Data reveals the competition among new public chains: Who can surpass Ethereum?

Written by: Steven Shi

Compiled by: TechFlow

Since the advent of Ethereum, Layer 1 (“L1”)Blockchain一直是加密货币中最受欢迎的投资领域之一。在市值排名前 20 的加密货币中,超过一半是 L1 Blockchain的原生代币。事实上,“新公链”(alt L1)的概念是 2017 年和 2021 年采用周期的关键叙事之一。由于对以太坊区块空间的巨大需求,许多投资者和用户纷纷涌向具有更高容量和更低费用的新型 L1。

但是,在 2021 年 alt L1 概念达到高峰几年后,以太坊仍然是事实上的 L1 区块链的主导者。许多其他 L1 看起来像是鬼城,用户增长停滞或下降。

尽管如此,新的 L1 仍在不断涌现。Aptos 和 Sui 是过去一年中推出的两个大型 L1,目前的估值总额超过 120 亿美元。此外,还有几个即将推出的项目,其中一些在私募轮估值方面达到九位数或十位数。此外,一些现有的 L1 仍然拥有强大的社区,他们相信自己能够发展壮大,与以太坊竞争。

The alt L1 debate is still going on. Therefore, we wanted to answer a question that readers often ask: Is there any Layer 1 blockchain that can surpass Ethereum?

L1 Overview

为了解答这个问题,我们回顾了 L1 的历史以及以太坊的领先地位。在本报告中,我们将 L1 的范围限定为广义的、无许可的智能合约区块链,也就是所谓的“ETH 杀手”。

The rise of L1 can be said to stem from the limitations of Bitcoin. Bitcoin was originally intended to effectively serve as a trustless peer-to-peer electronic cash system. As Bitcoin itself gradually gained recognition as a legal currency, developers began to try to create decentralized applications such as alternative digital currencies on Bitcoin. However, due to Bitcoin's limited scripting language and social layer's reluctance to add complex features to the network, Bitcoin is not suitable for supporting the development of other applications. Previous attempts to create applications on Bitcoin have stalled.

The launch of Ethereum filled this gap. It is the first widely recognized blockchain with a Turing-complete programming language, which greatly expanded the design space of decentralized blockchains.

Like Bitcoin, Ethereum’s core culture prioritizes decentralization over scalability. As a result, when Ethereum adoption grows, such as during the ICO boom of 2017 or the DeFi Summer of 2020-2021, the network quickly reaches its throughput limits. The network can become clogged for hours, with gas fees skyrocketing and unaffordable for many users. At times, a simple token transfer can cost $150 in transaction fees. Developers are reluctant to increase throughput limits for fear of risking “centralized creep” in the protocol.

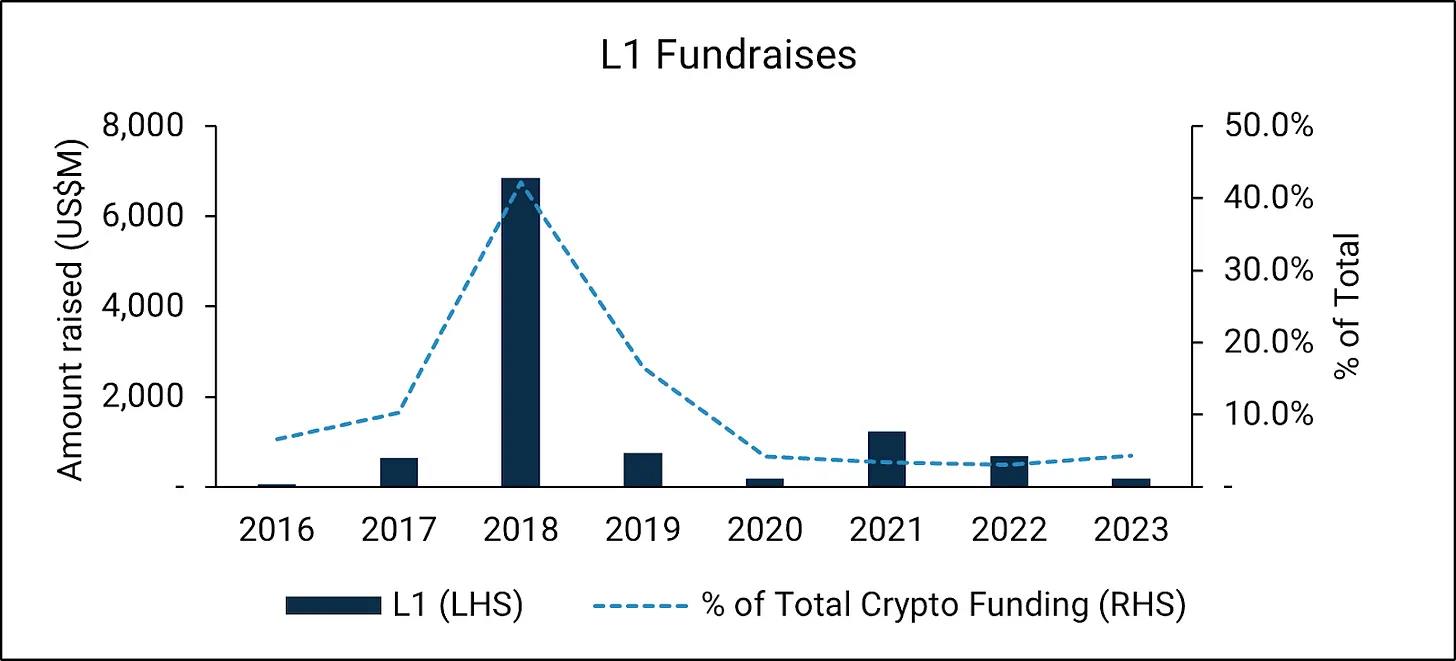

So, when Ethereum faced scalability issues, the hype for new public chains emerged. During the ICO boom, blockchains like EOS, Tezos, and Cardano raised hundreds of millions of dollars promising faster L1 architectures. This pattern has also been seen to a lesser extent in 2021. As shown in the figure below, the peak in L1 fundraising coincided with strong cryptocurrency adoption.

Market Status

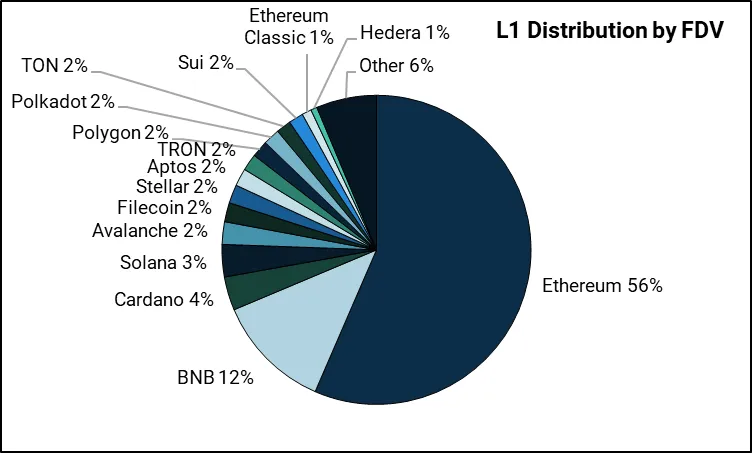

Even though there have been hundreds of L1 competitors since Ethereum launched, Ethereum is still considered the de facto L1. Clearly, Ethereum is the leader in terms of market cap. Among the top 50 L1 blockchains, Ethereum has a market share of more than 55%. But where is Ethereum still ahead? And what drives Ethereum's premium valuation?

Users - Cheaper, Faster L1 Wins

Users are often considered a driver of valuation, as the value of a network is thought to grow super-linearly with the number of users (Metcalfe’s Law).

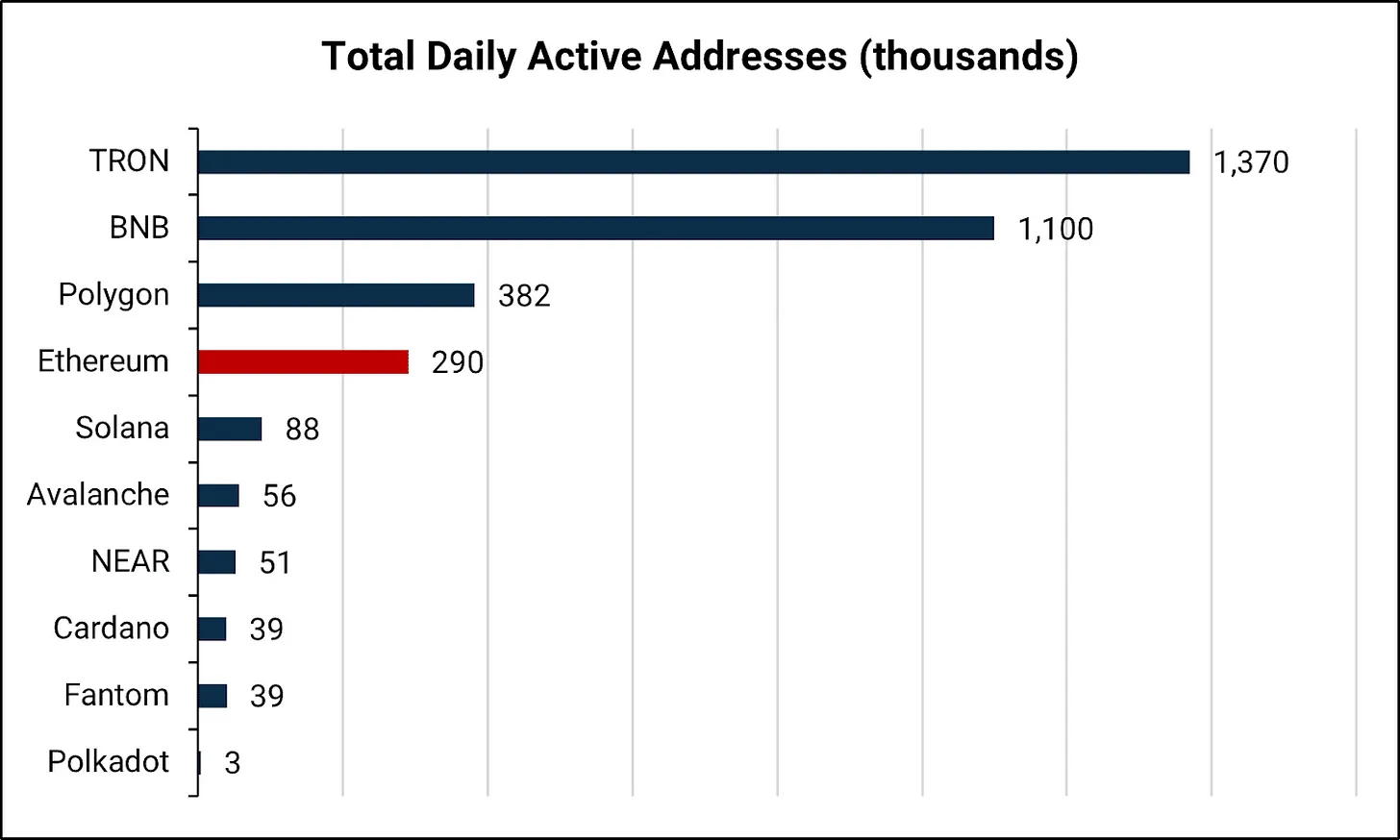

由于缺乏反女巫系统和相对容易创建新地址,加密货币中真实的活跃用户很难衡量。尽管如此,活跃地址可以在每个区块链的用户采用方面提供一个很好的初步近似值。

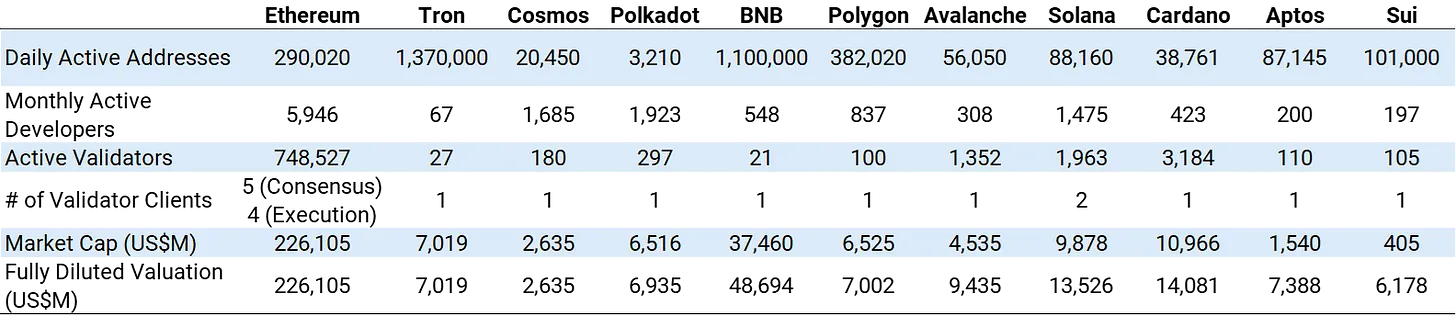

显然,以太坊在活跃用户方面落后。它的估值溢价并非来自用户数量。像波场(Tron)、币安币(BNB)和 Polygon 这样的更便宜的区块链都拥有更多的用户。而一些网络,如 Polkadot 和 Cardano,虽然活跃用户很少,但估值相对较高。因此,就标题问题而言,多个 L1 已经在用户数量上超过了以太坊。

Developers

Developers are another indicator of the health of the network. Developers not only maintain and improve the protocol layer, but also build use cases on L1. They can serve as a leading indicator of future value creation.

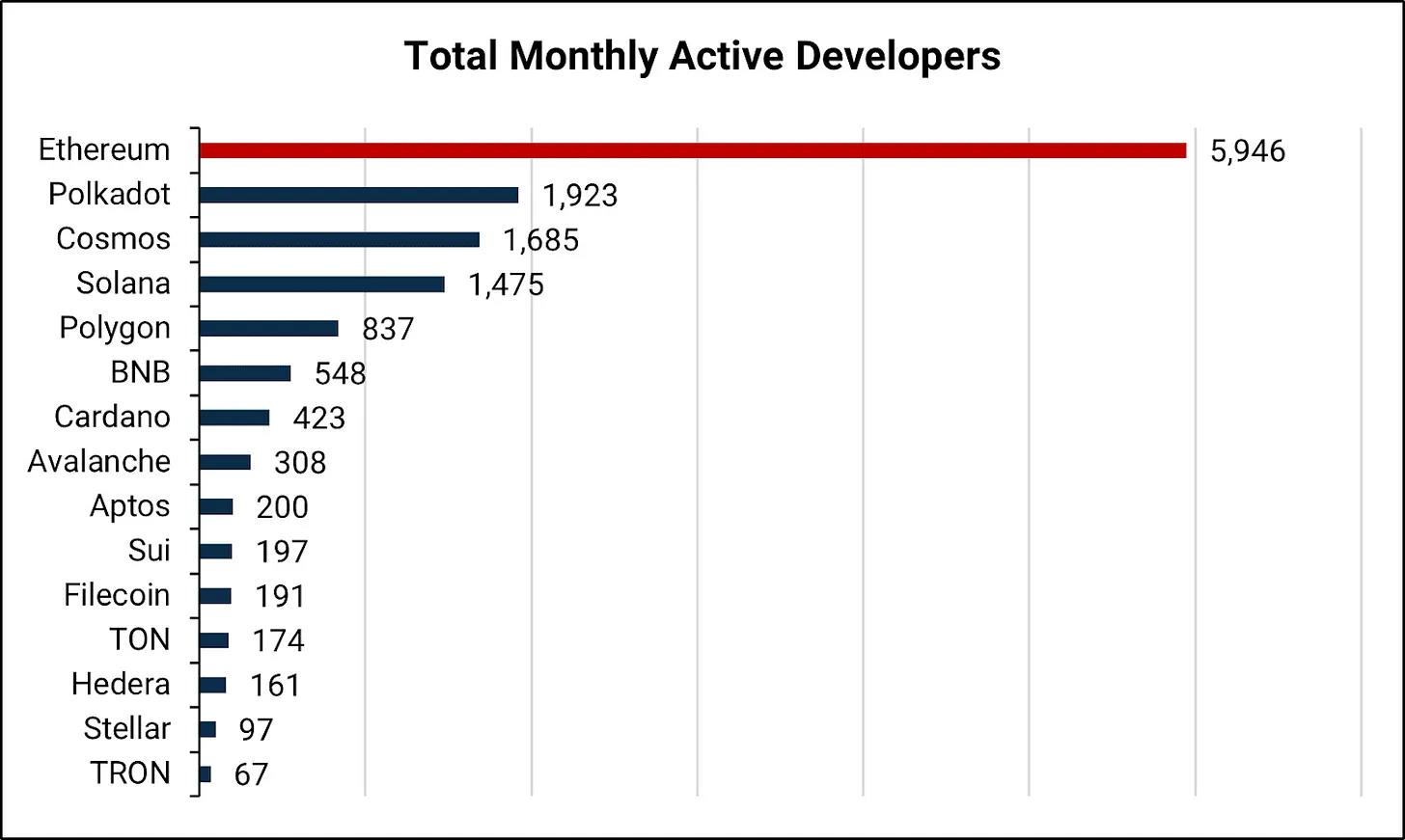

According to Electric Capital’s Developer Report, Ethereum stands out in terms of total active developer numbers.

Polkadot, Cosmos, and Solana have impressive developer counts, given that they have their own unique programming languages, and Aptos and Sui also have impressive developer counts, considering they were only recently launched.

fluidity

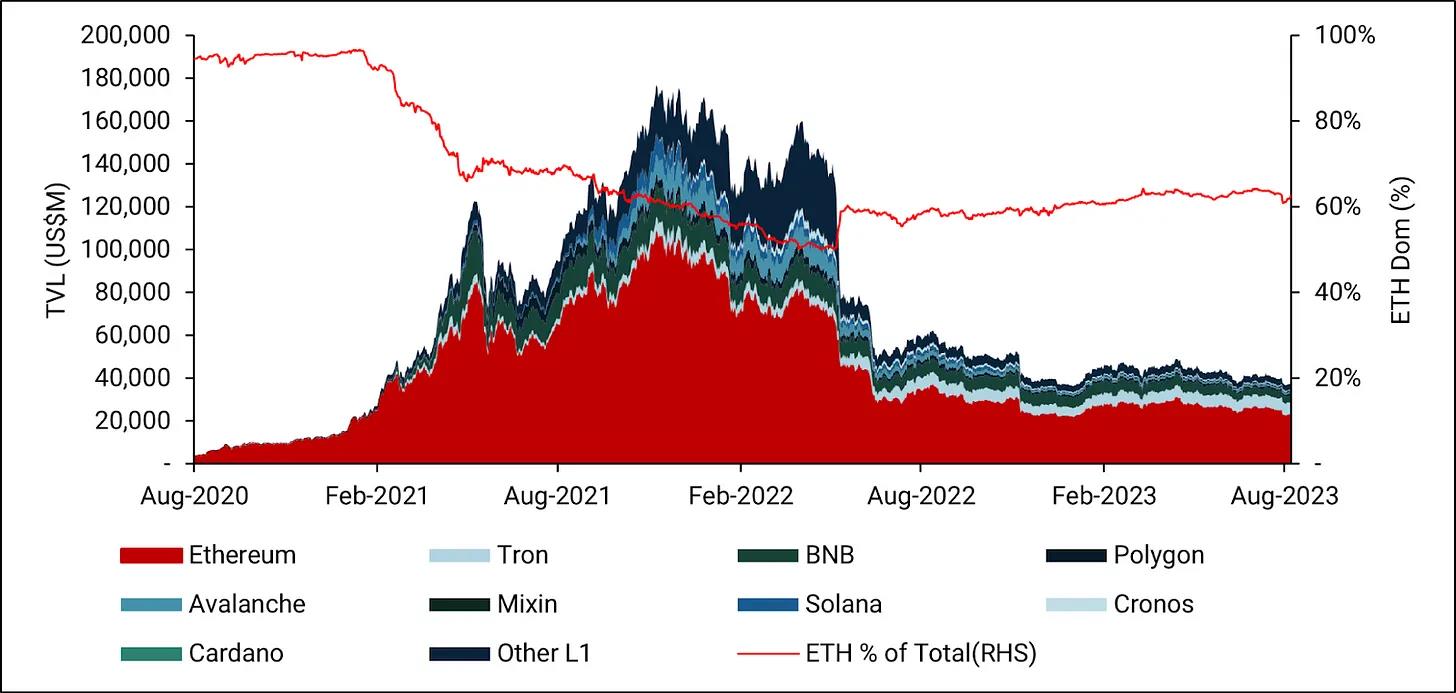

以太坊在网络上的流动性明显领先于其他所有 L1,这可以通过总锁定价值(TVL)、去中心化交易所(DEX)的交易量、交易对数量等指标来衡量。自 2022 年夏季以来,以太坊在其他 L1 中的 TVL 市场份额基本稳定在 60%左右,与 Terra 的崩溃时间相吻合。

Ethereum leads, but not without exception

To limit the scope of this article, we only looked at a few key metrics. There are many other factors to consider. Still, Ethereum’s valuation lead clearly does not come from user adoption. BNB and TRON win in these categories by a clear margin. Instead, Ethereum clearly leads in liquidity and capital flows. The market is clearly placing a considerable premium on capital.

Analyze the factors of L1

What drives the above metrics? Why do some chains have more users? What drives capital flows between L1s? Why do some L1s remain strong after multiple bear markets, while others are marginalized? Below, we provide some frameworks and models to help answer these questions.

Decentralization

We must first consider the fundamental property of blockchain: decentralization. Decentralization has multiple benefits. First, greater decentralization increases censorship resistance and helps the network defend against malicious attacks. It also increases the network’s resilience andSafetyThe L1 network is a decentralized network that provides users with the confidence to store and trade value. We believe that the higher the degree of decentralization, the higher the premium on L1.

Decentralization itself is an abstract concept and difficult to measure. It’s probably one of those things where you know it when you see it. Nonetheless, there are some factors we can use to measure the degree of decentralization of a network:

-

Number of nodes and node distributionNodes actively participate in the network, maintain the blockchain state, and, depending on their type, validate and pass transactions in the network. Therefore, more nodes generally help improve the resilience andSafetyIf nodes are more geographically and organizationally dispersed, it is harder for a single actor to exert influence on the network. It also matters whether nodes run on the same infrastructure (e.g. the same cloud provider) or independently and with dedicated hardware.

-

Token holder distributionThe risks of a highly concentrated distribution of token holders are obvious. Under a highly concentrated distribution, a small number of token holders can determine the development of the entire network and prevent users from transacting on the network.

-

Client DiversityClient diversity refers to the number of software clients that can be used to run a node. Multiple clients increase the network's resilience to attacks and errors. If a network runs on only one client, a client error could threaten the entire blockchain.

-

Satoshi coefficient. The Nakamoto coefficient measures the number of entities or nodes required to reach a majority (usually 51%) in the system. A higher coefficient indicates better decentralization because it means more entities are needed to compromise or control the system. However, this is a single metric and can miss a lot of subtleties. For example, Lido accounts for 32% of all staked Ethereum. But Lido spreads the stake among 30 node operators and has no control over what the operators do with their stakes (i.e., cannot force malicious collusion).

-

Governance Model. Off-chain governance involves decision making outside of the blockchain through community coordination, while on-chain governance embeds governance directly into the protocol, allowing for changes to be made through automated token-based voting. The impact on decentralization varies. Off-chain governance is not subject to concentration of token holders, but is prone to political centralization and potentially higher barriers to participation.

-

cultureCulture is an underrated aspect of blockchain decentralization. A culture of strong values can help defend against the risks and threats of centralization facing blockchains, such as Bitcoin’s cultural defense of application development or Ethereum’s unified push for improved client diversity.

Network Effects

Network effects in blockchain cover many aspects. One of the most obvious network effects is the interaction between users and developers, of which there are many analogies to Web2 platforms. User growth attracts developers to join the network, which often leads to new applications, further creating use cases and attracting more users to the network, and so on.

网络效应在其他方面也存在。例如,Solidity 等编程语言可以产生有意义的网络效应。随着越来越多的开发者学习 Solidity,Solidity 程序员社区扩大,更容易找到合作伙伴、雇佣开发者,并获得社区对问题的支持。还有更多的开发者资源,如软件库、工具和最佳实践,使创建强大的智能合约变得更容易。更容易找到胜任的安全审计员。所有这些都通过吸引更多的开发者和加速应用程序的上市时间,改善了生态系统内的创新循环。

Since financial applications are a key use case for cryptocurrencies, capital network effects are also critical. Liquidity begets more liquidity. New financial primitives are most likely to launch on networks with the largest market size and highest liquidity. These network effects are also supported by key stakeholders. For example, Coinbase supports deposits/withdrawals, Circle supports native USDC issuance, and Fireblocks supports custody, all of which help improve capital mobility.

Lindy Effect

Given the nascent nature of digital assets and the lack of historical data, many often cite the Lindy Effect as an appropriate mental model for measuring L1 success. The longer a blockchain exists and remains relevant, the more likely it is to remain relevant in the future. This model may apply. L1s that have weathered various challenges (such as technical issues, hacks, market volatility, regulatory scrutiny, competition, etc.) and still have strong user traction are more likely to succeed in future cycles.

This model suggests that more mature L1s remain relevant and have a better chance of eventually surpassing Ethereum.

Hysteresis Effect

Hysteresis is a concept that describes how a system's state depends on its history. Once a system is set on a path, it tends to persist on that path, and deviation becomes increasingly difficult the longer the system stays on track.

Lag effects play an important role in understanding the process of several L1s. For example, Ethereum’s early adoption of PoW before moving to PoS may have contributed to widespread participation and token distribution in the early years. This distribution is very difficult for new networks to replicate. As another example, although FTX has had a negative impact on the Solana ecosystem over the past few years, FTX’s early association may have helped push Solana into the mainstream and become a top new public chain ecosystem.

Viewed in this context, Ethereum’s leadership is not a result of technological superiority, but rather the result of its unique historical path, the momentum it has gained over the past decade, and the compounding effect of its choices. Like many other analogies in technological history (such as the oft-cited QWERTY example), Ethereum may maintain its dominance primarily through being a first mover and its unique history.

Differentiation

L1 blockchains often differentiate themselves from Ethereum and other L1 blockchains by offering superior architecture or catering to a specific domain. This may involve superior scalability, reduced transaction costs, unique consensus mechanisms, enhanced privacy features, or specialized tools for specific industries. For example, Solana differentiates itself by focusing on a monolithic blockchain architecture to maximize the benefits of composability and liquidity effects. Aptos and Sui offer a safer and more intuitive programming language, Move, to reduce the chance of accidental code errors.

Monetary Policy

A blockchain’s monetary policy is particularly important to its success, especially for layer 1 (L1) protocols. This policy dictates how the blockchain’s native cryptocurrency is issued, distributed, and potentially destroyed, influencing its scarcity and value proposition. A clear, consistent, and transparent monetary policy builds trust among participants, attracts long-term investors, and stabilizes the economics of the network. Additionally, it directly impacts the incentives of validators or miners, ensuring the security and functionality of the blockchain. If balanced correctly, monetary policy can foster continued growth, adoption, and stability, differentiating L1 blockchains in a competitive market and ensuring their long-term viability.

第二层(L2)

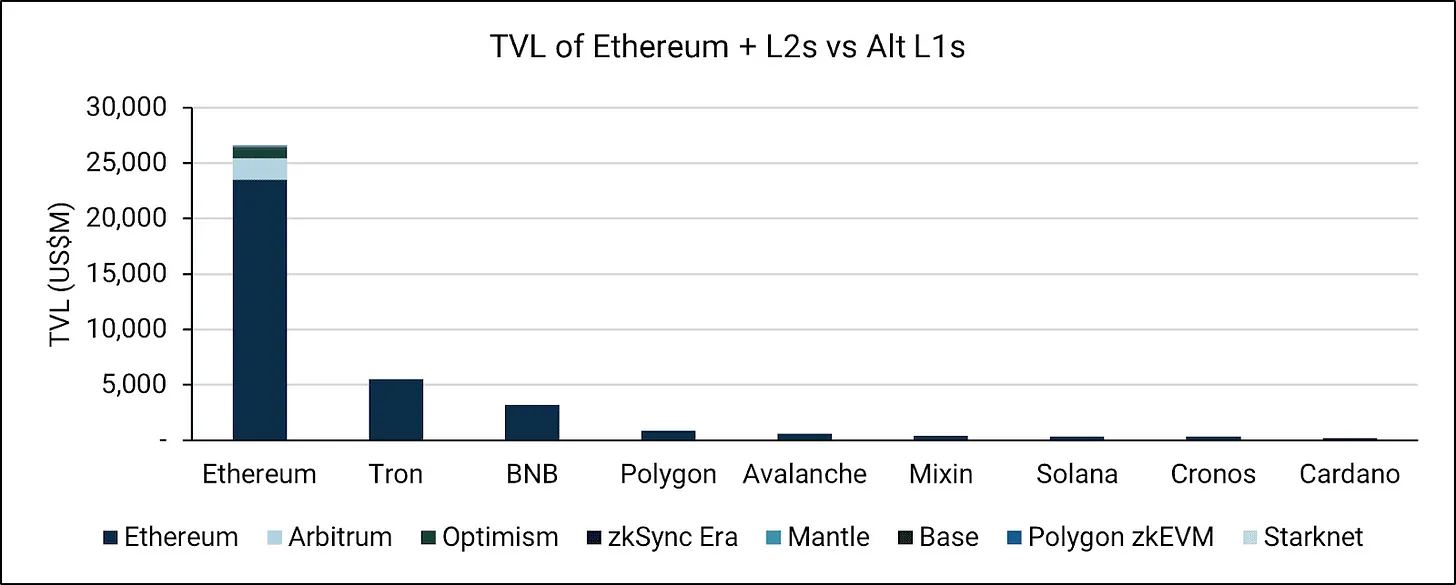

New public chain solutions are no longer the only viable scaling options. Roll-ups became the unofficial official scaling roadmap for Ethereum in October 2020. Since then, they have gradually gained share from other new public chains. In fact, Arbitrum and Optimism — both of which are Optimistic Roll-ups — have more active users and TVL than most top L1s. Recently, Coinbase’s Optimistic Roll-up Base has also quickly gained traction. In the coming years, ZK Roll-ups are likely to follow.

From a broader context, Optimistic Roll-ups, ZK Roll-ups, and application-specific Roll-ups are all part of the Ethereum ecosystem. When these networks are incorporated into Ethereum itself, the barrier to “surpassing Ethereum” becomes higher. From this perspective, Ethereum’s leadership is not a technical advantage, but rather the compounding effect of its unique historical path, the momentum of the past decade, and its choices.

in conclusion

The technology space, especially one as nascent as cryptocurrency, is constantly evolving and full of uncertainty. This question also suggests a zero-sum mentality, where the victory of one L1 means the defeat of another. As Buffett aptly said, “Forecasts tell you a lot about the forecaster, but they tell you nothing about the future.”

If forced to give an answer, it seems that Ethereum will maintain its leadership in the L1 space for the foreseeable future. It leads in the most important metrics, especially in decentralization. As active participants in cryptocurrencies, we also see the most active innovation in the Ethereum ecosystem around cutting-edge technologies, such as scaling solutions, ZK technologies and applications, privacy solutions, mitigation/democratization of MEV, and more.

Among the current new L1s, we believe Solana is the most promising candidate to surpass Ethereum. Its monolithic, high-throughput architecture forms a meaningful architectural difference with Ethereum. It is the only L1 with multiple validator clients. The Solana community has experienced serious crash events in the past few years, but it is still very active and enthusiastic. In this ecosystem, we have seen unique innovations that have not been seen on other chains, such as xNFTs, state compression, compressed NFTs, Solana mobile stack, and more.

However, the cryptocurrency space is new and evolving, and new disruptive technologies may emerge. In this dynamic environment, narrow predictions are meaningless. A more productive approach is to continue to observe, remain adaptable, and be willing to change your views.

The article comes from the Internet:Data reveals the competition among new public chains: Who can surpass Ethereum?