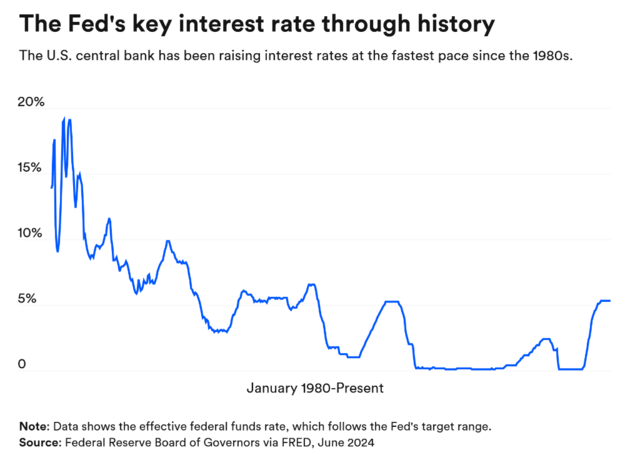

Forty years of the Federal Reserve’s monetary policy: “Volcker’s cure for inflation” - “Greenspan miracle” - “Bernanke QE”, what is Powell going to leave behind?

Written by Zhang Yaqi, Wall Street News

Over the past four decades, the Federal Reserve's monetary policy has been steered by a number of chairmen, each of whom has responded to the challenges of the times in a unique way.

From Volcker's iron-fisted interest rate hikes to curb inflation, to Greenspan leading the United States through economic prosperity, to Bernanke's quantitative easing to reshape the post-financial crisis economy,Xiaobai NavigationEconomic environment, Yellen enters the interest rate hike cycle. Today, the Federal Reserve is facing the most complex global economic situation in history.

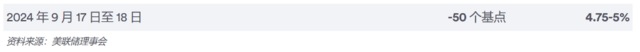

This Thursday, Powell announced a historic 50 basis point interest rate cut, opening a new round of easing cycle. Can he replicate the successful experience of past leaders and lead the US economy to a soft landing? What mark will he leave on the course of history?

The Volcker Moment: Resolutely curbing inflation, even at the cost of a recession

In the late 1970s, the United States was mired in stagflation and inflation remained high. Faced with the grim situation, then-Fed Chairman Paul Volcker adopted an unprecedented and radical interest rate hike policy.

Between 1981 and 1990, the federal funds rate soared to an all-time high of $19,20%. While this move successfully curbed inflation, it also triggered a recession, with unemployment soaring to nearly $11%, the highest since the Great Depression.

Meanwhile, the Fed’s interest rate fluctuated frequently, with a sharp drop to a target range of 13-14% on November 2, 1981, then a rise to 15% in the first four months of 1982, before falling back to 11.5-12% on July 20, 1982. Moving records show that the “effective” federal funds rate averaged 9.97% during this 10-year period. Since November 1984, the rate has not exceeded 10%.

Unlike today's method of controlling inflation by directly adjusting interest rates, Volcker's monetary policy centered on limiting the growth of the money supply. Although his strategy was criticized, it eventually brought inflation down to below 2% in 1986.

Alan Greenspan: Successfully guiding the US economy to a soft landing

As Chairman of the Federal Reserve (1987-2006), Alan Greenspan played a key role in U.S. monetary policy, economic management, and global economic affairs.

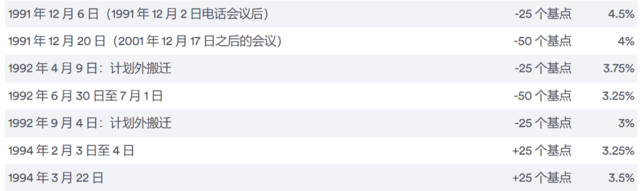

In August 1990, the US economy fell into an 8-month recession. Greenspan led the Federal Reserve to successfully respond, and eventually raised the federal funds rate to a high of 6.5% in May 2000, setting a record at the time. In September 1992, the interest rate fell to 3%, the lowest point in a decade.

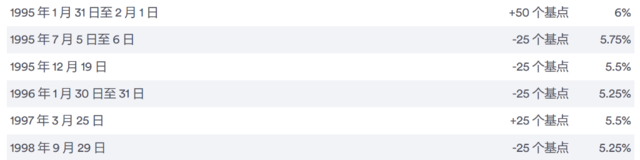

In 1995, Greenspan successfully guided the U.S. economy to a soft landing, paving the way for the subsequent economic boom.

In 1994, the Federal Reserve raised interest rates sharply to respond to inflationary pressures. By 1995, the labor market had cooled significantly. However, in May 1995, monthly employment growth turned negative.

The Fed cut interest rates by 25 basis points three times in 1995 and early 1996 and succeeded. By mid-1996, average monthly job creation rebounded to about 250,000, and inflation did not become a major problem for the US economy for a long time.

Greenspan's tenure was the longest in the history of the Federal Reserve. He was revered as an "economic master" by the outside world for successfully leading the US economy through the longest economic expansion in history at that time. Under his leadership, the Federal Reserve also informally established the 2% inflation target for the first time, a decision that had a profound impact on modern monetary policy.

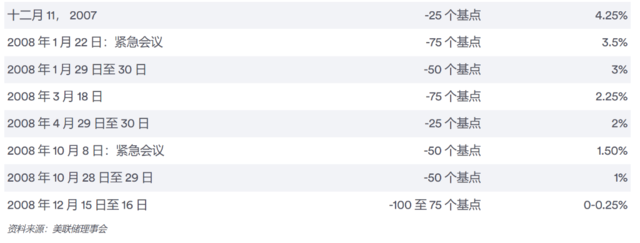

Ben Bernanke: Start QE personally

When the devastating financial crisis of 2008 broke out, Ben Bernanke led the Federal Reserve to launch QE (quantitative easing) and zero interest rates to rescue the US economy from the abyss.

Previously, the interest rate reached a high of 5.25%.After the subprime mortgage crisis, the Federal Reserve cut interest rates by 100 basis points to close to zero.

During this period, the US Federal Reserve implemented a policy of quantitative easing, namely large-scale asset purchases (LSAP). This move, aimed at lowering long-term interest rates and stimulating economic growth, led to a sharp expansion of the Fed's balance sheet, from an initial $870 billion to $4.5 trillion.

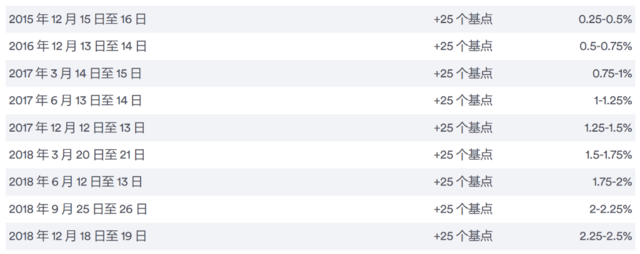

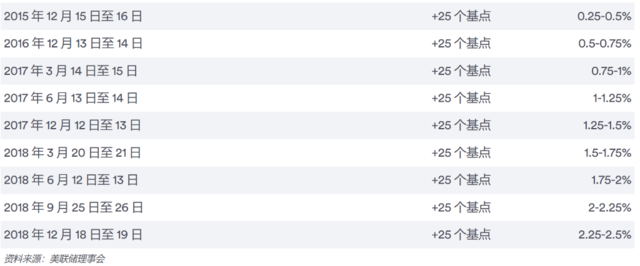

After 2015, the Federal Reserve raised interest rates by 25 basis points each time, and the interest rate reached 2.25-2.5% in 2018.

Yellen: From QE withdrawal to interest rate hike cycle

In February 2014, Federal Reserve Chair Janet Yellen took over the helm of the Fed from Bernanke and led the economy through the recovery from the Great Recession.

Since December 2015, the Fed has only raised interest rates by 25 basis points each year until 2017, when it raised interest rates three times and four more times in 2018. The federal funds rate peaked at 2.25-2.5%.

With Powell on the scene, where is the US economy headed?

In February 2018, the current Federal Reserve Chairman Jerome Powell came on the scene.

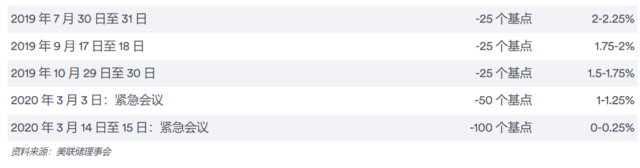

Faced with tepid inflation and slowing growth, the Fed decided to cut interest rates three times in 2019 in an effort to reignite the economy — similar to Greenspan’s “insurance” cuts in the 1990s.

Until the COVID-19 pandemic heralded the beginning of a new era. The Federal Reserve cut interest rates to zero in two emergency meetings within 13 days.

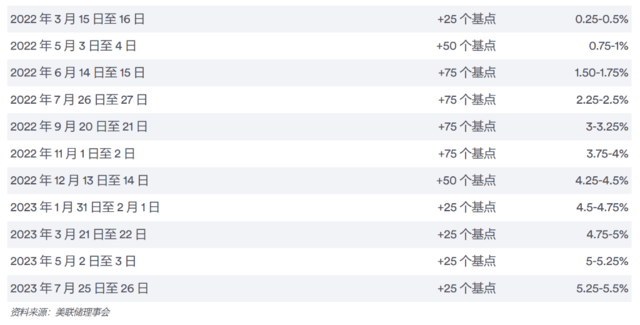

After the crisis, inflation once again became the number one economic threat to the U.S. The Fed raised interest rates by 25 basis points for the first time in March 2022, and kept the accelerator on for more than a year, raising the benchmark interest rate to a high of 5.25-5.5%.

This week, the Federal Reserve finally cut interest rates for the first time since April 2022, with the benchmark interest rate remaining at 4.74%-5%.

“Central banks tend to be focused on winning the last war,” said Scott Sumner, chairman emeritus of monetary policy at the Mercatus Center at George Mason University.

“If inflation is high, you take a more hawkish stance. If inflation is below target, the Fed thinks, ‘Well, maybe we should be more expansionary.’”Powell came into office determined that if there was another recession, they would take a more aggressive approach. I personally think that strategy was relatively successful at first, but it was pushed too far.”

The article comes from the Internet:Forty years of the Federal Reserve’s monetary policy: “Volcker’s cure for inflation” - “Greenspan miracle” - “Bernanke QE”, what is Powell going to leave behind?

利润的增长主要来自以美国国债为主的传统资产类投资。 来源:cryptoslate 编译:BlockchainAccording to the second quarter audit report recently released by BDO, a leading global independent accounting firm, Tether Holdings announced that its net profit in the first half of 2024 reached US$5.2 billion, setting a new record...