Re-examining crypto trading: A new interpretation of the liquidity revolution under the traditional TradFi system

In the context of the accelerating global integration process, cross-border payments have undoubtedly become the lifeblood of international trade, remittances and business operations. However, the traditional financial system is unable to meet the needs of the fast-digital world and faces many difficulties. On the one hand, the high transaction costs have deterred many companies and individuals, increasing the burden of global economic activities; on the other hand, the long settlement time has seriously affected the efficiency of capital circulation, which has greatly restricted the pace of business activities; in addition, complex regulatory barriers have also brought many uncertainties to cross-border payments, hindering the smooth progress of international trade.

We should take a long-term view. With the accelerated expansion of global trade demand, the market urgently needs more flexible, cost-effective and technologically advanced solutions. Against this background, cross-border payment methods based on digital currency have naturally emerged, which is expected to completely subvert the traditional cross-border payment model and bring new changes to modern international trade.

The Dilemma of Traditional Cross-Border Payments

In traditional cross-border payments, since the entire process involves multiple agent banks, the process is cumbersome and multi-step, so the settlement time may be extended to several days (T+N). At a time when real-time transactions are gradually becoming the norm, this undoubtedly causes a huge waste of efficiency.

Second, each intermediary bank involved in the transaction charges a fee, which significantly increases the total cost to the remitter. For businesses that rely on timely payments to manage cash flow efficiently and for individuals sending money to family members across borders, these delays and fees can be almost unbearable.

Furthermore, the regulatory environment in different jurisdictions is complex and diverse, so multiple intermediary banks around the world also pose challenges to traditional cross-border payments. During the long transaction period, the unpredictable risk of exchange rate fluctuations further exacerbates these difficulties.

In summary, there are many problems with the traditional financial interbank payment process, and the market urgently needs innovative solutions that can provide faster, more cost-effective and more reliable cross-border payment options to support the speed and scale of global trade.

Digital assets: a game-changer in global financial transactions

In the context of accelerating global integration, cross-border payments have undoubtedly become a digital asset and a key component of international trade, remittances, and business operations.BlockchainTechnology is increasingly recognized as a viable solution to these challenges.

First, by enabling real-time settlement and eliminating the need for intermediaries,BlockchainPayments made with the internet of things (IoT) significantly reduce transaction costs and improve the overall efficiency of cross-border transactions - not only reducing delays, but also solving the complexity and high costs associated with the traditional financial system, making cross-border payments more convenient and reliable for both businesses and individuals.

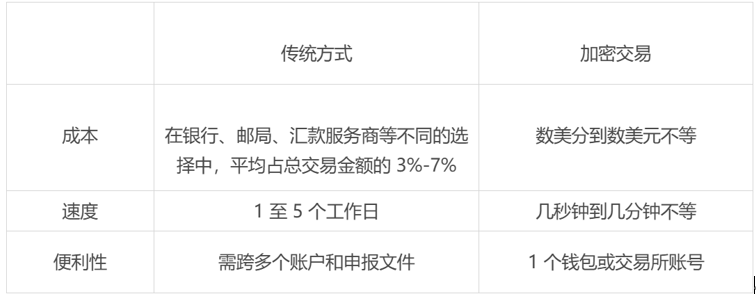

It is obvious from the above figure that digital assets have significant advantages over traditional payment systems in terms of cost and speed. By processing payments directly between parties, it eliminates the need for intermediaries, thereby greatly reducing transaction fees and saving a lot of costs.

Furthermore, they enable near-instant cross-border transfers, a significant improvement over traditional cross-border payment systems based on multiple correspondent banks, where settlements can take days.

More notably, digital assets enhance financial inclusion by providing financial services in areas where traditional banking infrastructure is limited or non-existent, particularly benefiting emerging markets. This convenience and efficiency also make digital assets an increasingly attractive option for businesses and individuals.

From the beginning, digital-driven cross-border payment solutions have begun to provide faster, cheaper and moreSafetyAn alternative method of cross-border transactions to subvert traditional cross-border payment channels.

The emerging landscape of digital payments

That’s why cross-border payments have become a central topic of discussion at recent events such as Money20/20, with industry leaders focusing on the challenges and opportunities presented by this evolving new landscape.

The complexity of cross-border transactions is particularly prominent in emerging markets (such as Asia), and it is expected that by 2023, the number of digitalwalletThe use of will account for more than 58% of all digital payment transactions. However, despite the rapid adoption of digital innovation, Jody Perla, Managing Director of Payoneer, stressed that cross-border transactions are still complex and costly, which highlights the urgency of continuously improving cross-border transaction payment methods to meet the needs of modern global trade.

As these trends continue to develop, more and more payment companies are looking at digital payments as an effective solution. For example, PayPal Ventures has invested in digital payment startup Mesh, indicating that the recognition of digital assets as a force for change in financial services continues to increase. Amman Bhasin, partner at PayPal Ventures, elaborated on this vision, saying: "As the financial services sector rapidly transforms, we believe that user ownership and portability of assets will become a key cornerstone of product innovation, and digital assets will be the first beachhead to achieve this goal."

The World Bank also recognizes the increasing application of digital assets such as stablecoins in addressing challenges in the existing monetary system, especially in emerging markets and developing economies (EMDEs). These digital assets are seen as key tools for enhancing financial inclusion and improving the efficiency of cross-border payments in regions where traditional financial infrastructure is lacking.

The use of stablecoins, which are pegged to stable assets such as the US dollar, also plays a vital role in mitigating the risks associated with currency fluctuations. This ensures a stable value for transactions, making them more reliable for businesses and individuals.

The adoption of stablecoins is evident in several key metrics: as of May 2024, there were more than 27.5 million active users, reflecting a 50% year-over-year increase in transaction volume, and approximately 30% of global remittances are now facilitated through stablecoins. This growing acceptance highlights a broader trend in which businesses and consumers are increasingly turning to digitally driven solutions to address the inefficiencies and limitations of traditional cross-border payment systems.

As the financial landscape continues to evolve, digital assets are expected to play an even more critical role in shaping the future of cross-border settlement and global finance.

Bridging the gap between traditional and digital: OSL OTC service

As a licensed and compliant digital asset service company in Hong Kong, OSL is standing at the forefront of this historic technological trend, committed to perfectly combining the advantages of digital currency and traditional methods by providing services that connect digital assets with the traditional banking system.

OSL OTC service is the main focus. Its key feature is its strong banking relationship, especially its close cooperation with major banks in Hong Kong, which greatly shortens the settlement time - this is especially important for digital finance:

Unlike traditional financial systems where cross-border transactions may take days, OSL uses advancedBlockchainTechnology and banking networks enable near-instant settlement.

This speed is critical for institutional clients who need to quickly execute large-scale transactions in different markets, ensuring that funds can be quickly transferred around the world.SafetyAt the same time, OSL adheres to strict KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, adding additionalSafetyHierarchy and trust.

It is worth noting that speed is the cornerstone of OSL’s OTC service, but it is far from its only advantage.exchange,因此其在监管合规和安全方面也树立了新的行业标杆——作为一直领航经营受监管交易所和全面保险覆盖的数字资产平台,OSL 获得了 SOC 2 Type 2 认证以及由知名会计师事务所进行的定期审计,确保了客户资产具有最高级别的安全性。

与此同时,OSL 的场外交易服务也可提供市场最佳的深度流动性,促进大宗交易的低摩擦无缝执行,其中它通过其先进的 REST API 和询价(RFQ)系统支持多种交易选项,使客户能够高效交易并获得有保证的报价,消除了传统交易所经常出现的场内价格滑点风险。

Additionally, OSL’s customized client services and strategic global partnerships enable it to meet the evolving needs of its diverse clientele in key markets around the world.

With the continuous development of the digital economy, the role of digital payments in innovating financial transactions has become increasingly significant. In particular, as the demand for speed, security and efficiency of cross-border transfers continues to grow, digital assets are expected to become the cornerstone of global financial infrastructure.

Innovators who stand at the forefront of the trend and lead the change undoubtedly need to integrate the characteristics of traditional finance and digital transactions, just as OSL OTC services cleverly integrate the advantages of digital assets with the reliability of traditional banks, thereby providing fastXiaobai Navigation, secure and compliant solutions, ensuring our customers can thrive in the dynamic digital economy.

The future is here, and the integration of traditional finance and digital transactions may inject new vitality into the global financial system.

*Note: The views and opinions expressed in this article are those of the author alone and do not necessarily reflect the views or positions of OSL Group Ltd. or its affiliates. Any forecasts and opinions contained herein are intended as general market commentary only and do not constitute an offer of securities or investments, nor do they constitute a solicitation of an offer, recommendation, investment advice or guaranteed returns. The information, forecasts and opinions contained herein are as of the date of this article, are subject to change without notice, and should not be considered as any investment product or market recommendation.

The article comes from the Internet:Re-examining crypto trading: A new interpretation of the liquidity revolution under the traditional TradFi system

相关推荐: Web3 Social 迷思:没弄清社交与社区的不同,还有灾难性的 X to Earn 模式

This is Whistle's 16th article, discussing the Web3 Social track and the limitations of monetization. Written by: Beichen The Web3 industry has emerged from the sluggish bear market in the past year. Although it is far from a real bull market, there are more and more voices about the coming of Social Summer. Especially recently, Teleg…