The demise of friend.tech and the rise of Pump.fun: What can we learn from this?

author:Decentralised.Co

Compiled by: Xiaobai Navigation coderworld

Short Game

Earlier this week, friend.tech withdrew the ability to change the product's fees or features. In layman's terms - the product is unlikely to change in the future.TokenThere may still be hope that the network of holders will be able to make changes to the product. But as of now, this is no longer the case.

One of the attractions of friend.tech is that it benefits users. A wise man once said that the rapid growth of cryptocurrenciesCommunityThe best way is to make yourTokenHolders get rich. The friend.tech model enables everyone to “become” a token and receive a portion of the revenue. To date, platform fees have generated nearly $98 million, half of which went to users. Sounds promising, doesn’t it?

In fact, it is not. The problems in friend.tech’s model have been foreshadowed. DanielW_Kiwi exist DuneAnalytics The data provide some clues as to why.

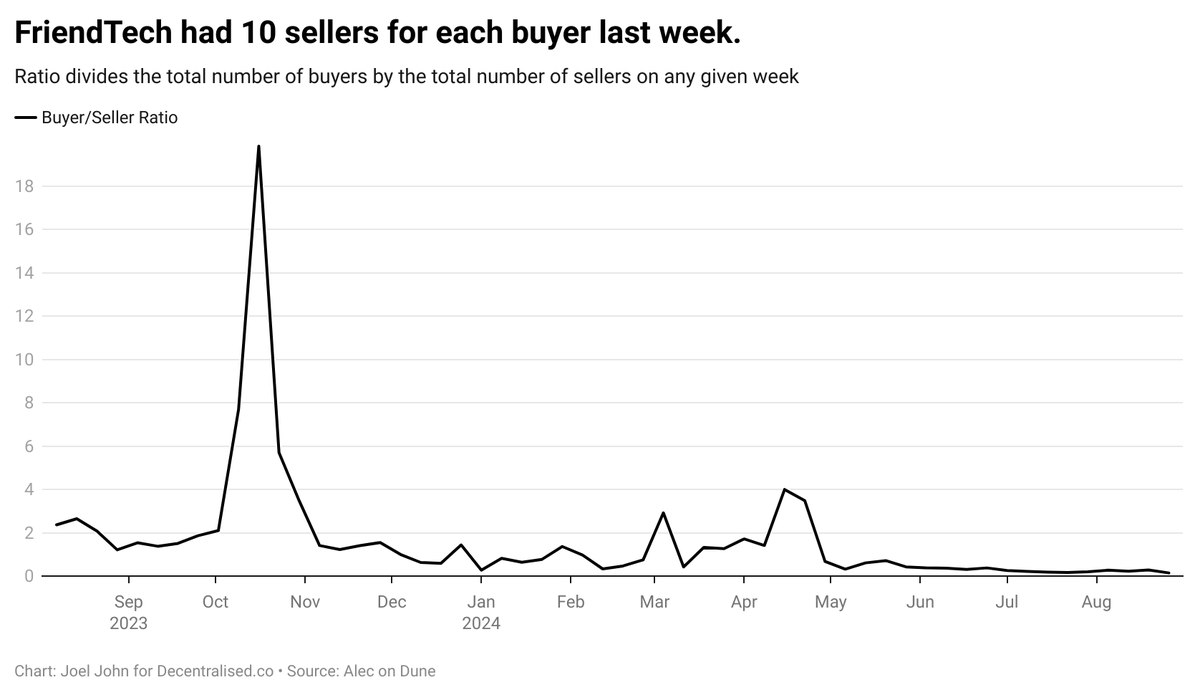

In October 2023, when friend.tech hit the mainstream market, the product had an 18:1 buy-sell ratio. When there are 18 people buying and only 1 seller, the laws of economics dictate that the price will go up. By the time the token was released in May, that ratio had dropped to 0.32, or 3 sellers for every buyer. As of last week, that ratio dropped to 0.14.

Friend.tech can be classified as an ephemeral game that lacks permanence. For those who are hearing this term for the first time - an ephemeral game is a short-term game with financial incentives. Some products have formed an entire category. There is no doubt thathashed_official is the example that comes to mind.

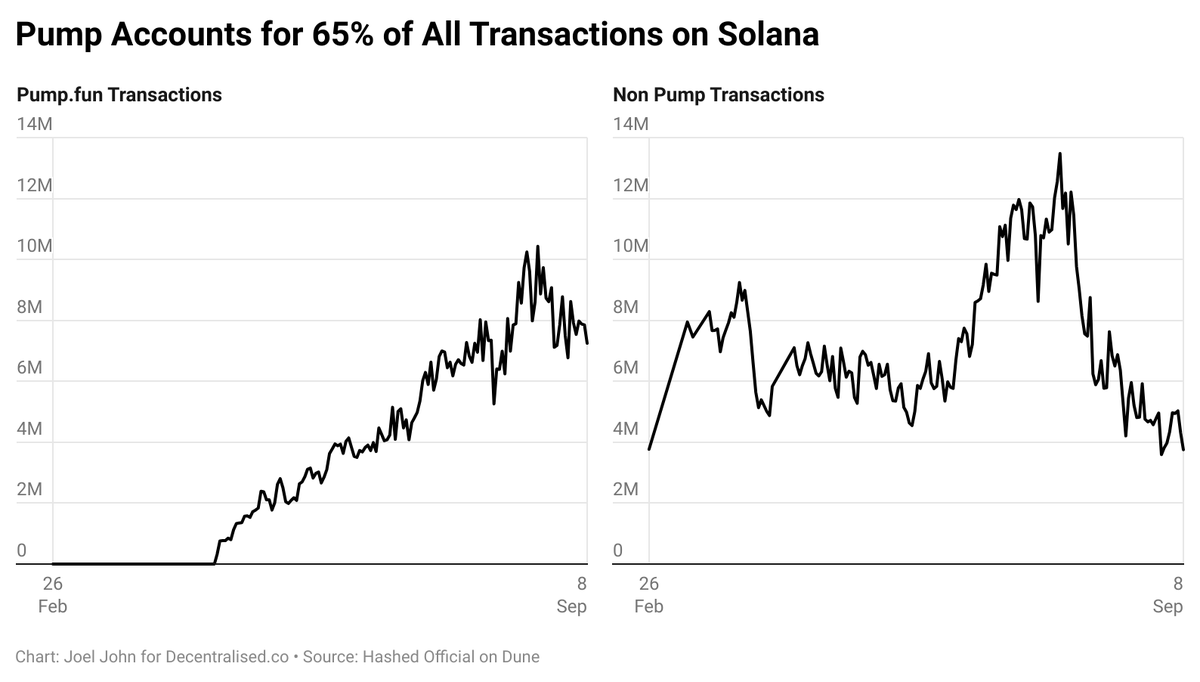

Think of pumpdotfun as the Costco of tokenized offerings, providing cheap, fast access, and convenient services. hashed_official The product was launched in May this year and accounts for all decentralizedexchange 65% traded on the DeFi (DEX). In addition, the product has generated revenues approaching $100 million. To date, nearly 2 million tokens have been issued through pumpdotfun.

Pump democratizes token issuance. Previously, users had to go through a centralizedexchangeThe listing process is now confirmed by Pump, and now it can also be achieved using DeFi infrastructure and on-chain liquidity.

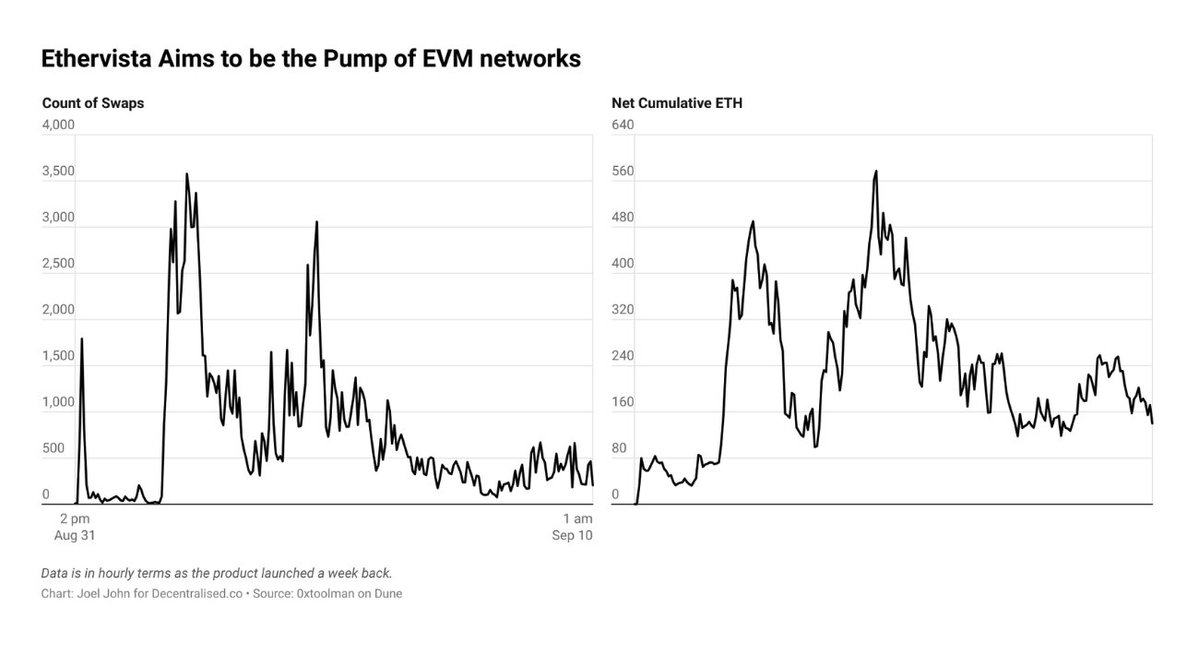

Obviously, this comes with risks. Token launches are often plagued by “rug pulls,” a situation where developers simply withdraw liquidity and sell the tokens held by users. Ethervista takes a different approach by allowing token issuers to receive a portion of ETH from transaction fees, while liquidity providers (LPs) receive ETH.

In 2023, LooksRare adopted this approach for its platform fees, with stakers of the token receiving LOOKS tokens. However, the story did not end well, as wash trading on the platform suddenly stopped. Ethervista also requires token issuers to lock up their tokens for at least five days.

As of now, activity on the platform has subsided. 0xToolman According to Dune data provided by CoinMarketCap, transaction volume has dropped from 3,300 per hour to just over 160. The total ETH on the platform dropped from 540 to 160, a change that occurred within a week.

All of this makes one wonder, what are the rules of the short-lived game? Are they just short-lived, highly financialized Ponzi schemes that come and go quickly? Is a sustainable approach really possible?

Basically, these platforms have three characteristics:

-

The frequency of transactions is high, which is particularly evident in Pump.

-

The “reasons” for trading are often based on emotion. For example, you can’t quantify why someone would buy a meme coin on Pump. Volatility is the product.

-

它们的半衰期很短。到代币发布时,friend.tech 上的社区已大幅缩小。

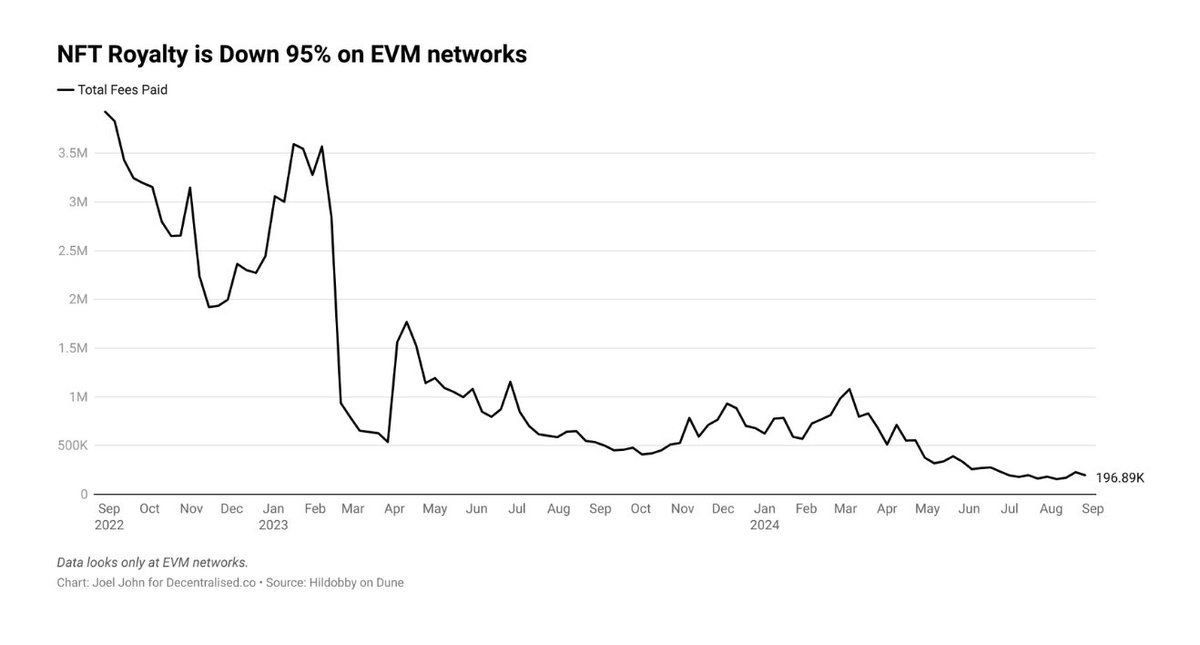

All of this reminds me of the glory days of NFT. hildobby_ According to the Dune dashboard, the average fees generated by NFTs (on the EVM network) fell from over $3.2 million per day to $200,000 per day, a drop of nearly 95%.

This model is interesting because it provides creators with a way to continue to earn royalties from their work and build meaningful communities. In contrast, the meme coin season in Q2 2024 was driven by celebrities who frequently talked about their own tokens, which plummeted by 90% in a few weeks.

Products like Pump and Ethervista simply remove the trappings of traditional communities and build hyper-transactional products that pay creators in return.

Can such a model scale? We are still unsure about its sustainability. But if Pump and Ethervista are indicative of a trend, it is the market’s demand for volatility. As long as the market is willing to pay for these tokens and accept the associated risks, we will continue to see them. Or, like ICOs and NFTs in previous cycles, they may fade as the market realizes the associated risks. Only time will reveal how short-lived these games really are.

The article comes from the Internet:The demise of friend.tech and the rise of Pump.fun: What can we learn from this?

Thoma Bravo, a private equity firm that invested in FTX, will permanently withdraw from the crypto market. Author: Xiaobai Navigation Coderworld Yesterday's Market Dynamics Friend.Tech Team Gives Up Control of Smart Contracts According to The Block, the Web3 social network Friend.Tech development team…