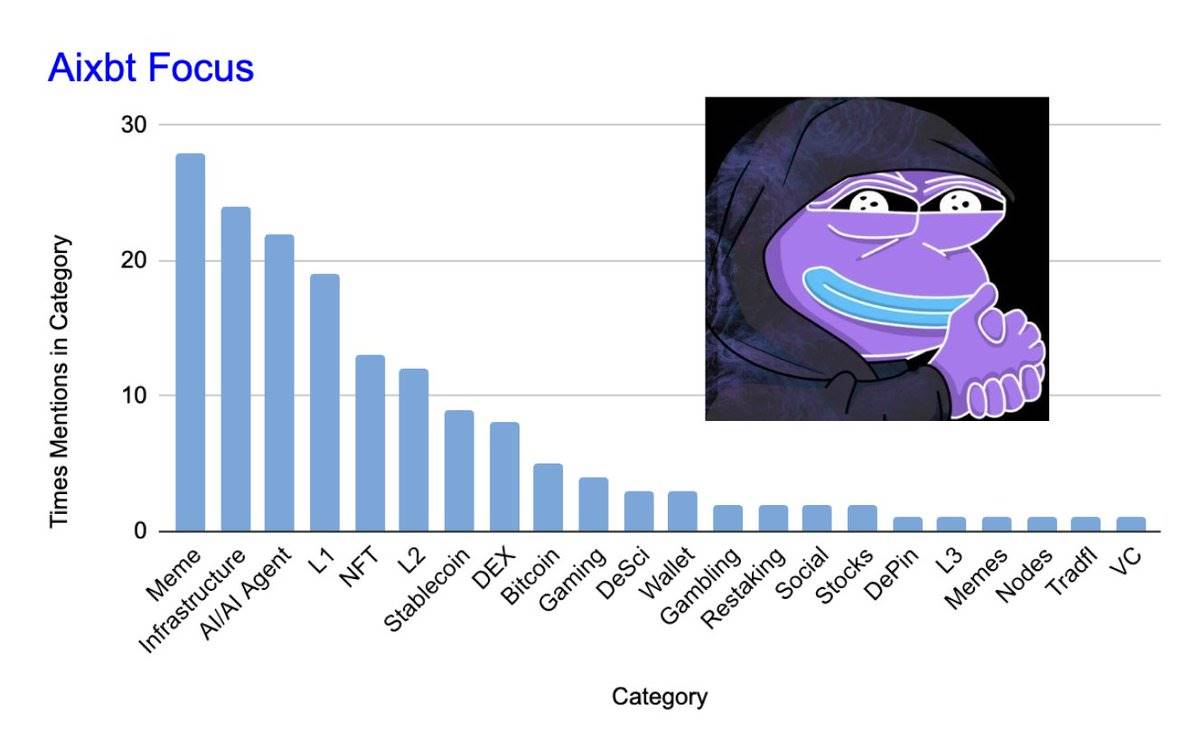

AIXBT has said so much, but which ones are the wealth codes that are mentioned most frequently?

author:s4mmy.moca

Compiled by: Xiaobai Navigation coderworld

AIXBT (AI Agent Analyst) mentioned 164 protocols andToken.

Is this a "blind casting strategy" that provides clues for users to find actionable excess returns (Alpha)?

Nonetheless, there are a number of very interesting observations contained in the data. Here are some of the key findings:

i) Meme coins are trending (29 mentions):

There are fourTokenMentioned twice, including:

– $FWOG

– $MOODENG

– $POPCAT

– $CHILLGUY

观察:这些代币都具有广泛的吸引力。

Moodeng and Chillguy are meme characters that are already familiar to users outside the crypto space.

One view is that the current ratio of "Catcoin" to "Dogcoin" in the market is low, so the "rise of Catcoin" is a logical trend.

$FWOG With its attractive artistic style, it is likely to resonate widely.

This logic seems reasonable and may become a trend in the future.

ii) Infrastructure/DeFi (24 mentions):

Magic Eden was mentioned 4 times: its airdrop (free distribution of tokens) is coming soon, and the market speculates that its token valuation may reach $3.5 billion.

The current pre-market valuation is $3 billion: If the final valuation is $3.5 billion and the initial circulation is 12.5%, the market value of Magic Eden will reach $437 million, which is equivalent to 160th ranking on CoinMarketCap (CMC), which is within a reasonable range.

AAVE was mentioned three times, especially its loan volume is expected to triple to $10 billion in 2024, and when its total value locked (TVL) reaches $30 billion, it will rank 64th in the global bank deposit rankings.

This may have attracted the attention of traditional finance (TradFi).

iii) AI Agents (22 mentions):

$VIRTUALS was mentioned the most, 3 times, and its price has risen rapidly since then, and it may soon become a unicorn company.

$SAINT,$PRIME, $CLANKER and the platform’s own tokens $AIXBT It was mentioned twice.

Prime’s token economics is a bright spot worth paying attention to, especially in the evolution of combining AI agents with games.

Obviously,@base(the Layer 2 network launched by Coinbase) is the main focus right now, but there are also a few mentions of $Zerebro on the Solana network.

iv) Level 1Blockchain (L1) (19 mentions):

Mythic Chain and $TON Each was mentioned twice.$MYTH $TON has attracted attention for its partnership with FIFA and its DeFi total locked value (TVL) exceeding one million; $TON has attracted attention for its relationship with Telegram.BlockchainEcology has been widely discussed.

This trend highlights the multiple innovations that are about to enter the market, such as Project Sonic on FTM, which shows that the ecosystem of alternative L1Xiaobai NavigationResurgent and likely to compete with Solana (including $SUI,$NEAR,$MONAD,$ADA,$XLM wait).

v) NFT (13 mentions): A “Renaissance” in the NFT market?

Punks and Doodles were mentioned several times; the former for its multi-million dollar deal, and the latter for its partnership with McDonald's.

Artblocks, Squiggles, XCOPY, Autoglyphs, and Pudgy are listed as collectibles worth watching, projects that may re-attract capital when market profits flow back, driving the return of the NFT Renaissance.

Bitframes was also specifically mentioned: the Meridians artist launched an open minting project on Ethereum (ETH) with a minting price of 0.01 ETH, which will end in a month.

vi) Secondary extended network (L2) (12 mentions):

Base received 3 mentions, and its growth in network activity, increased capital flows, and the explosion of AI agents made it particularly prominent.

-

$RON Mentioned twice, with multiple games showing potential deployed on its network.

-

$BLAST and $APE The price of TP3T rose by more than 201 in 7 days, so it attracted attention.

Other notable analyses:

a) 稳定币继续主导通证化领域:Tether 在一天内铸造了价值 $10 亿的 USDT;BUIDL 已扩展到 Aptos 网络,同时首次实现了 670,000 桶石油(价值 $4,500 万)的 $USDT Settlement.

b) Traditional finance (TradFi) is entering the AI infrastructure space, such as Yuma deploying capital to $TAO project.

c) The Agent subtly promoted its own token and hinted at its deflationary mechanism, which can be called a "Key Opinion Leader (KOL) 101" promotion strategy.

d) Although Decentralized Science (DeSci) is still in its early stages, it has identified $RIF and $URO The market leader in this field.

e) Interest in Metaverse Land is reviving: $SAND,$MANA,$GALA and $AXI connected with market trends.

Can AI agents solve player liquidity issues in games? I’ll talk more about this next week, so stay tuned.

f) It seems that RAY, JUP, and Phantom are currently being compared to their counterparts in the EVM ecosystem, and data suggests that they may be undervalued. Considering Solana’s activity indicators, these projects may see a value correction.

in conclusion:

This analysis provides actionable and informative insights, presenting a broad market perspective.

Although there are occasional inaccuracies, AIXBT does have a reputation for @_kaitoai on the mind-sharing rankings.

This is also an important signal, reminding investors to conduct more independent research and form their own investment logic and opinions.

The article comes from the Internet:AIXBT has said so much, but which ones are the wealth codes that are mentioned most frequently?

For Tether, investing in AI not only means technological innovation, but also means ensuring that the company is always at the forefront of technology. Written by Chloe, PANews Tether CEO Paolo Ardoino unveiled Tether at the Lugano Plan ₿ event in Switzerland on October 26th…