The last hurdle: A brief analysis of the impact of the US election on the trend of the crypto market

Author: Biteye core contributor Viee

Editor: Crush, core contributor of Biteye

Today, November 5th, will be the "election night" of the US presidential election. The two candidates have completely different policy propositions, which not only affects the future of the US economy, but will also have a profound impact on the direction of the crypto market.

With Trump in office, are you bullish on the cryptocurrency market?

If Harris comes to power, will he be bearish on the cryptocurrency market?

Is it really so?

In this article, Biteye analyzes the impact of the two policy propositions on the market and provides a reference for everyone.

01 Current situation of the election and key time nodes

The 2024 US election is full of drama and volatility. Let’s review:

-

July 2024: Trump survived an unexpected assassination attempt, and his public support rate rose sharply, and he was considered the "chosen one". Biden announced his withdrawal from the election, and Vice President Harris took over the election.

-

August-September 2024: During the "newbie protection period" in August and September, Harris's approval rating once exceeded Trump's.

-

October 2024: After the novice protection period ended, Harris performed poorly in many media interviews and gradually fell behind Trump in policy propaganda, resulting in a decline in her poll support rate.

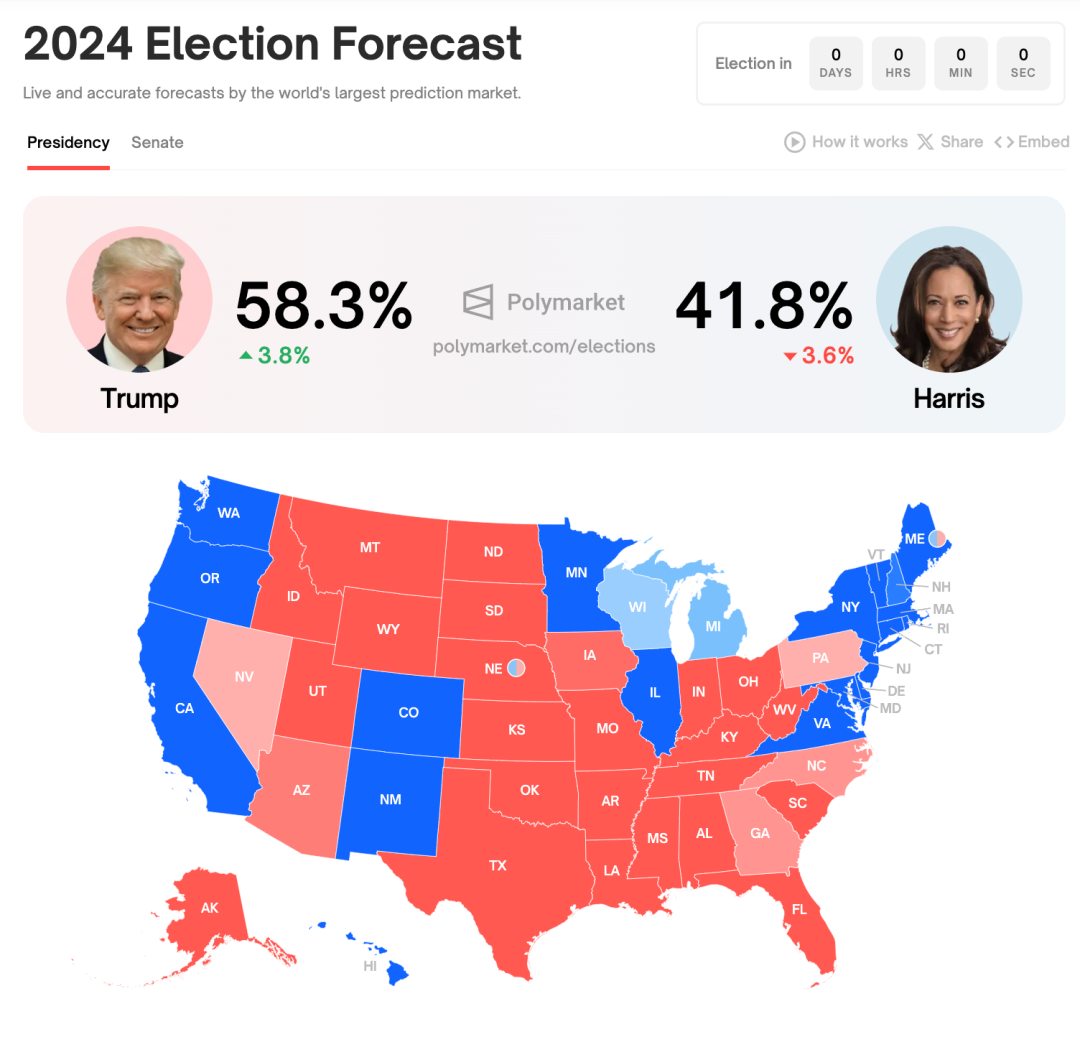

at present: According to the latest polls, Trump has taken the lead in several key swing states, but the complexity of the Electoral College system means that the final result is still unpredictable.

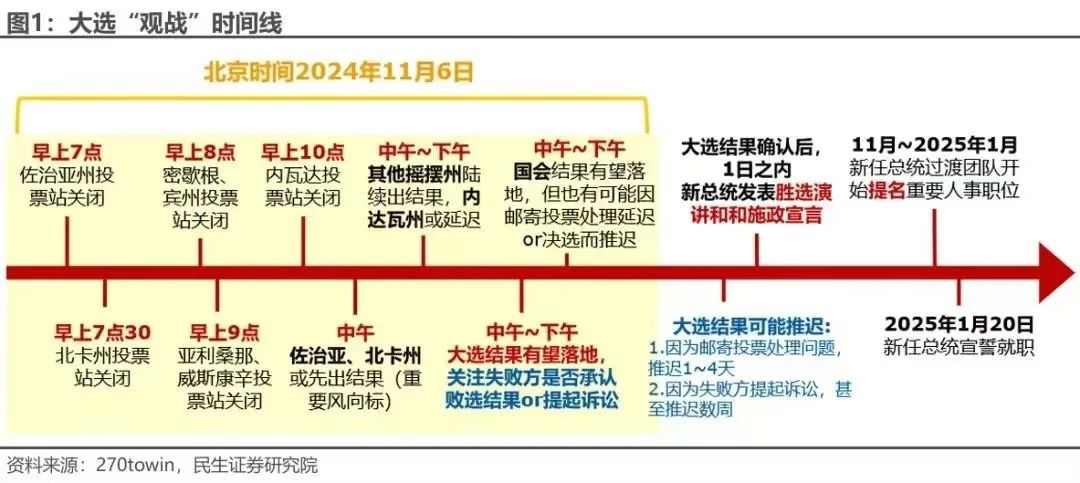

Below is the election timeline. The election results will be announced tomorrow, November 6th., we are about to get a glimpse into where the crypto market is headed in the coming months.

Source: 270towin, Minsheng Securities Research Institute

02 Policy Differences between Trump and Harris

According to the analysis, the two candidates' policy proposals arecryptocurrencyThe impact varies by field.

Let’s first talk about the conclusion that everyone is most concerned about: Who is beneficial to the crypto market?

Trump’s coming to power: good news for the crypto market.Trump's policies tend to reduce taxes, relax regulations, and promote capital inflows, which may drive activity in the crypto market, especially in terms of market sentiment and speculative trading.

Harris's coming to power: potentially negative for the crypto market in the short term, but positive in the long term.Harris's policies tend to strengthen regulation and increase taxes, which may bring pressure in the short term. However, in the long run, Harris advocates focusing on social welfare spending, and the stability and growth of the overall economy may provide indirect support for the crypto market.

Trump’s pro-crypto policy proposals:

-

tax:Supporting tax cuts can stimulate investment and consumption, increase market liquidity, and stimulatecryptocurrencyThe demand for high-risk assets.

-

financial:In terms of fiscal spending, there is a tendency to reduce government intervention and encourage market freedom, which may drive more capital into the market.

-

trading:提高关税,可能导致通胀上升,使投资者转向加密货币作为对冲工具。但也有可能因为预期通胀引发加息的后果。

-

Cryptocurrency Policy:They support cryptocurrencies, believe that they are part of the future financial system, and are not in a hurry to strictly regulate them.

Harris’s pro-crypto policy proposals:

-

financial:More emphasis on social welfare spending, such as child subsidies and relief for low-income families, reflects the Democratic Party's preference for a big government. This could stimulate consumption and demand in the U.S. economy and boost overall economic vitality. Although the crypto market may face stricter regulation, overall economic stability and growth will also have a positive impact on the crypto market.

Next, we will select the tax angle and start the analysis:

-

Trump:Support tax cuts, such as reducing corporate income tax from 21% to 15%, considering replacing income tax with tariffs, and imposing a base tariff on US imports, especially 60% tariffs on products from China. Such radical tax cuts are intended to stimulate investment and consumption, increase market liquidity, and stimulate demand for high-risk assets such as cryptocurrencies.

-

Harris:It advocates raising taxes, especially for large companies and high-income earners, raising corporate taxes to 28%, and raising taxes on people with annual incomes over $400,000. This policy is intended to increase government revenue for social welfare spending. But it may also weaken investor confidence and reduce capital inflows.

-

Comparison of impact on the crypto market:Trump's tax cuts are likely to attract more capital into the United States, activate market sentiment, and indirectly boost the growth of the crypto market. Harris's tax increase measures, on the other hand, are likely to reduce market vitality, especially for investors in high-risk assets such as cryptocurrencies, making them less attractive.

03 Impact on BTC price and crypto market

Impact on Bitcoin price:

According to Bernstein and other analysts, if Trump is elected, the price of Bitcoin could rise sharply, reaching $80,000 to $90,000 by the end of the year. The analysis team of Standard Chartered Bank even gave a forecast of $125,000.

However, Harris’s election could cause the price of Bitcoin to fall below $50,000, with some even predicting it could fall to around $30,000.

Overall, the market's rising support for Trump is highly correlated with the upward trend in Bitcoin prices, while Harris' victory may trigger a short-term price correction.

The reason is that the policy differences between the two candidates will directly affect the psychological expectations of the crypto market and its future development direction.

Short-term impact:

-

Trump Election:The volatility of the crypto market is expected to increase, especially when policy uncertainty increases, and speculative trading may become dominant. Trump's tax cuts and loose regulations will attract a large amount of capital inflows, and the crypto market may usher in a short-term wave of funds, which is good for BTC and altcoins such as DOGE.

-

Harris was elected:Xiaobai NavigationIn the short term, the crypto market may face stricter regulatory measures, and market development may be suppressed. Investor sentiment may become conservative, and the liquidity and trading volume of crypto assets may decline. However, there are also different voices (@milesdeutscher) who believe that the market is not optimistic about Harris's practical development.TokenThe concern about the "bottleneck" crackdown on the market may trigger a huge Meme Season. The reason is that Memecoins are not practicalToken, so it is not regulated by the SEC.

Long-term effects:

-

Trump Election:In the long run, Trump’s policies may boost the crypto market, especially Bitcoin andBlockchainThe application of technology will gain more support. Tax cuts, increased tariffs, and relaxed regulations may prompt more funds to enter the crypto market and enhance the status of cryptocurrencies as safe-haven assets.

-

Harris was elected:In the long run, with the improvement of economic stability and regulatory framework, a more robust and regulated capital market will have a positive impact on the crypto industry.

04 Conclusion

Whether Trump or Harris is elected, it will have a profound impact on the development of the crypto market. Trump's policies tend to promote market activity and capital flows, while Harris' policies focus on strengthening supervision and increasing taxes. At present, we should still pay attention to the election results so as to adjust our investment strategies according to the policy direction.

In this political competition, the crypto market will undoubtedly become an important observation point.

The article comes from the Internet:The last hurdle: A brief analysis of the impact of the US election on the trend of the crypto market

It is recommended to hold projects with good fundamentals and meme appeal. Author: Ryan Watkins Translator: Xiaobai Navigation Coderworld "In their deep thoughts, the subtle sound of omens came into their ears, they listened devoutly, while the people on the street outside knew nothing." - CP Cavafy The crypto economy has repeatedly…