Competition on the BTC (Re)staking supply side intensifies, with wrapped BTC scrambling to seize the WBTC market

Xiaobai Navigation

Written by: 0xMaiaa, BeWater Research

With the launch of the first phase of the Babylon mainnet a month ago, the launch of BTC LST on Pendle, and the launch of various BTC packages, market attention has been constantly brought back to BTCFi. The following content will cover the recent major updates on BTC (re)staking and BTC-pegged assets:

BTC (Re)staking:

-

The importance of ecological strategy to BTC LST

-

Pendle is coming to BTCFi

-

SatLayer joins the BTC re-staking market competition

BTC anchored assets:

-

Coinbase Launches cbBTC

-

WBTC’s multi-chain expansion

-

FBTC’s aggressive expansion

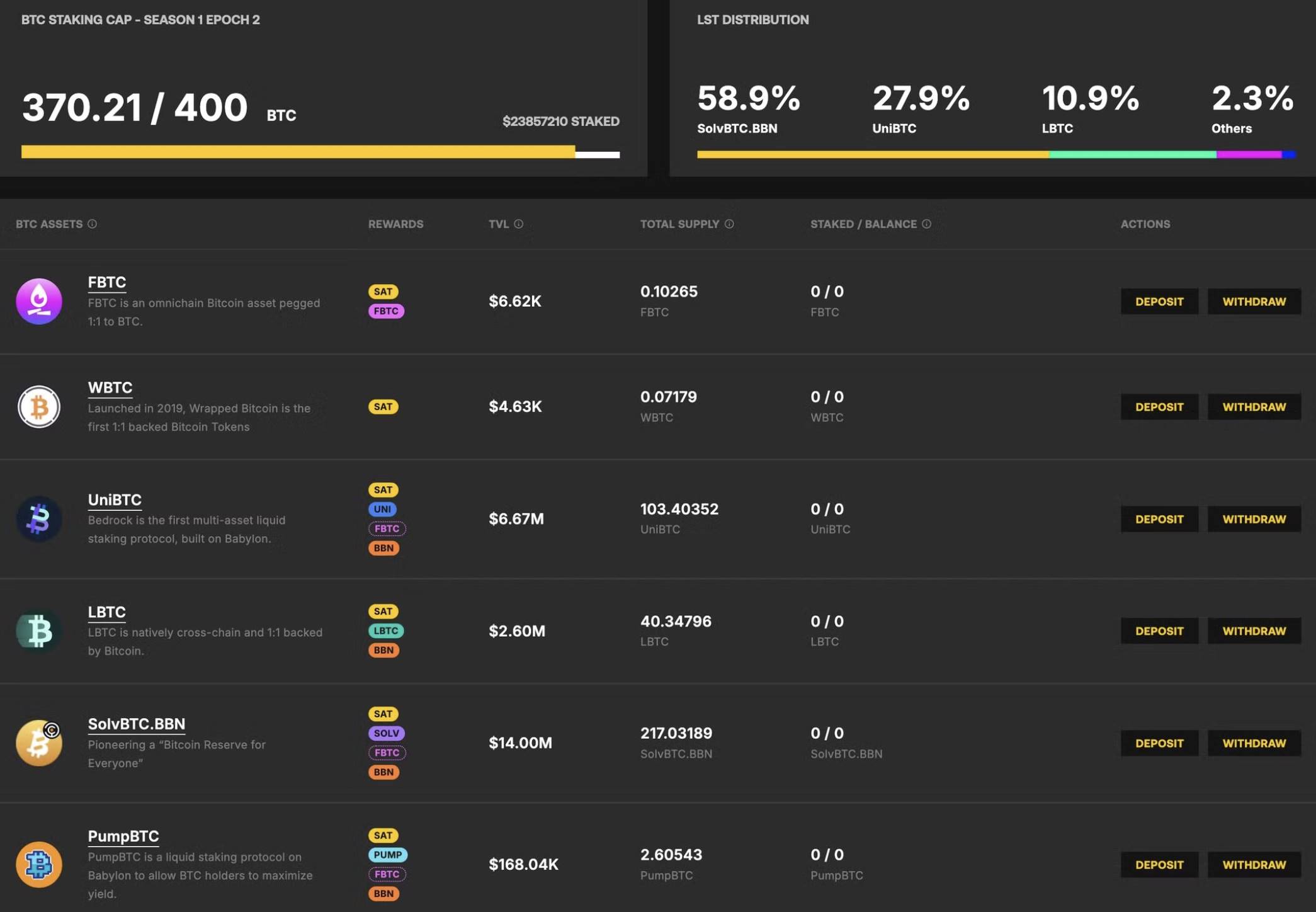

2/ Current BTC LST competition situation:

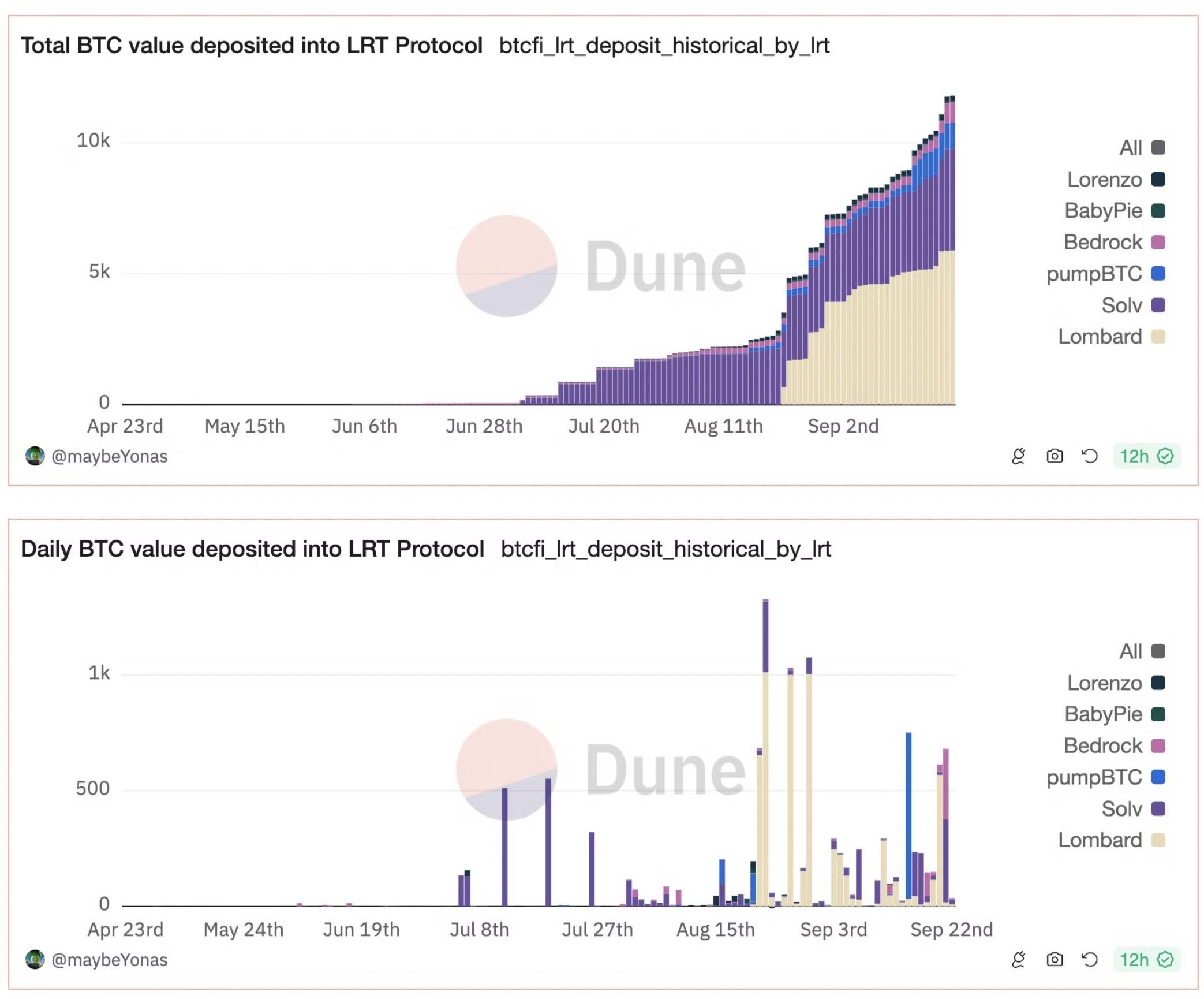

After Babylon Stage 1 quickly reached the 1000 BTC cap, competition among BTC LSTs continued to heat up, with all parties vying for the entry point for staking and earning interest on BTC and its wrapped assets. In the past 30 days, @Lombard_Finance has achieved rapid growth, reaching the current highest TVL with 5.9k BTC in deposits, surpassing @SolvProtocol, which has long been in the leading position.

Lombard has gained a competitive advantage at this stage by reaching a strategic partnership with the top re-staking protocol @symbioticfi, providing its participants with a richer source of re-staking income from the ETH ecosystem and opportunities to participate in DeFi.

3/ The importance of ecological strategy to BTC LST:

In the field of BTC LST, ecological strategy has become a key factor affecting the current competitive landscape. Unlike ETH LRT, which benefits from ETH and ETH L2 Mature DeFi ecosystem to supportTokenDownstream applications, BTC LST currently faces more complex considerations, including downstream DeFi application scenarios, BTC L2 The development stage, the combination with BTC anchored assets on various chains, and the integration with the re-pledge platform, etc.

At the current stage, the choice of ecological strategy will affect the growth rate and the grabbing of early market share. The specific situation of each BTC LST provider is as follows:

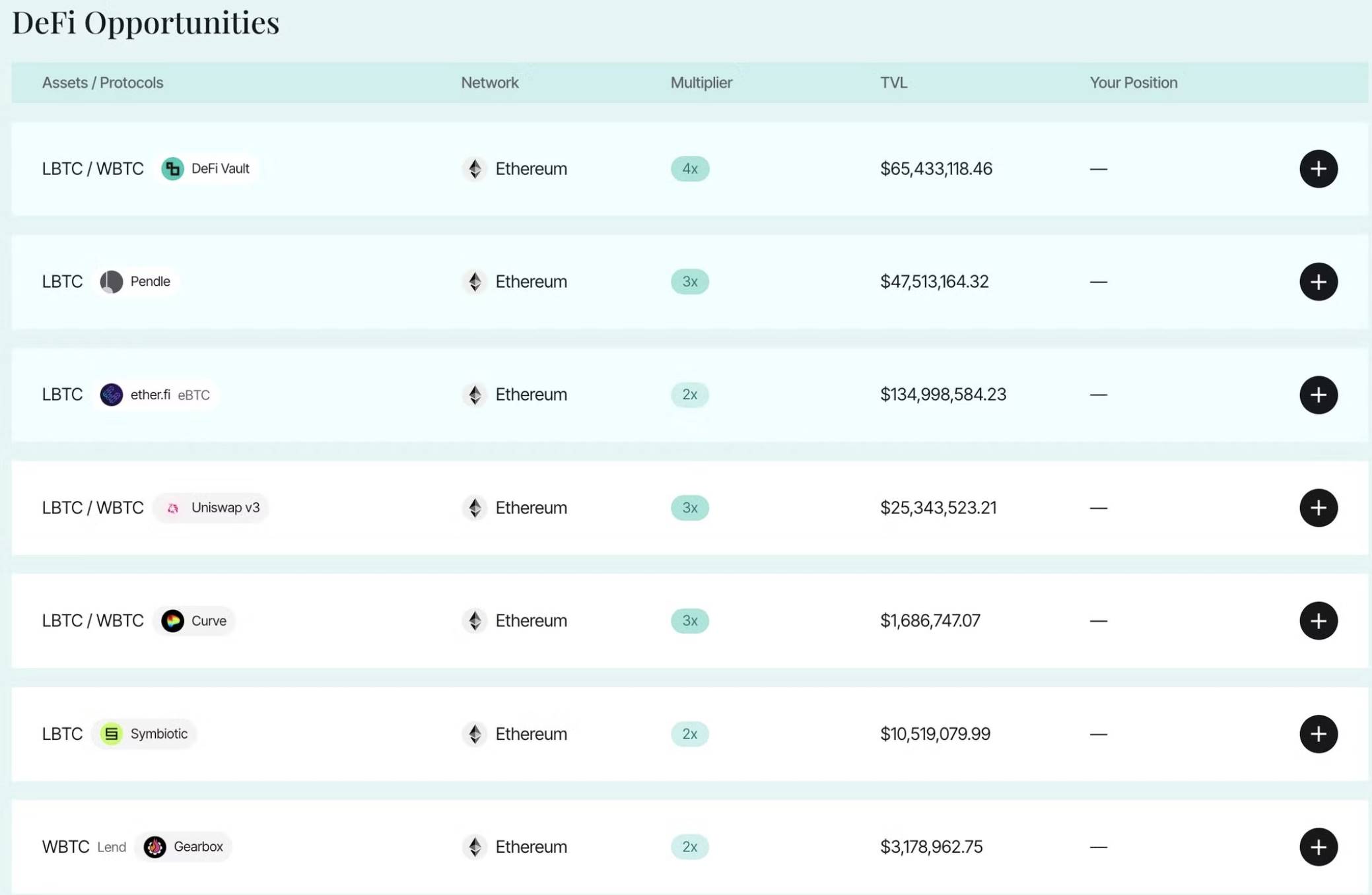

4/ At this stage, @Lombard_Finance is strategically focused on the development of the ETH ecosystem. Through cooperation with @symbioticfi and @Karak_Network, Lombard provides pledgers with rich external rewards outside of @babylonlabs_io. At the same time, $LBTC is the first BTC LST to be supported by the re-staking protocol on ETH. In addition, in terms of LST utility, Lombard is actively promoting the leveraged gameplay of $LBTC on ETH, and important partners include @pendle_fi@GearboxProtocol@zerolendxyz, etc. It is worth noting that with the acceptance of $LBTC deposits by http://Ether.Fi, $LBTC will benefit from all future downstream applications related to $eBTC, further enhancing its competitive advantage.

5/ 与 Lombard 的聚焦策略不同,@SolvProtocol@Bedrock_DeFi 都在积极进行多链扩展,生态开发涵盖上游存款的接收和下游应用的建设。目前,SolvBTC.BBN 和 uniBTC 的主要流动性集中在 BNB 和 ETH 链上,同时也为其他 L2 注入 BTC 流动性。Solv 值得一提的策略是需要用户存入 SolvBTC 来转换为 SolvBTC.BBN 参与 Babylon,这将会推动市场对 SolvBTC 的需求并巩固 Solv 作为 Decentralized Bitcoin Reserve 的核心业务。

6/ @LorenzoProtocol and @pStakeFinance, supported by @BinanceLabs, are focusing on the construction of the BNB chain in the initial launch phase. They have supported receiving $BTCB deposits and minted LST on the BNB chain - $stBTC and $yBTC respectively. Lorenzo is unique in that it has built a yield market based on BTCFi, using the method of converting liquid principal into aTokenThe structure that separates the LPT (LPT) and the yield accumulation token (YAT) is similar to the Pendle model, making the gameplay based on BTC restaking income more flexible.

7/ From another perspective, the different ecological strategies of various BTC LSTs – acceptance of upstream BTC derivatives and minting of LST – will affect the liquidity and DeFi adoption of BTC-anchored assets in each ecosystem. As the BTC LST market continues to expand, this trend will become more and more significant, triggering a TVL defense war between chains.

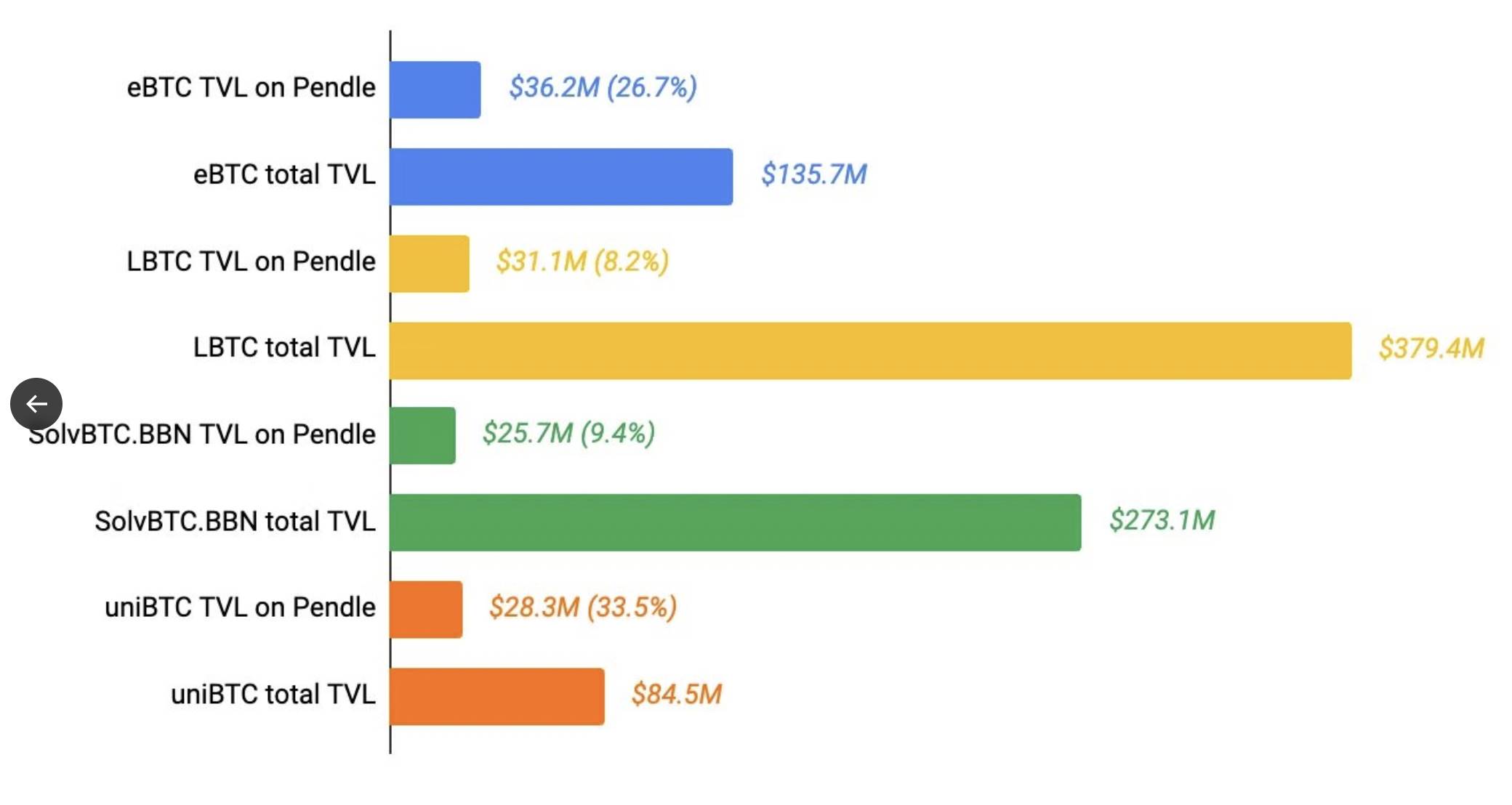

8/ Pendle is entering BTCFi:

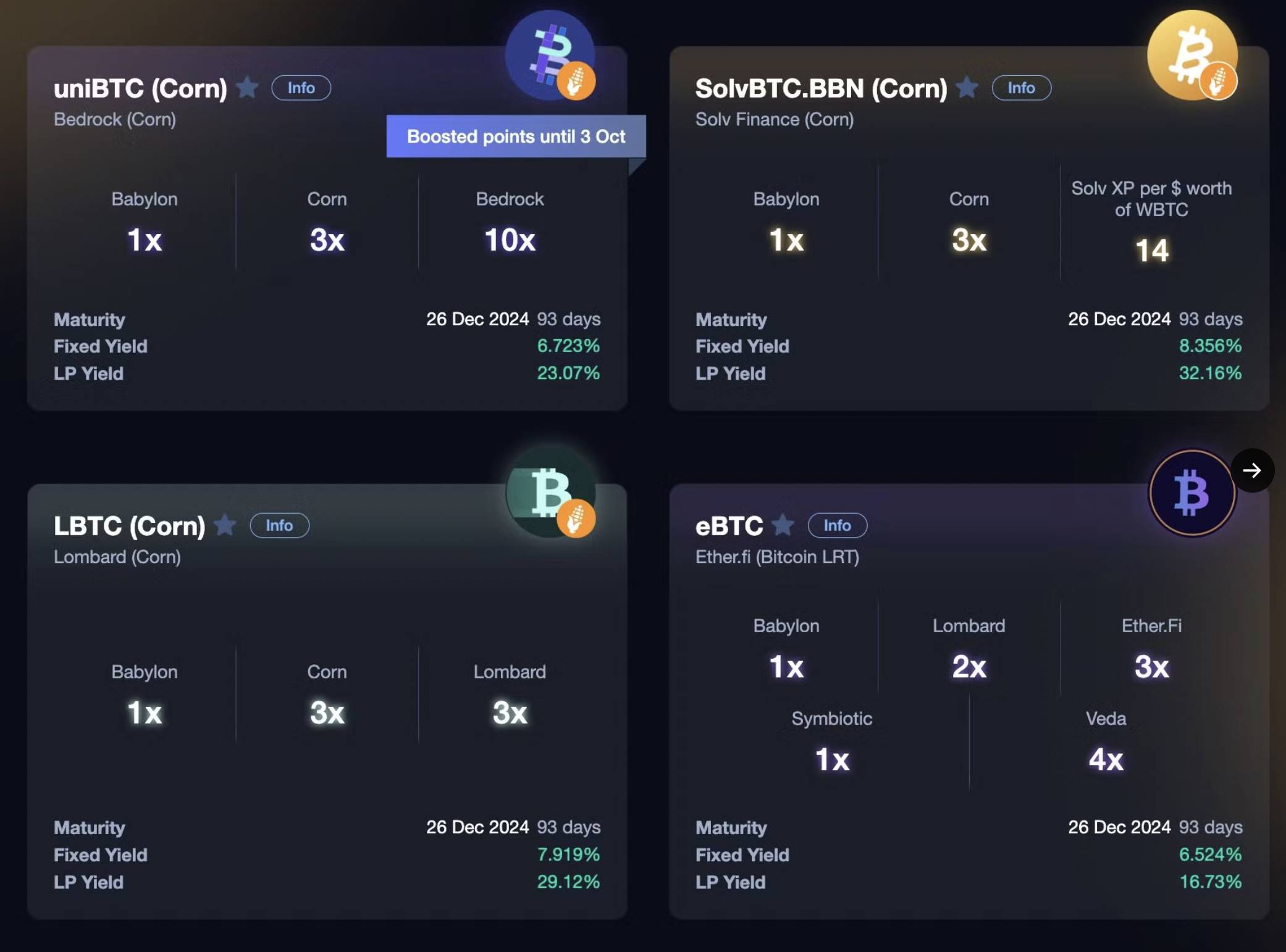

Recently, Pendle has integrated four BTC LSTs into its points market, including $LBTC, $eBTC, $uniBTC, and $SolvBTC.BBN. The current liquidity and total TVL of each LST on Pendle are shown in the figure. Among them, the actual adoption of $LBTC is higher than the surface value in the LBTC (Corn) pool. Since 37%'s $eBTC is supported by $LBTC, Pendle's integration of $eBTC will also indirectly benefit Lombard, giving $LBTC holders more opportunities to optimize their income strategies.

9/ Except for $eBTC, the other three LSTs are bound in cooperation with another important participant @use_corn. Corn is an emerging ETH L2 with two unique designs: veTokenomics and Hybrid Tokenized Bitcoin. Since Corn's gas token $BTCN will be minted through a hybrid method, the current cooperation also indicates the possibility of BTC LST with a trust basis being accepted for minting $BTCN in the future.

The future integration path may be: Wrap BTC → BTC LST → BTCN → DeFi. This architecture adds another layer of leverage to the BTCFi system. Although it enables users to kill two birds with one stone in more protocols, it also introduces new systemic risks and the possibility that the points system of each protocol will be over-mined and the final benefits will be far less than expected. For the release of Corn and Lombard points, please refer to: https://x.com/PendleIntern/status/1835579019515027549

10/ Points leverage is one of the key scenarios for interest-bearing asset strategies including ETH LRT, BTC LST, etc. As a leader, Pendle's integration of BTC LST will largely drive the wider application trend of the DeFi ecosystem. Currently, @GearboxProtocol has introduced $LBTC in its points market, and @PichiFinance also hinted that BTC LST will be integrated in the near future.

11/ SatLayer joins the BTC re-staking market competition: @satlayer enters the BTC re-staking space and becomes an emerging competitor to @Pell_Network. Both accept BTC LST re-staking and use it to provide other protocolsSafetyGuarantee, similar to @eigenlayer's approach. As a pioneer in the BTC restaking field, Pell has accumulated $270 million in TVL and has integrated almost all major BTC derivatives across 13 networks. On the other hand, SatLayer is also rapidly expanding its market after announcing a financing round led by @Hack_VC@CastleIslandVC last month.

12/ SatLayer is currently deployed on Ethereum and already supports receiving multiple BTC LSTs including WBTC, FBTC, pumpBTC, SolvBTC.BBN, uniBTC and LBTC, and more integrations are expected. As more and more homogenous re-staking platforms emerge, the liquidity competition for BTC and its variants will become more intense. Although this provides participants with an additional layer of nesting doll income opportunities, it also shows signs of oversupply of supply-side infrastructure in the restaking sector.

13/ Current status of BTC wrapped tokens:

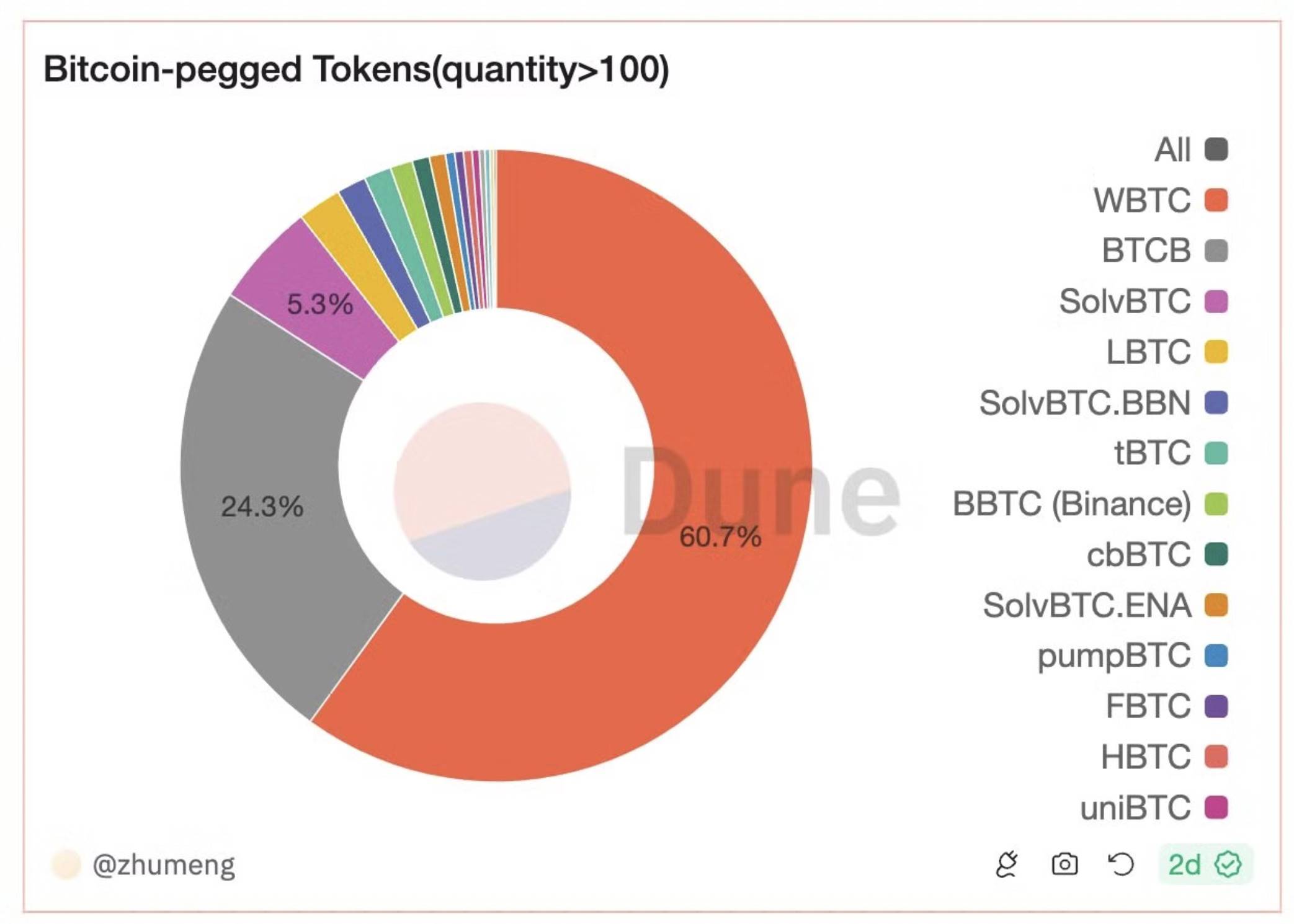

Since Justin Sun's involvement in WBTC custody caused a stir, competition in the wrapped BTC market has intensified. The main competing alternative assets currently include @Binance's $BTCB (supply 65.3k), @MerlinLayer2's $mBTC (supply 22.3k), @TheTNetwork's $tBTC (supply 3.6k), @0xMantle's $FBTC (supply 3k) and the various BTC LST assets mentioned above.

14/ Coinbase launches cbBTC:

Coinbase 在上周推出由其托管支持的封装资产 $cbBTC,目前供应量达 2.7k。$cbBTC 部署于 Base 和以太坊网络,已获得包括 @0xfluid 等多个主流 DeFi 协议的支持,并且计划在未来扩展到更多链上。此外,BTC LST @Pumpbtcxyz

And @SolvProtocol quickly expressed its intention to cooperate with Base after $cbBTC was launched, demonstrating the development potential of $cbBTC in BTCFi.

15/ WBTC’s multi-chain expansion:

Despite the existence ofSafetyDespite concerns about the security of BTC, $WBTC still occupies more than 60% of the wrapped BTC market. @BitGo recently announced that it will deploy $WBTC on Avalanche and BNB chains, and through @LayerZero_Core's full-chain fungible token (OFT) standard, it aims to consolidate its market position with the help of multi-chain expansion.

However, the adoption rate of WBTC continues to decline. As leading DeFi protocols such as @aave and @SkyEcosystem begin to remove WBTC as collateral, this trend will affect the attitudes of more DeFi protocols towards WBTC.

16/ FBTC’s aggressive expansion:

$FBTC, jointly managed by Mantle, Antalpha and Cobo, has been deployed on Ethereum, Mantle and BNB chains. Through the "Sparkle Campaign", @FBTC_official is actively promoting the wider adoption of $FBTC in the BTCFi field. In the BTC (re)staking field, $FBTC has been adopted by Solv, BedRock, PumpBTC and Pell, providing Sparks points incentives for early adopters.

17/ Currently, various packaged BTC assets are actively striving to be integrated into major DeFi protocols and accepted by a wide range of users in order to compete for the market position of the next $WBTC. In addition to the existing packaged BTC assets, new participants such as @ton_blockchain's $tgBTC and @Stacks' $sBTC will soon join the competition.

18/ In the current trend of BTCFi’s continued growth, BTC (re)staking and BTC-pegged assets are two key sectors that deserve continued attention.

In the field of BTC (re)staking, there is currently a trend of over-construction and involution on the supply side, while the market size on the demand side is still unknown. In the current early competition landscape, differentiated ecological strategies and unique downstream gameplay have become key factors affecting the competition among various BTC LST companies. On the other hand, the trend of various BTC anchored assets being nested with each other has also introduced new systemic risks, and there is a possibility that each protocol will be over-mined and ultimately have little benefit.

Trust remains a key issue for each BTC-anchored asset.exchange, L2 and BTC LST are all actively developing their own BTC-pegged assets through different plans, striving to be accepted by mainstream DeFi protocols and a wide range of users, so as to quickly occupy the market lost by WBTC.

The article comes from the Internet:Competition on the BTC (Re)staking supply side intensifies, with wrapped BTC scrambling to seize the WBTC market

Drinking and chatting with VC bosses more often will help you grow in the industry the most. Author: ZTZZ ฿ I'm almost being used as an HR by my friends. Everyone asks me for girls, operations, and BD. The most outrageous thing is that some even ask me for CEO. Complaints aside, as I'm about to get 10,000 followers, let me talk about some advanced knowledge of the cryptocurrency circle. It's actually more than 3,000 words after I finish writing it. Believe me, you will definitely gain something after reading it...