Focus on long-term value: How should crypto projects navigate narrative ups and downs?

Written by: Kyrian Alex

Compiled by: TechFlow

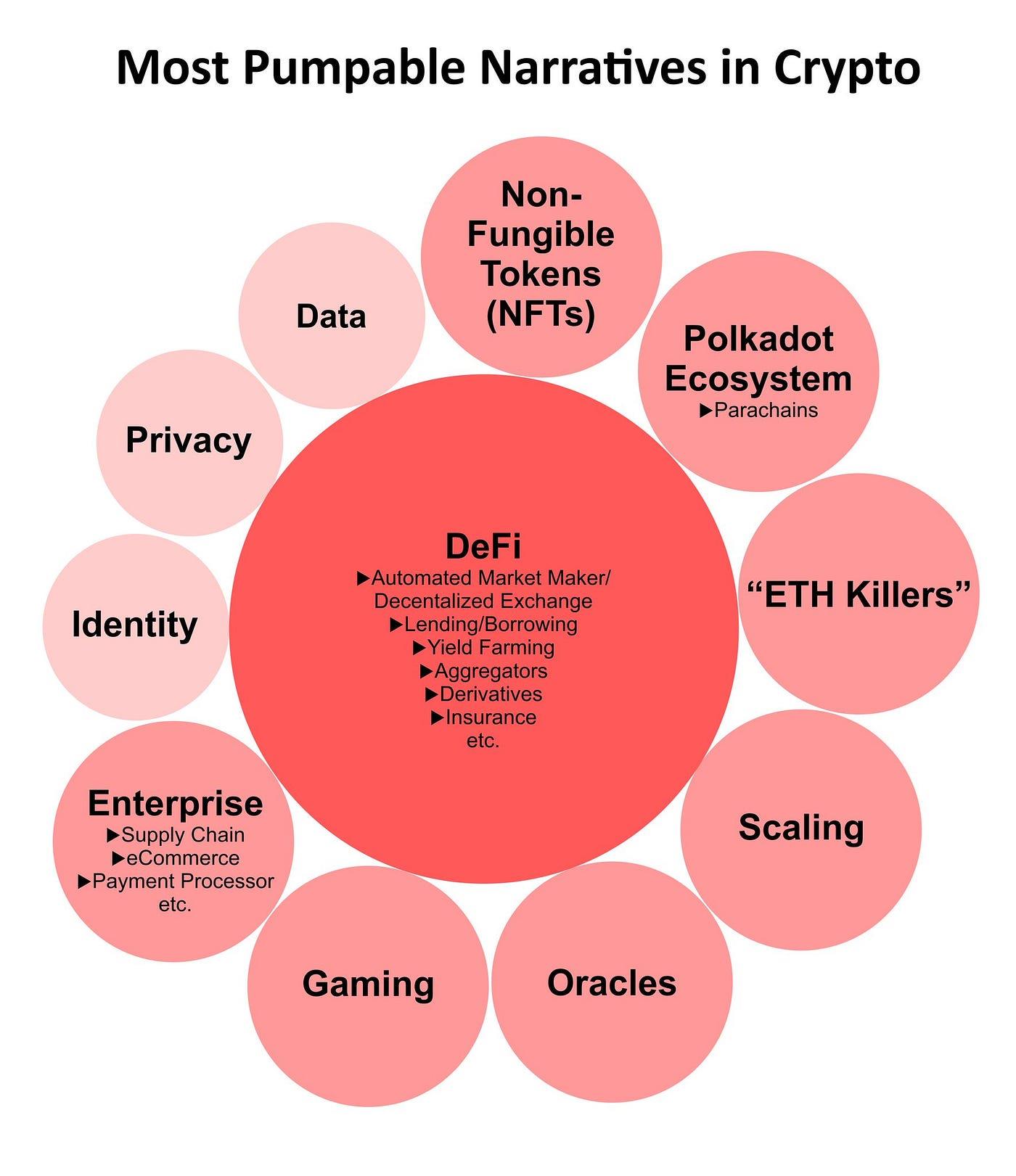

existBlockchainAcross the space, narratives have consistently proven to be a powerful driver of attention, investment, and growth. The ever-changing landscape has seen the rise and fall of a variety of themes, from ICOs to DeFi and NFTs, leaving behind important lessons for investors, founders, and enthusiasts.

通过从首次代币发行(ICO)到发射平台的转变,可以观察到叙事的演变。2017 年的 ICO 热潮承诺了风险投资的革命,但许多项目未能保持他们的势头。随着行业的成熟,注意力转向更精细的投资机制,交易所引领了发射平台的趋势。这些叙事转变凸显了 Web3 空间的动态特性,其中趋势迅速出现、达到高峰,然后逐渐消退。

叙事就像潮汐般席卷整个加密货币领域,将曾经默默无闻的概念推到了关注的前沿。让我们看一些最近的案例,以说明这种现象。

首先,我们经历了比特币 DeFi。比特币通常不与实验联系在一起,但引入了 Ordinals,通过独特的标识符代表比特币,为复杂的 DeFi 应用打开了大门。建立在 Ordinals 上的 BRC-20 代币旨在通过独特特征模仿 ERC-20 代币的可替代性,潜在地为比特币上的 DeFi 铺平了道路,包括部分所有权、智能合约、去中心化交易所、借贷平台和保险平台。但正如我们经常说的,加密货币社区的注意力持续时间甚至不到两个月。只有最早的用户/开发者真正从中获利。

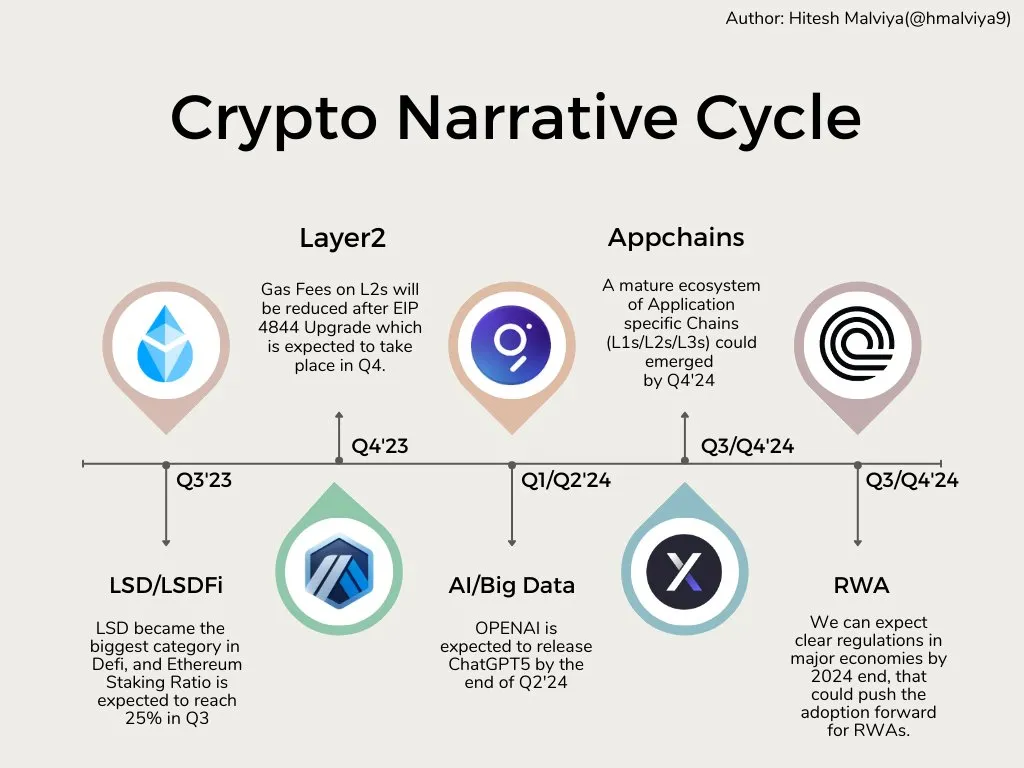

Then we had the LSD-Fi craze. LSDs dominated the DeFi space due to Ethereum's transition to PoS. It provided users with staking rewards without locking up assets, and LSDfi protocols like Lybra Finance and Pendle Finance built on this concept to expand the ecosystem by increasing liquidity and reducing risk. The annualized yield soared. But guess what? After the initial speculators entered, the annualized yield dropped sharply, and the hype faded.

We saw the same thing with the Memecoin craze. Tokens like $PEPE and $BEN surged on social media, the popularity of NFTs, and the desire for quick profits. Even though people knew these tokens were risky and highly volatile, they just wanted to make 100x in the shortest possible time. The hype was due to the relative ease of buying and the potential for good profits in a stagnant market. Well, like all meme seasons known to man, the hype ended abruptly with a slew of scandals, scams, hacks, and pushback.

哦,我们怎么能忘记由于最近 Chatgpt 的人工智能的流行而引起的 AI 币炒作呢?是什么推动了炒作?是进展的猜测?是变革潜力?还是投机性的改头换面?

Or can we forget the so-called VR revolution? Rumors about Apple VR headsets and Meta’s makeover sparked interest and speculation about the Metaverse. Tokens like Decentraland (MANA), The Sandbox (SAND), Axie Infinity (AXS), and Render Network (RNDR) have gained many times over amidst these rumors. Old players have profited, and newcomers have lost.

Narratives have their limitations.

They can bring a subject to the forefront, but they cannot guarantee long-term success.As a result, founders are often faced with a dilemma: the challenge of getting the timing right within a fluctuating narrative cycle.

Note that most of the projects I mentioned earlier were very good projects, but the narrative that drove their price and popularity ended up hurting them. Therefore, founders try to live with the fact that they are earning enough revenue/profit to cover operating costs during a down market. Because even a bear market can expose the fragility of projects that were caught up in the attention frenzy, leading to a reduced user base and weakened market prospects.

The Web3 investment space resembles uncharted territory, where pioneers must rely on a mix of foresight and calculated risk.

For founders navigating the Web3 landscape, several survival strategies have emerged:

-

Understanding the narrative: It is critical to distinguish between investor-driven narratives and themes with deep potential. Founders should determine whether they are getting in early on a narrative or riding the wave of an existing narrative.

-

Early Action: Early mover advantage often means months of investor education and persuasion. This double-edged sword is both a boon and a challenge for founders seeking support and investment.

-

Flexible survival: Survival in an environment where many of your peers are likely to fail is a remarkable achievement in itself. Prudent financial management designed to weather the storm may be the key to long-term success.

-

Consumer concerns take precedence over capital: Prioritizing user engagement and iterating on your product based on consumer feedback before seeking investor capital is a smart strategy. Meeting consumer needs promotes more sustainable organic growth.

-

Identifying the Right Moment: Timing is critical; entering a collapsing theme or misinterpreting a short-term price rally as genuine consumer demand can lead to challenges in obtaining follow-on funding support.

The Dichotomy of DeFi

Once touted as a beacon of innovation, DeFi has now moved from inflated expectations to a more pragmatic stage of enlightenment. Despite the decrease in attention and usage, the potential user base remains relatively stable, indicating that many users are still actively engaged in the space.

This dichotomy raises a key question: Can DeFi maintain its relevance outside of the volatility of market narratives?

The answer depends on the ability of the DeFi ecosystem to address the challenges that emerged during the initial hype phase. This includes addressing high transaction fees, network congestion, andSafetyVulnerabilities and other issues.

We must then turn our focus to tangible practicality and real-world use cases.

DeFi projects that can demonstrate concrete value propositions, solve real problems, and provide sustainable financial products are likely to find a more stable footing. A balance needs to be struck between innovation and compliance. We must shift the transition from speculative trading tokens to products that provide real financial services.

The current emphasis on ownership and exclusivity in the Web3 ecosystem can be compared to free content access in the early days of the Internet. The shift toward ownership comes at a cost, both in terms of monetary investment and user engagement.

Emerging topics such as DeFi, NFTs, and Web3 games continue to be unfolding stories, each with its own unique trajectory. The shift from relying solely on investor capital to facilitating consumer engagement is a critical shift that founders must embrace. It is no longer enough to chase trends, founders must build products that solve real needs and provide real value.

In seeking to create value while retaining user attention, models that combine a “free” experience and ownership (like Reddit) offer a potential path forward.

In the Web3 investment space, a new paradigm is emerging, one that places a higher value on sustainability, user engagement, and meaningful differentiation. Unlike the frenzied ICO era, investors are now scrutinizing projects’ long-term viability and their ability to withstand market volatility — caused by rising market rates and drying up liquidity. The concept of “survival of the fittest” applies not only to the projects themselves, but also to investors and entrepreneurs who adapt and evolve with the tide of change.

As the Web3 investment space continues to evolve, the challenge lies in striking a delicate balance between risk and reward. Correctly timing investments within narrative cycles, understanding a project’s intrinsic value beyond speculative hype, and fostering user engagement are the cornerstones of success. Investors, founders, and enthusiasts must navigate this complex space with long-term potential in mind, by learning from past experiences and commitment to a more sustainable future.

in conclusion

The Web3 investment space is a complex landscape of narrative, attention, capital, and survival. It is a space where trends rise and fall, and hype can both propel projects forward and extinguish them. The definition of success depends on a combination of foresight and adaptability. As the industry matures, the focus should shift from short-term price action to long-term value creation. The path ahead requires a strategic approach. As such, builders, creators, and users alike should understand the changing dynamics and remain steadfast in their commitment to innovations that stand the test of time.

The article comes from the Internet:Focus on long-term value: How should crypto projects navigate narrative ups and downs?