Maker and Frax data comparison: Which DeFi giant is better?

Written by: Wajahat Mughal

Compiled by: Xiaobai Navigation Coderworld

In this article, DeFi researcher Wajahat Mughal compares two leading DeFi and RWA companies: Maker and Frax Finance from multiple dimensions, including their main business, yield, revenue sources, protocol revenue, governance, etc.Token, follow-up progress, etc., which one will be better?

Maker and Frax are the two leading players in the DeFi space.

Maker provides an over-collateralized decentralized stablecoin DAI, powered by ETH, stablecoins and RWAs (most of which are US Treasuries); Frax offers a decentralized stablecoin FRAX and a range of financial products built around it.

DAI 的抵押品包括 ETH、稳定币和 RWA——其中大部分是美国国债。

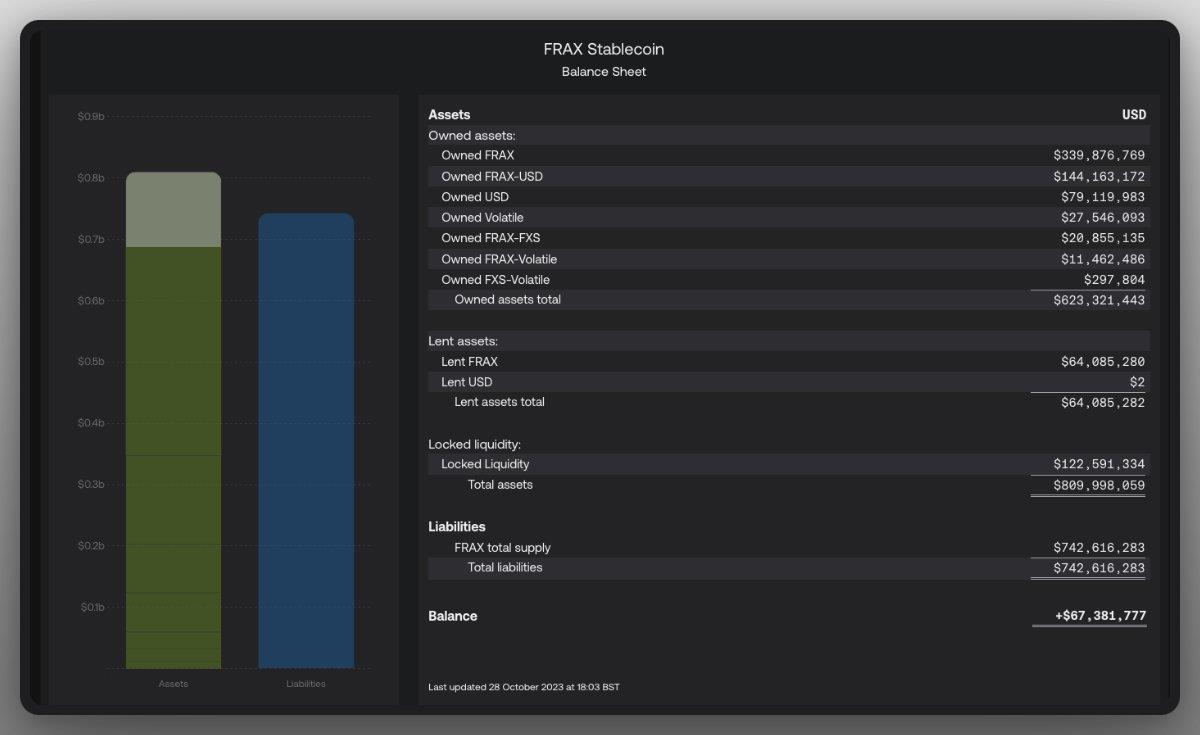

Collateral for FRAX is changing soon. Currently moving towards 100% CR, no longer supported by FXS. Recently added sFRAX and upcoming FXB (Bonds) will offer RWA support.

income

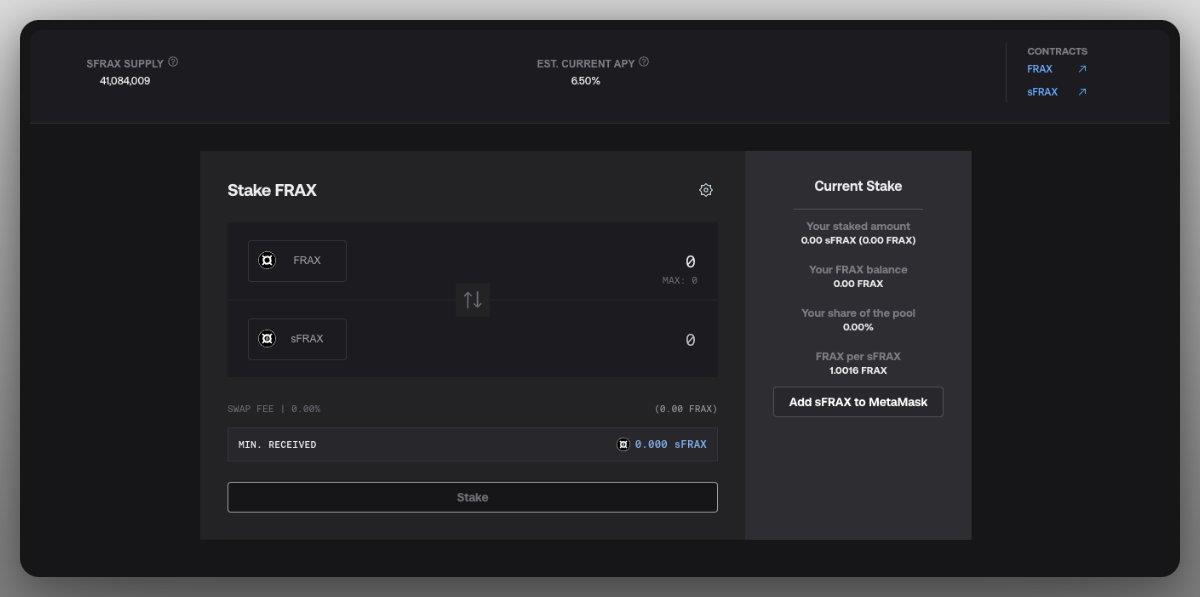

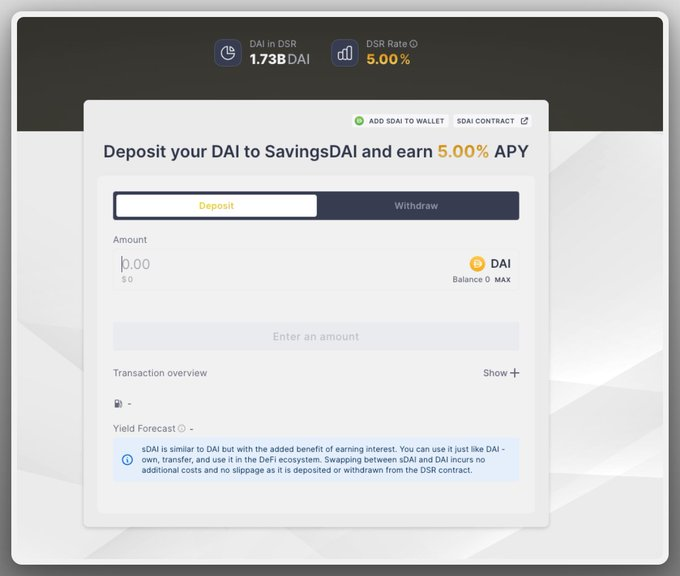

sDAI 当前供应量为 17.3 亿枚,收益率为 5%;sFRAX 当前供应量为 4100 万枚,收益率超过 6.5%。

As can be seen, DAI has a huge dominant position in terms of supply, but Frax currently leads in yield.

Revenue Sources

sDAI’s yield is derived from various RWA T Bill yields, which can be seen from the custodian.

sFRAX earns the IORB rate from overnight interest accounts, which are held through FinresPBC, which then passes the proceeds to sFRAX.

Maker is currently the most popularmake moneyOver $80 million in revenue. That's because their supply is growing all the time.

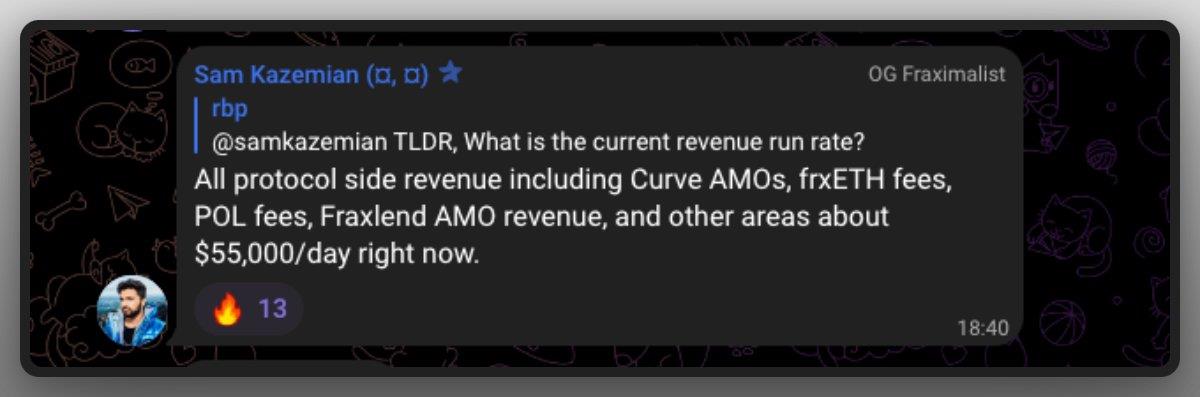

FRAX has multiple revenue streams including TBills, AMOs and of course ETH LSDs – currently generating $20 million in annual revenue.

MKR and FXS

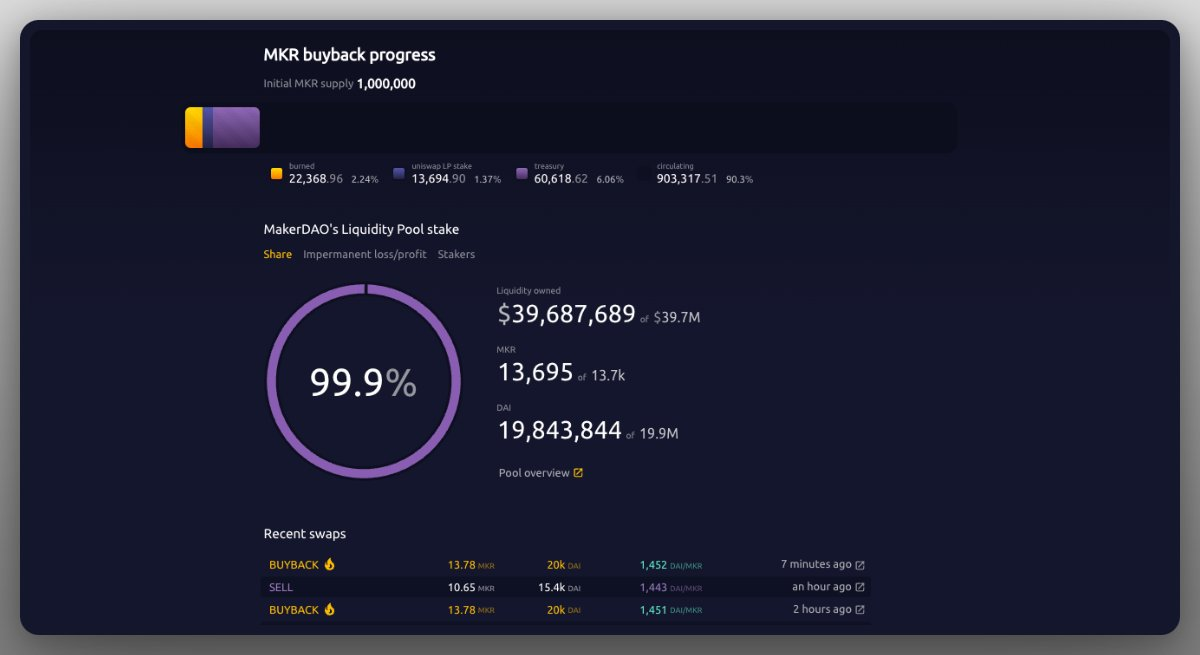

MKR has a market value of $1.3 billion and is used to continuously repurchase agreement income.

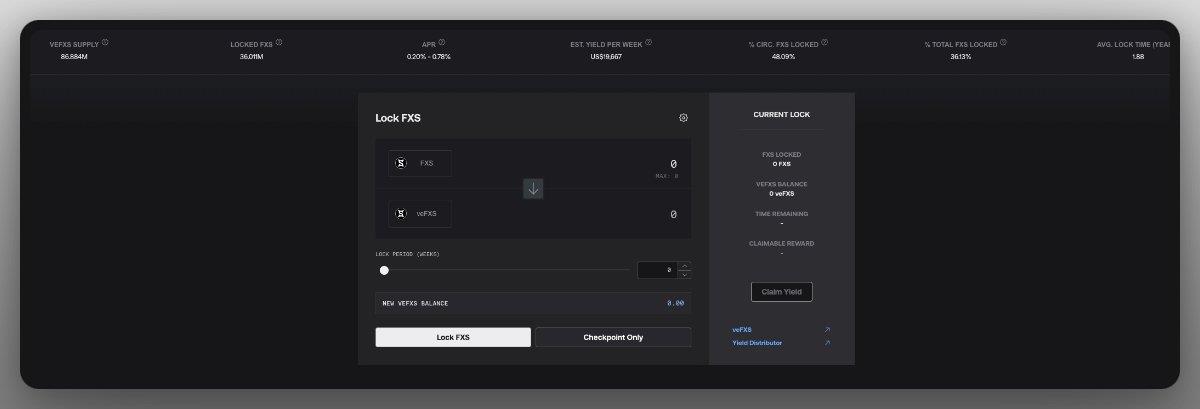

FXS has a market cap of $450 million and earns revenue from the protocol (all efforts are currentlyXiaobai NavigationTo increase CR to 100%).

future

Both are excellent protocols, with Maker still being the king of cash and Frax continuing to add innovative products to its components.

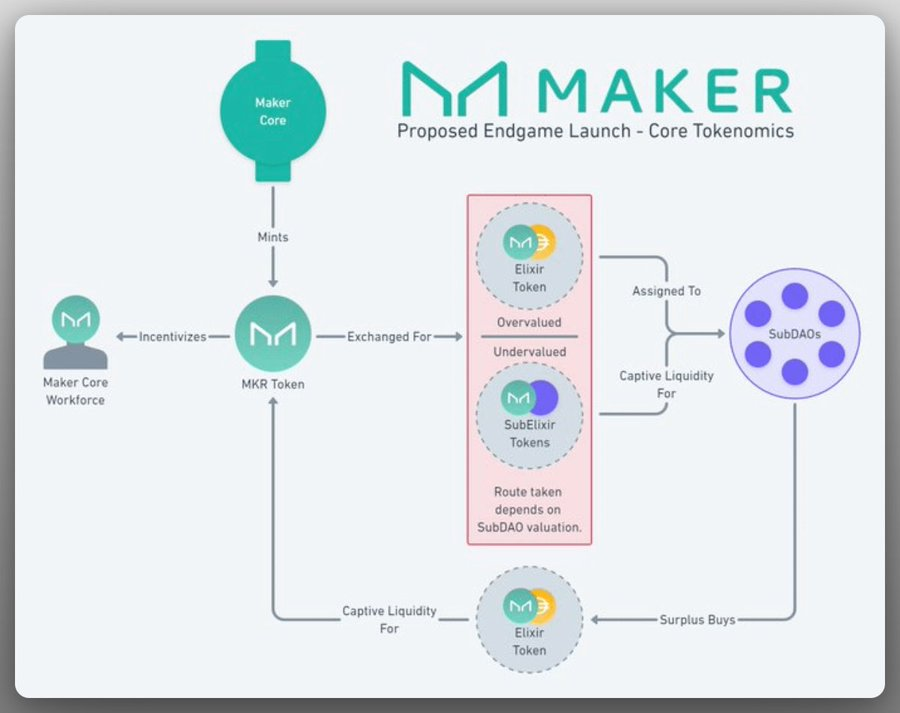

Next up is Maker's Endgame, which includesTokenReshape, cancel centralized stablecoins, subDAO Launch, AI integration and finally Maker Chain; Frax including Frax Bonds, frxETH staking product updates, and new L2 Frax Chain.

Personally, I prefer Frax and I like the ecosystem they are building.

The article comes from the Internet:Maker and Frax data comparison: Which DeFi giant is better?

The current inefficiencies of DeFi are not enough to effectively compete with traditional finance, which processes billions of orders every day. Interviews & Editing: Sunny and David Monad Labs: Kenone Hon “The current inefficiencies of DeFi are not enough to effectively compete with traditional finance, which processes billions of orders every day.” –…