As AI narrative heats up, how can DeFi benefit from it?

Author: DeSpread Research

Compiled by: Xiaobai Navigation coderworld

Disclaimer: The content in this report represents the personal opinions of the author and is for reference only. This article is not intended to be a recommendation to buy or sellTokenor use of any protocol. Nothing in the report constitutes investment advice and should not be considered investment advice.

1. Introduction

With the development of the IT industry, the improvement of computing power and the widespread application of big data, the performance of artificial intelligence (AI) models has also improved significantly. In recent years, AI capabilities have reached or even surpassed human levels in many fields and have been rapidly applied to industries such as healthcare, finance and education.

A typical example of AI commercialization is ChatGPT, a generative AI model launched by OpenAI in November 2022 that can understand and respond to human natural language. ChatGPT attracted 1 million users just 5 days after its launch and reached 100 million monthly active users within 2 months, becoming the fastest growing consumer application in history.

NVIDIA, which designs and manufactures GPUs required for major AI platforms, has also benefited greatly from this trend. In the first quarter of 2024, NVIDIA's net profit increased by 628% year-on-year to US$14.8 billion, its stock price rose about three times from last year, and its market value reached US$3.2 trillion, which was quite outstanding.

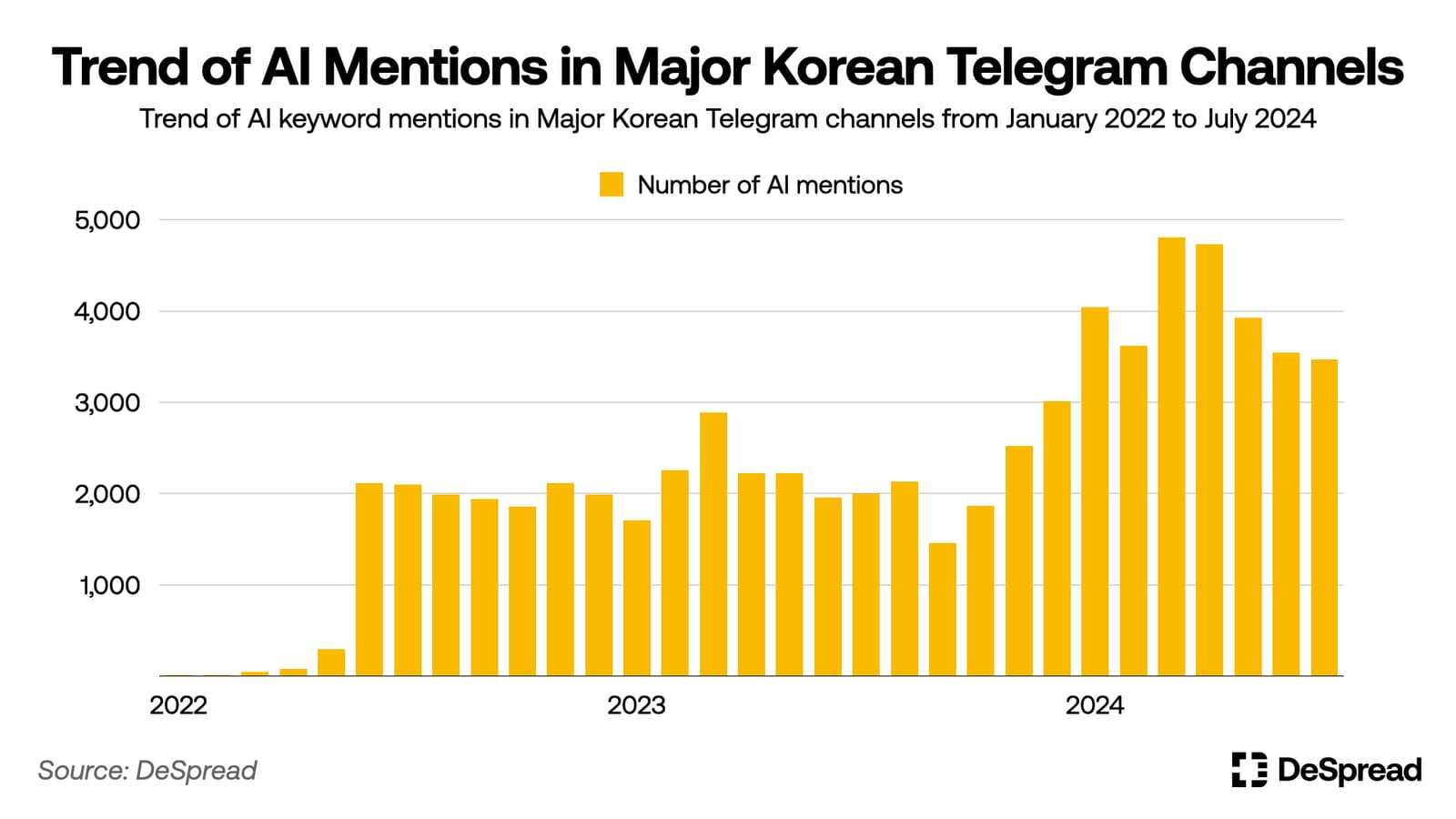

The rise of the AI industry has had a significant impact on the crypto market. In June 2022, when NFT art projects were booming, the AI model DALL-E 2 developed by OpenAI was released, which was able to generate high-quality images based on text, which led to an 8-fold increase in the mention of AI keywords in major Korean encrypted Telegram channels. In addition, starting in the second half of 2022, there have been more and more attempts to combine AI andBlockchainMore directly tied in, AI mentions increased another 2x.

encryptionCommunityThe strong interest in AI is also reflected in the investment trend of AI-related crypto projects. According to data from virtual asset statistics website Coingecko, as of August 20, 2024, the number of projects combining AI andBlockchainSince the beginning of 2017, 277 projects have been classified as AI projects.BlockchainThe total market value of the project has grown rapidly, reaching US$21 billion, which is about 25% higher than the Layer2 category.

However, the AI field that is currently receiving attentionBlockchainThe project mainly uses blockchain technology to solve the limitations exposed in the development of the AI industry. The main application scenarios include:

-

distributed GPU network:These projects use blockchain technology to create a distributed GPU network where anyone can contribute GPU computing power and receive token rewards, thereby lowering the entry barrier caused by the high GPU costs required for AI model training (for example,IO.NET, Akash Network).

-

Decentralized AI Training and model development:These projects allow multiple participants to jointly participate in AI training and model development and receive token rewards through blockchain technology, aiming to solve the AI bias problem caused by centralized AI development environments (for example,Bittensor).

-

On-chain AI market:These decentralized AI market projects use blockchain technology to transparently evaluate and trade the performance and reliability of AI models or agents to meet the needs of various industries and specific functions for AI models or agents (e.g.SingularityNET, Autonolas).

In addition to the above examples, many new attempts are emerging to use blockchain infrastructure, such as decentralized data markets and IP protocols, to solve the challenges currently facing the AI industry. These attempts are creating synergies by providing a more stable infrastructure for the AI industry and expanding the scope of application of blockchain technology.

At the same time, integrating AI into the blockchain ecosystem also holds unlimited development potential. In particular, in permissionless DeFi services, the introduction of AI can reduce reliance on trusted third parties, thereby realizing many existing intelligentcontractDifficult to achieve functionality.

In this article, we will explore specific application examples of AI in current DeFi protocols, the challenges faced, and the future development direction of AI in DeFi.

2. Smart DeFi

AI has excellent real-time data analysis capabilities and can draw conclusions from large amounts of data. This feature plays an important role in concretizing the return and risk data provided by DeFi protocols when helping users perform fund operations and conduct risk management. In this case, AI is mainly applied to the user interface of Dapp, allowing existing DeFi protocols to utilize AI without major structural adjustments.

Yearn Finance is a typical example, it is a revenue aggregator.SafetyYearn Finance is working with AI agents to build a platform for investment environment GIZAcooperate, building a real-time policy risk assessment system for its v3 vault.

However, I am more concerned about the potential for DeFi protocols to become autonomous by leveraging AI’s ability to think and act autonomously in the convergence of the DeFi ecosystem and AI.

目前的 DeFi 协议通常是被动响应用户交易的,也就是说,协议的智能合约会根据用户的互动以预设方式运行。然而,通过将 AI 融入 DeFi 协议,协议可以自主分析市场状况,做出最佳决策,并主动生成交易。这使得能够提供以往难以实现的新型金融服务的 DeFi 协议成为可能。

Let’s take a closer look at some of the smart DeFi protocols that apply AI in their main operating mechanisms.

2.1. Fyde Treasury: AI Tokenfund

Fyde Treasury is a protocol that provides a basket fund service called Liquid Vault.Xiaobai NavigationThe service operates multiple tokens together, and AI manages the portfolio. Users can receive and use the liquidity token $TRSY corresponding to the assets deposited in Liquid Vault.

2.1.1. Asset selection and fund operation methods

Liquid Vault’s core mission is to increase the proportion of low-volatility tokens during market downturns in order to provide users with a smaller loss rate and thus a portfolio that outperforms other asset classes in the long run.

Fyde Treasury selects assets to be included in the Liquid Vault portfolio in three steps:

-

Assess whether trading liquidity is sufficient

-

Check the background of the protocol founders and audit the protocol code to determine if there are any issues

-

Analyze on-chain data through AI to assess whether there are wash transactions, token concentration, and natural growth trends, etc.

Tokens that meet these criteria will be included in the Liquid Vault portfolio. In addition, Fyde Treasury also uses AI in the asset management process of Liquid Vault, including:

-

Market Analysisand prediction:Analyze on-chain transaction data, market trends, news, etc. to predict future market trends

-

Weight calculation andRebalancing:Calculate the optimal token weights and rebalance based on the predicted market trends and the recent performance and volatility of the tokens in the portfolio

-

Risk Management and Response:Quickly identify governance attacks, liquidity pool exhaustion, and specific attacks on each token in the portfolio in real timewalletabnormal transactions, etc., and adjust the investment portfolio or isolate the relevant tokens in a timely manner

-

Advanced Asset Management Strategies:Continuously evaluate the performance of the portfolio, analyze the effectiveness of the strategy, and extract data from it to modify and develop new strategies. Then, compare and test the existing strategy with the new strategy, measure its performance, and apply it to the actual operation strategy.

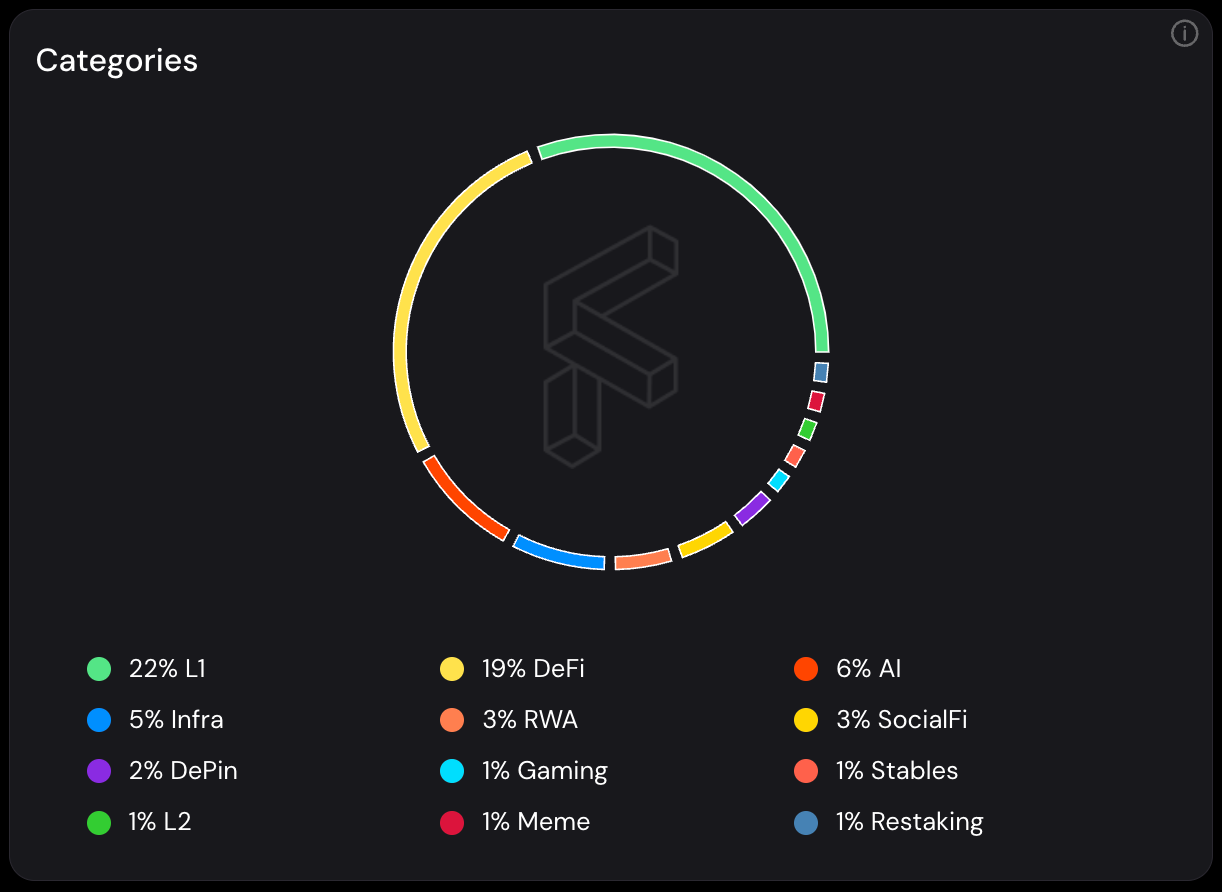

As of the writing date of August 23, there are 29 tokens in the Liquid Vault portfolio, all of which are various industry tokens based on the Ethereum network.

Liquid Vault Dashboard, Source:Fyde

此外,Fyde Treasury 提供了一项功能,使得将特定协议治理 Token 存入 Liquid Vault 的用户可以通过流动性 Token 来保持其治理投票权。用户存入 Liquid Vault 的治理 Token 会以 $gTRSY-token 的形式发送到他们的钱包中,这些 Token 可以在 Fyde Treasury 的Governance TabIt is used to execute governance votes for the corresponding protocols.

However, voting rights are affected by the weight of tokens in the portfolio, so voting rights may change every time the portfolio is adjusted.

2.1.2. Liquidity Mining Activities

Fyde Treasury rewards Fyde points to liquidity providers who increase the liquidity of the $TRSY (Liquid Vault liquidity token) market, and promises to distribute its governance token $FYDE based on these points in the future.

Unlike other projects that usually require users to be decentralizedexchangeDirectly deposit into trading pairs to obtain liquidity mining activities of tokens or points. Fyde Treasury accepts users to deposit $FYDE into the liquidity mining contract within the protocol and directly Uniswap Uniswap v3 is a decentralized exchange that allows users to set supply ranges when providing liquidity.exchange.

When providing liquidity to Uniswap v3, the system uses an AI-driven simulation environment to calculate and execute the optimal path to convert part of the $FYDE deposited in the liquidity mining contract into $ETH. In addition, AI also manages and optimizes the range of liquidity deposits on Uniswap v3 in real time based on market conditions, making capital efficiency about 4 times higher than providing liquidity for the same capital on general decentralized exchanges.

AI Simulation Dashboard, Source:Fyde Docs

In this way, Fyde Treasury is building a basket fund that uses AI to manage the assets deposited by users in the protocol in real time, thereby reducing human judgment and preventing various risks in the market.

2.1.3. Protocol Performance

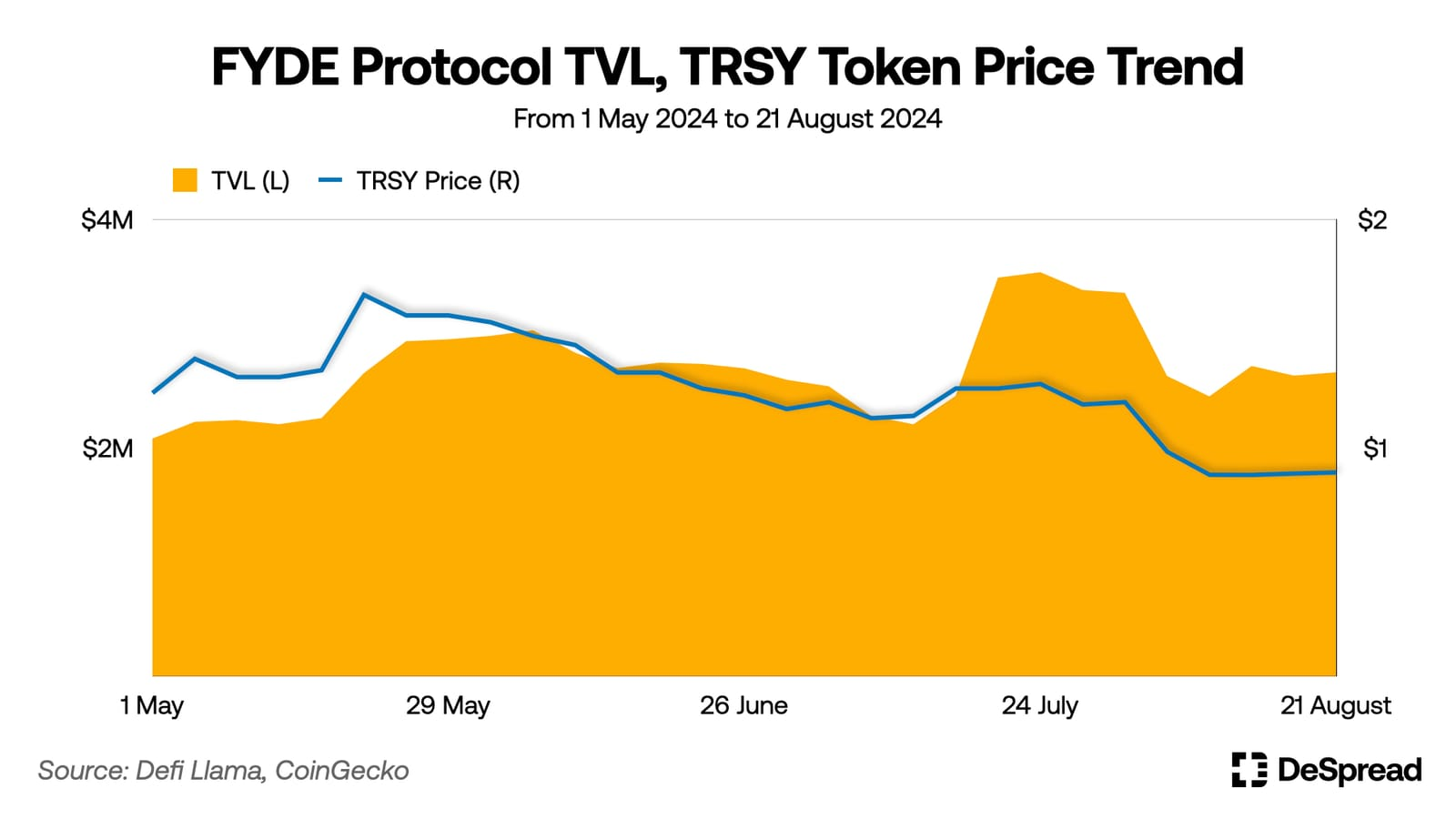

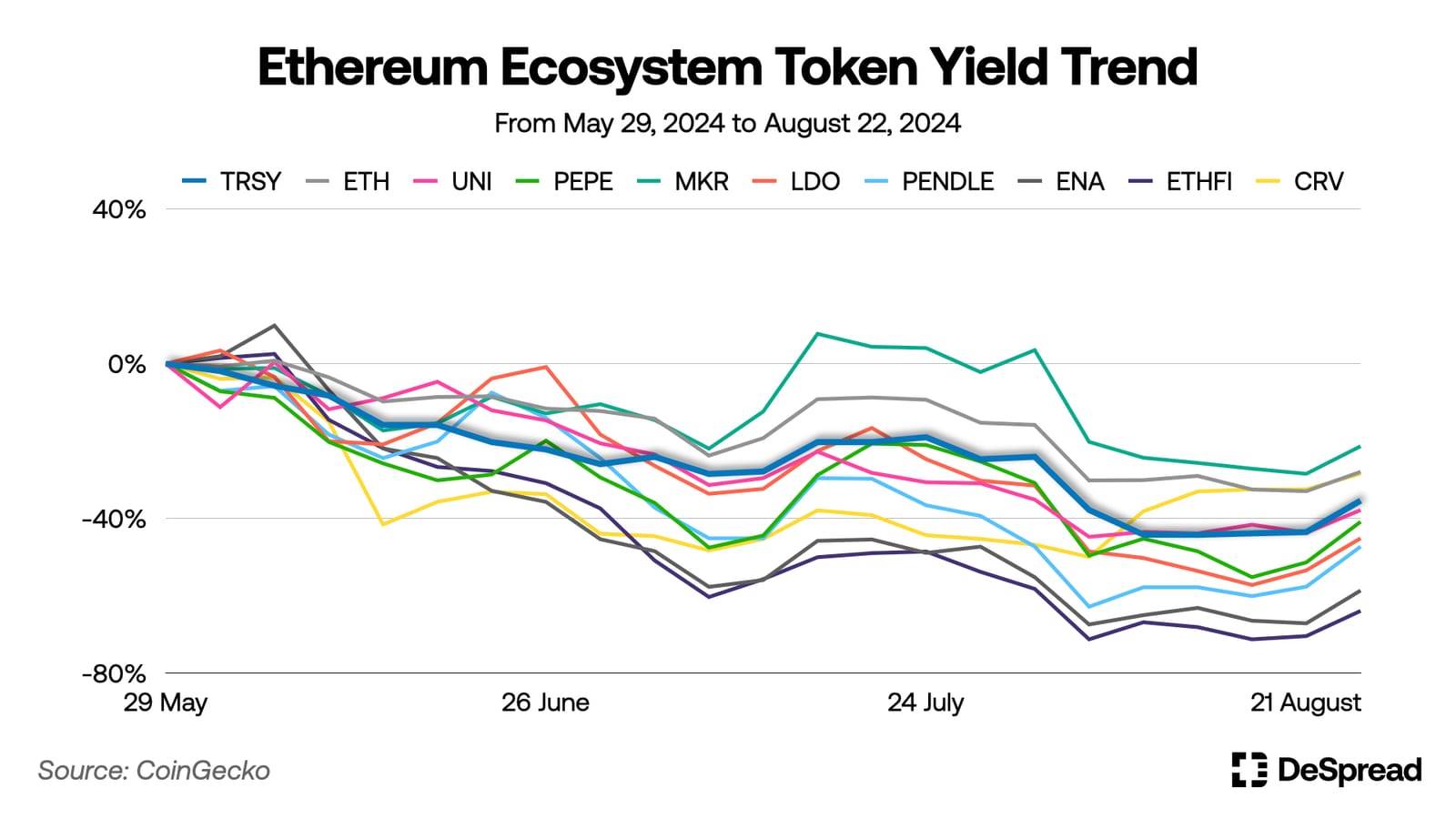

Since its launch in January 2024, Fyde Treasury’s TVL has grown steadily, reaching and stabilizing at approximately $2 million. However, due to the continued weakness in the market since late May, $TRSY Token has a return of -35% in the past three months.

However, comparing the returns of $TRSY with other major tokens in the Ethereum ecosystem, the price fluctuations of $TRSY are relatively stable with smaller declines.

Although Fyde Treasury has been launched for less than a year, its AI model has been continuously learning and developing through market data. As AI learning accumulates and optimizes, it may perform better in the future, so it is worth paying attention to Fyde Treasury's future development direction and performance.

2.2. Mozaic Finance:AI Revenue Optimizer

Mozaic Finance is a yield optimization protocol that uses AI to optimize yield farming strategies, implemented through a specific DeFi protocol. It provides users with a variety of DeFi ecosystem asset management strategies, presented in the form of vaults, and uses the following two AIs for strategy optimization:

-

Conon:Analyze on-chain data in real time to predict market conditions and APY changes of yield farming strategies

-

Archimedes:Calculate the best investment strategy based on Conon's forecast data and execute fund allocation

In Mozaic Finance, the AI agent Conon plays the role of "analyst" and Archimedes plays the role of "strategist", jointly managing the assets deposited by users.

2.2.1. Vault Type

-

Hercules:This is a treasury that uses stablecoins for yield farming, and depositors will receive MOZ-HER-LP Token as a liquidity token.

-

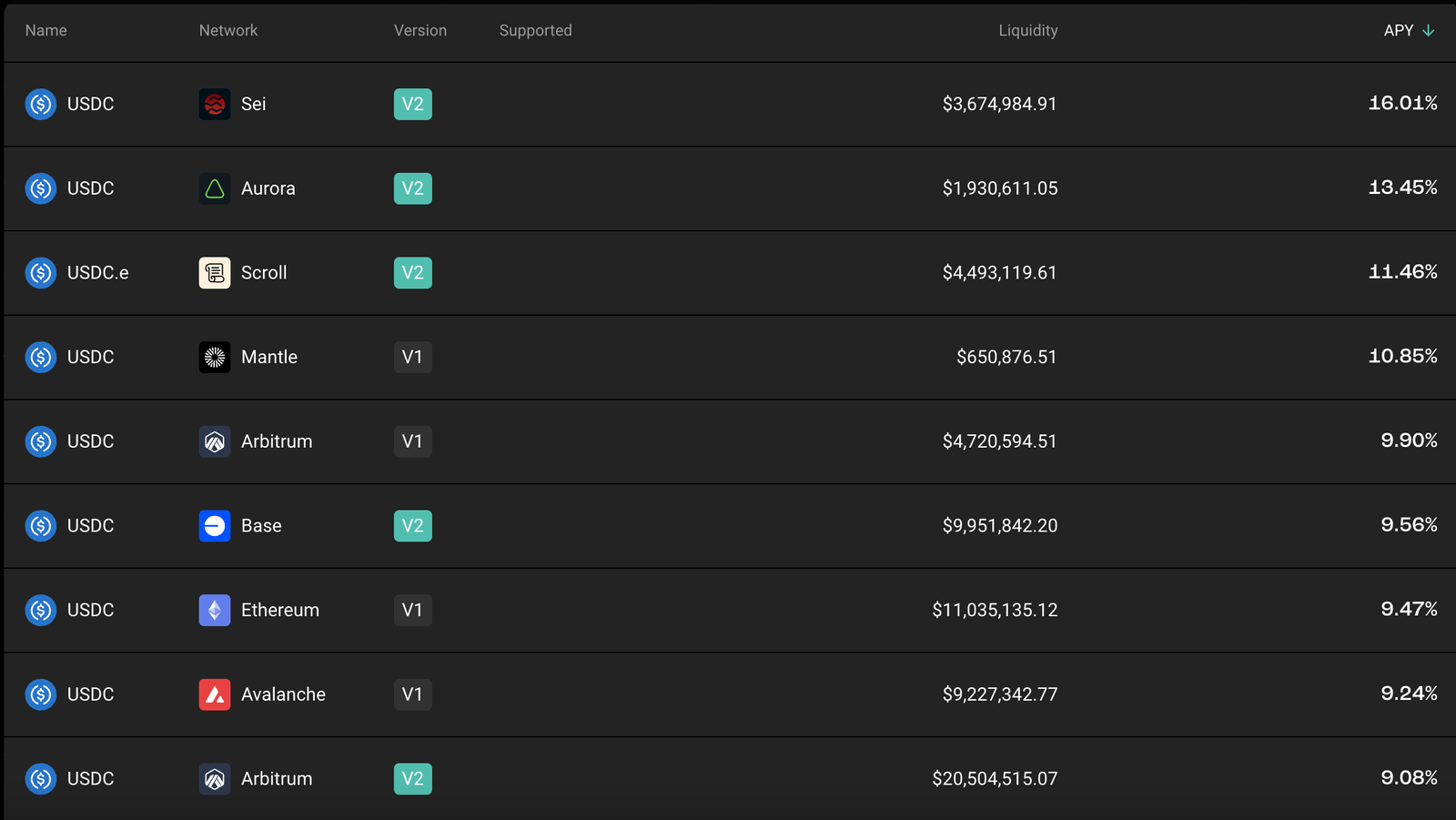

The assets deposited by users in the vault are used to provide liquidity through the bridge protocol Stargate Generate income. AI will bridge and rebalance the vault assets to higher-yielding liquidity pools in real time. The characteristic of Stargate is that even for the same asset, the APY of different networks will vary due to liquidity differences.

-

Stargate Farm Dashboard, Source:Stargate

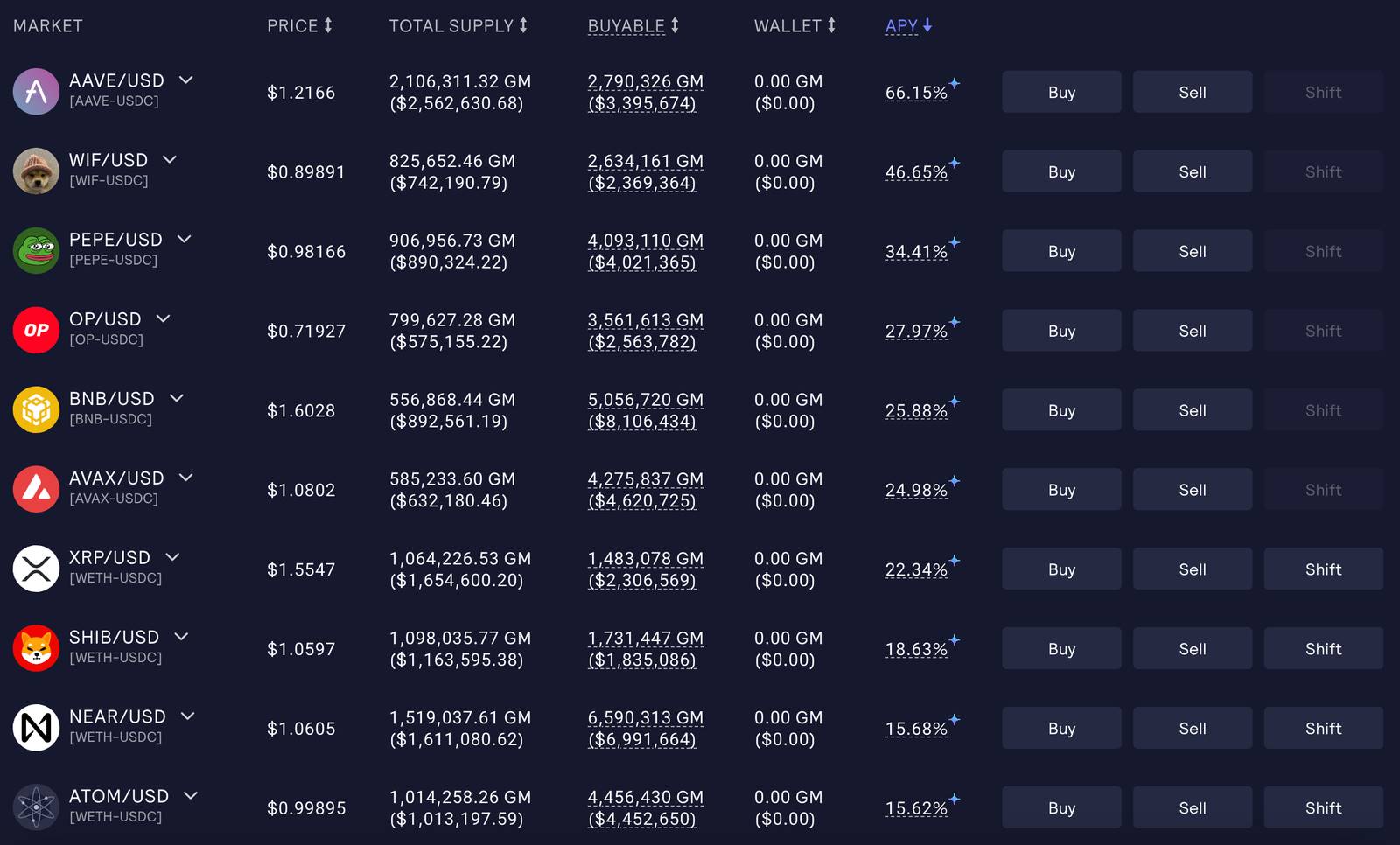

Theseus:This is a vault that generates income through various volatile assets, and depositors will receive MOZ-THE-LP Token as a liquidity token.

-

The user's assets will be deposited in the GM pool of the GMX protocol, a decentralized perpetual futures exchange that provides liquidity and incentives for traders. When deploying liquidity, the volatility and interest rates of the assets traded in each GM pool are taken into account. Depending on market conditions, the proportion of stablecoins may be increased and deposited in Stargate to generate additional interest.

GMX GM Pool Dashboard, Source:GMX

GMX GM Pool Dashboard, Source:GMX

-

Perseus:This is a vault that actively utilizes the PoL (Proof of Liquidity) consensus mechanism to provide a platform for the upcoming mainnet launch. Berachain The Mozaic Finance team is developing and preparing to launch a strategy using the Berachain testnet, details of which will be announced later.

For more information about Berachain and the PoL consensus mechanism, please refer to the article Berachain — The Bear Catching Two Rabbits: Liquidity and Security.

Unlike Fyde Treasury, which builds a token basket fund, Mozaic Finance is a protocol that uses AI to optimize liquidity provision strategies and processes and manage risks when depositing user assets into DeFi protocols.

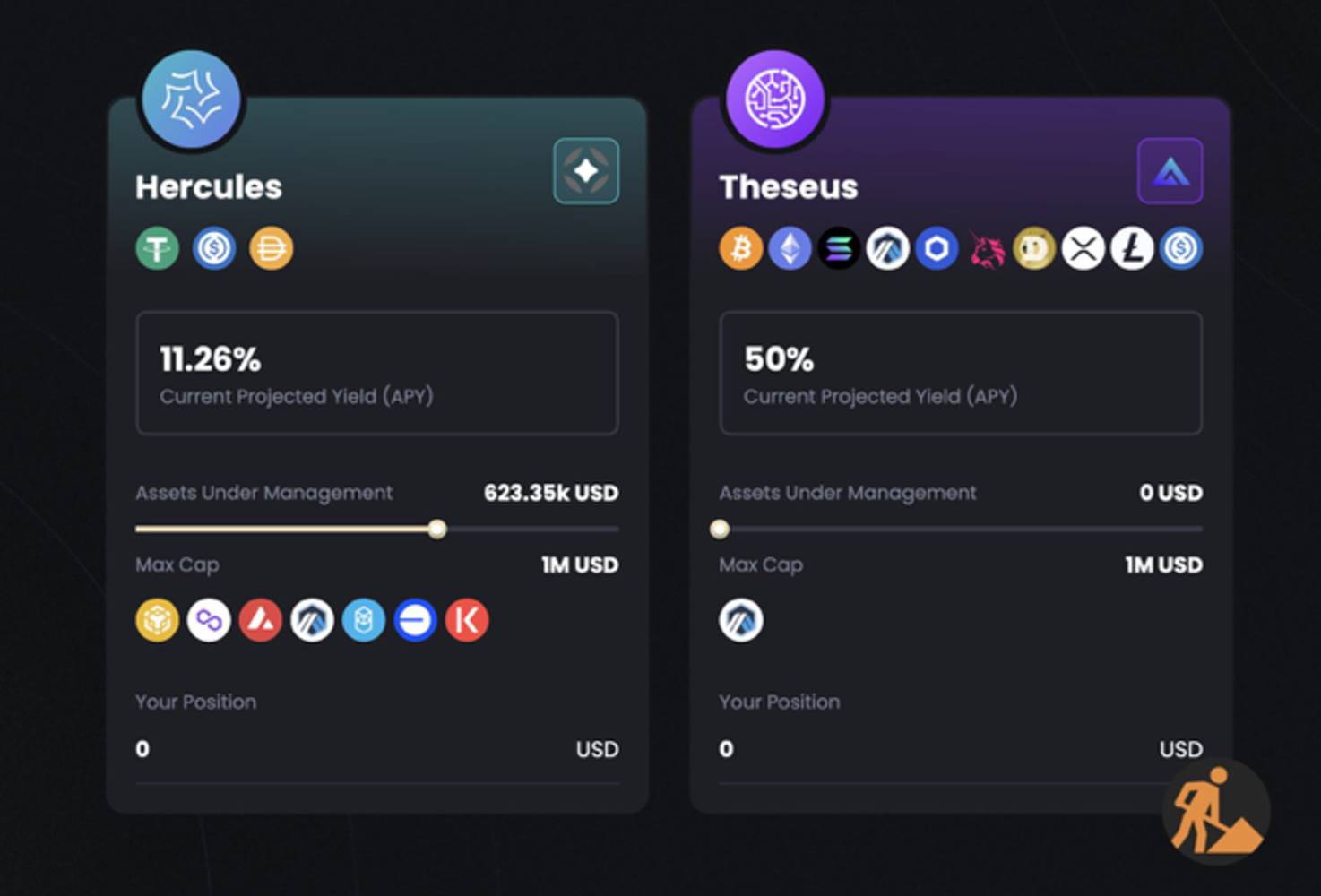

As of January 2024, the Hercules and Theseus vaults have performed well, with expected APYs of approximately 11% and 50%, respectively.stealThe incident, both vaults have been suspended.

Expected annual returns for the Hercules and Theseus vaults as of January 2024, source:@Mozaic_Fi

2.2.2. FundingstealstealEvents and Mozaic 2.0

Mozaic Finance 于 2024 年 3 月 15 日发生了一起资金盗steal事件。当时,团队正在过渡到由 Hypernative New developmentSafetySolutions to improve on-chain risk andSafety性。在安全更新完成之前,一名内部开发人员发现可以通过使用核心团队成员的私钥来盗取金库资金。他们入侵了该成员的电脑以获取私钥,并利用该密钥盗取了约 200 万美元的金库资产,然后将这些资产转移到中心化交易所进行清算。

Affected by this incident, the Mozaic Finance team suspended the operation of the Hercules and Theseus vaults, and the value of the governance and protocol fee collection token $MOZ fell by about 80%. After the incident, the Mozaic Finance team immediately and transparently announced the progress of the incident and cooperated with security companies to track the flow of stolen assets. At the same time, they applied to the exchange where the developers stored the stolen assets to freeze and return the funds, and worked hard to restore the normal operation of the protocol.

Fortunately, the return of all stolen funds is currently underway. While waiting for the return of stolen funds from centralized exchanges, the team is preparing to launch Mozaic 2.0. The new version includes the following improvements:

-

Enhanced Security:Code audits and security enhancements were performed by security professional companies such as Trust Security, Testmachine, and Hypernative.

-

AI Model improvements:Comprehensively upgrade the existing Archimedes model and predict and learn from black swan events that have not yet occurred based on expert knowledge. In addition, detect abnormal decisions and set flags for manual review and model improvement.

-

Improve user experience:Improve the UI/UX of Dapps and enhance users’ access to Dapps in various chain environments through account abstraction and bridge service integration.

Therefore, although Mozaic Finance has experienced a major fund theft crisis, they are actively preparing to launch Mozaic 2.0, committed to providing users with more secure and efficient asset management services.

3. Challenge: AI’s decentralization and scalability dilemma

So far, through the cases of Fyde Treasury and Mozaic Finance, we have learned how smart DeFi protocols use AI as a core component of DeFi applications. The advantages that smart DeFi protocols can bring through AI include:

-

Building a new DeFi protocol model through autonomy

-

Improve capital efficiency by analyzing and optimizing the way funds operate

-

Real-time analysis and response to risks such as abnormal transactions

Currently, the integration of blockchain and AI is mostly focused on building blockchain infrastructure to overcome the limitations of AI. However, given the advantages mentioned above, it is expected that there will be more attempts to introduce AI into DeFi protocols. Of course, there are challenges that need to be addressed in the process of integrating these two fields.

AI requires an environment that can process large amounts of data quickly, but current blockchain infrastructure is not yet capable of this data processing speed. For example, the ChatGPT-3 model is estimated to need to process trillions of data per second to answer questions, which is about 10 million times faster than Solana’s maximum TPS (transactions per second) of 65,000.

In addition, even if the blockchain infrastructure develops to the point where it can support AI computing, the transparency of public blockchains may still expose the training data and decision weights of AI models to the public. This means that AI-generated transactions may become predictable, exposing them to the risk of various external attacks.

As a result, DeFi protocols looking to leverage AI, including Fyde Treasury and Mozaic Finance, currently choose to run the AI on centralized servers and interact with the blockchain based on its results.

However, this approach results in users having to trust the honesty of the team responsible for managing the AI when depositing assets in the protocol. This situation undermines the core principle of DeFi, which is to provide a trustless trading environment by eliminating the need for trusted third parties through smart contracts.

When applying AI in blockchain,Decentralization and ScalabilityThe problem is seen as a challenge that DeFi applications must solve in the process of utilizing AI. zkML (zero knowledgeMachine Learning)Technology is gaining attention as a solution.

3.1. zkML (Zero-Knowledge Machine Learning)

zkML is aZero knowledge proof(ZKP)与机器学习(ML)相结合的技术。零知识证明是一种加密方法,它可以在不透露数据本身的情况下验证数据的真实性,从而实现隐私保护和数据完整性验证。zkML 利用零知识证明的这些特性,应用于机器学习领域,使得在不公开输入、参数和 AI 模型内部机制的情况下,能够验证模型输出的正确性。

Furthermore, by designing the smart contracts of DeFi protocols to verify zero-knowledge proofs, on-chain transactions are generated only when the AI model operates honestly as expected and without external interference, so that AI can be safely integrated into DeFi protocols.

For example, the previously mentioned Mozaic Finance plans to introduce zero-knowledge proof technology into its protocol in the future.In the document it is stated, this technology will enhance the ability to verify Archimedes’ honest decisions and manage the vault in real time.

However, zero-knowledge proof technology is still emerging and requires a lot of discussion and development to achieve practical application. In particular, for complex AI models, generating zero-knowledge proofs is more efficient than executing AI models directly on the blockchain, but it still requires computing power and storage space that exceeds what the current blockchain infrastructure can provide. Therefore, in order to make zkML truly practical, further technological progress and optimization must be achieved in zero-knowledge proofs and blockchain infrastructure.

4. AI-based economy and identity verification

I expect that as blockchain and AI technologies develop further, they will gradually overcome the challenges required to achieve the integration of the two. Based on this progress, I believe that in the near future, most DeFi protocols will integrate AI into their operating mechanisms.

In addition, with the emergence and maturity of AI agent deployment and trading platforms such as SingularityNET and Autonolas, AI can be integrated not only at the protocol level, but also an environment is created for individual users to easily use AI agents. In other words, everyone participating in the blockchain ecosystem is able to build and use smart DeFi protocols optimized for individuals.

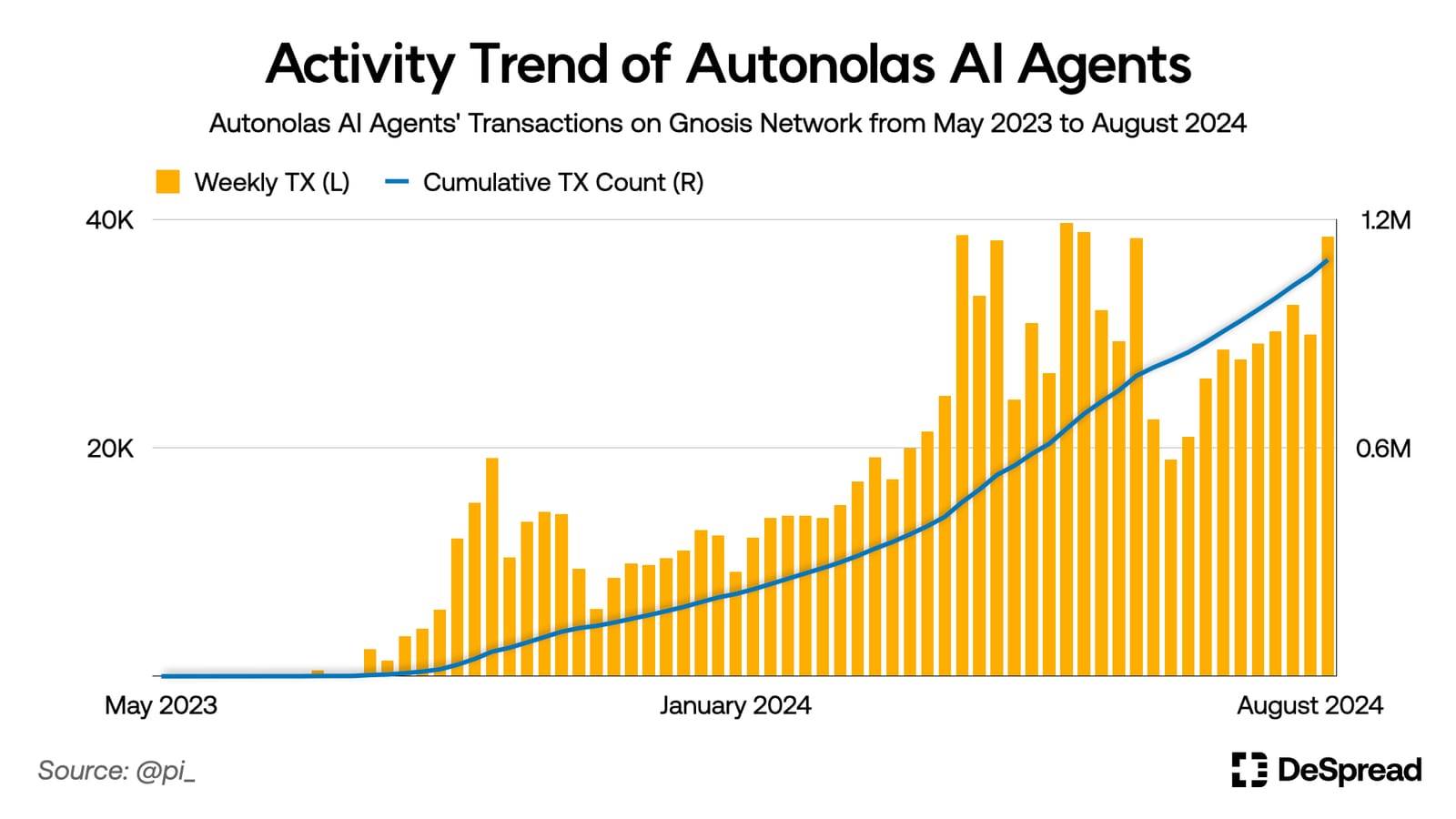

For example, Autonolas’ AI agent is on the Gnosis network’s prediction market platform Omen The number and activity of these agents, which place bets by analyzing on-chain and off-chain data, has steadily increased. In the year from July 2023, these agents have generated more than one million transactions.

It is expected that the number of personalized AI agents that can efficiently manage capital around the clock will increase in the future and actively participate in the blockchain ecosystem. This will promote the utilization of idle liquidity and more efficient capital operations, thereby significantly improving the overall liquidity of the ecosystem. Ultimately, transactions between AI agents may become the main activity of the ecosystem, forming a new economic ecosystem based on agents.

In addition, as personalized AI agent models become increasingly intelligent, these agents may expand their activities into areas designed specifically for “humans.” This includes on-chain asset management customized to personal preferences, capturing and participating in airdrop opportunities, and participating in governance activities.

Therefore, as AI agents mimic human behavior more and more accurately, it will become increasingly difficult to distinguish between "real" human users and AI agents in the future. To this end, proof of identity as a mechanism to prove the identity and uniqueness of users is expected to become increasingly important, especially in protocols that value human values and agency.

4.1. Proof of Identity

Proof of identity is a mechanism that verifies an individual's identity and uniqueness by combining unique human characteristics with a personal account on the network. The methods currently under discussion and development can be divided into two main categories:

-

Physical authentication based methods:Use hardware devices to collect unique biometric information, such as facial recognition, fingerprint recognition, and iris recognition.

-

Behavior analysis-based methods:The authenticity and uniqueness of an account is determined by analyzing the user's social network graph, reputation, and network activity patterns. This method relies on the network activity of a user's specific account and its interaction with other accounts.

The identity verification method based on behavioral analysis can better protect user privacy and can be implemented without the use of special hardware equipment. However, in order to improve the accuracy and reliability of the proof, this method requires a large amount of network data. As the complexity of AI agents increases, their recognition ability may decrease, so it is expected that the identity verification method based on physical authentication will be more widely used in the future.

A representative protocol that uses physical authentication for identity verification is Worldcoin. The project was co-founded by Sam Altman, founder of OpenAI, who is also the creator of ChatGPT. Worldcoin aims to assign a unique digital ID to everyone in the world through identity proof and distribute $WLD tokens to those who have the ID. The move is to study and explore the possibility of achieving universal basic income to cope with the unemployment problem caused by the development of AI in the future.

4.1.1. Worldcoin

Worldcoin is an identity verification project based on physical authentication, which uses special hardware called Orb to identify human irises. After iris recognition is completed, the Worldcoin network will issue a World ID for the iris and generate a private key on the user's personal device that can be used to access the World ID.

Worldcoin Orb, Source:Worldcoin Whitepaper

Currently, the Worldcoin network only stores the hash value of the scanned iris data, which prevents the user's iris from being reconstructed or recognized. When World ID authentication is required, the user's device generates a zero-knowledge proof and sends it to the network, thereby protecting the data privacy of the user's on-chain activities. However, since the system only performs iris recognition when issuing a World ID, there are still some challenges, such as transferring World IDs by trading devices holding private keys, and AI agents obtaining private keys. To address these issues, Worldcoin is discussing the introduction of a biometric verification system when using World ID and developing an AI detection algorithm based on behavioral analysis.

5. Conclusion

In this article, we explore the new service protocols that emerge as AI is integrated into the blockchain ecosystem, the challenges these protocols face, and the future of blockchain ecosystems based on AI agents.

In the future, AI and blockchain technologies will continue to develop and merge with each other to make up for each other's shortcomings. Through this fusion, it is expected to provide individuals with a more convenient environment to easily access and utilize AI and blockchain technologies.

Especially in the future on-chain economic ecosystem with AI agents at its core, people will be able to easily use and provide financial services without deep financial knowledge. This will help significantly improve the liquidity of the on-chain ecosystem and expand the inclusiveness of the financial industry.

In addition, AI and blockchain can not only influence each other, but also have the potential to become the infrastructure of various industries. Therefore, the development of these two technologies will have a profound impact on the entire human society, not just a single industry.

However, AI-related regulations, such as data privacy protection and AI liability issues, and blockchain-related regulations, such as the securities attributes of tokens, will have a significant impact on the future development direction and industry structure of these technologies. Therefore, we need to pay close attention to the upcoming AI and blockchain industry regulations.

We ultimately hope that the development of these technologies will create a better environment for humans and help solve many problems in society.

The article comes from the Internet:As AI narrative heats up, how can DeFi benefit from it?

OverProtocol focuses on node optimization technology and is committed to building a comprehensive ecosystem to lower the threshold for participation for ordinary users. Author: OverProtocol Compiler: Coderworld OverProtocol successfully launched its Layer 1 blockchain main...