Data chart review: What happened to Ethereum after the Cancun upgrade?

Written by: ParaFi Capital

编译:1912212.eth,Foresight News

We are deeply studying the development of Ethereum after EIP-4844, focusing on the following three important directions:

-

What is the latest progress of ETH destruction?

-

L2 How attractive is the Internet?

-

What is the economic connection between L2 and Ethereum?

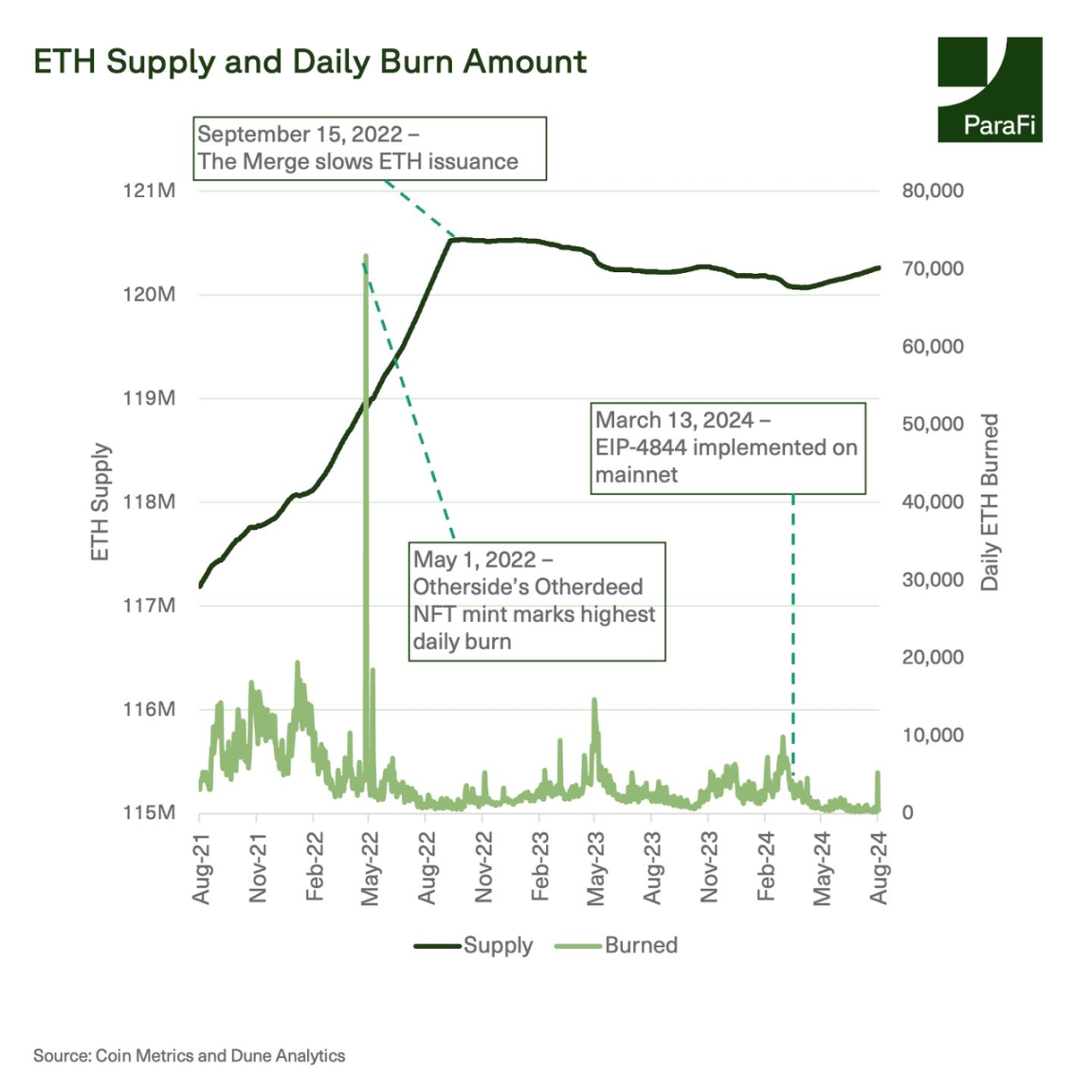

After EIP-1559 and the merge upgrade, people were excited about the economics of ETH as a cash flow-generating asset. After the first two upgrades, the supply of ETH did drop, dropping by about 0.38% from September 2022 to April 2024. However, since then, as the destruction rate has slowed, the ETH supply has started to climb.

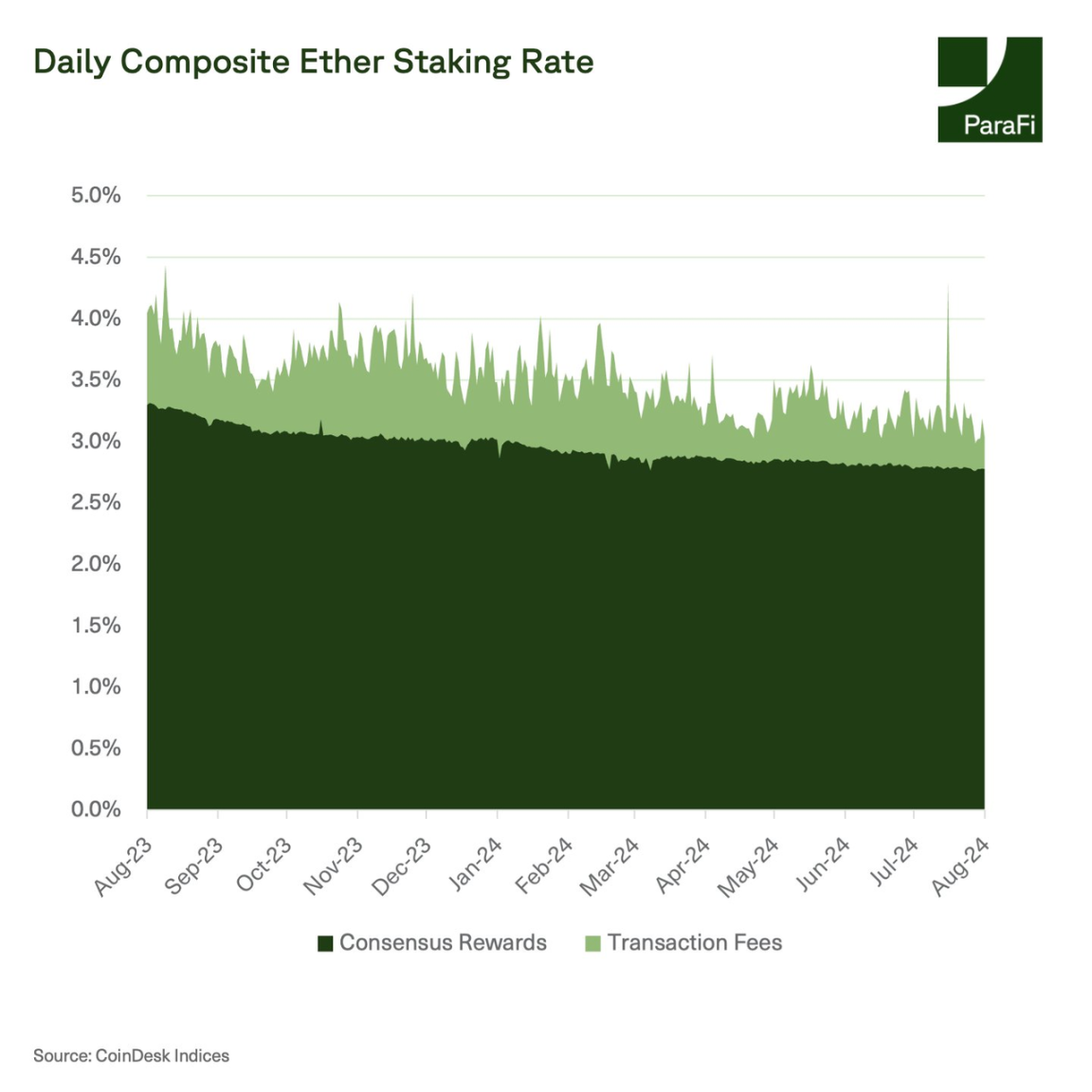

The ETH staking reward rate has been trending downward over the past 12 months as the number of Ethereum validators has grown by 79% over the past year while L1 transaction fees have fallen.

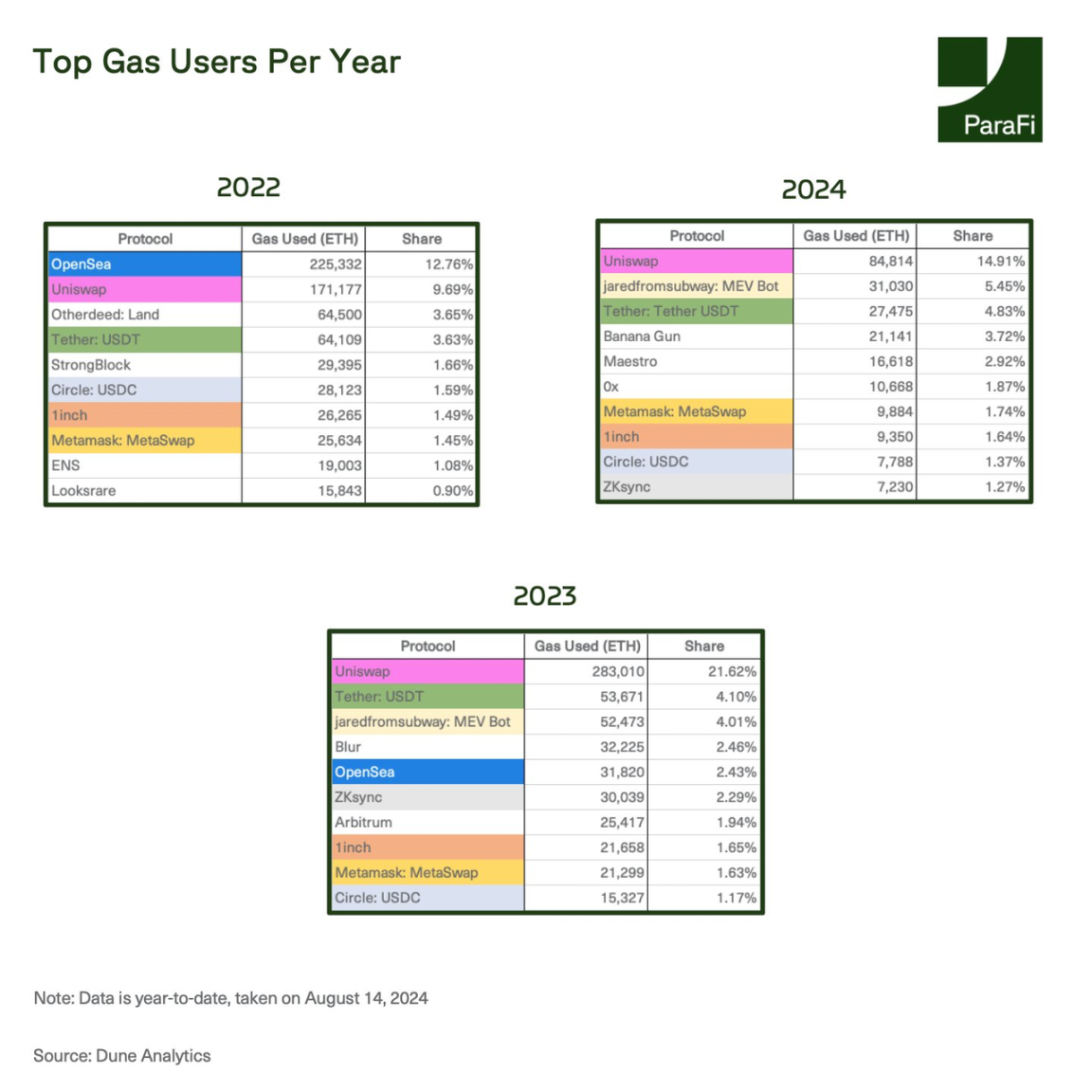

Although the destruction rate has slowed down, applications or protocols such as Uniswap, Tether, 1inch and MetaMask continue to drive most of the Gas consumption on Ethereum. In 2023, Arbitrum and ZKsync were the main Gas consumers, but their data has dropped significantly this year because the EIP-4844 proposal allows L2 to publish data more efficiently, reducing its data storage requirements.

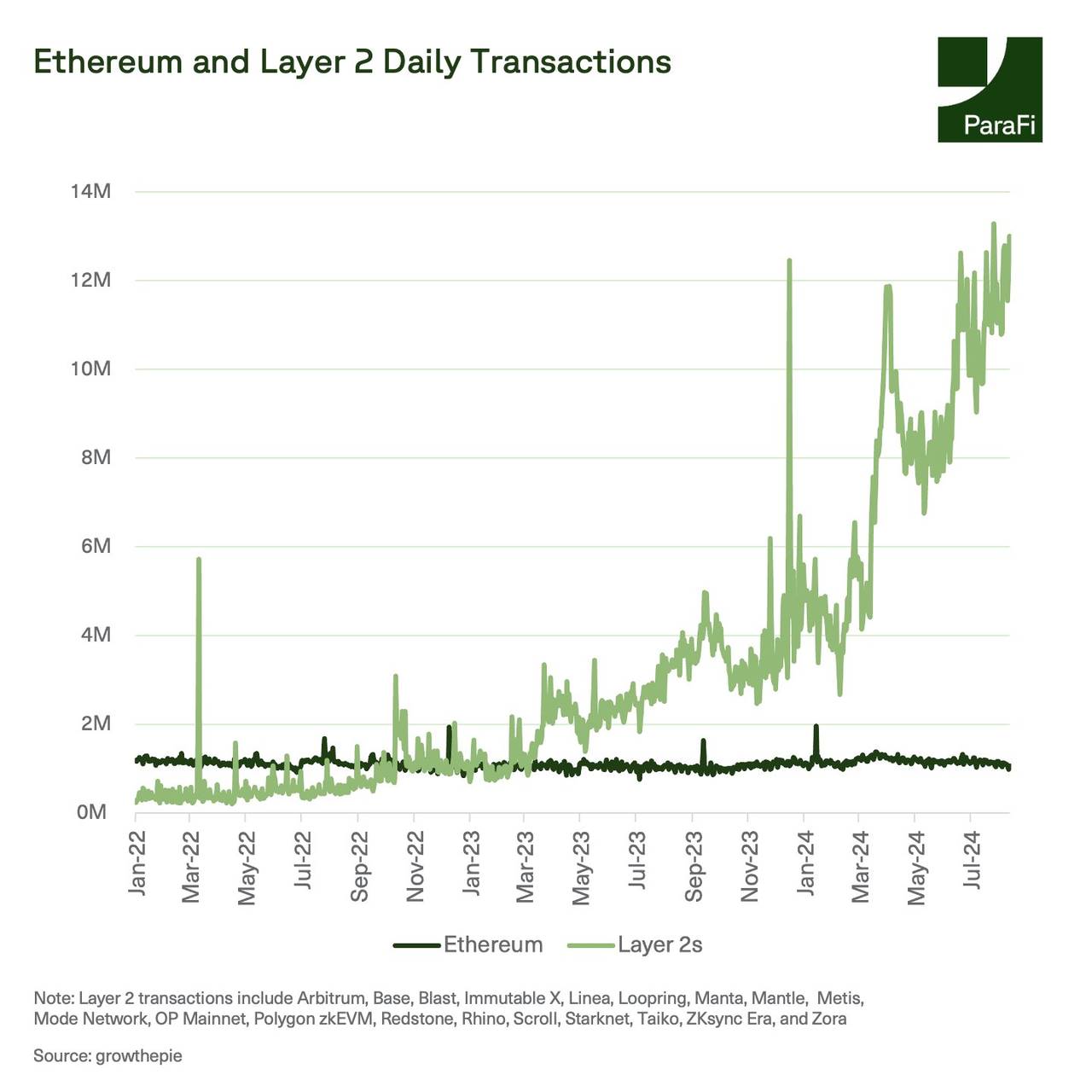

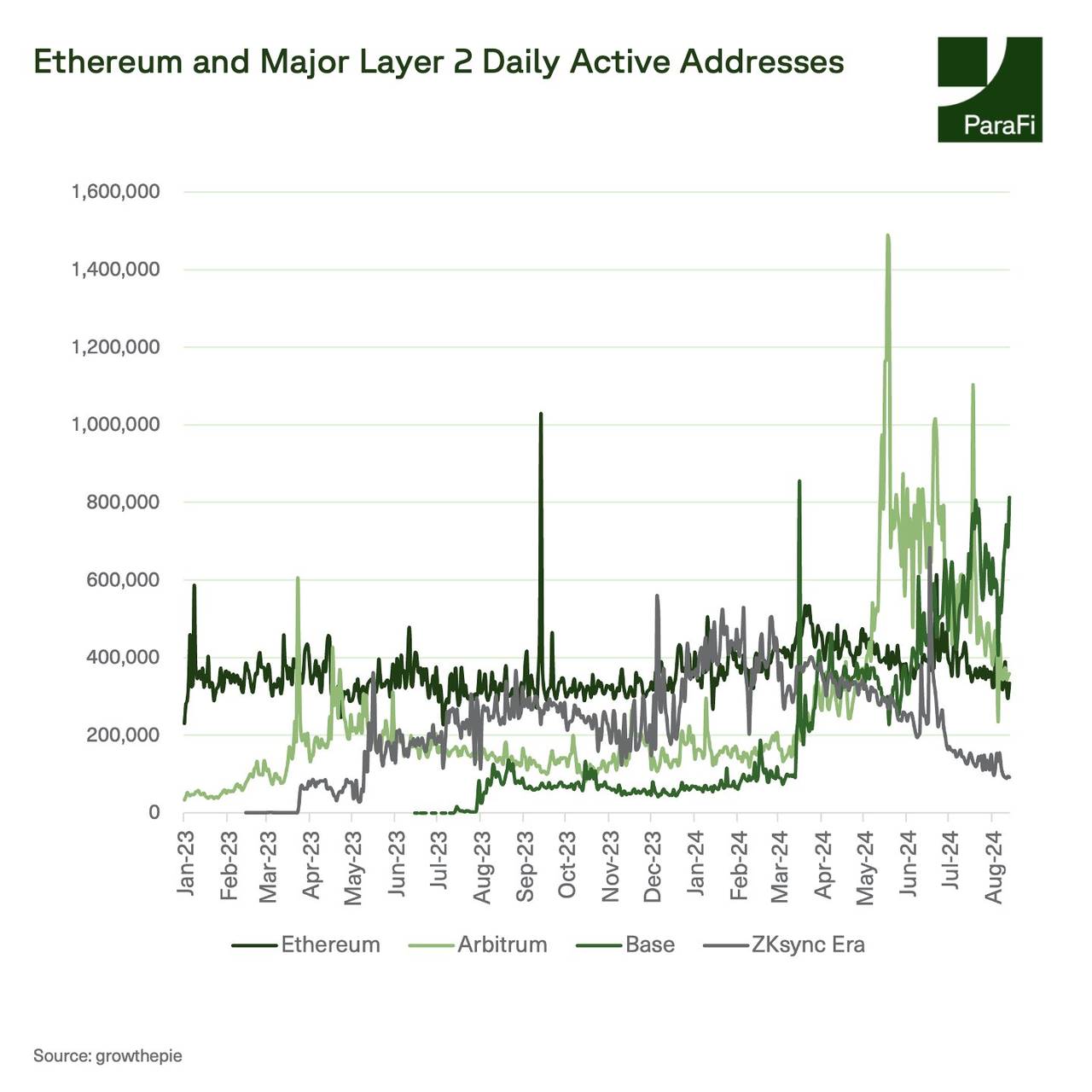

Over the past two and a half years, the number of Ethereum transactions has remained relatively stagnant, while the total number of L2 transactions exceeded L1 by 10 times in August 2024.

The growth in L2 activity can be attributed to the launch of new L2s and the explosive growth of some existing L2s. Since March, Base and Arbitrum have both seen more than 100 million transactions per day.Xiaobai NavigationWhile this chart aggregates transactions from multiple L2s, each L2 is providing alternative block space to Ethereum, highlighting the general trend of L1 to L2 migration.

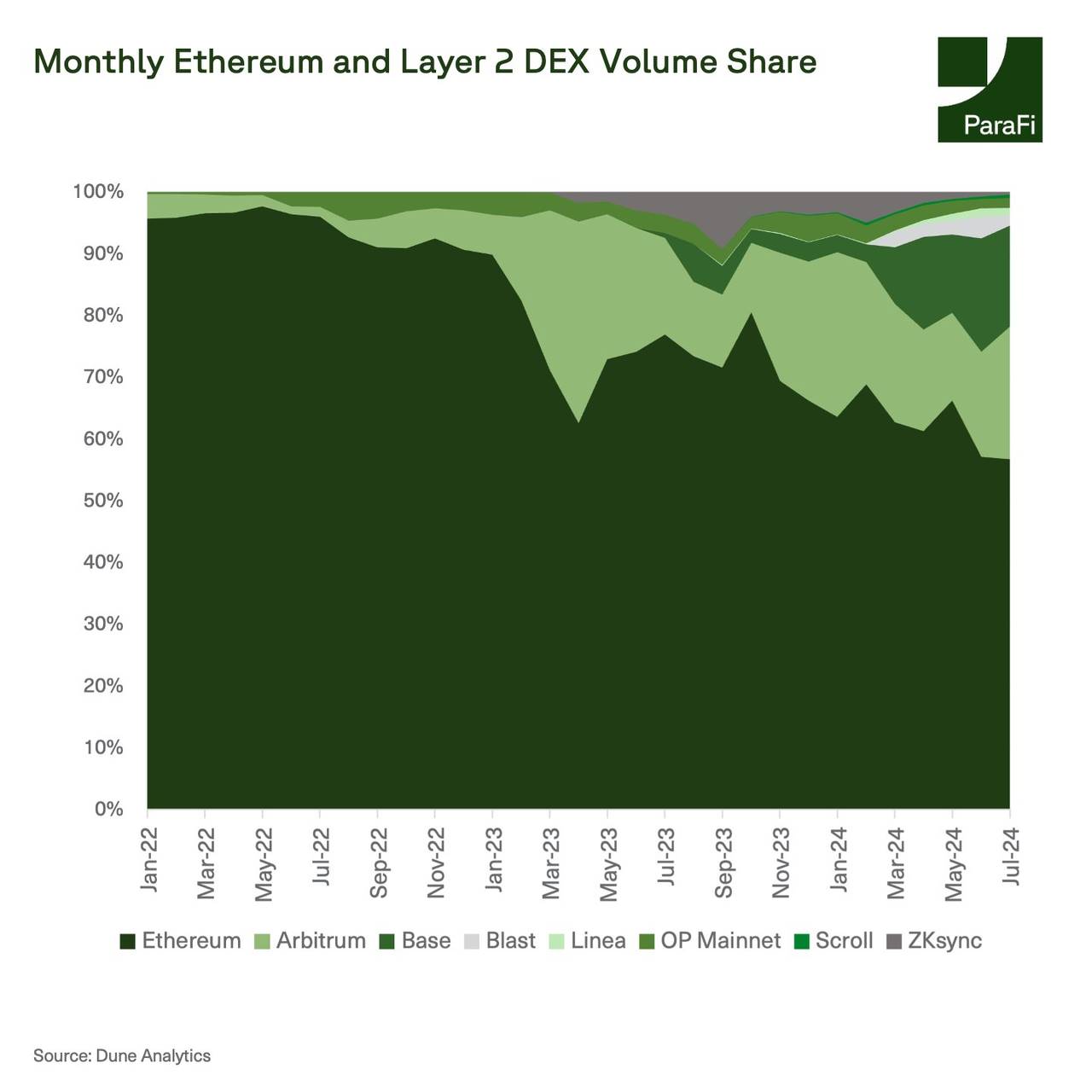

The growing popularity of Ethereum L2 is also reflected in the fact that they have attracted a large amount of DEX market share from Ethereum. After the EIP-4844 upgrade, L2 has reduced the DEX market share on the Ethereum mainnet to less than 60%.

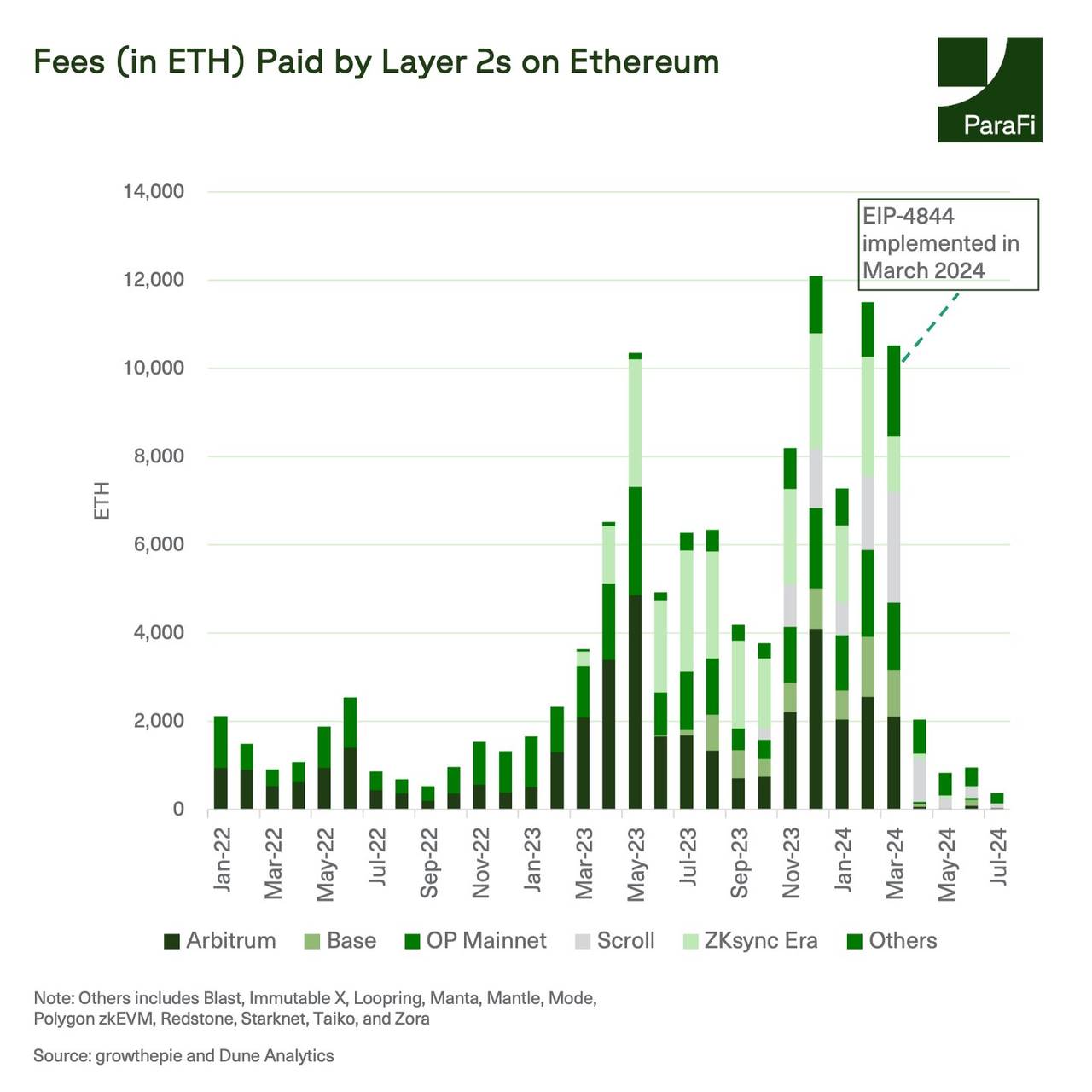

However, this also highlights the problem of liquidity fragmentation caused by the continuous development of the Rollup network. Despite the great success of these L2s, they cost relatively little to publish data on Ethereum due to the EIP-4844 upgrade. EIP-4844 was implemented in March 2024 and introduced a new data storage mechanism called "blobs" to Ethereum, which is a cheaper alternative to the previous Calldata structure.

In March 2024, L2 paid more than 10,000 ETH in fees on Ethereum, but in July, they paid less than 400 ETH, a drop of about 96%. With the reduction in costs, L2 now contributes less to the destruction of ETH and also reduces the gas fee on the mainnet.

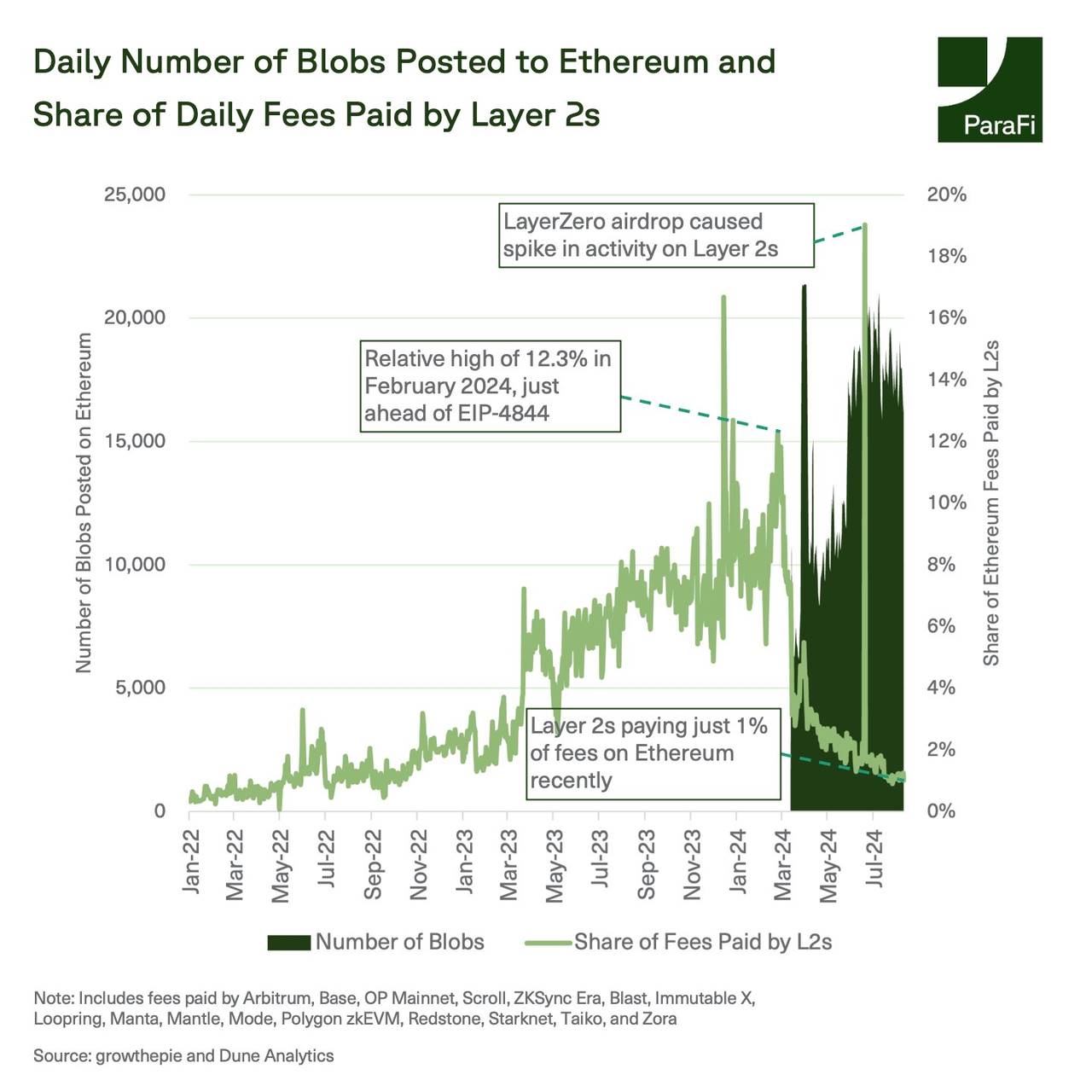

Since L2s need to publish a large amount of transaction summary data on-chain, they have rapidly adopted blobs. Since the beginning of June, at least 16,000 blobs have been published on Ethereum every day. This has led to a decrease in the proportion of total fees paid by major L2s, from 12% in 2024 to 1%.

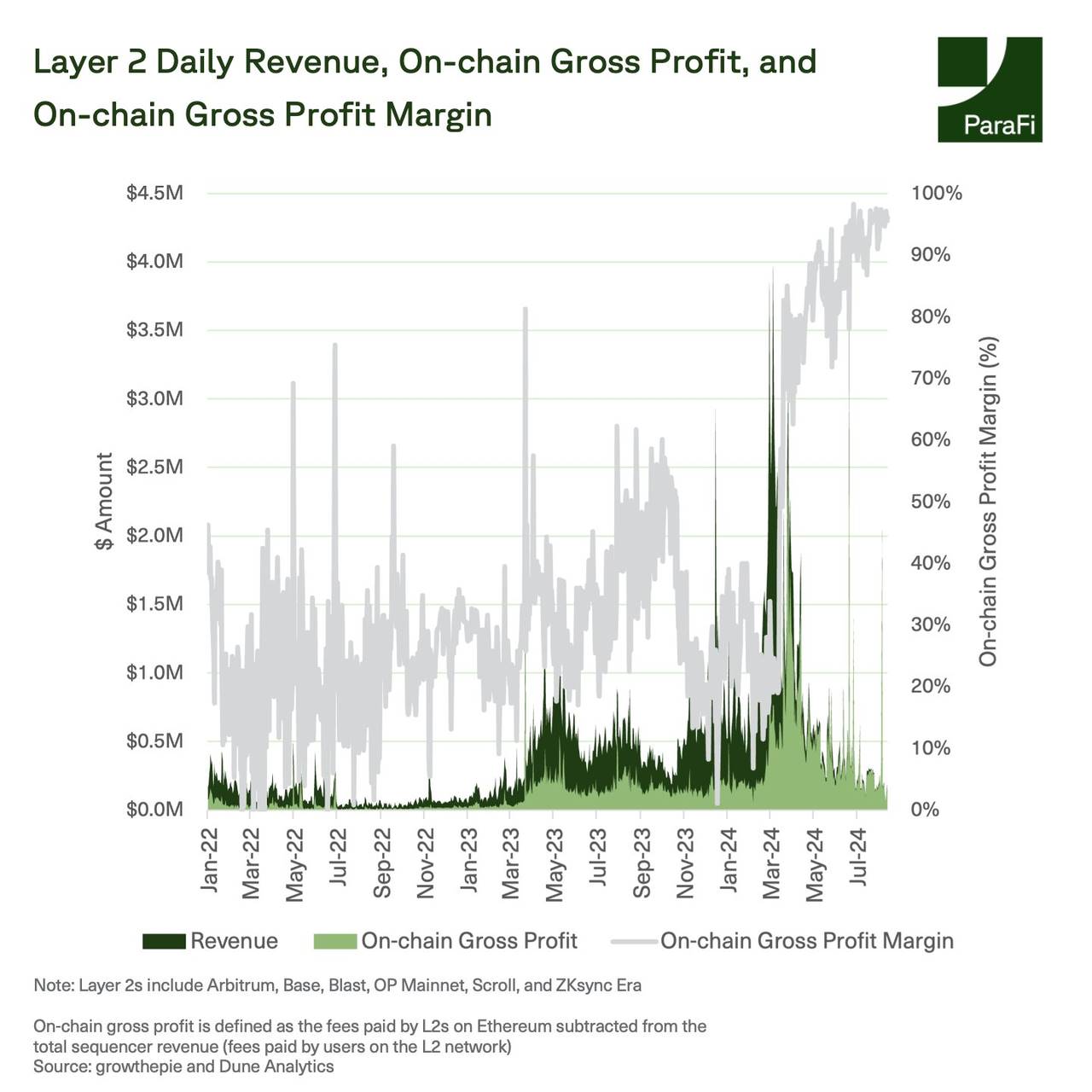

Since the implementation of EIP-4844, L2 operating margins have increased significantly. Although the total sorter revenue (i.e. the sum of fees paid on the L2 network) of the scaling solution has fallen by an average of ~48% so far this year, operating costs have fallen by ~87%, meaning that Rollups now retain the majority of revenue. The mainstream L2s now have operating margins of over 90%, even after passing on the bulk of the cost savings to users. Users benefit, with fees falling by ~90% over the past year on networks using blobs, with the median transaction cost typically below $0.01.

EIP-4844 has a significant impact on Ethereum L1.

Despite the surge in L2 usage, the direct benefit to ETH as an asset is unclear. Over the past few months, while L2 profits have risen sharply, the ETH burn rate has declined, resulting in less value flowing into ETH.

This leaves the Ethereum ecosystem with a lot of questions to think about:

-

As L2 usage continues to grow, TokenWhat role will it play? L2 TokenHow much value will be captured compared to ETH?

-

Are Rollups offering too much benefit relative to Ethereum? Or is this structure ideal to attract more users and developers to the broader Ethereum ecosystem?

-

As more L2s are launched, how will users and liquidity interoperate between these different networks?

-

With fees on the Ethereum mainnet now at historic levels, will we see developers reconsider deploying directly on L1, or will L2 remain more attractive?

The article comes from the Internet:Data chart review: What happened to Ethereum after the Cancun upgrade?

Basenames 将透过荷兰式拍卖机制销售。 撰文:Zhang joy,动区动趋 BlockTempo 美国最大的加密货币交易所 Coinbase 旗下 Layer2 网路 Base,昨(20)日在社交平台 X 上发文表示,Base 链将推出基于以太坊域名服…