Network Effects and Token Economics: The Twin Engines of Web3 Project Growth

Author: chandan

Compiled by: Xiaobai Navigation coderworld

Most successful internet-era companies rely on network effects, the idea that the value of a product increases as the number of users increases.

Many leading companies and startups today benefit from network effects, such as:

-

E-commerce:eBay, Etsy, Amazon, Alibaba

-

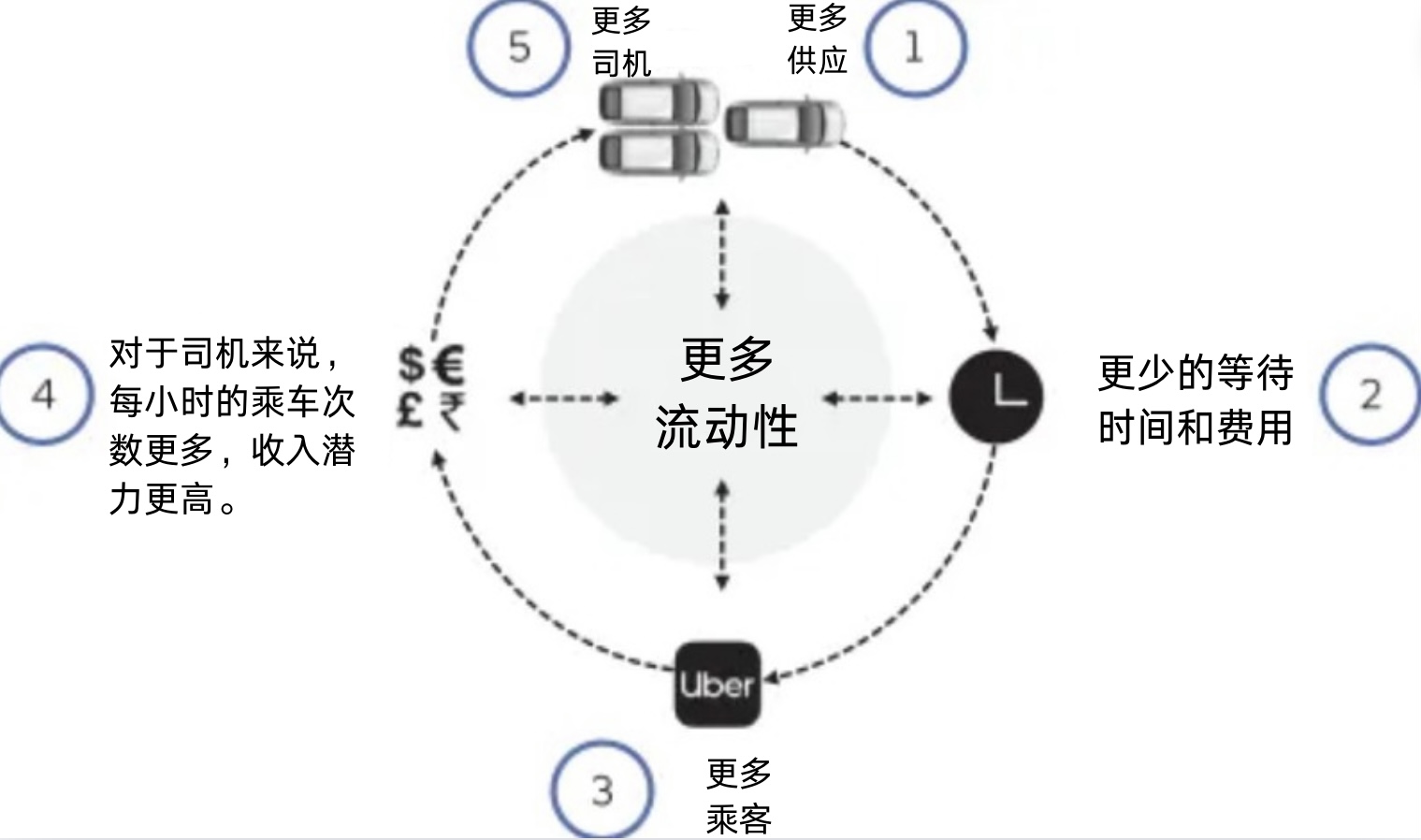

Shared travel:Uber, Lyft

-

Social Media:Facebook, Twitter, Instagram, YouTube

In the Web3 space, network effects and power laws are even more prominent, thanks to composability, open source standards, andTokenWe have seen the network effect manifest itself in many areas of Web3, as follows:

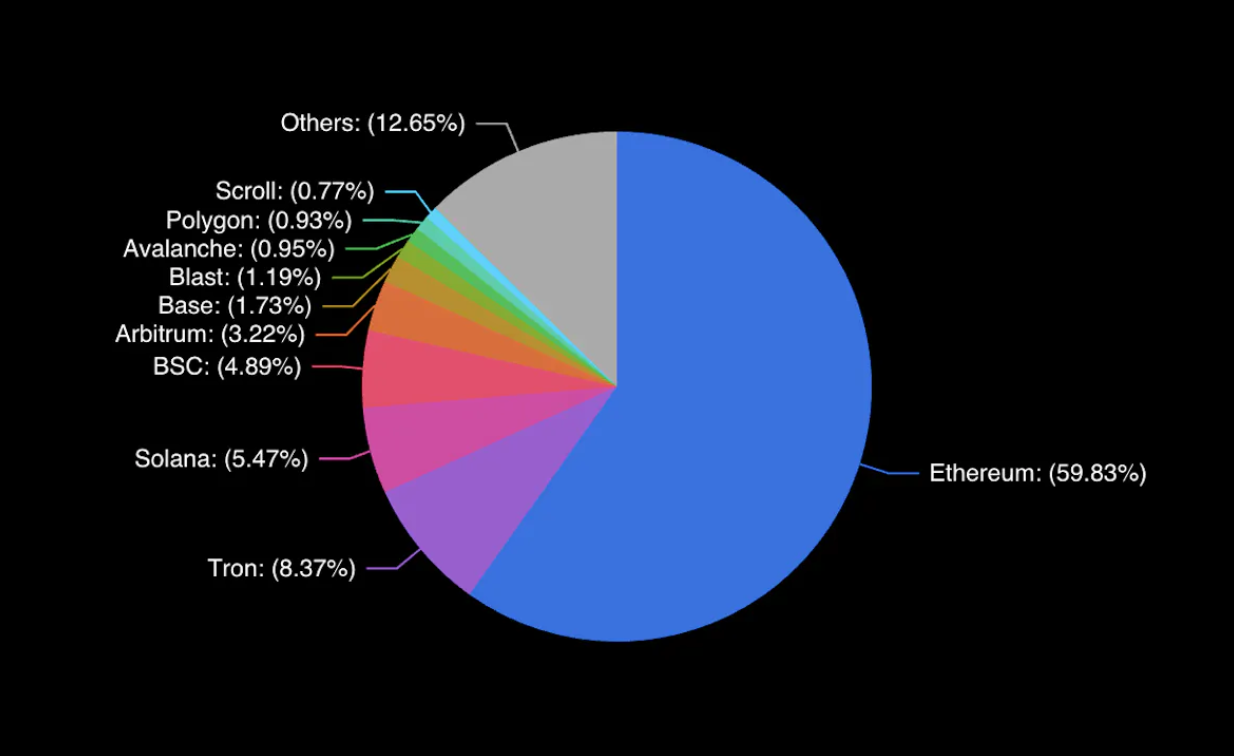

Blockchainlayer

existBlockchainAt the blockchain level, Ethereum, Tron, and Solana account for more than 70% of the total locked value (TVL) market share.

Based on market prices, Bitcoin, Ethereum, and Solana are the most valuableXiaobai NavigationSolana) occupied the market share of 76%.

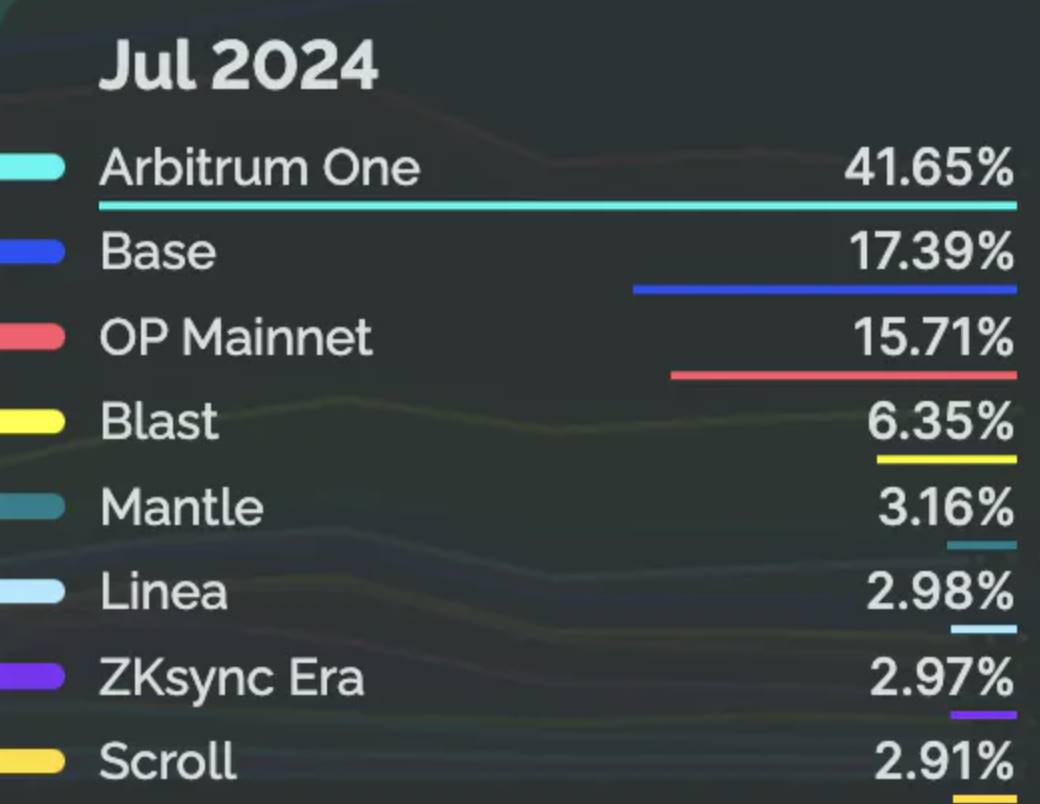

In Ethereum's Layer 2 ecosystem, Arbitrum One, Base and OP Mainnet account for more than 75% of market share.

Application Layer

In the liquid staking market, Lido's market share exceeds 62%.

In decentralizationexchangeIn the (DEX) field, Uniswap and Raydium have a market share of more than 70%.

In the lending market, Aave, Justlend and Spark have a market share of more than 60%.

Similar to many successful companies in the Internet era, many Web3 projects that dominate the market also exhibit two-sided or three-sided network effects, as follows.

BlockchainNetwork Effects

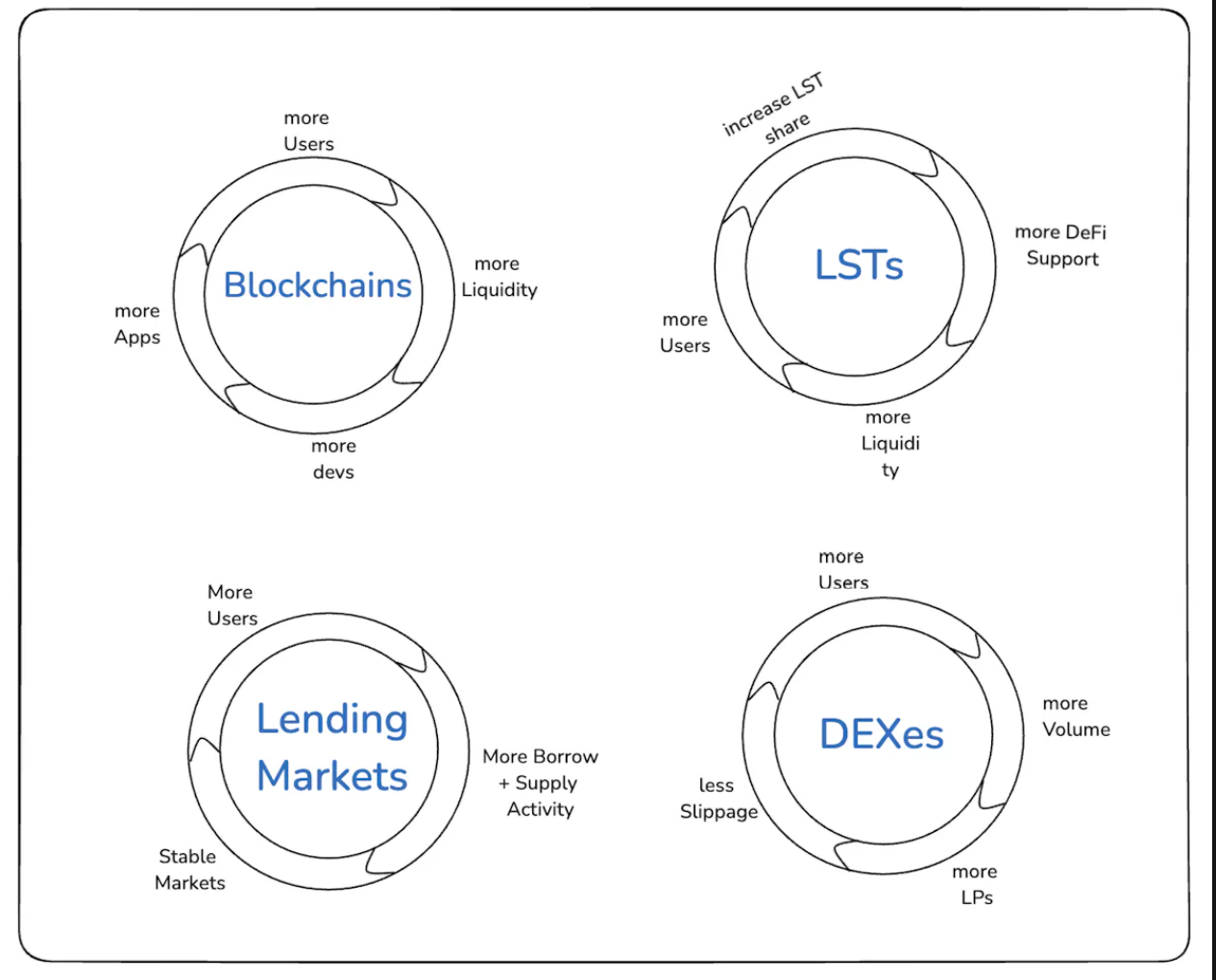

对于区块链而言,用户增加 → 开发者增加 → 应用增加 → 用户进一步增加 → 形成飞轮效应。

For DEX, an increase in users → an increase in trading volume → an increase in liquidity providers (LPs) → a decrease in slippage → a further increase in users → a flywheel effect is formed.

For the lending market, more users → more borrowed/supply assets → improved market stability → more suppliers and borrowers → a flywheel effect.

For Liquidity PledgeToken(LST), when the market share of a certain token increases → more DEX, lending and yield DeFi products begin to support it → make LST more usable → attract new users → increase liquidity → form a flywheel effect.

In Web2, developing products around other companies’ products or APIs can be risky because the main company may close API access and develop the product in-house.

For example:

-

Twitter shut down access to its API.

-

Facebook removed Groups API access.

-

Pebble lost to the Apple Watch.

-

Clubhouse lost to Twitter Spaces.

-

Slack is at risk of losing out to Microsoft Teams.

In Web3, applications are composable and immutable, which allows other projects to build on top of them without having to trust the original team. This creates a larger network effect at scale than Web2.

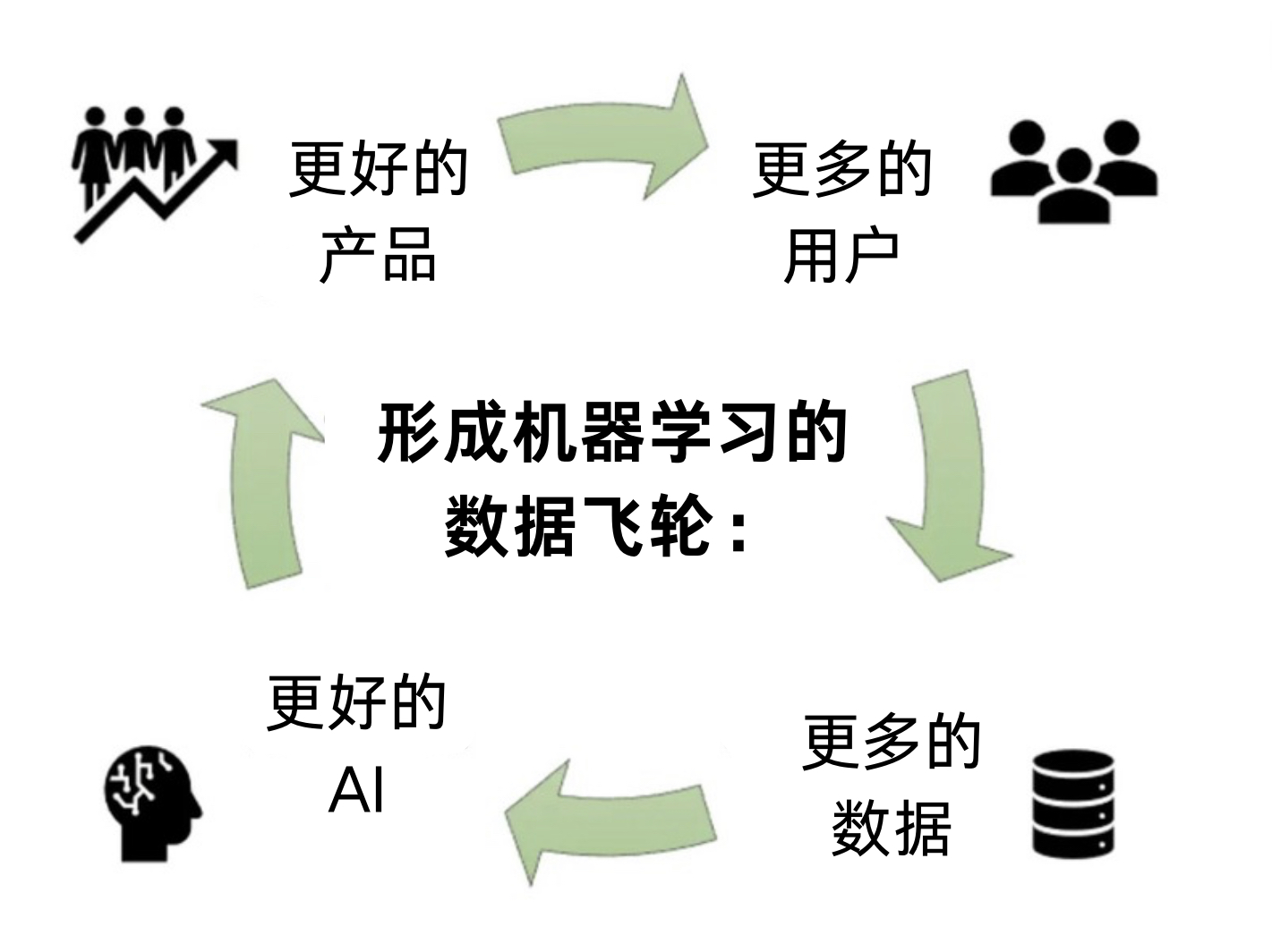

The Importance of Tokens in Creating Network Effects

In Web2, it is difficult for users to leave the system due to economies of scale and broad network effects; however, in Web3, the situation is different:

In Web3, building competitive advantage is challenging because:

-

User data and identities are public, making it easier to build new products and "bleed" existing ones.

-

Switching costs are lower, leading to increased competition.

-

Creating alternatives (forks) becomes easier.

-

Tokens enable projects to address these issues, as well as cold start and supply problems.

When users develop a genuine preference for a platform, it becomes very attractive. In Web3, this preference may stem from owning the platform’s tokens, which enhances the user’s sense of belonging and investment in the platform.

As users grow with a platform or app, their identities become tied to the projects they support. This is particularly evident on Crypto Twitter, where people from different ecosystems passionately defend their projects.

Considerations for builders and investors

-

Which network effects are defensible?

-

Who provides value to the network and who extracts value from the network?

-

Which users can bring strong network effects and quickly expand the network?

-

Do network effects apply to tokens or platforms?

-

Are network effects local or global?

-

Who should be incentivized and who should be charged?

in conclusion

Network effects are critical for any platform to gain a competitive advantage. As important applications are built on top of it, the blockchain becomes indispensable, incentivizing the maintenance and development of the platform or tool.

The article comes from the Internet:Network Effects and Token Economics: The Twin Engines of Web3 Project Growth

随着资本不断流入,加密市场,长期看跌的前景难以支撑。 作者:CRYPTO, DISTILLED 编译:小白导航coderworld 加密货币,像大多数风险资产一样,目前正面临严峻的宏观逆风,导致市场波动性和恐惧感加剧。 尽管面临这些挑战,比特币和区块链的强大价…