"AMM" VS "CLOB": Which of the two trading models is better?

Written by: 0XNATALIE

Recently, Flashbots strategy director Hasu pointed out that on the Solana chain, most of the trading volume is actually completed through automated market makers (AMMs) rather than through central limit order books (CLOBs, or simply order book models). This conclusion is surprising because many people once believed that one of the important reasons for Solana's success in the market was its ability to support CLOBs. As Feng Liu said, "One of the core selling points of Solana was that it could finally run an order book dex on it, and that 'order book trading is the future of dex'."

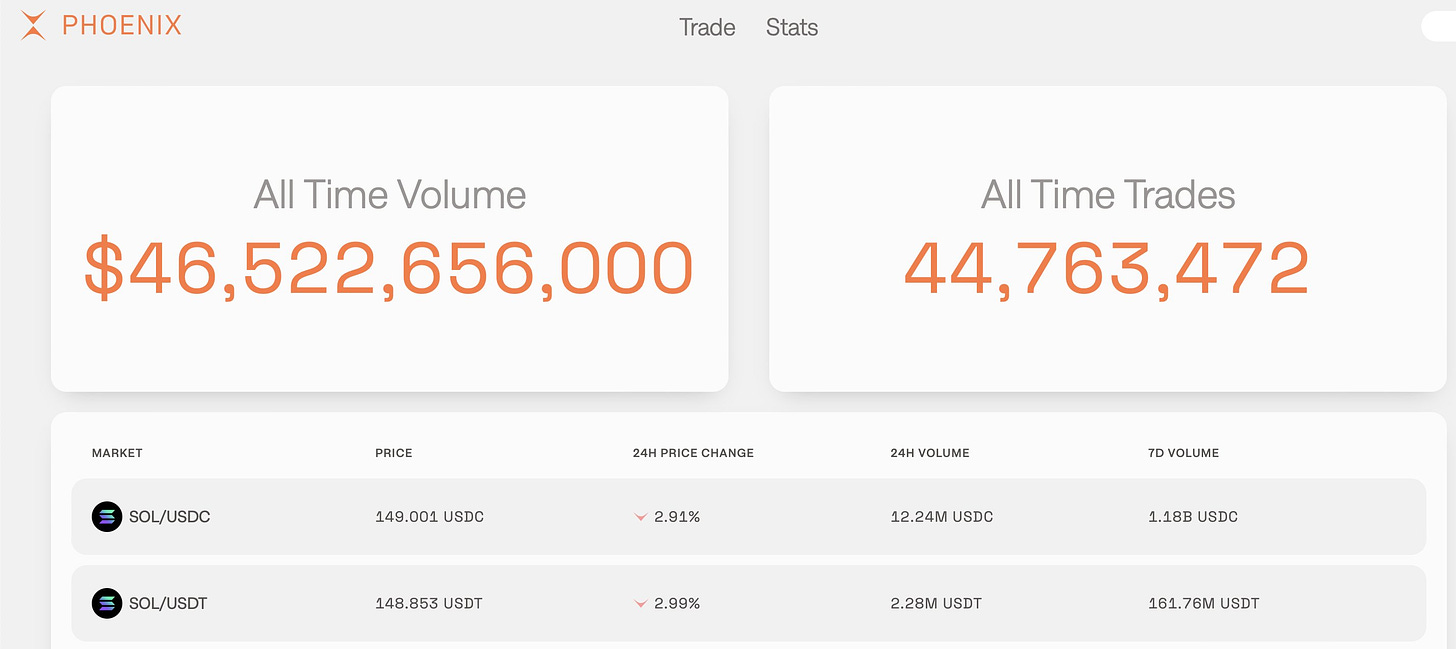

It is worth noting that the debate between AMM and CLOB did not start recently, but has been going on for a long time. Since the DeFi Summer, AMM has quickly become the core of decentralized trading with its algorithm-driven asset pricing method, while CLOB has become the core of decentralized trading due to its integration between traditional finance and centralizedexchangeThe competition has promoted their dominance in variousBlockchainContinuous innovation on the platform. Especially on Solana, which focuses on speed and low cost, Phoenix successfully made CLOB the focus for a time.

Is the reason why AMM dominates the market just because of long-tail assets?

Hasu's discoveryCommunityThis quickly sparked widespread discussion. In this regard, Kyle Samani, partner of Multicoin Capital, explained that in the market of long-tail assets, there is a lack of real market makers (MM) to provide liquidity, and the emergence of AMM has made up for this deficiency, thus forming the current AMM-dominated situation. Solana's success does not only rely on CLOB, but also because it can provide a consistently fast and low-cost trading experience and can provide support for various types of assets. In addition, Solana's no bridging mechanism is also an important factor in its success, because users generally have a negative attitude towards cross-chain bridging.

Udi Wertheimer, founder of Taproot Wizards, also believes that AMM has unique advantages in supporting long-tail assets and can help smallCommunityforXiaobai NavigationLong-tail assets quickly start liquidity. There are a large number of memecoins on Solana, and AMM is a very suitable choice for these assets.

Krane further divides the market into three types: memecoin, major assets (such as SOL/USDC), and stablecoins. He pointed out that AMMs excel in the memecoin market because these assets require good passive liquidity, and CLOBs perform poorly in this regard. For major assets, although CLOBs have a certain position in some cases, AMMs are still competitive. In the stablecoin market, the application of CLOBs has not yet been widely popularized.

However, Doug Colkitt, founder of Ambient, put forward a different view and refuted it with data. He pointed out that many people mistakenly believe that the AMM trading volume on Solana mainly comes from some inactive long-tail assets. However, the data he provided shows that even in major trading pairs (such as SOL/USDC), AMM's trading volume far exceeds CLOB. For example, Orca's trading volume in 24 hours was as high as 250 million US dollars, while Phoenix's trading volume was only 14 million US dollars. Even if the most favorable assumptions for CLOB are adopted (using Phoenix's 7-day average daily trading volume instead of the lower trading volume of the day, and counting CLOB's trading volume as much as possible), AMM's trading volume on major trading pairs is 50% higher than CLOB, and if these assumptions are not adopted, the gap will even widen to 10 times.

社区观点:CLOB 的发展受到BlockchainPerformance Limitations

The reason why AMMs dominate Solana is not just because of long-tail assets, but also becauseBlockchain性能的限制。许多社区成员认为,CLOB 的发展受限于区块链的性能瓶颈。Sam 觉得区块链面临的固有挑战(高延迟、Gas 费高、隐私保护不佳等)使得 CLOB 不适合在当前的区块链环境中有效运行。相比之下,AMM 更能适应区块链的特点,尤其是在价格发现和流动性提供方面。

Enzo holds a similar view, believing that CLOB faces limitations of high latency, expensive gas fees, and low throughput on Layer 1, but these limitations can be overcome in Layer 2 solutions, making CLOB more competitive in these environments. On the current Layer 1 chain, AMM is still a more practical choice.

In fact, a similar point of view was mentioned in the article "Death, Taxes, and EVM Parallelization" published by Reforge Research in April. The article points out that when implementing CLOB on blockchain platforms such as Ethereum, due to the limitations of platform processing power and speed, it often leads to high latency and high transaction costs. However, with the introduction of parallel EVM, the processing power and efficiency of the network have been greatly improved, the feasibility of CLOB has also increased, and DeFi activities are expected to increase significantly.

The article comes from the Internet:"AMM" VS "CLOB": Which of the two trading models is better?

相关推荐: 币安研究院 CPI 指数分析:9 月美国降息可能性增加

The probability of a rate cut in September rose to more than 80% after the data was released. Written by: Xiaobai Navigation Coderworld In the cryptocurrency circle, understanding macroeconomic data is a must for leeks. Binance Research Institute just released an interpretation of the recently released CPI index, analyzing the definition, impact and future development of the CPI index through a picture. Xiaobai Navigation Coderwor…