Corn: Binance Labs participates in the first Ethereum L2 to use Bitcoin as Gas

Written by: Xiaobai Navigation Coderworld

The Bitcoin ecosystem has attracted much attention recently.

Whether it is the controversy over wBTC or the variousL2With the activeness of CoinMarketCap and DeFi, the market remains enthusiastic about Bitcoin-related concepts.

However, this enthusiasm is more focused on Bitcoin itself. Various projects are busy looking for more profit value for Bitcoin and trying their best to be within the Bitcoin ecosystem.

但现在已经足够卷的以太坊 L2 ,也将目光投向了比特币。

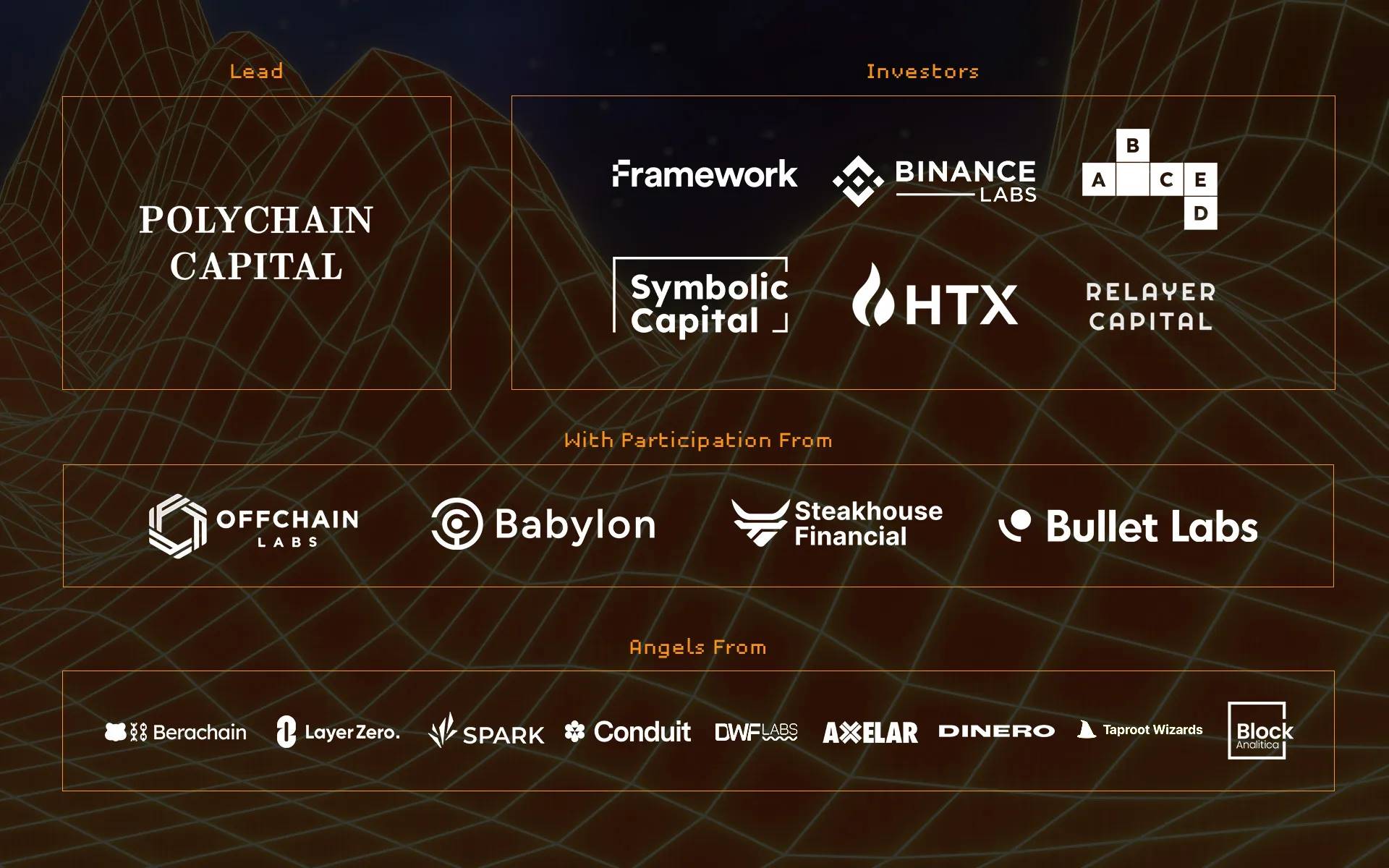

On August 20, a Corn 的新以太坊 L2 宣布完成670万美元种子轮融资,Polychain Capital Lead Investor,Binance Labs,Framework Ventures,ABCDE,Symbolic Capital,HTX Venturesand Relayer Capital Waiting for VC to participate in the investment,

Developers from well-known projects such as Polygon and Berachain also participated in the investment in their personal capacity.

And this L2 has a remarkable feature— Use BTC as L2 main network through some mapping method Gas, while looking for more benefits for BTC in the Ethereum ecosystem.

Previously, whether it was wBTC or other DeFi, they all made BTC profits through assets and applications; it was the first time that infrastructure-type L2 used BTC-mapped assets as Gas.

At the same time, the name of the project Corn also refers to the cryptographic stalk of farmers earning profits from a good corn harvest. An L2 centered around BTC and maximizing related profits is about to emerge.

What exactly should Corn do, and what opportunities are there for early participation and planning?

BTC as Gas

It should be noted that Corn is currently in its early stages, the features that can be experienced on the official website are still under development, and the white paper and instructions have not yet been fully launched. We will make a preview of the project based on the current public information.

First, let’s take a look at what it means to use BTC as Gas.

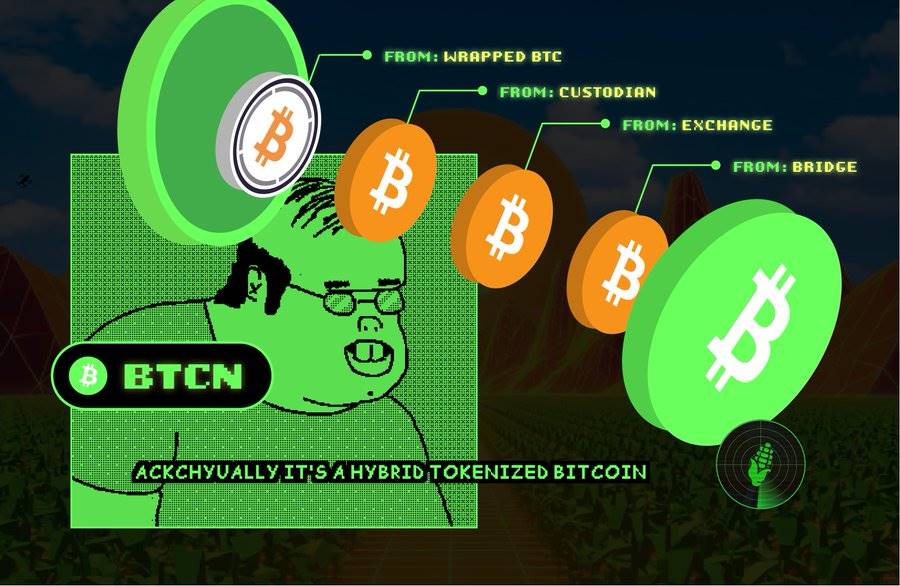

Corn Network introduces a newToken化比特币,称为 BTCN。这是 Corn 网络的原生 Gas 代币,用于支付网络交易费用。

So you can understand that BTCN is a Bitcoin mapping in ERC-20 format. It is speculated that it is similar to wBTC, but there are some technical differences.

Why use mapped BTCN as Gas? Some reasons may be:

-

Improving the efficiency of Bitcoin usage:By converting BTC into Gas that can be used on the Ethereum L2 network, it makes it easier for Bitcoin holders to participate in the Ethereum ecosystem without completely converting their assets.

-

Reduce transaction costs:Since BTCN is used directly on the L2 network, expensive gas fee transactions on the Ethereum mainnet can be avoided.

-

Increasing Bitcoin’s value capture: By introducing Bitcoin into the Ethereum ecosystem, Corn creates new value capture opportunities for Bitcoin, making it more than just a store of value asset, but also an active medium of exchange.

Although Corn has not yet fully disclosed its technical details, based on the existing information, we can reasonably speculate its implementation process:

-

Multi-party hosting:The minting rights of BTCN are not limited to a single centralized custodian, but are extended to multiple custodians, smartcontractand/or bridge protocols to improveSafetyand degree of decentralization.

-

bridgingmechanism:Users may need to deposit their BTC into the Corn network through a special bridge protocol. This bridge protocol will lock the native BTC and mint an equal amount of BTCN on the Corn network.

-

intelligentcontract:On the Corn network, there may be a series of smart contracts to manage the minting, destruction, and transfer process of BTCN. These contracts will ensure that the supply of BTCN always maintains a 1:1 ratio with the locked BTC.

-

Liquidity Pool: Ensure liquidity between BTCN and other assets such as ETH or stablecoins.

-

Authentication mechanism:A strong verification mechanism is needed to ensure the minting and destruction process of BTCNSafetyThis may involve multi-signaturewallet、时间锁定和其他安全措施。

Find more benefits for BTC in the Ethereum ecosystem

How can Corn's L2 bring more benefits to BTC?

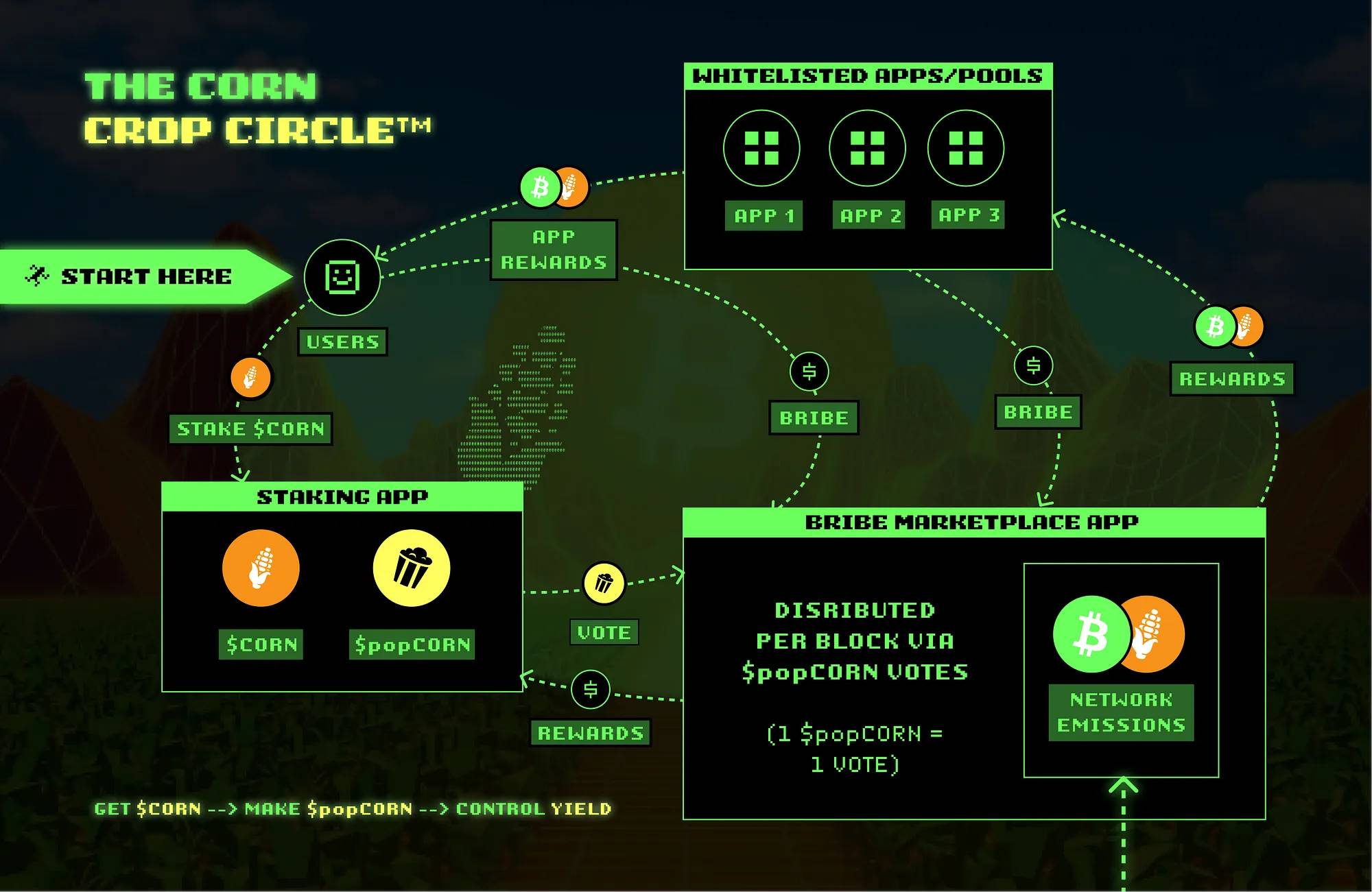

Corn proposed a method called "Crop Circle"Crop CircleThe core idea of this system is to recycle the value of BTC in the Ethereum ecosystem in various ways to generate additional benefits.

In the absence of more public information, we can analyze and understand this official picture.

首先,用户可以质押他们的 BTCN 代币来获得网络收益。这类似于其他 PoS 网络的质押机制,但独特之处在于质押的是与 BTC 挂钩的资产。

In addition, Corn may launch a liquidity mining project to encourage users to provide liquidity for trading pairs between BTCN and other tokens to earn additional income; at the same time, through integration with other public chains and DeFi protocols, Corn can provide users with cross-chain income opportunities, such as participating in DeFi projects on other chains.

From the official Twitter and blog information, Corn plans to deeply integrate with the existing Ethereum DeFi protocol to provide diversified financial services for BTCN holders:

-

Lending: Users can use BTXiaobai NavigationCN can be used as collateral to borrow other assets on DeFi platforms, or BTCN can be lent out to earn interest.

-

Derivatives: Develop BTCN-based derivatives markets, such as options, perpetual contracts, etc., to provide users with more investment and hedging tools.

-

Yield Aggregator: Helps users optimize their BTCN yields across different DeFi protocols.

At the same time, Corn also introduced two tokens: $CORN and $popCORN, which are similar to Curve's vote-escrowed (ve) model.

CORN, as a base token, is similar to CRV in Curve. Users can obtain CORN in a variety of ways, including staking BTCN, participating in liquidity provision or other ecosystem activities. $popCORN is similar to veCRV, which is a governance token obtained by locking $CORN.

Locking mechanism:

Users can choose to lock their $CORN for a period of time to obtain $popCORN. The longer the lock period, the more $popCORN you get. This mechanism encourages users to hold and participate for the long term, because a longer lock period means greater governance weight and potential benefits.

Dynamic Weight: The voting weight of popCORN may decrease over time, similar to the decay mechanism of veCRV in Curve. This means that users need to regularly "re-lock" their CORN to maintain maximum governance weight, further promoting active ecosystem participation.

Governance and Reward Distribution: Users who hold $popCORN can not only participate in the governance decisions of the ecosystem, but also potentially receive additional rewards. This may include a share of transaction fees, an allocation of newly minted $CORN, or priority rights to participate in specific projects.

Liquidity Incentives: Drawing on Curve’s model, Corn may use $popCORN to determine the weights of different liquidity pools. Users holding more $popCORN can “vote” to increase the weight of a pool, thereby attracting more liquidity rewards to the pool.

Bribe Marketplace: Corn is an innovative extension of the Curve model. In the Curve ecosystem, an informal "bribe" market has emerged, and Corn seems to have formalized and integrated this concept into its platform. Users may be able to participate in this market through $popCORN to influence votes or get extra rewards.

The application of this ve model appears to enhance the utility of $CORN and $popCORN, with long-term holders being rewarded with more governance rights and potential returns, which in turn increases the demand and value of the tokens.

At the same time, this model also finds a unique positioning and value creation path for BTC in the Ethereum ecosystem.

Currently available space

Currently, Corn’s testnet and tokens have not been officially launched, but the official has also released some warm-up information.

At 11pm on the 21st, the project will open a Space,Details of the mainnet token airdrop will be given, but in the initial airdrop phase, only eligible users will be added to the eligibility list.

The screening criteria for this list are the thousands of super DeFi users who have used DeFi protocols that have cooperated with Corn in the past 12 months. The specific screening list is unknown. It is recommended to follow its official Twitter and Space for more details.

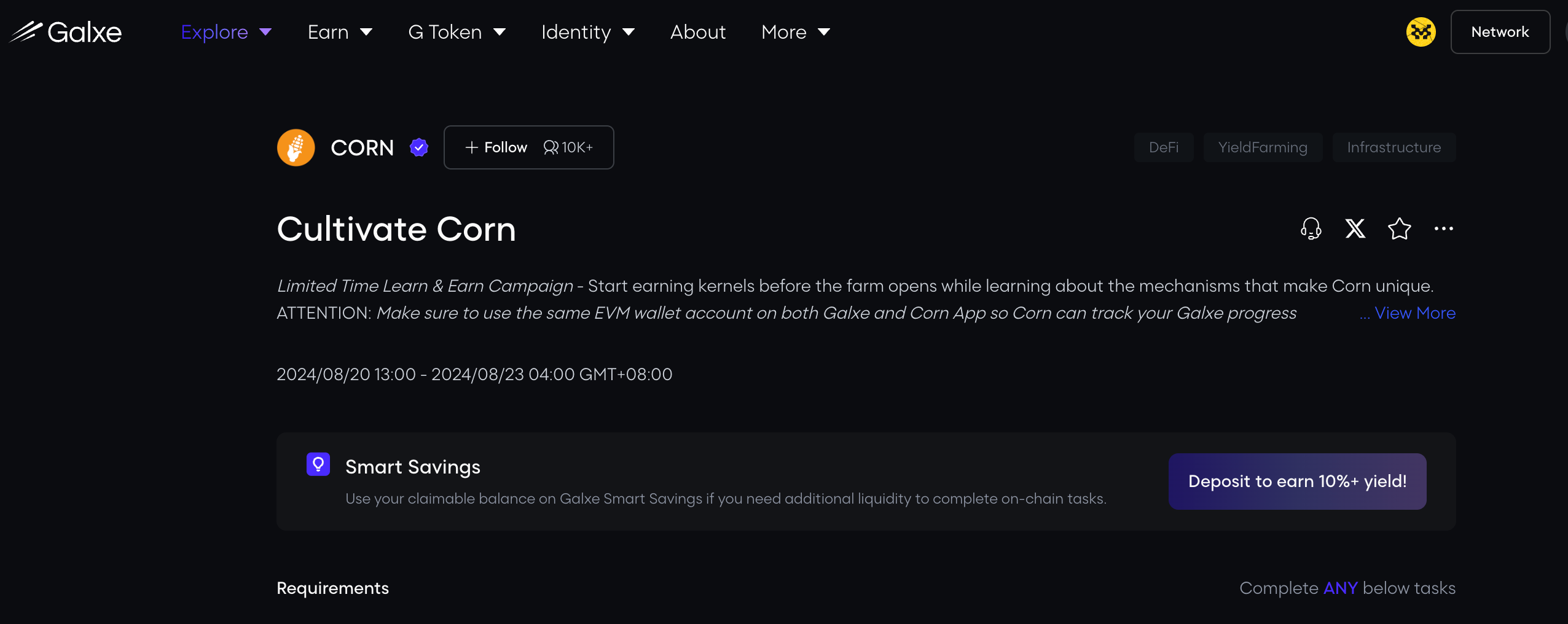

At the same time, Galxe also launched a new website about Corn.Social media campaigns,The duration is from the 20th to the 23rd. Players need to simply follow its Twitter account, like and forward related posts to earn points, and join its DC to obtain Farmer status.

The article comes from the Internet:Corn: Binance Labs participates in the first Ethereum L2 to use Bitcoin as Gas

相关推荐: Vitalik 新文:不要因为某人“支持加密货币”而决定你的政治立场

Don't just support cryptocurrency itself, but support the underlying goals and the policy impacts it brings. Author: Vitalik Buterin Translator: Xiaobai Navigation Coderworld In the past few years, "cryptocurrency" has become increasingly important in political policies, and various jurisdictions are considering different bills to regulate it.BlockchainParticipants of the event…