through lido staking, and then split into a certain number of stablecoin-like assets fETH and leveraged assets xETH. fETH only has the volatility of the underlying asset 10%, while xETH bears all the remaining volatility.

The whole essence of the protocol lies in the following simple formula:

We can see that the underlying asset of the protocol is 2698.868 ETH, and the TVL is $4,889,229. This TVL is equal to the sum of the NAV (net asset value) of the two assets, that is, fETH market cap + xETH market cap. The price fluctuation of fETH is nailed to the price fluctuation of Ethereum at 10%, that is, the price pf of fETH is fixed, and the quantity of nf and nx is unchanged, so the price of px can be calculated.

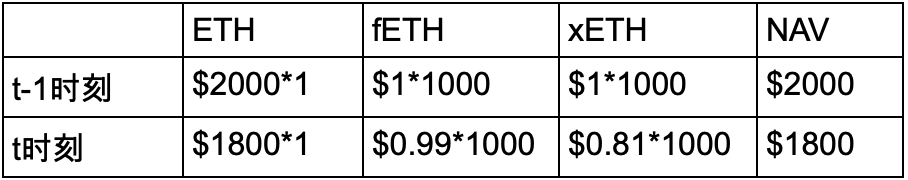

Let's take an example to make this clearer:

The initial user minted 1000 fETH and 1000 xETH with 1 Ethereum worth (2000). The next day, Ethereum fell by 10% and the price changed to)1800. The volatility of fETH was set according to the protocol and could only fall by 1%, that is, the price of fETH changed to (0.99. According to formula 1, we can calculate that the price of xETH changed to)0.81. What is the volatility of xETH? (1-0.81)*100%=19%, and the corresponding leverage ratio is 1.9 times.

We can also see from the volatility curves of different assets in the dashboard that the volatility of fETH is very small, while the volatility of xETH is greater than the volatility of ETH itself. Here the project can make the UI more intuitive.

2. How to ensure system stability

f(x) The first law of stability: The volatility of the price of the quasi-stablecoin fETH is always precisely stable at the volatility of ETH 10%.

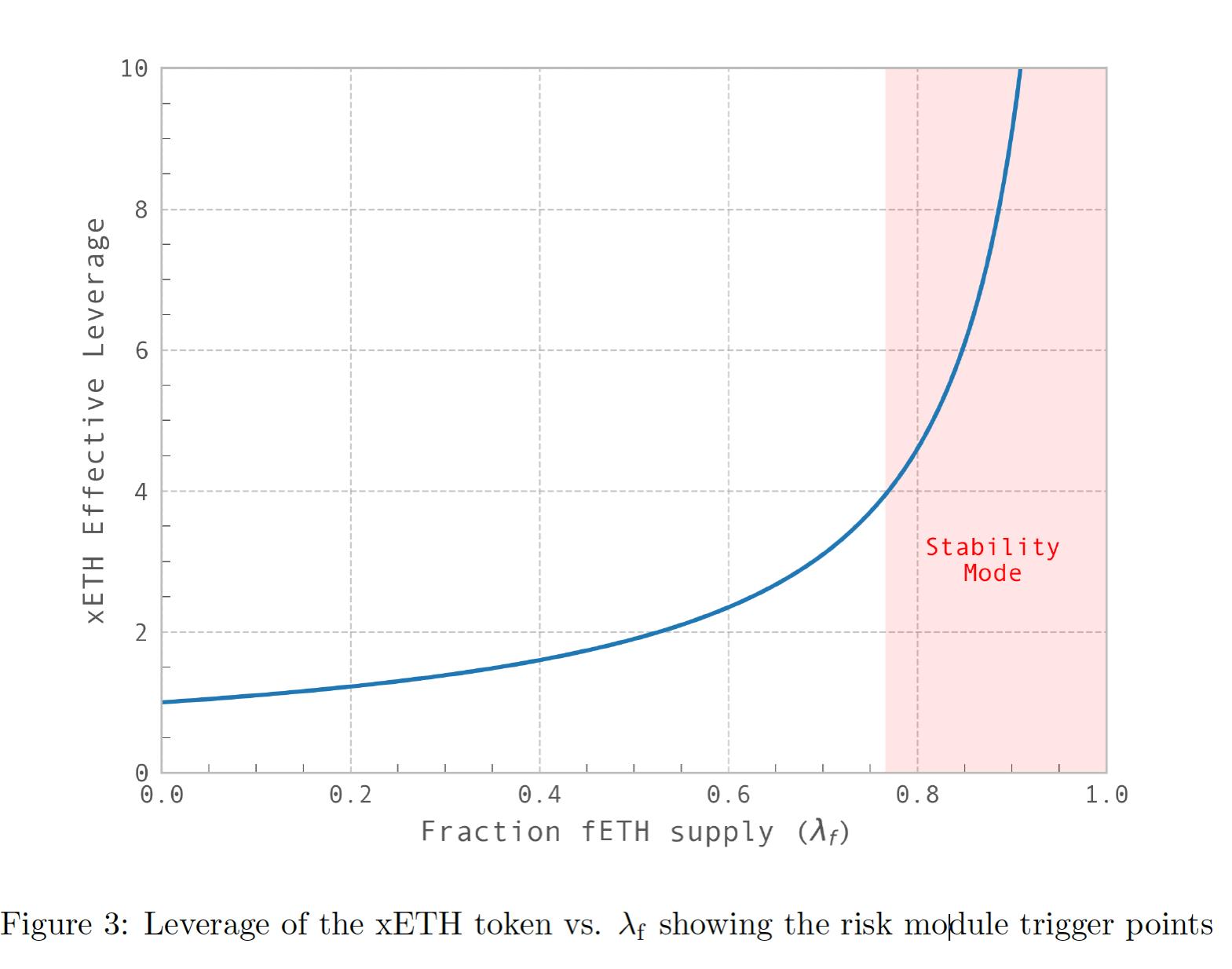

First inference: To satisfy the first law, there must be enough leveraged coins xETH to take over the volatility of the underlying assets outside of the stablecoin fETH. If the amount of xETH is relatively small, the xETH leverage ratio is increased to take over the volatility (see the red part on the right side of the figure below). If the amount of xETH is large, the leverage is reduced (see the left side of the figure below). Low leverage can dilute volatility.

These two simple conditions form the basic conditions of the f(x) protocol. However, this curve is not a financial system that will spontaneously return to stability. We need to pay special attention to the extreme situations on both sides of the curve.

(1) Left side of the curve: There are too many leveraged coins xETH relative to the stablecoin fETH. This situation will probably be more common in a bull market, as more people are willing to buy leveraged products rather than holding stablecoins. In the extreme case, the leverage ratio of the leveraged coin xETH drops sharply to close to 1, which is no different from holding the native asset Ethereum. However, even so, it will not harm the entire protocol, and the system will automatically return to the middle of the curve.

Here, the f(x) white paper also mentions that although the demand for fETH determines the supply of fETH, the amount of fETH that can be minted at the lowest fee to meet the demand at any moment is typically much higher, and this amount is only limited by the supply of xETH.

Here, the protocol can have an operating space for AMO (algorithmic market operation) similar to the frax protocol. For example, if xETH grows too much, resulting in too low leverage and reduced market attractiveness, the f(x) protocol can take the initiative to issue additional fETH to keep the leverage ratio at, for example, more than 1.5 times. At the same time, it can deal with the decline in demand for xETH in the future, and then destroy this part of the additional fETH to minimize the surge in leverage.

(2) On the right side of the curve: There are too few leveraged coins xETH relative to stable coins fETH. This situation is dangerous for the system and needs to be prevented. This is because it usually happens when the market is extremely pessimistic. The coin price continues to fall. Everyone is seeking stability. Few people are willing to take the risk of adding leverage to go long. At this time, the leverage ratio of xETH can be seen in the curve to have a steep surge, which will form a fatal negative death spiral. Even fewer people are willing to add leverage to go long - the leverage ratio is higher - and they are even less willing to add leverage...

Faced with this situation, the free market cannot solve this problem spontaneously. Fortunately, the f(x) protocol uses some methods to avoid such tragedies.

3. f(x) protocol risk boundary

The f(x) protocol introduces a concept in the CDP lending protocol - CR (Collateral Ratio). In the view of the protocol party, the underlying assets pledged by users in the protocol are collateral Collateral, and the minted stablecoin fETH is the borrowed asset. The protocol must ensure that the value of the borrowed stablecoin cannot exceed the value of the collateral, that is, CR>100%, otherwise bad debts will be generated and the assets will be insolvent. The value of xETH is not calculated here because in extreme cases, xETH may return to zero, but even so, the protocol must ensure normal operation to avoid bad debts.

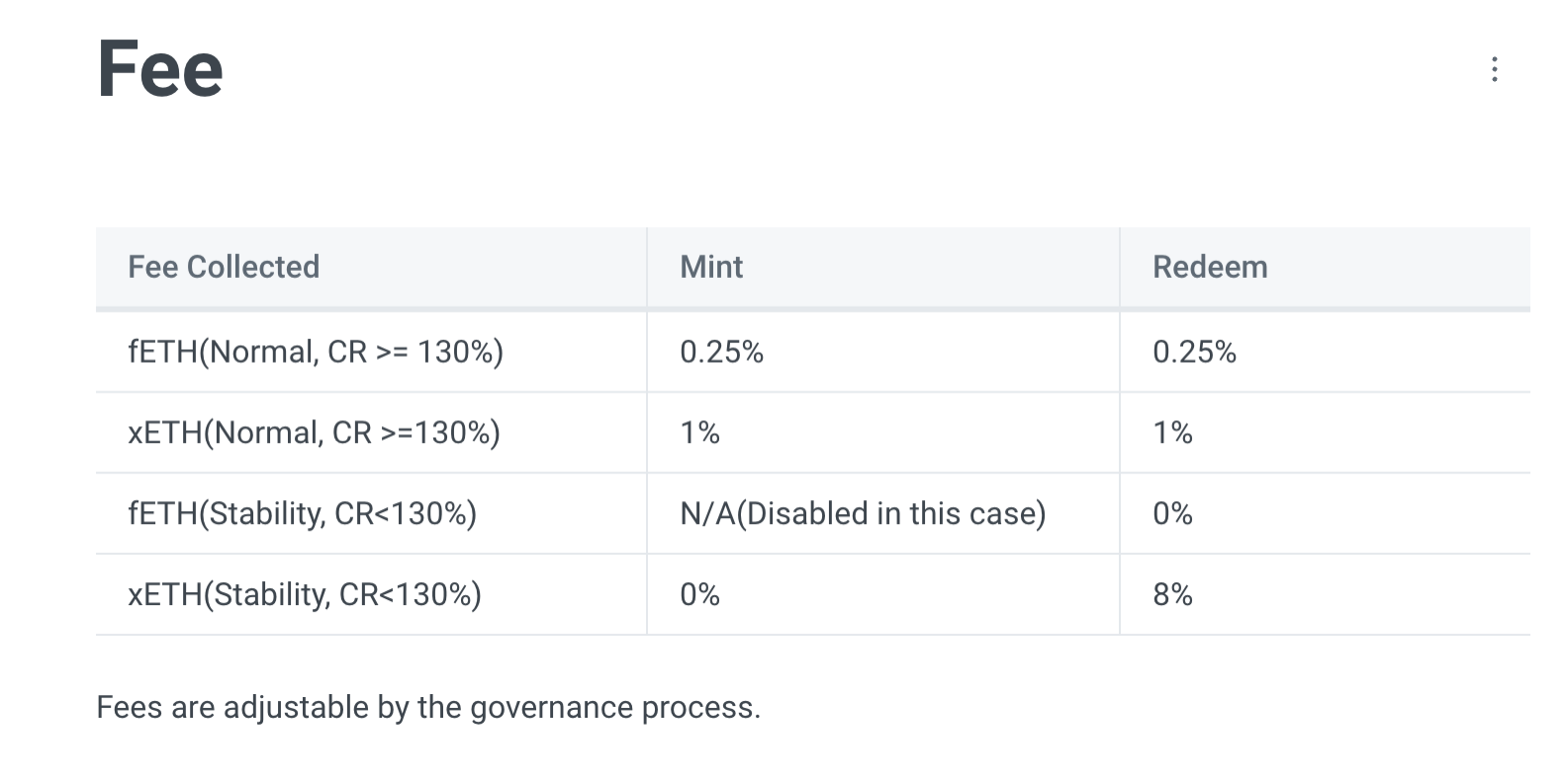

The f(x) protocol uses the daily Ethereum price change data since January 1, 2017 to make calculations. When the probability of risk occurrence is no more than 0.1%, this is equivalent to a situation where Ethereum drops 25% in one day. Under this level of disaster, a CR of 130% is completely resistant, so the protocol sets the CR of 130% to aSafetyThreshold, below which the stability mode is automatically activated. At this point, the value of the corresponding stablecoin fETH exceeds 0.78 times the value of the underlying asset, and the leverage ratio of xETH is exactly four times. In the stability mode, the measures taken by the protocol are:

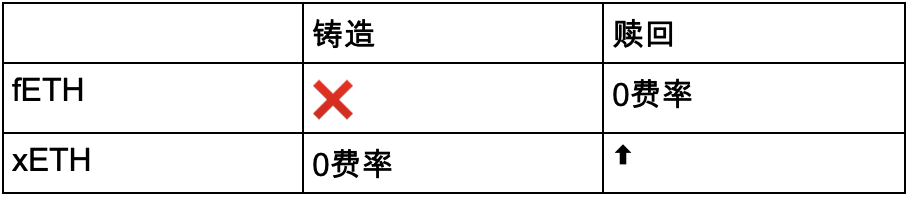

(1) Control protocol entry and exit

The f(x) protocol controls the minting and redemption fees of fETH and xETH, and even stops the minting of fETH, with the aim of increasing the value of xETH relative to fETH and improving the protocol's ability to absorb the volatility of the underlying assets.

(2) Internal Asset Rebalancing — Rebalancing Pool

与 Liquity 项目的 stability pool 相似,协议鼓励 fETH 持有者将手中的币放在协议自己的池子中赚取一定的质押收益,而协议有权动用这部分资产在 CR 低于安全阈值时将 fETH 赎回为储备资产,即 stETH。

fETH holders who have hedging needs can increase their returns through the Rebalancing Pool while significantly reducing their volatility. The protocol, through guiding incentives, will include fETH as its own protocol liquidity in a short period of time (the latest change is from locking for two weeks to locking for one day), thereby effectively adjusting the CR value of the protocol to run away from risks.

Of course, if the assets in the Rebalancing Pool are exhausted, CR is at risk of continuing to fall, and the f(x) project will use the protocol revenue to incentivize xETH minters.

Unlike Liquidity, the income obtained by Rebalancing Pool liquidity providers comes from outside the protocol, that is, the Ethereum staking income of the Lido protocol, while Liquidity uses its ownToken排放作为激励,这也造成了 $LQTY 代币的长期抛压,但这也是它使用最纯粹的原生代币 ETH 必须要付出的代价。

In my opinion, the f(x) protocol can still learn from the practice of liquidity. After the CR is lower than 130%, the redemption process of fETH can obtain certain rewards similar to liquidation income, so as to encourage more fETH to enter the Rebalancing Pool.

This is different from the case of the stablecoin lusd. The most important function of the stablecoin is its circulation function, while the important function of fETH is its hedging function when held. In essence, it does not require a large amount of circulation in the market.

(3) Protocol Treasury Income Subsidizes xETH Minters

If using the Rebalancing Pool is to increase CR by shrinking the TVL scale of the protocol, then subsidizing xETH minters is a more positive way to increase CR by expanding TVL. The specific intensity and actual effect of the subsidy still need to be tested in actual combat.

User decisions in extreme market conditions

Risk Averse

对于类稳定币 fETH 持有者,如果将手中 fETH 放入到 Rebalancing Pool,那需要关注 CR 是否会降到 130% 以下,出现这个苗头应及时撤出该池子,最新的修改锁仓期仅有一天时间,对于用户来讲非常友好。但对协议来说,大规模的流动性撤出势必会对协议的安全性造成严重影响。

For users who really seek stability, it is safest to keep fETH in hand to avoid possible forced redemption. However, if the protocol reaches its extreme boundary value - CR = 100%, the volatility of fETH will be equal to that of ETH. This risk is not unbearable. After all, the epic plunge is probably almost over at this time, and the asset has avoided the most significant decline.

Leveraged Players

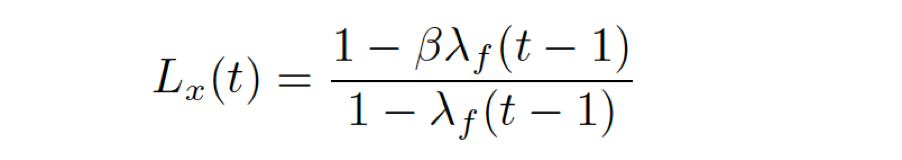

For leveraged players, if the leverage ratio is very low, then the fun is gone, but it is not a big problem. The fear is that when CR drops below 130%, the leverage ratio will soar. At this time, it will inevitably be accompanied by a sharp drop in market conditions, and the loss will increase rapidly. If you want to redeem, you will have to pay a fee of 8%. When CR is close to 100%, xETH will return to zero.

但我要分析的是,在市场剧烈下跌的情况下,类稳定币持有者和杠杆币持有者或铸造者并不是一成不变的拿着币不动的,他们之间存在着一种博弈平衡。当 CR 快到了 100%,持有 fETH 失去了意义,多了一层合约风险,自然会有部分用户选择赎回底层资产 ETH,并在低位持有 ETH。而这时的 xETH 杠杆率会飙升到 20 倍,乃至到 100 倍,这时候风险收益比已经完全倒向杠杆玩家一边了,一点点的投入有可能换取 100 倍的回报,会没有人来冲吗,我不信啊。这就一定会造成了 CR 的逐渐上升,让系统回归稳定。

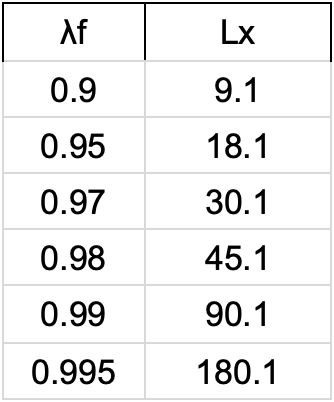

Through the leverage formula of the f(x) protocol, we can calculate the leverage ratio table at different ratios of fETH to total assets.

Therefore, CR will not really reach 100%, because leverage cannot be infinite, and CR of 100% is just a mathematical limit concept. From this point of view, this system has its inherent ability to return to stability. Of course, this is just a pure theoretical analysis. The real market trend and the operation of the protocol under stress may not be as I said.

Another external risk of the protocol cannot be ignored, that is, the decoupling of stETH caused by lido problems or other reasons. If the difference between the price of stETH and the price of ETH exceeds 1%, the protocol will temporarily stop minting. Redemption is still normal, but fETH redemption uses the higher price of the two prices (stETH, ETH), and xETH redemption uses the lower price. This also protects the interests of the stablecoin fETH holders.

Conclusion

After a bunch of analysis above, the official propaganda of "xETH is the first ever levered ETH you can HODL" is actually true. The current price of Ethereum in stable mode is $1078, and the CR of the protocol is 207%. The protocol has a relatively large safety margin.

在我看来,f(x) 协议最大的意义在于为不同风险偏好的用户提供了一种去中心化的金融工具,使得用户可以完全远离中心化交易所,去除掉现实世界资产风险,完全依靠加密货币原生资产去尽情的施展自己的策略,真正做到成为自己资产的主人,这与中本聪精神是一脉相承的,也是 defi 产生并存在的最大意义。

The article comes from the Internet:Analyzing the new decentralized gambling tool: f(x) project risk research

Even if the Fed has to continue raising interest rates, Bitcoin will be able to survive.Blockchain Note: This article is a translated version of the original text, and some content has been deleted and summarized during the translation process. Due to space limitations or other reasons, some details or information may not be fully translated or deleted. We recommend that readers refer to the original text while reading this article for a more complete…