It is easy to sell all in but difficult to sell. How to become a master at selling?

author:Crypto, Distilled

Compiled by: Xiaobai Navigation coderworld

How to sell at a high point (no luck):

1.Understanding the Market

cryptocurrencyThe cycle is driven by three key factors:

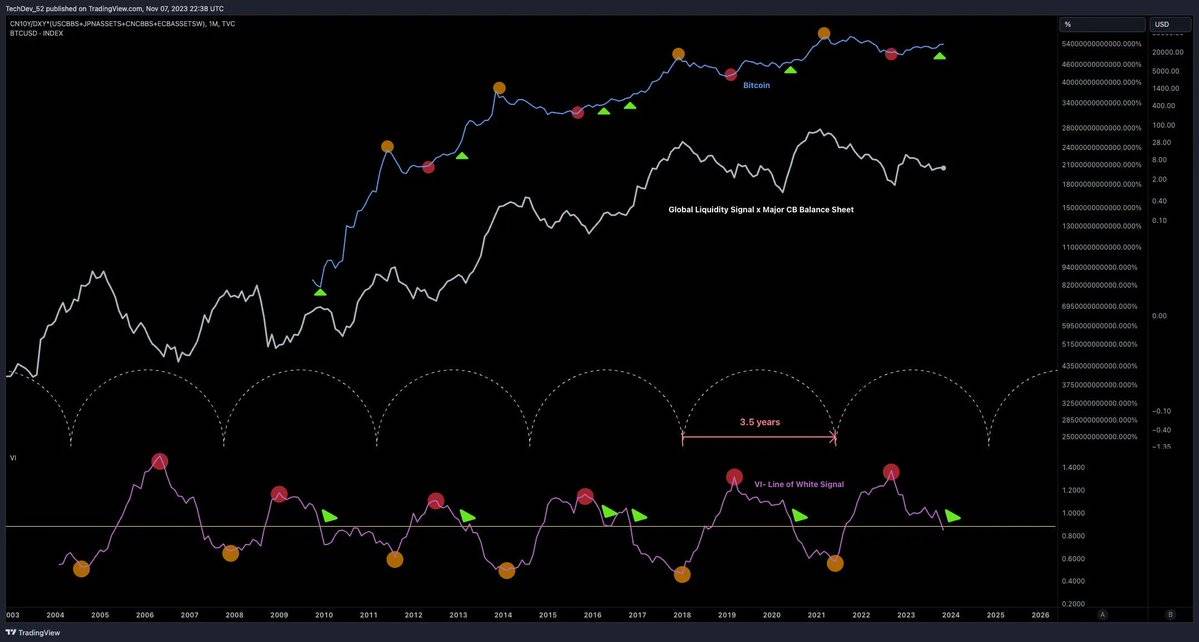

(A) Global liquidity cycle (since 2008)

(B) Bitcoin halving (since 2012)

(C) U.S. Elections/Regulation

Notice the 4-year cycle? (Thanks @TechDev_52)

Identifying patterns

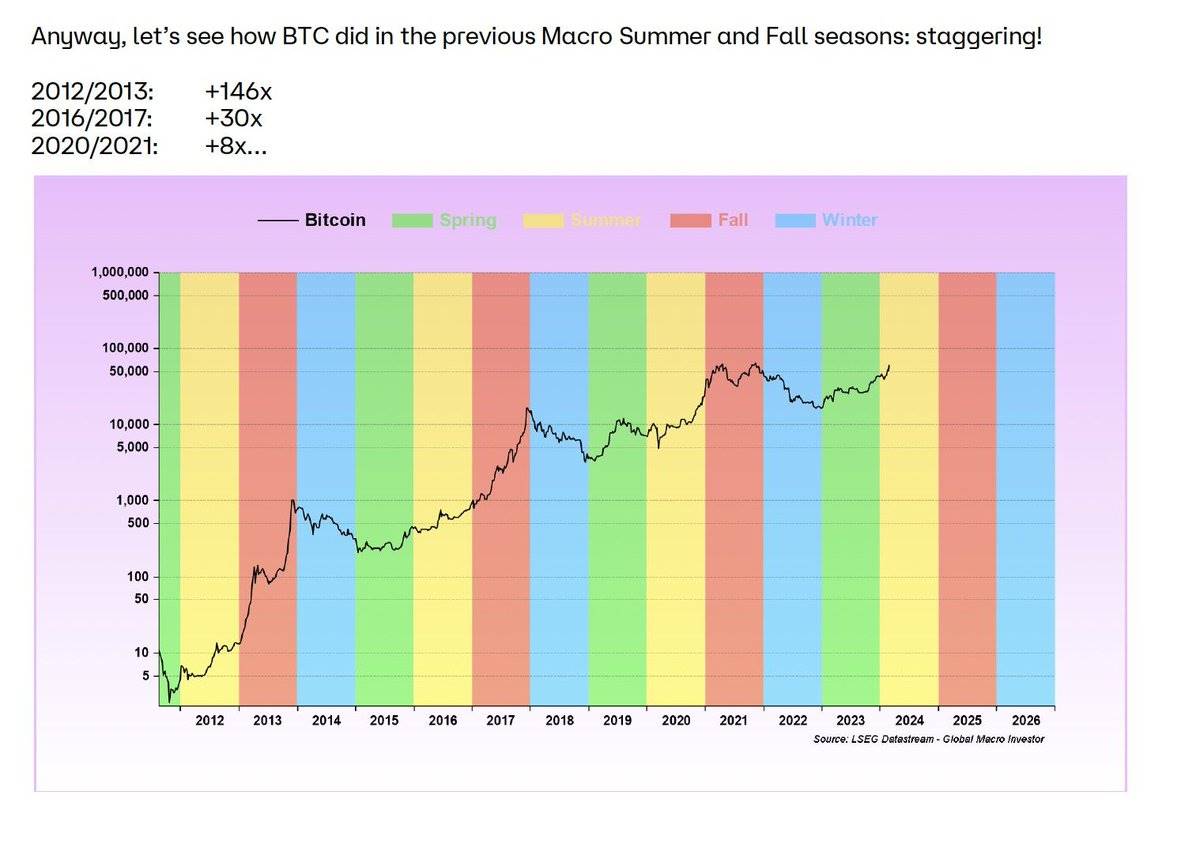

In a 4-year cycle,cryptocurrencyThe market is similar to traditional seasons:

Winter = Bear Market (like 2022)

Summer = Bull Market (e.g. 2023)

Spring and Fall = Transition Period

(Acknowledgements @RaoulGMI)

2.Determine the current season

Assuming the end of 2022 is the start of the bull run, we may be in summer now.

Prices have already surged, but there may be room to rise.

Summers typically cool down after a strong spring (seen in 2021 and 2024).

Identifying the “Best” Season

Fall is typically a time of market frenzy and cycle highs.

The goal is to sell at this time (and then buy back in the winter).

Seize the opportunity of the "frenzy moment"

This is the hardest part, the market is noisy and greed is high.

You may not be willing to sell.

3.To combat greed, look for indicators that a top may be approaching

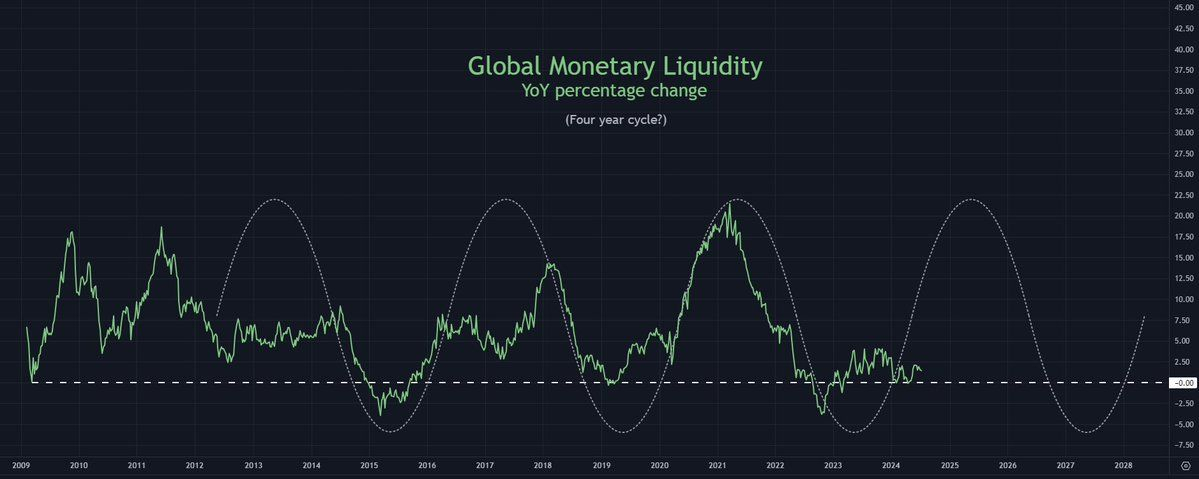

The most important thing is global liquidity.

In particular, the year-on-year (YoY) percentage change in global liquidity.

Riding liquidity is like surfing the wave.

If the year-on-year (YoY) trend of global liquidity is upward, continue to ride the wave; if it is downward, withdraw in time.

Make sure to exit before the wave crashes.

"Happy Zone"

The "happy zone" is the period when the market is easiest to operate (prices are all in the red).

During the “happy zone” period, the year-on-year (YoY) change in global liquidity typically reaches 4.5%.

Currently, we are at 1.5%. History will not repeat itself, so be flexible in setting goals.Xiaobai Navigation

(Acknowledgements @TomasOnMarkets)

Liquidity as a leading indicator.

Liquidity changes can predict price trends 6-12 months in advance.

Cryptocurrencies are a high-risk asset class and the transmission effect of funds may take time.

Warning: This also applies when liquidity dries up.

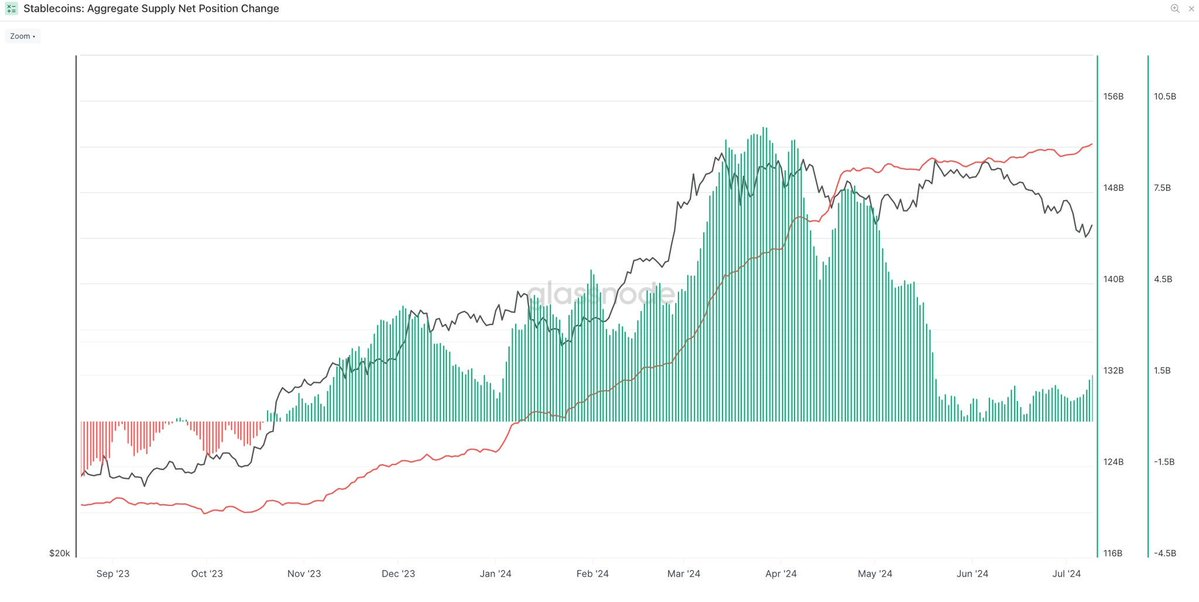

Focus on stablecoin supply.

To understand cryptocurrency liquidity specifically, focus on stablecoin supply.

Ideally, stablecoin supply should accelerate to sustain the market rebound.

Think of global liquidity as a global map and stablecoin liquidity as a local map.

(Acknowledgements @glassnode)

The significance of stablecoin liquidity

It represents the underlying buying pressure on altcoins. New capital drives the market rally.

Bitcoin is important, but with the launch of ETFs,exchangeThe capital transmission effect of (CEXs) may no longer be significant.

4.Narrowing the time window

Based on liquidity alone, let's assume we can predict a market top within 2-3 months.

How to narrow the time window further? Try to identify the confluence of multiple top signals.

The Lollapalooza Effect

The more signals there are, the clearer the overall picture.

The core of this strategy is the Lollapalooza effect (Charlie Munger).

It refers to the fact that when multiple forces combine, they can have a huge impact.

Example forces (you can create your own).

-

Bitcoin Approaches $100K (Hype Peak)

-

Sovereign wealth funds chase Bitcoin gains

-

Liquidity has reached its peak, and there are rumors of overheating

-

Cryptocurrency search trends hit all-time high

-

Sports teams adopt NFT tickets

5.What if the signal doesn't appear?

This is when the backup plan comes in handy.

A backup plan is a last-ditch effort to support your plan.

Backup plan for time signals.

If your top signal is time based, a good fallback option is events.

Suppose you forecast the top to occur in the first half of 2025.

Prepare 5-10 event-based signals to hedge your risk until the first half of 2025.

Fallback plan for event signaling:

For event-based signals, use fixed time frames as a fallback plan.

For example, exit a certain percentage of your positions by the end of 2024, regardless of whether a top signal appears.

This protects you from unforeseen black swan events or systemic risks.

Reality check.

It takes a lot of luck to sell everything at the top - stay realistic.

Instead, the goal is to try to get your average exit price as close to the top as possible.

Realistic goals:

Operate around the top (sell some before the top, sell some at the top, sell some after the top).

If you are not in crypto full time, exiting the first 1/3 of the market is a solid goal.

Altcoin trends:

If you are heavily invested in altcoins, you should outperform Bitcoin throughout this process.

This hedges against the fact that altcoins have been falling much faster than Bitcoin.

Judging the top of altcoins is difficult due to echo bubbles and other risk factors.

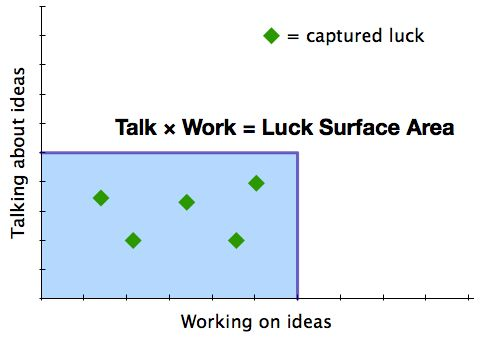

5.Increase your "luck area" and obtain more information and resources through multiple channels ()

The more back-up plans, signals, and overall research you have, the better your exit strategy will be.

Build connections, be active on Twitter, and continue to learn and grow.

(Courtesy of Network Capital)

Strategy Review

-

Nature of the research cycle

-

Identify the current season

-

Anticipate and follow liquidity

-

Reduce the exit window by signaling

-

Hedge your strategy with a backup plan

-

Increase your "luck area" through the Internet

(Post inspired by:@Naval)

The article comes from the Internet:It is easy to sell all in but difficult to sell. How to become a master at selling?

MS only subtracted from the original cake of PumpFun and kicked out some dog dealers. Xiaobai Navigation Author: CedricZ A large number of DEX Screeners perfectly interpreted tonight what it means to use one's own weaknesses to attack the other's strengths. The following content is based on the perspective of a Degen, which may be too focused. Considering my hasty...