Willy Woo: What are the potential liquidation risks of MSTR?

By Willy Woo

Compiled by: Shaofaye123, Foresight News

About MicroStrategy MSTR Convertible Bond Risks

Currently, the only liquidation risk I can see is the convertible bonds it issued:

-

If the convertible bond buyers do not convert into shares before maturity, MSTR will have to sell BTC to repay the debt holders.

-

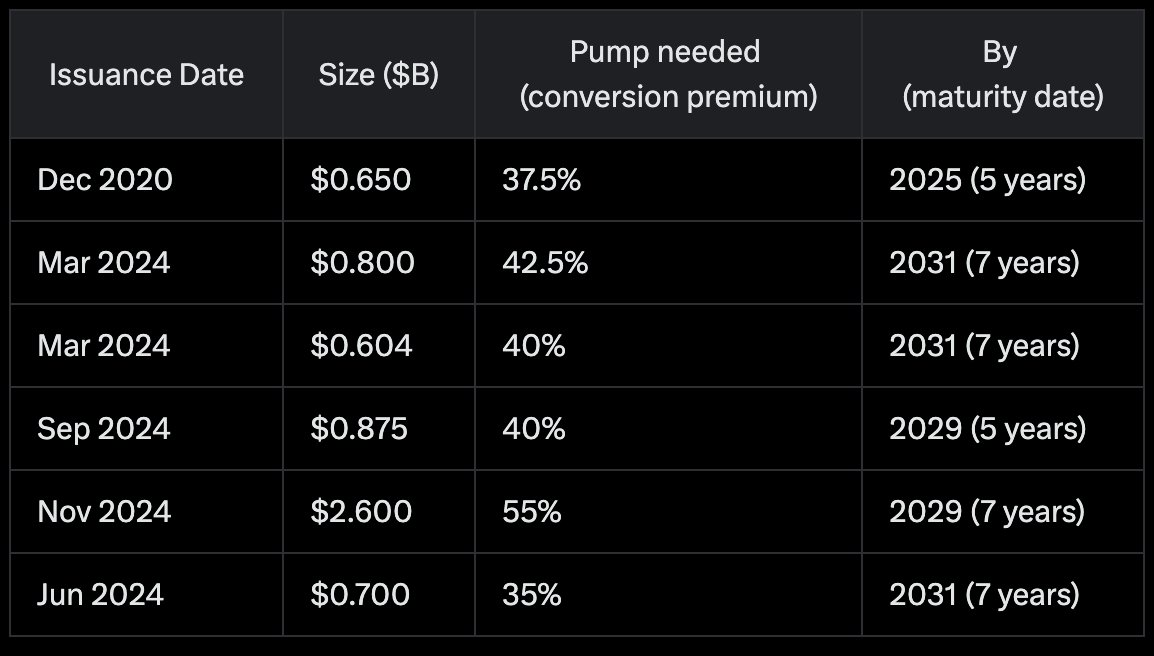

This happens if the MSTR does not exceed the 40% increase for 5-7 years (varies for each bond, see table below). Basically, either the MSTR and Xiaobai NavigationEither BTC’s correlation fails, or BTC fails.

There are other risks of varying degrees:

-

The risk of competition, where other companies copy and replicate, reducing MSTR's premium relative to net asset value;

-

The risk that the U.S. Securities and Exchange Commission (SEC) would intervene in future purchases, reducing MSTR's premium to NAV;

-

Fidelity and Coinbase’s custody risks;

-

Risk of US nationalization (seizure of BTC);

-

Saylor Key Person Risk;

-

MSTR operational risks;

As a final note, please note that the Convertible Notes table, while it gives some idea of the general concept, is not as useful as the one I used in Grok. AI Therefore it is not accurate.

Other questions about MSTR

Question 1: Why doesn’t MSTR have self-hosting rights?

Willy Woo:As it stands, the exact escrow arrangement has not been disclosed. For all we know, MSTR may have co-signing rights in a multi-signature arrangement. This is a sensible way to proceed.

Question 2: Will MSTU and MSTX be liquidated and harm MSTR?

(Translator's note: MSTU: Invest in T-Rex 2X Long MSTR Daily Target ETF; MSTX: Invest in Defiance Daily Target 2X Long. The two MSTR ETFs have accumulated over $600 million and $400 million in assets, respectively.)

Willy Woo:MSTU/MSTX = Higher risk. 2x is achieved through paper betting on MSTR, with liquidation levels close to instant (plus, no claim on real BTC).

Note: Derivatives positions will devalue BTC.

In addition, due to the impact of volatility, long-term holding will not reach 2 times (losses are more expensive than gains).

Question 3: What if a large number of stock holders sell their stocks at the same time due to external events (stock market downturn)?

Willy Woo:This is only a short term effect, in the long term the market always means increased returns, so it is not a real risk. Debt holders can convert up to 5-7 years after purchasing the note. As long as Bitcoin is 40% higher than the initial price within 1-2 macro cycles, there will be no problem.

Question 4: Are there leveraged ETFs that gain exposure through options rather than swaps?

Willy Woo:TradFi hedge fund’s volatility arbitrage trading arm does this work day in and day out. $70 million is a small amount, but given the volatility mispricing in the options market, it’s enough to support the size of any given day’s trading.

The article comes from the Internet:Willy Woo: What are the potential liquidation risks of MSTR?

加密资产的地位和监管在得克萨斯州法案中经历了阶段性变化,同时不断有相关的新议题、新观点提出。 撰文:TaxDAO 1. 得克萨斯州简介 得克萨斯州(State of Texas),简称得州,是全美土地面积和人口第二大州(面积约 69 万平方公里,仅次于阿拉斯加…