Is there still hope for overturning SAB 121? Biden's crypto policy stance may continue to loosen under pressure

Written by: Weilin, PANews

On July 12, members of the U.S. House of RepresentativescryptocurrencyA vote was held on the relevant resolution of Accounting Bulletin SAB 121, but the result was unsuccessful in overturning the previous veto of SAB 121 by US President Biden.

But then,cryptocurrencyPolicy-friendly lawmakers may continue efforts to break SAB 121 through a new bipartisan bill, the Uniform Treatment for Custodial Assets Act, or may impose budgetary restrictions on the implementation of SAB 121 through the U.S. House of Representatives Appropriations Committee. Meanwhile, an SEC source revealed that some companies and financial institutions have proposed business practices that have been approved by SEC staff to exempt them from the controversial SAB 121.

此外,拜登的高级顾问最近还参加了一场大咖云集的加密货币圆桌会议,释放出更多的积极信号。

US House fails to block Biden's veto of SAB 121

On July 12, members of the U.S. House of Representatives voted on a resolution on cryptocurrency accounting bulletin SAB 121, with a vote of 228 to 184. Since the vote failed to reach the two-thirds majority threshold (290 votes), the U.S. Securities and Exchange Commission (SEC) audit guidance will remain in effect.

In the past year, SAB 121 (Staff Accounting Bulletin No. 121) requires digital asset custodians to treat digital assets as liabilities and list them on their balance sheets at fair value. The cryptocurrency industry is generally concerned that it may prevent banks from keeping digital assets and exclude banks from the crypto market.

In February this year, Republican Senator Mike Flood of Nebraska and Democratic Senator Wiley Nickel of North Carolina proposed a resolution to overturn the proclamation. Subsequently, the House of Representatives passed a measure to overturn SAB 121 in May this year by 228 votes to 182, with Republicans and 21 Democrats supporting the overturning of the bill. A week later, the U.S. Senate passed a resolution to overturn SAB 121 by 60 votes to 38, with several Democrats, including Senate Majority Leader Chuck Schumer, voting in favor.

But then, the resolution to overturn SAB 121 was vetoed by US President Biden.

“The Administration strongly opposes passage of HJ Res. 109, which would disrupt the SEC’s work to protect investors in the crypto asset markets and safeguard the broader financial system,” the White House said in a May policy statement. The SEC said SAB 121 is “non-binding staff guidance” aimed at strengthening disclosures to investors.

Now, despite the House's failed vote to overturn Biden's veto, crypto-friendly lawmakers have not given up their efforts and are already working on a plan B. Republican Rep. Mike Flood of Nebraska said he hopes to pass "a regular piece of legislation" to overturn the SEC's guidelines through a related bill and attach it to the legislation that must be passed, which would relieve the pressure on Democrats to openly go against the president.

According to a Democratic staffer familiar with the thinking of House leaders, they had not originally expected many Democrats to change their votes on July 10.

They believe there is a better path to overturn SAB 121 through HR 5741, the Uniform Treatment for Custodial Assets Act, a bipartisan bill introduced by Mike Flood, the lead legislative sponsor mentioned above, and co-sponsored by French Hill, Wiley Nickel, and Ritchie Torres.

Republican Congressman Mike Flood, who supports overturning SAB 121, speaks before the House vote

In addition, the U.S. House Appropriations Committee also included a policy rider in its budget bill that prohibits the SEC from using relevant appropriation funds to implement SAB 121. However, the bill must be approved by the Senate before it can take effect.

By allowing some companies to circumvent SAB 121, could the SEC be creating a backdoor?

According to BXiaobai NavigationLoomberg Tax reported that an SEC source revealed that business practices proposed by some companies and financial institutions have been approved by SEC staff, allowing them to be exempt from the controversial SAB 121.

SAB 121 was released in March 2022. As some companies in the cryptocurrency industry have frequently gone bankrupt, some companies have been seeking advice from the SEC on how to develop new policies and procedures related to cryptocurrencies. The source added that the legal guidance itself, SAB 121, has not changed.

When SAB 121 was created, it took into account some actual crypto industry situations at the time. "In April 2022, there are still many unanswered questions about how these laws will be implemented, and we have seen many participants in the cryptocurrency industry not be careful enough in providing these services, hurting many customers," the SEC source said.

The source added that some companies have now demonstrated that they have certain procedures and technology in place that would allow customers to retrieve their cryptocurrencies in the event of bankruptcy just as they would other assets, such as U.S. dollars, and therefore do not need to comply with SAB 121 obligations.

Nonetheless, more information and disclosure are still needed to determine which companies will be eligible to bypass SAB 121 and what the SEC's policy stance on the related initiative will be.

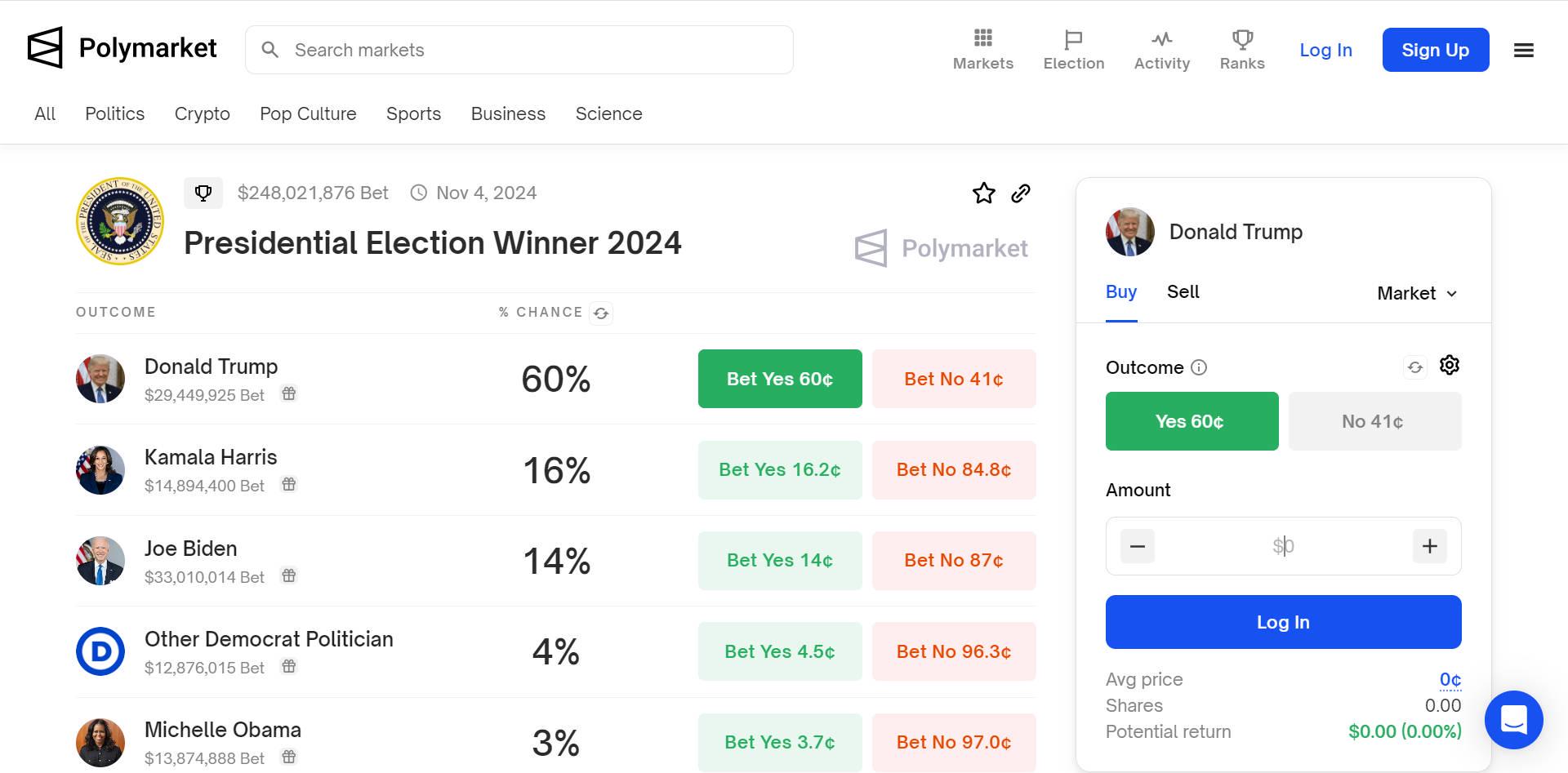

On July 12, the prediction market Polymarket said that the probability of former President Trump winning has reached 60%

Biden's senior advisers attended the encryption roundtable and sent key signals

Just two days ago (July 10), Anita Dunn, a senior adviser to Biden, met with dozens of leaders in the cryptocurrency field in a personal capacity. The roundtable was organized by crypto-friendly California Democratic Congressman Ro Khanna. Also participating in the crypto roundtable organized by Khanna were New York Democratic Senator Kirsten Gillibrand and Colorado Democratic Congressman Joe Neguse, as well as billionaire Mark Cuban, who supports Biden's re-election but criticizes his government's approach to cryptocurrencies.

Several guests at the meeting called the meeting "productive" and praised California Democrats for arranging the roundtable.

“I really want to give Congressman Khanna a huge thumbs up for bringing together about 30 or more industry leaders and giving them the opportunity to engage directly with Ms. Dunn and her team, which extends all the way to the White House,” said the cryptocurrency industry’s vice president of marketing.exchange Paul Grewal, Coinbase’s chief legal officer, said:

Grewal described the meeting as a "critical moment" for the Biden administration to reverse its "almost unanimous hostility" to cryptocurrencies, while Republicans and former President Trump are supporting the crypto industry. "We are at a critical moment where Republicans are fully embracing cryptocurrencies and are incorporating them into their party platform in a very specific and explicit way in the upcoming meeting," he said. "So I think the current administration now needs to make a choice."

Sheila Warren, CEO of the Crypto Council for Innovation, said, “It was clear that the guests in attendance understood the importance and opportunity that cryptocurrencies offer.” She added in a statement, “I am hopeful for future conversations and even more determined to advocate for this groundbreaking technology’s promise to transform many systems.”

Now, with the next televised debate and election day approaching, Biden has little time left to clarify his crypto policy stance in the face of pressure from the Republican Party.

The article comes from the Internet:Is there still hope for overturning SAB 121? Biden's crypto policy stance may continue to loosen under pressure

Related recommendation: Which countries and regions will be exempt from crypto taxes in 2024?

本文深入研究了为加密货币投资者提供了重大税收优势的 12 个国家。 撰文:Sandhya Deepak 编译:TaxDAO 在加密货币快速发展的形势下,本文深入研究了为加密货币投资者提供了重大税收优势的 12 个国家,强调了有利的加密货币税收政策对于节省资金、…