Logarithm Finance: Will LPDFi be the next new narrative?

Written by: THE DEFI SAINT

Compiled by: Xiaobai Navigation Coderworld

To maximize gains in the crypto market, you must get ahead of the narrative:

-

$GMX dominated the derivatives narrative;

-

$LDO dominates the LSD narrative;

-

$LBR dominates the LSDFI narrative.

After LSDFI, the next big narrative will be LPDFi (liquidity provision derivatives finance), which Logarithm Finance is pioneering. Is it too early for us to understand this narrative now?

Very early, because Logarithm Finance has not yetToken,但其代币已经确认为$LOG。

Here’s everything we need to know about LPDFi Narrative and Logarithm:

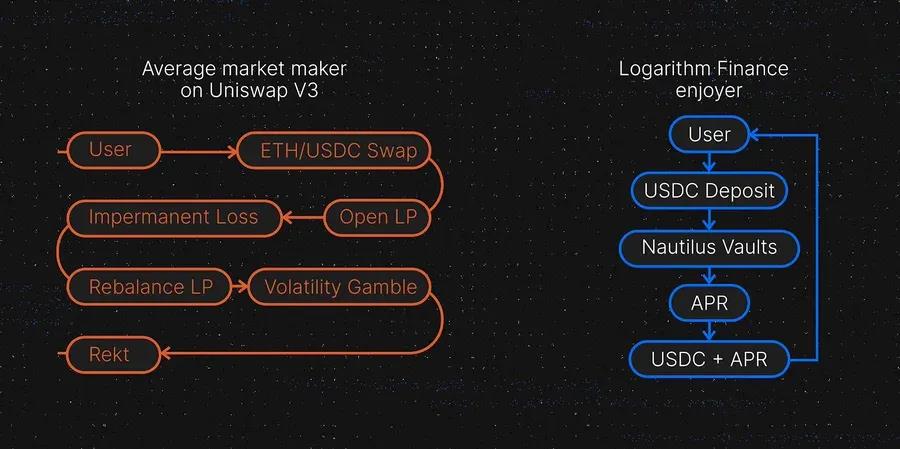

LPDFI (Liquidity Providing Derivatives Finance) Just as LSDFI extracts maximum value from LSD, LPDFI extracts maximum value from LPD.

LPD uses users’ LP positions to build products on top of them (options, income, perpetualcontractIt opens up entirely new opportunities for users’ LP positions in Uniswap V3 (or similar types of AMMs), rather than letting users’ LP positions sit idle.

In short, the Gamma strategy is to LPs what Logarithm Finance is to users’ LP positions. A deeper look into Logarithm’s approach to LPDFI reveals that Logarithm Finance aims to become the liquidity center for LPDs.

It aims to achieve this by utilizing a delta-neutral strategy while minimizing volatility and maximizing returns for these LPs.

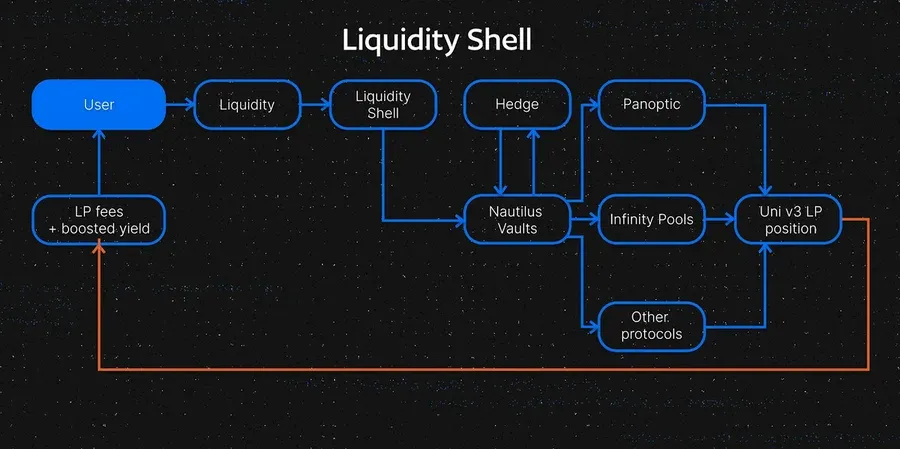

Logarithm Finance 通过其他 LPDFI 协议来路由 LP 代币,以获取增强收益和引导这些协议的流动性。Logarithm Finance Liquidity Shell 正在使这成为现实。

Like a yield aggregator, Logarithm Finance extracts value from different LPDFI protocols to maximize yield for users, in turn creating seamless liquidity access for these LPDFI protocols and Uniswap V3.

These LPDFI protocols include:

-

panoptic;

-

smilee ;

-

Infinity Pool;

-

Limitless.

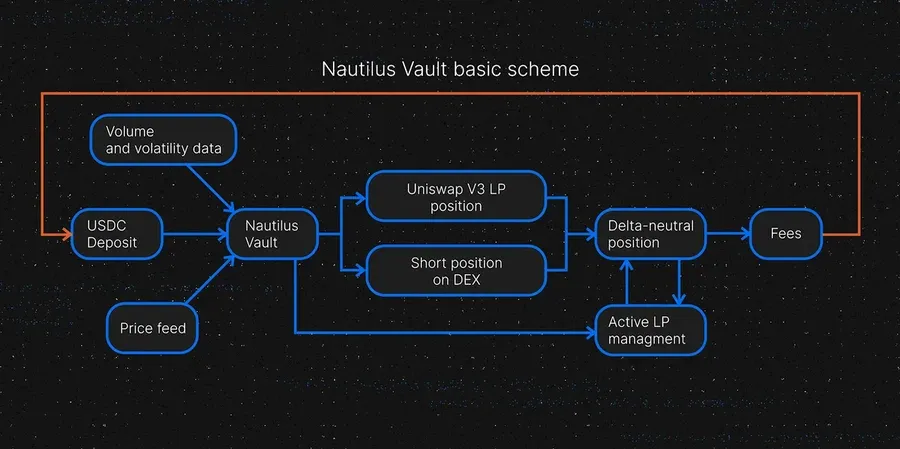

Let’s take a closer look at Nautilus Vault, a Logarithm Finance Xiaobai Navigation’s core product and one of the features of its Liquidity Shell, which enhances its vision of providing market making as a service.

Nautilus Vault manages uni v3 CL positions and opens shorts on Perpetual DEX (GMX) to hedge against volatile assets and ensure no IL while earning fees.

From an LP perspective, Logarithm Finance is also suitable for LAAS (Liquidity as a Service), just like CLMs such as Gamma Strategies, Dyson, and DeFI Edge.

In the future, Nautilus Vault will expand to other centralized liquidity AMM DEXs, such as Chronos, and will also expand to other chains. When it comes to how Logarithm Finance will bring these real benefits to users, it is critical to understand where these benefits come from:

-

LP fees from Uniswap V3;

-

LP fees from the LPDFI protocol;

-

Logarithm incentives given to LP in the form of $LOG;

-

Token issuance from the LPDFI project.

Logarithm Finance has proven the authenticity of these returns through its backtesting, with an annualized return of 11.8%.

It is worth noting that the Logarithm Finance Beta version has been announced and will be launched soon.

Logarithm Finance Token $LOG has also confirmed that Logarithm Finance will be conducting a private placement for its tokens, although few details are available yet on the economics of the token distribution.

So, why is Logarithm Finance worth watching? Because it does fit into multiple narratives;

-

LPDFI ;

-

MMaaS (Market Making as a Service);

-

LaaS (Liquidity as a Service).

The article comes from the Internet:Logarithm Finance: Will LPDFi be the next new narrative?

From the birth of Ethereum to thecontractFrom the vision to the implementation of Ethereum’s “consensus mechanism”, these are destined to be recorded inBlockchainThe milestones in history are narrated by Vitalik. Compiled by fanfan and published by DeThings Editor’s note: This article is a post by Ethereum co-founder Vitalik Buterin in Singapore on September 6…