A brief history of airdrops and anti-witch strategies: On the tradition and future of the culture of masturbation

Written by: DefiOasis

Introduction:This is an airdrop/brief history of the game that every fan of the game should read.It is also a very interesting popular science article about petting.

Only by understanding the history of a field can we better "know ourselves and know our enemies, so that we can fight a hundred battles without danger."

Origin of the airdrop

"Getting rewards at almost zero cost." "Money is not earned, it is blown by the wind." These are the voices left by airdrop players on social media in recent years. This kind of freeloading is already common in the early years of Web2's strategy of burning money to subsidize users - price war. But in comparison, Web3's "subsidy" model of directly giving money is more eye-catching. After the emergence of airdrop wealth myths such as ENS and DYDX, the entire Web3 circle has fallen into the "gold rush" of airdrops.

The earliest Web3 airdrop can be traced back to a programmer named Baldur Friggjar Odinsson.He launched AuroraCoin in 2014 and airdropped 31.8 tokens to each of Iceland’s 330,000 citizens.

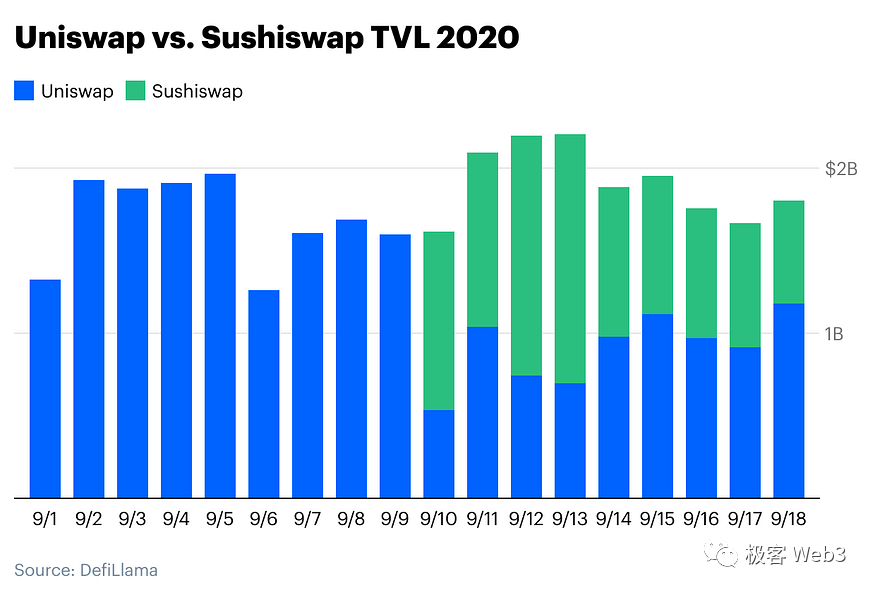

butMost people recognize that Uniswap is the originator of airdrops。为了应对 Sushiswap 的吸血鬼攻击,Uniswap 项目方向每个地址都空投了至少 400 枚 UNI,最低也超过 1000 美元。亲眼目睹了 Uniswap 空投的引流效应后,1inch、Lon 等各大项目方都争相模仿,某种程度上催化了 2020 年的 Defi 之夏。在 Web3、DAO 等名词逐渐火热后,空投成为了各大项目方在去中心化方面约定俗成的传统,甚至称其为BlockchainThe unique culture of the circle is not an exaggeration.

有趣的是,发放空投的项目方可以分为「VC 项目」和「社区项目」两类,本文重点分析的是 VC 项目。

Several major functions of airdrop

1. Promotional marketing

In the past two years, airdrops have become a must-have for most projects. A good airdrop event can instantly expand the influence of a project, and for the coin flippers, airdrops are the source of their good impression of the project; the coin flippers spontaneously "show off" their achievements on social media, which invisibly creates a "chain reaction" and further intensifies the public's attention to the project.

Many project parties hope to create a circle effect through airdrop activities, attract a group of new users and establish stronger stickiness with early users. In tracks such as DeFi and NFT, airdrop distribution is also one of the ways for many project parties to seize market share and launch a "vampire attack" on competitors.

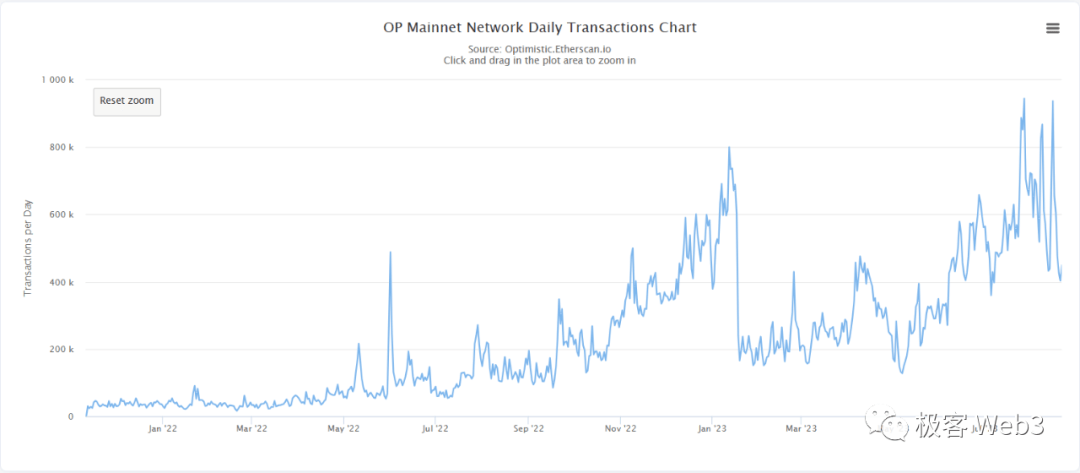

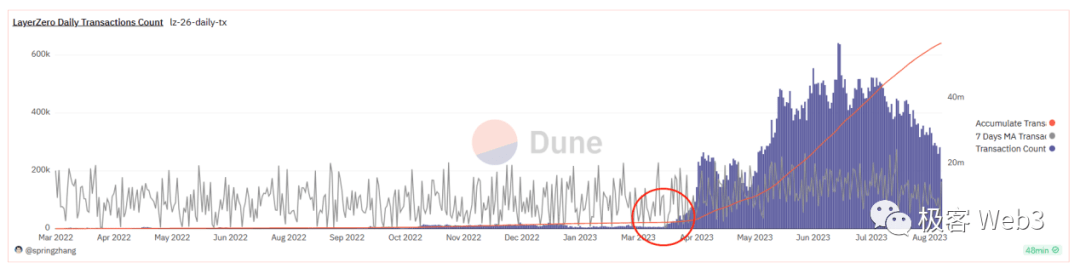

(The number of daily transactions on the OP chain has remained high for a long time after the airdrop)

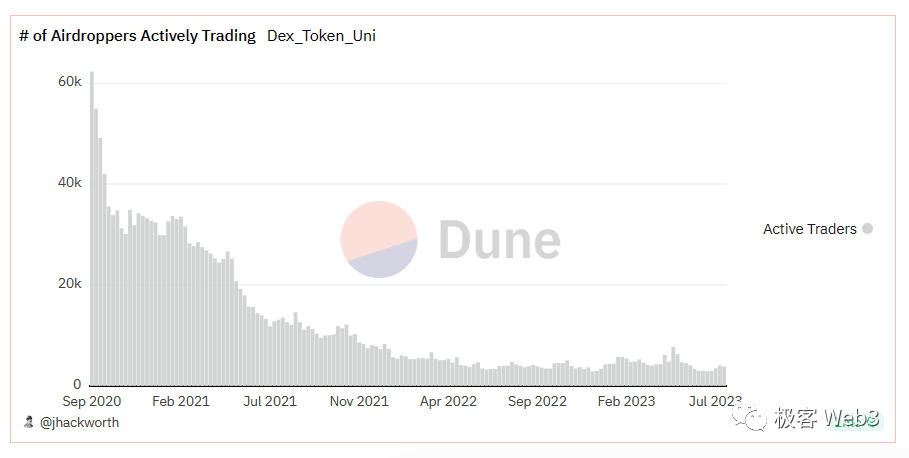

While airdrops can attract new users, there is also some evidence that they do not actually help user loyalty. According to the Uniswap data dashboard created by Dune user @jhackworth,Only the 6.2% airdrop address still holds UNI.The addresses that received the UNI airdrop and have remained active every week account for less than 2% of Uniswap's weekly active addresses and only 1% of trading volume.

Although the decline in the above ratio may be related to the growth of users without airdrops, the continued decline in weekly activity of addresses with airdrops (as shown in the above figure) actually reflects that the UNI airdrop’s impact on user stickiness is not as strong as expected.

2. Decentralization of chips

After completing early development, many project parties tend to transfer part of the governance rights and responsibilities and create DAO organizations to achieve decentralization. Most POS public chains often have stronger chip decentralization requirements than Defi projects, so they usually transfer part of the tokens through airdrops or public offerings.

In order to reduce the concentration of token shares in early VCs and project parties themselves, most projects will distribute part of the tokens to the community or early users, and community members can help redistribute the chips to further disperse them into the hands of more people.

Game between the Mao party and the project party

1. Witch Hunt – A Game of Cat and Mouse

女巫攻击(Sybil Attack)最早由微软研究学院 JohnR.Douceur 在 2002 年提出,源自 1973 年的科幻小说《Sybil》,该小说的女主 Sybil Dorsett 患有兼具 16 种人格的分离性身份认同障碍。在互联网世界中,A Sybil attack is a process of creating many fake identities/accounts, pretending to be multiple different entities, in order to gain power and profit.But in fact, the controller behind the scenes is one person.

The phenomenon of witch attacks has existed since the Web1 era.BlockchainThe "no access permission" itself inherently lacks KYC methods, the on-chain addresses have strong anonymity and extremely low costs, making it easier for witch attackers to create a large number of addresses with one "flesh" to obtain multiple airdrop rewards.

Airdrop project owners often hope to deliver rewards to users and reach a consensus on interests. Although short-term free-to-air activities can provide project owners with impressive user data, the witch addresses cash out after receiving rewards and become inactive after a "wave of activity", which is obviously contrary to the vision of major project owners.

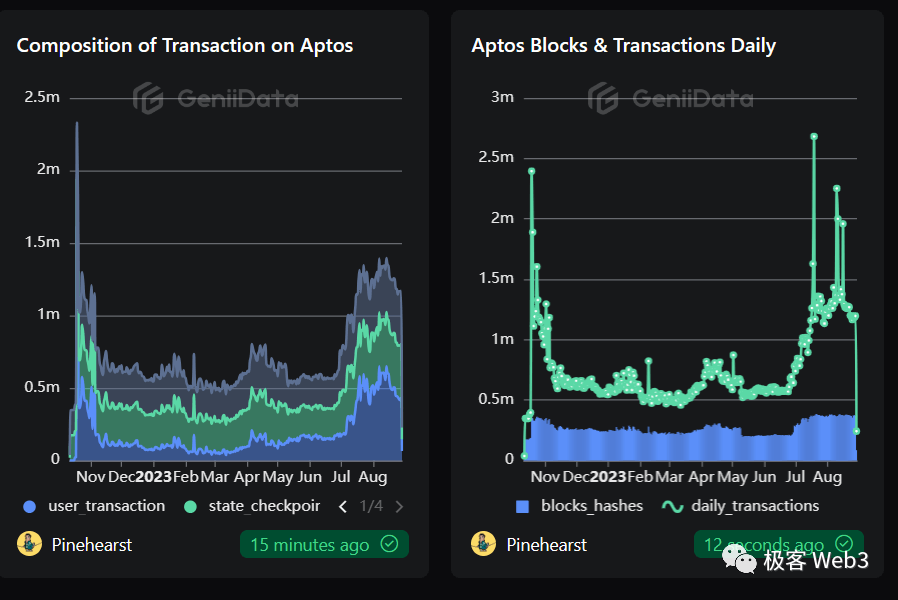

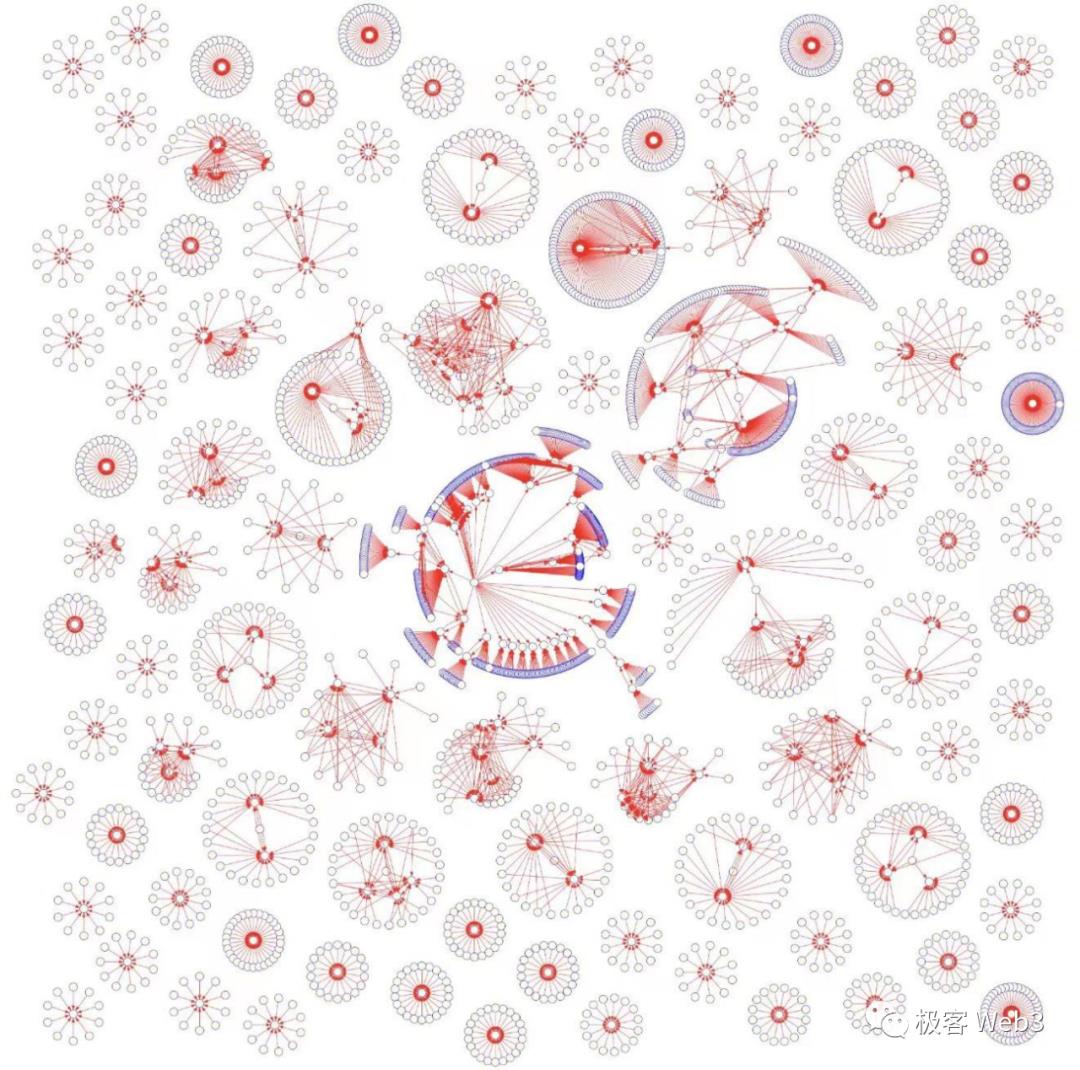

(Aptos, which did not implement anti-sybil censorship, saw the number of on-chain transactions peak briefly when the airdrop was issued, and then remained sluggish for a long time)

Therefore, a "witch hunt" specifically targeting attackers is imperative, and there are many ways to deal with witch attacks:

On-chain behavior review:该方法主要是以链上数据分析为主,通过地址间的资金关联(资金分发或归集、转账关联性)、链上行为相似度(交互的智能合约、交易间隔、交易时间、活跃时间段等)对链上地址进行筛选,这也是最常见的审查方法。

Depending on the tolerance of the project party, the upper limit of associated addresses is generally 10-20.Some project owners will also delegate the review power to the community and reward the confiscated witch airdrop shares to anti-witch contributors.Community members are encouraged to actively report Sybil addresses. The most typical examples in this regard are Hop Protocol and Connext. However, as the saying goes, “the higher the virtue, the higher the evil”. Airdrop hunters are also constantly improving their professionalism. Such advanced players often take substantial precautions.

(One of the reports given by the Connext community based on the results of the contributors’ reports on the Sybil addresses on the chain)

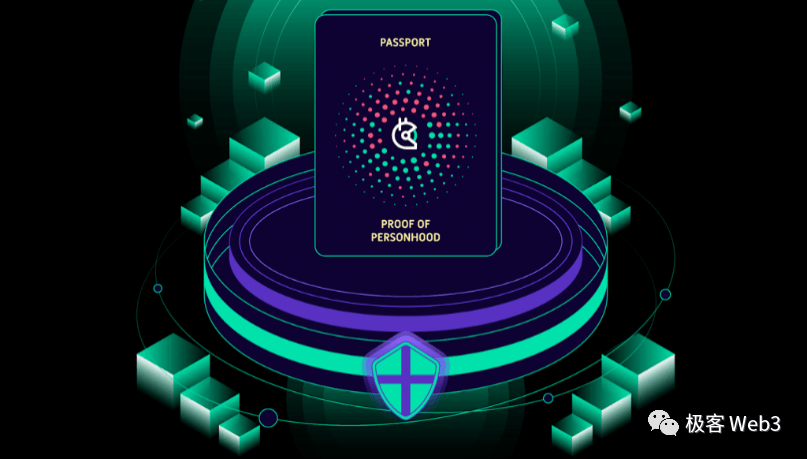

Reputation Rating:Reputation scores generally examine users’ activity records on different chains (such as on-chain activity, transaction volume, gas consumed, etc.), identity authentication built on well-known applications (ENS, Lens, etc.), whether they participate in on-chain governance (Snapshot, Tally, etc.), NFT collection footprints, etc., and use multi-dimensional indicators to analyze the creditworthiness of an on-chain address and whether it is controlled by a robot.

This method is mainlyIdentifying Sybil Addresses by Reputation Scores, greatly raising the cost of Sybil attackers to commit evil (the principle is a bit like Proof of Work). Gitcoin Passport, Phi, Nomis, etc. are representatives of reputation scoring projects. However, some reputation classification platforms have smuggled behavior, and will grant users who use their own products a higher score weight. In order to win over big users, they will even set higher capital requirements, or require users to upload Twitter, Google, Facebook and other Web2 account information to prove the entity identity of the "person" behind them.

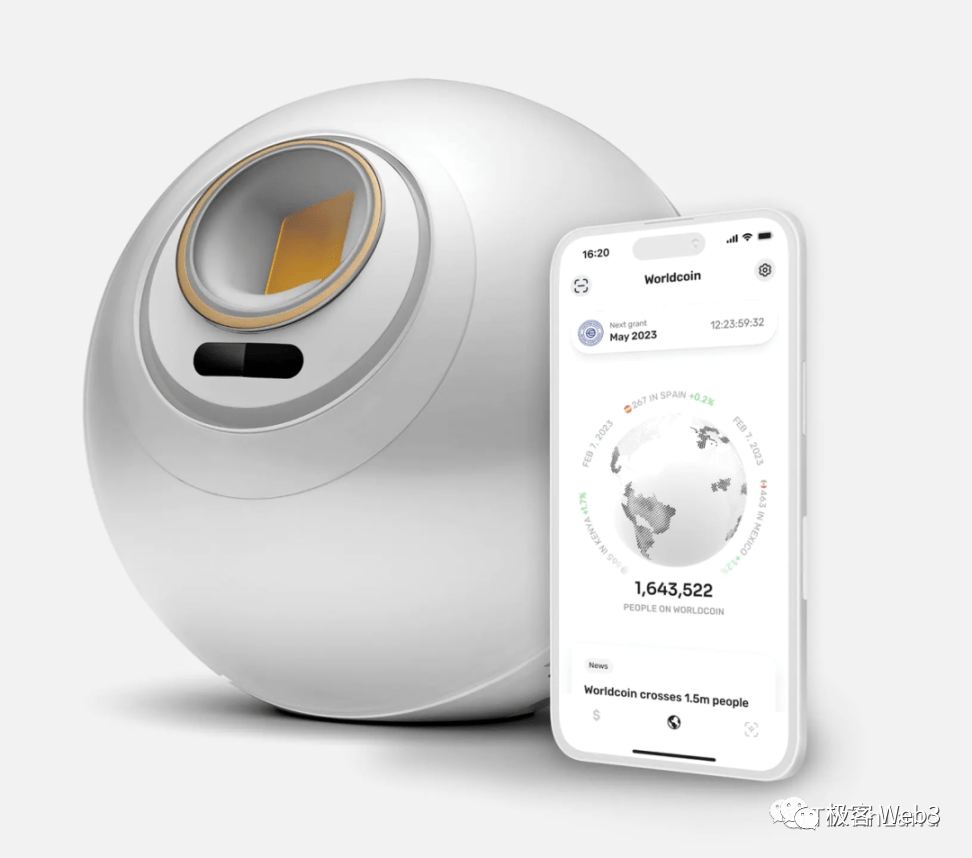

Biometric verification:Personal biometrics are unique and unchangeable. Everyone's iris, fingerprints, and facial features are unique and difficult to forge. For airdrop project owners, biometric verification can ensure that most of the distributed rewards belong to real users, but this verification is inefficient. Judging from the controversy caused by Worldcoin's iris authentication and Sei's facial scanning, the collection of user biometric information by project owners will also cause privacy leaks and legal risks in different countries and regions.

此外,上传所属国家或地区的公民身份信息(驾照、护照、身份证)的 KYC 认证、灵魂绑定 Token SBT、通过线下或线上的当面验证颁发的 Poap、Proof of human 也是主流的反女巫手段。

In fact, taking reasonable witch-hunting actions to clean up witch users can ensure the fairness of the reward distribution mechanism. However, overly strict witch-hunting may accidentally hurt real users, and delegating witch-hunting authority to the community may also destroy the feelings between community members and aggravate conflicts between people.

But no matter which anti-sybil method is used, it is unrealistic to completely filter out illegal users. When the potential benefits are higher than the cost of doing evil, sybil attacks are inevitable (POW and POS cannot stop sybil nodes, they can only curb such behavior to the greatest extent), and this cat-and-mouse game is difficult to stop.

2. When one suffers, all suffer; when one prospers, all prosper.

On the surface, there is a game relationship between the project party and the users. The opposition between the two is not only reflected in witches and anti-witches, but sometimes the project party will also hint at airdrops, launch Odyssey missions and other "manage airdrop expectations" activities to PUA users to participate in the interaction. Without knowing whether there are airdrops and the specific rules for airdrop allocation, the wool-pulling party takes the risk of paying costs and losing all their money to participate in the interaction, forcing the project party to provide airdrops to users, give out whitelist distribution and other rights.

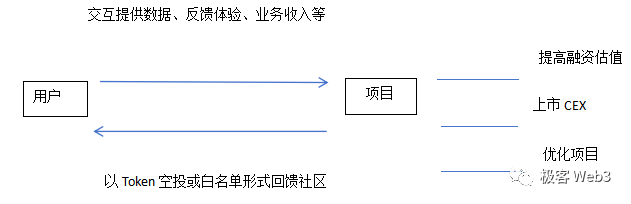

Although there are various game relationships between the project owners and the wool party, under the surface, the two are in a mutually parasitic and mutually beneficial relationship.The behavior of stealing money is an important part of the active data on the project chain, and can find various bugs in the project at an early stage, promote the optimization of product experience, which is equivalent to doing stress testing (OP and ARB both had performance problems when airdropped), and also bring business income to the project. In the Web3 circle that has always relied on the wealth-making effect, many projects can only rely on "raising wool parties" to survive the long bear market. And most project parties also need wool parties to contribute data to increase valuations or go online on CEX.

On the other hand, the wool party can also receive Token airdrops in the future, and the two together build a "False prosperity".

Changes to Airdrop Policy

1. The history of the airdrop initiator

The story of the project's airdrop history can be told from Uniswap. In the DeFi track where liquidity is king, DeFi projects led by Sushi "sucked blood" from Uniswap in the DeFi Summer of 2020 through liquidity mining incentives and seized a lot of user shares and locked funds (up to 1.2 billion US dollars). Under this premise,Under pressure, Uniswap issued a large number of UNI airdrops to users unprecedentedly and launched a liquidity mining plan.Attract users to return and regain the leading position in DEX, and maintain the leading position to date.

(Sushi launched a vampire attack in 2020 and seized market share from Uniswap)

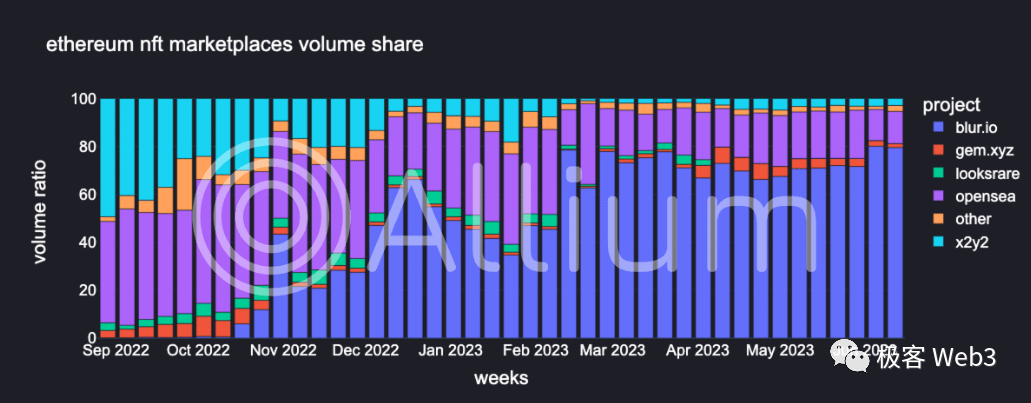

Nowadays, airdrops have become one of the conventional weapons to compete with competitors in the same track to grab users and launch "vampire attacks". Project parties have also come up with various tricks to retain users. In the fiercely competitive Layer2 track, OP has conducted multiple rounds of airdrops to users to put pressure on competitors. However, in the past two years, the "vampire attacks" related to airdrops have become more obvious in the NFT field. Before the emergence of Blur, which maximizes the release of NFT liquidity,Several NFT trading platforms such as LooksRare and X2Y2 have tried to capture users through airdrops, but these products themselves lack differentiated advantages.After the expected returns gradually dried up, users naturally stopped buying into it, and the platform's trading volume and activity dropped significantly. However, OpenSea's position as the big brother remains difficult to shake.

(Blur is gradually eroding the market share advantage established by OpenSea)

This also serves as a good warning for future project owners, that is, the practicality and rigid demand of the project are still the key to user retention. Excellent products are the moat, and airdrops are just a foil to add icing on the cake for the project.

To this day, Uniswap, which has been updated to version V4, is still the benchmark for DEX, and Blur has alleviated the liquidity problem of NFT in the bear market. Optimism, as one of the leading Layer2, provides Ethereum users with a good underlying infrastructure. Although the airdrop brought a short-term popularity, those projects that lacked practicality and rigid demand were eventually buried in the torrent of history.

2. The internal circulation of the wool party

From a light experience where you only need to leave an email address and join the project community, to a deep participation and follow-up on the project to have a chance to get rewards, the airdrop track has changed a lot in just a few years. In the context of few good projects and many users (infinite addresses), the relationship between the project and the users is no longer a dynamic balance, and the initiative has been handed over from the users to the project. The project manipulates the user's expectations of airdrops, and spontaneously or jointly with task platforms such as Galxe, Layer3, and Rabbithole to launch activities such as "Odyssey" to PUA users. From "seeking users" to "users seeking airdrops", the wool party has also developed the "street wisdom" of its own community.

3. Direction is more important than effort

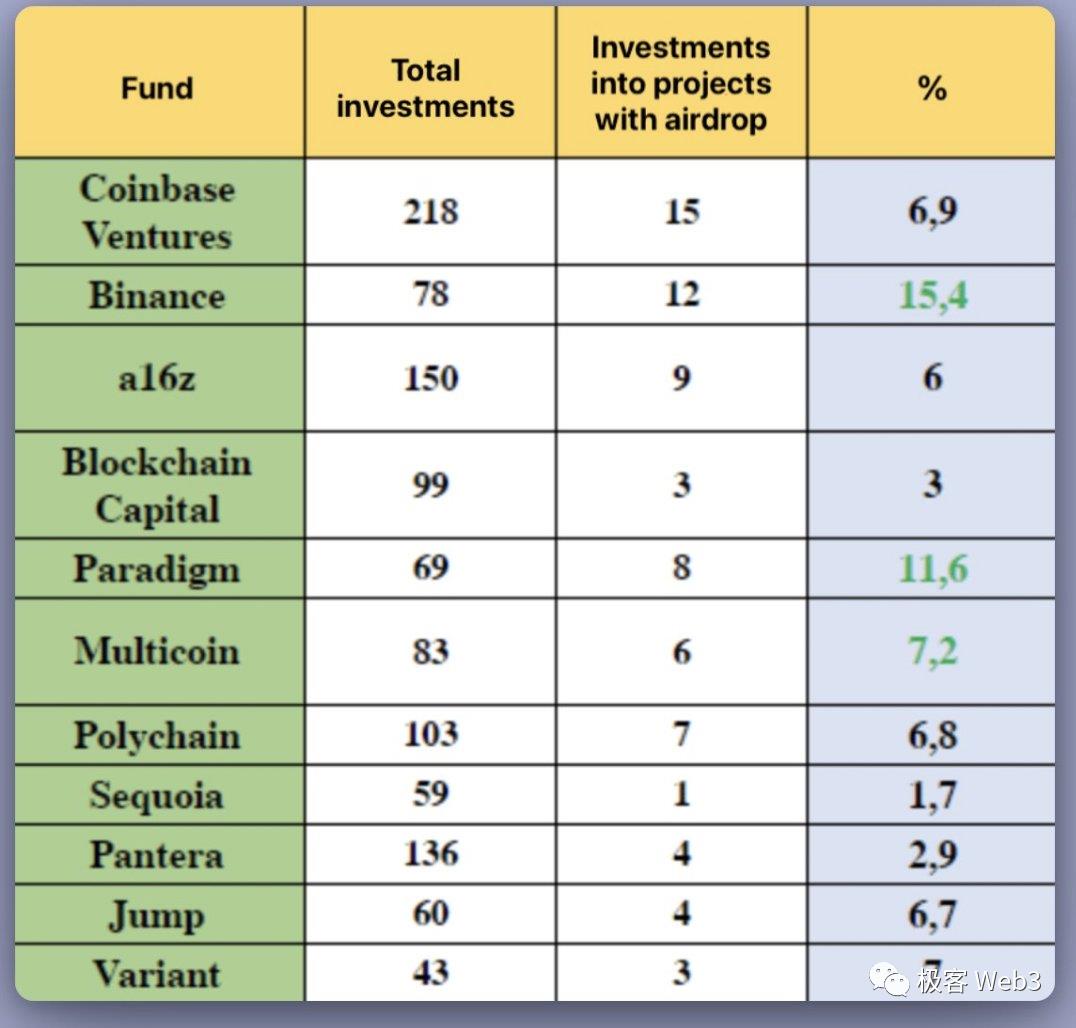

Many freeloaders closely follow projects invested by well-known investment institutions such as A16Z, Paradigm, and Coinbase. On the one hand, they believe that these institutions have unique vision and the market value ceiling of tokens issued in the future will be higher. On the other hand, projects invested by well-known large institutions have a good probability of airdrops.

According to the data summary of airdrop blogger @ardizor, among well-known investment institutions,Projects invested by Binance, Paradigm, and Multicoin have the highest probability of airdrops.They are 15.4%, 11.6% and 7.2% respectively.

(Source: @ardizor)

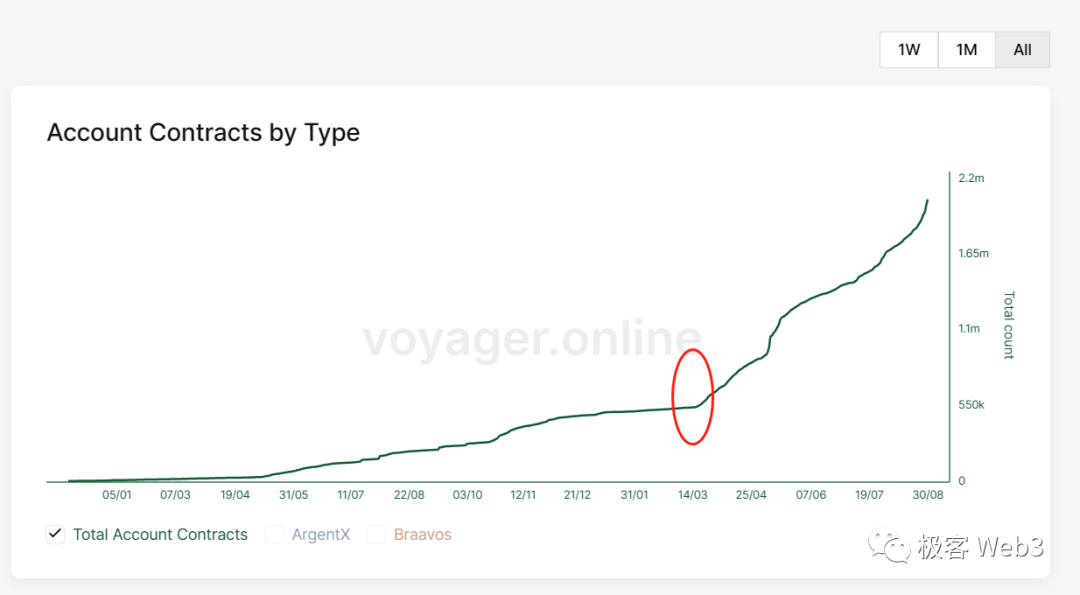

Among projects invested by well-known VCs, the freeloaders also prefer projects with high financing amounts. Large financing projects mean that they have better cash flow and better prospects, and they will be more generous with their airdrops. When a project has the support of well-known VCs and high financing, the odds of airdrops will also increase. The freeloaders will naturally vote with their feet and bet on star projects with large financing amounts that have not issued tokens, such as zkSync, Starknet, Aleo, Aztec and LayerZero.zkSync (about 4 million active addresses), Starknet (about 2 million active addresses) and LayerZero (about 3 million active addresses) are currently the densely populated areas for freeloaders.

(After the Arbitrum airdrop, the number of addresses and daily activity of Layerzero and Starknet, three projects with over $100 million in financing, increased significantly. ZkSyncEra has been growing at a rate of at least 5,000 new active addresses per day since its mainnet launch in March)

4. The harder you work, the luckier you get

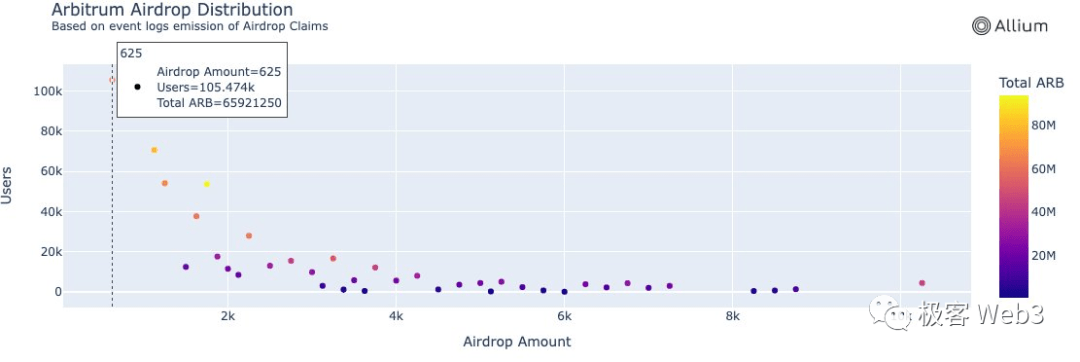

Excluding airdrops with non-fixed shares like Worldcoin, Arbitrum, which airdropped in February this year, has the largest address size at the time of the current snapshot, reaching an astonishing 2.3 million. With more and more freeloaders joining and the airdrop shares fixed, the project needs to reduce the number of users who receive rewards. But instead of increasing the intensity of Sybil censorship and gaining a bad reputation in the community, it is better to raise the threshold for obtaining, screen high-quality users, and distribute rewards more accurately to user groups. This is also a common practice for project airdrops today.

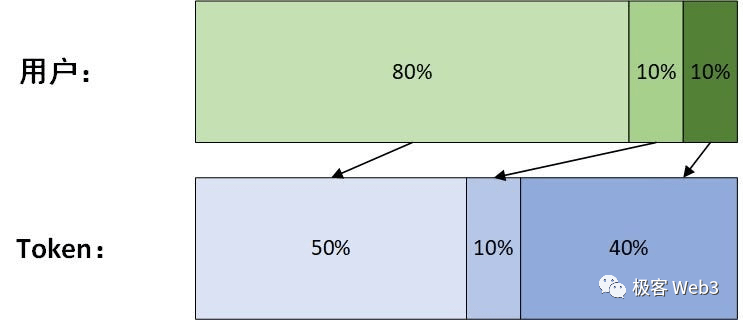

Tiga from W3.Hitchhiker, a quantitative and venture capital firm, discovered the approximate distribution pattern of the project’s airdrops:

Starting reward: Users of rank 0%-80% will be allocated a total of approximately 50% tokens.

Intermediate rewards: Users of rank 80%-90% will be allocated a total of approximately 10% tokens.

Highest reward: The top 10% users will be allocated a total of approximately 40% tokens.

(The 82 rule also exists in airdrops. Source: Tiga, W3.Hitchhiker)

This type of tiered airdrop will better stratify users, distributing most of the token shares to users who meet the threshold, satisfying the desire of the wool party, while also taking care of the large group of people who have made great contributions to the project, and then giving maximum rewards to deep participants. "Everyone gets what they need" and can win a good reputation in their respective group communities.

The current typical method of tiered airdrops is the "airdrop points system", which is generally divided into explicit and implicit points.

Explicit Points System:Mintfun, Blur, Arkham and other projects are representative of this. They have open airdrops but the value of the airdrops is uncertain (part of it can be calculated and estimated through valuation). In essence, they are transaction mining or interactive mining using airdrops as a gimmick. It is also a "Witch attack" tacitly approved by the project party, using the expectation of airdrops to maintain user loyalty.

Implicit Points System:Represented by Connext, Arbitrum, etc., users do not know whether there will be airdrops before interacting with the project. The implicit point system will add points for relatively unpopular interactive links or give multipliers to interactive behaviors that meet specific conditions, and will deduct points for some users' suspected robot behaviors.

As tiered airdrops become more popular, the gap between the smallest airdrop and the largest airdrop is sometimes more than 10 times. If users want to get the largest airdrop, they need to work harder in addition to choosing the right direction. As a result, the term "premium account" for the largest airdrop was born in the airdrop community. This kind of address generally imitates real users by looking for the conditions of airdrops in the same track and type of projects, and by using various random interaction footprints on multiple chains. The wool party predicts the airdrop conditions based on the research of the project, and pretends to be a deeply involved user by predicting that the interaction time and money spent just meet the "full allocation" airdrop.

But whether it is raising the threshold for obtaining rewards or using stricter Sybil reviews, it will ultimately damage the potential benefits of real users.

(The harder you work, the luckier you get: Arbitrum is widening the gap between rewards for light participants and those who contribute significantly to the ecosystem)

Has the airdrop market become a red ocean?

空投受到经济比较一般的第三世界国家 Web3 用户关注,在美元购买力、低成本高赔率的回报和多地址多收益的利益驱动下,大部分空投工作室在这些非发达国家诞生。经历多次重大空投的洗礼后,撸毛工作室不仅有更好的现金流扩大交互规模,而且还在逐渐走向专业化,随机交互脚本、分散且独立的 IP 地址、更严格地规避钱包关联等反反女巫审查手段比比皆是。

(According to Google trends, airdrop keyword searches are concentrated in low- and middle-income developing countries)

Although some studios have closed down due to cash flow and airdrop cycle problems, most mature studios have passed on the risk by selling tools and other services, maintaining thousands of interactive addresses. The huge number of addresses has brought a lot of pressure to the project owners. Some project owners have directly set entry barriers to deal with too many wool parties, such as Lens Protocol. Most projects have chosen to raise the airdrop threshold to counter, which has led to the airdrop track "active witches, zombie users".

In addition, after the Arbitrum airdrop was issued, multiple addresses for a single user became commonplace, and the airdrop circle was spawning an industrial chain, with the emergence of KOLs who wrote airdrop tutorials, identity verification providers for witch attackers, IP isolation and automation script tool suppliers, anti-witch organizations, and even hackers who targeted users, all of which reflected the current maturity of the airdrop track.

(Image source: @0xNingNing)

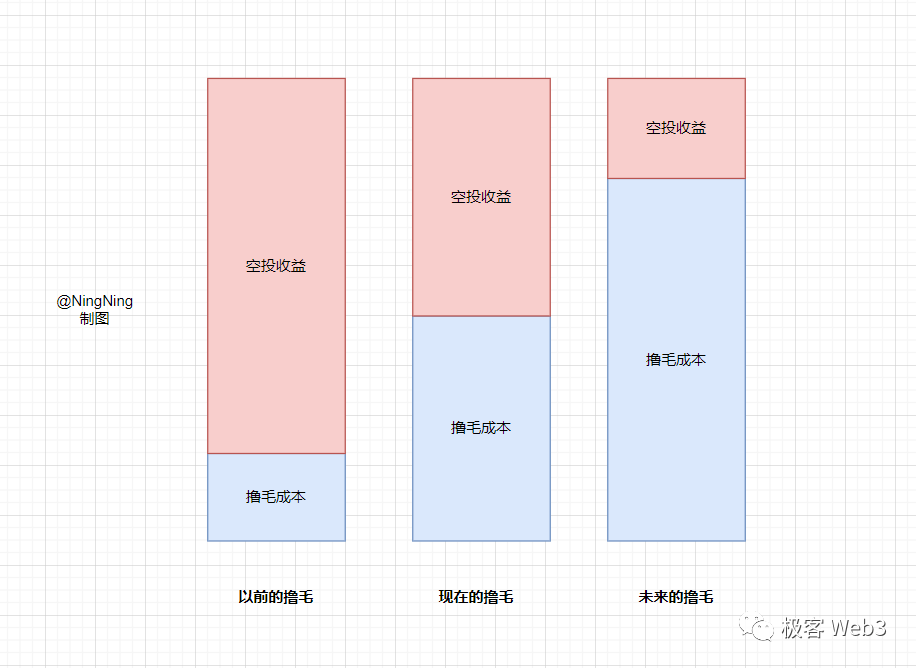

总的来说,空投赛道在早期阶段对于厌恶风险、期望高回报的用户是一个不错赔率的「赌博」,随着空投的内卷加剧,预期收益降低是肯定的。如果用户把牺牲资金流动性以及不确定回报周期的空投视为投资,那么在反撸、女巫和收益锐减的风险下,最终收益有可能不如在熊市期间定投现货。从以往小成本博取高收益到需要一定成本的「套利」,空投史也是加密货币一级市场变迁史的缩写。

在加密货币的历史上看,Coinlist 等诞生百倍币、GamefiXTOEarn 的打金模式等都随着大量羊毛党加入而逐渐冷却,但明眼人都知道高回报模式持续性不会太久,羊毛党不过是加速了生命周期。

The article comes from the Internet:A brief history of airdrops and anti-witch strategies: On the tradition and future of the culture of masturbation