How the $1.4 Billion Crypto Prediction Market Emerged

source:cryptoslate

Compile:Blockchainknight

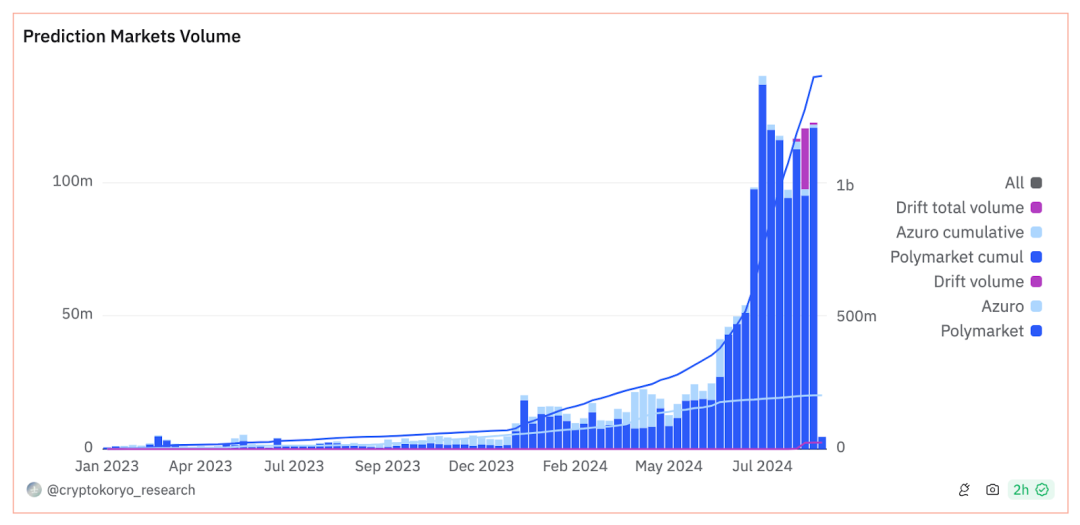

The Crypto prediction market is growing with the development of platforms such as Polymarket.

Castle Capital pointed out in its latest in-depth research report thatPrediction markets enable users to bet on future events using Crypto assets, moving traditional gambling to a decentralized space.

This shift allows participants to transact with each other rather than with centralized institutions, increasing transparency and resistance to manipulation.

Castle Capital outlines how prediction markets have historically been centralized, limiting user participation and flexibility.

BlockchainThe introduction of technology has made these markets decentralized, allowing users to create their own markets and conditions.

自 2015 年另一个预测市场 Augur 推出以来,预测市场已被公认为区块链技术的一个突出应用,尽管主流关注度最近才有所加强。

The total value locked in the industry has reached $162 million, with user engagement and transaction volumes increasing significantly.

Platforms such as Azuro and Polymarket have facilitated this growth by offering different approaches.

Polymarket is based on Polygon and operates in an order book model, focusing on major political and news related events.

Currently, Polymarket has processed more than $1.4 billion in trading volume and has become an important betting platform for events such as the US presidential election.

Castle Capital explained that Azuro uses a peer-to-peer pool design that allows users to provide liquidity to pools that serve multiple markets. This model spreads risk and improves capital efficiency, mainly targeting sports betting.

Azuro has processed over $200 million in forecast volume, attracting users who place repeat bets across a wide range of sporting events.

Both platforms aim to expand market share.

Polymarket is trying to reduce its reliance on political events by adding more diverse markets, while Azuro is reportedly planning to add politics and news markets in addition to sports markets.

The growth of these platforms highlights the growing interest in decentralized prediction markets as a tool to gauge public sentiment.

Castle Capital outlined the challenges that still face mainstream adoption.Including liquidity issues, regulatory uncertainty and the need to improve user experience.

确保可靠的谕令和数据准确性至关重要,解决区块链网络的可扩展性问题也是如此。克服这些障碍需要创新和与监管机构的合作。

As Castle Capital points out, prediction markets have the potential to provide accurate public sentiment on a variety of topics, fromXiaobai NavigationAnd transcend seasonal hype to become an indispensable tool for decision-making.

Integrating AI and expanding market offerings are likely to enhance their usefulness and appealPrediction markets can provide news organizations with decentralized sentiment data and influence political discourse.

With platforms like Azuro and Polymarket as examples, the future of prediction markets seems promising.

Their continued growth and adaptability will likely solidify their position in the crypto asset space, providing valuable insights and opportunities for users to predict future events.

Castle Capital’s report states:The development of prediction markets reflects the growing adoption of decentralized applications.

However, it remains to be seen whether these platforms can maintain their momentum, meet future challenges, and gain mainstream acceptance.

The article comes from the Internet:How the $1.4 Billion Crypto Prediction Market Emerged

相关推荐: 对话 a16z 法律专家:代币发行的“做”与“不做”

在寻找产品市场契合时如何避免常见陷阱? 整理 & 编译:小白导航coderworld 嘉宾:Eddy Lazzarin, 小白导航a16z crypto 首席技术官; Miles Jennings,总法律顾问兼去中心化负责人 主持人:Robert Ha…