Pyth Oracle Security Staking (OIS): Improving DeFi security with more secure price feed incentives

Pyth Network is committed to providing strong support for DeFi and narrowing the gap between traditional finance and on-chain finance.Python price oracle The launch of marks a critical first step in this mission. As DeFi continues to develop, the needs of developers and users continue to evolve.contractDevelopers and market participants have higher expectations for Web3 capital marketsSecurity and reliabilityThe demand is becoming more and more urgent.

Oracle Security Staking(Oracle Integrity Staking, OIS) - is the latest iteration of the Pyth price oracle, introducing a more powerful data source accountability mechanism, creating a more decentralized staking reward and penalty mechanism for network participants.SafetyDeFi ecosystem.

-

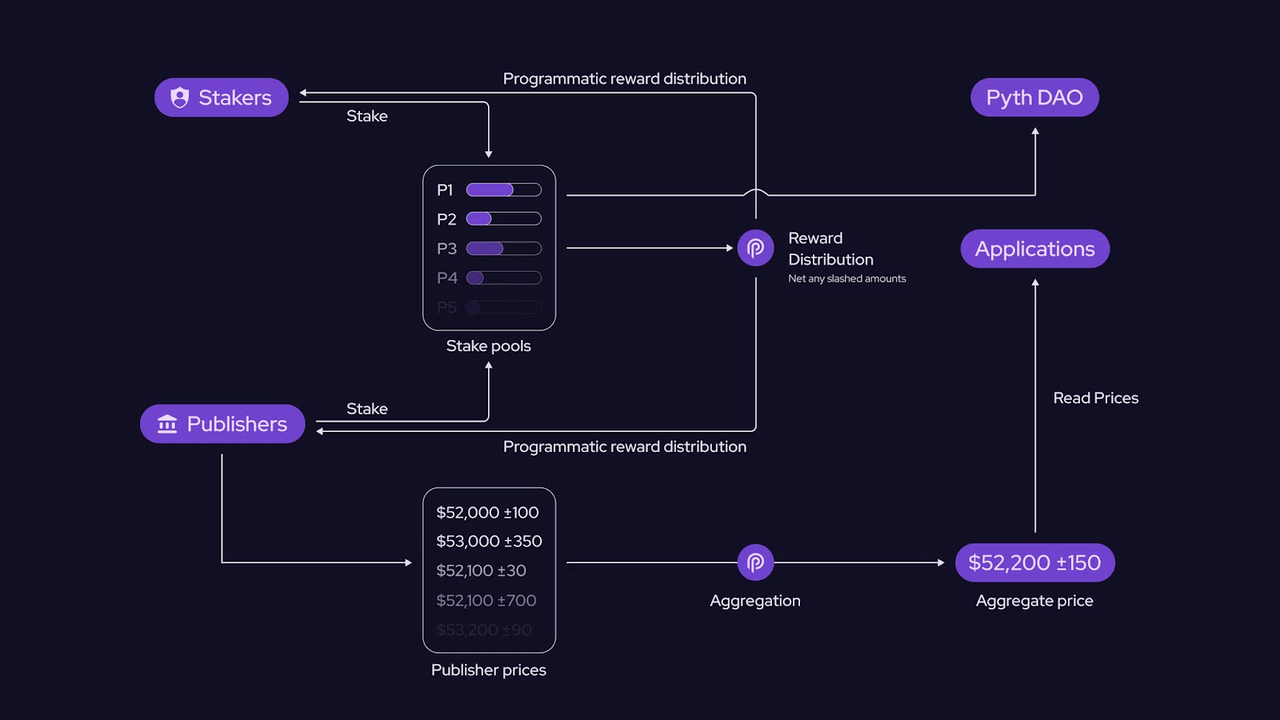

Python Data Publisher(Data Providers) — Will be able to systematically receive rewards from the Pyth protocol for ensuring the quality of price data. If they provide incorrect data that negatively impacts the protocol, their stake will be slashed. DAO A vote could be held to decide what to do with the slashed funds, such as distributing them to affected users or for other purposes.

-

PYTH StakersThey can pledge theirTokenDelegating to PYTH data publishers to increase the potential rewards for data publishers to provide high-quality data. This move helps to strengthen the resilience andSafetyIn return, PYTH stakers will also automatically receive rewards by protecting the oracle network and the DeFi ecosystem.

预言机安全性质押(OIS)涵盖了所有的 500多个 Pyth 喂价数据,为预言机技术和市场参与者融入 DeFi 生态系统设定了更高的标准。此次发布是 Pyth Network 在实现为所有BlockchainThis is an important milestone in the mission of providing reliable and accurate price data, while also meeting the ongoing needs of decentralization and sustainable development.

本文将深度探讨预言机安全性质押(OIS)如何通过增强的数据责任制度和价格预言机的安全性,让开发者能够安心地进行应用构建。

Oracle Security StakingChanges brought by (OIS) to developers

The most pressing challenge in the current oracle field is how toBlockchainProviding developers with high-quality and reliable price data for all the assets they need.

Currently, the data infrastructure available to developers does not yet provide comprehensive accountability measures to ensure the quality of data. Existing oracles can only use a simple on-chain incentive mechanism to ensure quality for a few relatively safe markets.

Expanding asset coverage is also a complex challenge for push model oracles. Pyth pull model oracles have provided a lot of information on how to quickly expand price feed data to newBlockchainThis establishes a new paradigm while also allowing applications using Pyth to earn rewards for accessing new, trending or strategic assets, even if they have not yet been recognized by the public.

Oracle Security Staking (OIS) directly addresses issues of data quality and scalability by holding Pyth data publishers accountable for price accuracy and coverage of assets.

Price Accuracy

Data publishers must stake PYTH TokenOnly after providingHigh FidelityPrice dataYou can only get the mechanism reward when you have completed the task.

On the contrary, if the data publisher provides wrong or malicious data, part of the staked tokens will be cut as a penalty. DAO You can vote on how to handle the slashed funds, including paying them back to affected users or using them in other ways to support other purposes of Pyth Network development.

For developers, these results mean greater trust in data, without having to worry about the quality and security of the data. These safeguards are an improvement over the existing Python price oracle.Reliability PracticeThe supplement includes eliminating the impact of abnormal data through on-chain aggregation mechanism and conducting consistency testing on the price feeds of newly launched assets.

Asset coverage

Oracle Security Staking (OIS) also allows data publishers toPrice Feed DataAdditionally, if data publishers start publishing unique price feeds, their potential rewards will increase.

This incentive mechanism makes Pyth an intelligentcontractThe oracle of choice for developers building a wide range of applications; wherever teams choose to build, whatever asset type they need data on, the Pyth price oracle can scale to cover those needs.

Protecting the DeFi We Love

Python CommunityIt also plays a vital role in Oracle Security Staking (OIS), where PYTH stakers can now be rewarded programmatically for contributing to the security of the oracle network. By staking tokens to Pyth data publishers, the potential returns for selected publishers are enhanced, while also strengthening the resilience and accuracy of Pyth price feed data. The staking reward mechanism first rewards publishers based on data quality, and then rewards stakers based on their contribution to the network.

This mechanism provides a unique way for stakers to guide data publishers to support more price feeds and asset types, in addition to maintaining a high standard for price feed data. It is worth noting that the reward and slashing mechanism of Oracle Security Staking (OIS) affects both data publishers and their stakers. Publishers are responsible for the data they provide to oracles, and stakers can help strengthen the oracle network by choosing which data publishers to support.

How Oracle Security Staking (OIS) Works

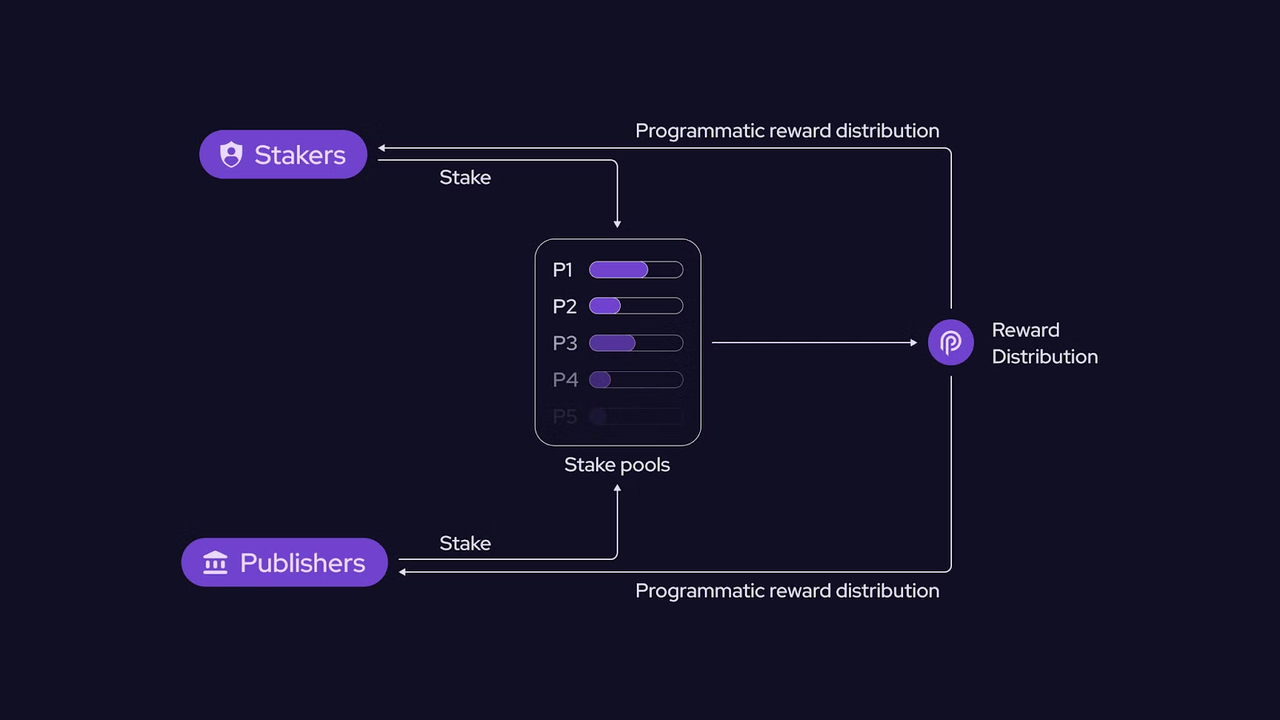

Oracle Security Staking (OIS) allows anyone to participate in securing Pyth and protecting the DeFi ecosystem. The program introduces a decentralized staking reward and slashing mechanism to incentivizePublisherandPYTH Token HoldersStrengthen the quality of the oracle by staking tokens.

Staking Rewards and Slashing Process

The core of Oracle Security Staking (OIS) isStaking Pool,每个质押池对应一个不同的数据发布者。每个参与的发布者都可以自行质押 PYTH 代币,以获得他们所发布数据的数据奖励。PYTH 质押者 —— Pyth 社区的成员都可以选择他们希望支持的发布者,并可以将 PYTH 代币质押到任何发布者的池中,以帮助保护预言机网络安全。

The total amount of rewards generated by the staking pool is determined by the total number of tokens staked in the staking pool (determined by the data publisher and the stakers). As the total number of stakes increases, the reward amount will also increase accordingly until it reachesStaking Limit. Data publishers can increase their staking cap by supporting more price feeds. Conversely, stakers can incentivize publishers to list more price feeds by choosing to stake more publishers of price feeds that are important to the ecosystem. Rewards will be automatically distributed between publishers and stakers, with rewards going first to publishers and the remainder to stakers.

Pyth DAO 为质押池设定了最高奖励利率,以在可持续性和有效参与之间取得平衡。这个利率目前是 10%,但可以由 Pyth DAO 投票进行调整。当质押池中的总质押量低于质押上限时,质押者可以获得最大奖励利率。但奖励总额永远不能超过The maximum reward rate multiplied by the staking limit; This means that if the staking limit is exceeded, stakers will receive a lower reward rate.

This arrangement incentivizes stakers to carefully evaluate the full list of all publishers in the network when deciding which publisher to stake with, in order to help secure the oracle network. The detailed reward calculation can be found inDeveloper documentationView in.

In summary, the Oracle Security Staking (OIS) rewards are determined based on multiple key factors, all of which can be adjusted by Pyth DAO voting.

-

Staking limit:This is the maximum number of tokens that can be staked with the publisher (including the publisher itself and additional stakers) and be eligible for rewards. A higher staking cap allows publishers to attract more stakers and increase the nominal rewards for the staking pool.

-

Number of symbols supported by the publisher:Publishers can increase their staking cap by supporting more symbols, thus receiving higher potential rewards. These additional rewards are compensation for taking on the slashing risk that comes with supporting more symbols.

-

Highest Reward Rate:The DAO sets a maximum reward rate that can be obtained in the staking pool, calculated as an annualized rate of return (APY). While a higher maximum reward rate can increase the total profit potential of participants, the DAO needs to carefully manage this parameter to maintain a balance between incentivizing participation and ensuring the long-term sustainability of Oracle Integrity Staking and the Pyth Network.

-

Commission Fee:The publisher charges a fixed percentage of rewards (currently 20%) to stakers in the staking pool as a delegation fee, which is the net reward after deducting any slashing amount. The DAO can vote to adjust this rate and structure.

-

Reduction Mechanism:If the data provided by a group of publishers does not meet the standards, both the publishers and the stakers who support them may face slashing penalties. This shared responsibility model encourages stakers to carefully evaluate publishers and promote a culture of responsibility across the network. Currently, the slashing mechanism is capped at 5% of the total stake, and this ratio can be adjusted by the Pyth DAO. The DAO can also vote on how to use the slashed tokens, including whether to distribute them to users affected by the error or for other purposes to support the Pyth Network.

How Stakers Can Get Involved

PYTH stakers play a vital role in Oracle Integrity Staking, enhancing the security and data integrity of the oracle by staking tokens to publishers.

To begin participating, anyone holding unlocked PYTH tokens can visit the Pyth Staking Dashboard and navigate to the Oracle Integrity Staking Program. Eligible participants* can begin exploring the list of publishers and select the ones they wish to support and help secure the oracle network.

Stakers can sort and evaluate publishers based on pool composition, publisher quality ranking, the number of price oracles supported by publishers, or other criteria that are most important to them. When ready, stakers can stake tokens into any publisher's staking pool. These tokens will enter a cooldown period before they are officially staked and help secure oracles. Stakers can manage their stake allocation across different publishers based on their personal preferences and strategies for maintaining the integrity of the oracle network.

PYTH holders who have staked tokens to Pyth Governance will see those tokens in the Oracle Integrity Staking Program and can stake them directly to issuers without having to withdraw them first.wallet.

Finally, participants can stake the same tokens to both the Oracle Integrity Staking Program and the Pyth Governance Program, ensuring the security of the oracle while gaining voting rights on Pyth improvement proposals. Participants can also choose to stake only to Pyth Governance without participating in Oracle Integrity Staking.

The role of PythonDAO

The Pyth DAO is responsible for determining the parameters that govern Oracle Integrity Staking, such as staking caps, delegation fees, slashing amounts, etc. These parameters ensure that incentives are aligned with maintaining high data standards. The current parameter settings can be found in the documentation.

The Pyth DAO is also responsible for overseeing important updates to the staking and slashing mechanisms, such as determining the sources of rewards for publishers and stakers. To kick off this initiative, the Pyth Data Association has allocated 100 million unlocked tokens. The Pyth DAO can vote on additional sources of rewards, such as on-chain revenue generated by the Pyth oracle.

In addition, Pyth DAO can also vote on how to deal with tokens that have been slashed due to publishers providing incorrect data. Although the slashed tokens will automatically return to the DAO treasury, Pyth DAO can vote to distribute these tokens to relevant parties affected by the data error or use them for other purposes permitted by DAO governance.Xiaobai Navigationuse.

The DAO could also change the reward structure, such as to include other digital assets as rewards, allowing for broader staking participation, further enhancing the security and coverage of the oracle.

Through these responsibilities, the Pyth DAO empowers the community to shape the future of Oracle Integrity Staking, ensuring the continued resilience and scalability of the Pyth Network.

Price Oracle V3 and Future Development

In decentralized finance (DeFi), the reliability and accuracy of oracle data is critical. As more funds flow into the blockchain ecosystem, the risk of inaccurate or manipulated data increases.

While the existing reliability measures of the Pyth price oracle are essential to maintaining the current DeFi, the evolving DeFi requires more advanced security mechanisms. Therefore, using cryptoeconomics to secure price data is the logical next step for price oracles.

Pyth Network first launched Price Oracle V1 on Solana, the first to provide high-frequency on-chain data from first-party sources. With the high speed of Solana, Pyth set a new standard for reliable data delivery. With the launch of Price Oracle V2, Pyth became the first pull oracle, expanding its influence to multiple blockchain ecosystems such as EVM, Move, Cosmos, and Bitcoin, providing developers with high-quality, low-latency price data on any chain.

Oracle Integrity Staking unlocks Price Oracle V3, a major advancement in Python price oracles that introduces accountability for each data source. A core component of V3 is that through Oracle Integrity Staking, Web3 developers can build with confidence without having to worry about inaccurate or malicious data manipulation.

Oracle Integrity Staking introduces a new paradigm in the oracle space that proactively prioritizes accountability for data sources and protection of the entire data supply chain, setting a higher industry standard for price oracles.

To date, Pyth Network is the only data infrastructure solution that provides this level of data accountability and security across all of its existing oracles, from the most commonly used price oracles to long-tail assets with low liquidity. Oracle integrity pledges ensure that every price oracle is secure, every user is protected, and every publisher is accountable.

Pyth Network is redefining the future of DeFi. No matter which ecosystem you come from or how you choose to contribute, you are welcome to join this journey of change and make history together.

The article comes from the Internet:Pyth Oracle Security Staking (OIS): Improving DeFi security with more secure price feed incentives

If people don't like your content, it's because the content itself is not attractive enough. Author: Simon & Gregor Translator: Xiaobai Navigation Coderworld Clubhouse, we all remember its golden age. In January 2021, during the epidemic, the Clubhouse app rang in almost everyone's ears. It relied on audio...