AO Protocol Revealed: A Complete Guide from Technical Core to Staking Participation

Written by: Mat, Riffi, Sylvia

Written in front

With technical documentation, test networkToken With the release of $CRED and multiple memecoins, the AO ecosystem has attracted many active developers and demonstrated broad development potential.BlockchainIn the field of technology, the AO protocol has become an ideal platform for large-scale data processing due to its significant advantages in high-concurrency processing and data storage.

After recognizing the project from a value perspective, how should users participate?

By participating in the AO testnet, readers can obtain AO by depositing stETH Token, and take the initiative to enter the field of decentralized computing. Through this report, you will learn how to participate in AO's staking activities, as well as the core features, development history and future prospects of the AO project, helping you seize the initiative in the new era of decentralized computing and jointly witness and participate in this transformative technological advancement.

Project Introduction

1. AO Protocol Overview

AO is a decentralized computing system inspired by the Actor-Oriented Paradigm, capable of supporting a large number of parallel processes without the typical limitations of current decentralized computing models. Its features include:

-

Network verifiability and minimal trust requirements: The architecture is highly modular and easy to integrate with existing smartcontractPlatform integration allows for computing resources, virtual machines,Safetymechanism and payment mechanism.

2. AO Core Features

-

Single system image: Hosted on a heterogeneous collection of nodes in a distributed network, allowing any number of parallel processes to coordinate through an open messaging layer.

-

Unlimited resource utilization: Supports computing operations of arbitrary size and form while maintaining the verifiability of the network itself.

-

Modular architecture: Users can choose the virtual machine that best suits them, messagingSafetyGuarantee and payment options.

3. Key functions of the AO protocol

-

Parallel Processes: Supports any number of processes (contract) run in parallel, inspired by the original actor model and Erlang.

-

Resource Utilization: Based on the delayed evaluation architecture of SmartWeave and LazyLedger (later called Celestia), nodes can reach consensus on program state transitions without performing any calculations.

-

Data storage: With Arweave, AO processes can seamlessly load and execute data of any size and write it back to the network.

-

Automatically activate the contract: Allows contracts to have scheduled "cron" interactions, automatically wake up and perform calculations at set intervals.

4. AO key development nodes

Since AO announced the launch of the testnet on February 27, 2024, the market has responded enthusiastically, the AR coin price has risen sharply, and it has attracted the active participation of thousands of developers and a large number of users. The release of the technical documentation Cookbook and the testnet token $CRED, as well as the holding of AO online hackathons and other activities, have further promoted the development and improvement of the AO ecosystem. At present, the AO subnet has launched a full fair release plan for tokens, which is launched on Binance/OKX and other exchanges.exchange AR ecosystem incubation is defined as a decentralized computing system. The relationship between AR and AO can be roughly understood as Fil and Difinity, which are responsible for storage and high-performance computing scenarios respectively.

-

Release of technical documentation Cookbook: including concept explanation, operation principle and development tutorial, PermaDAO The Development Guild participated in the translation and provided English and Chinese versions.

-

Release the test network token $CRED: As the native token of the AO test network, it is obtained by completing bounty tasks.

-

Held AO's online hackathon Hack The Weave Hackathon: 11 days, multiple prizes, and a total bounty of over $10,000.

-

Two AO memecoins were launched: $WHAT and $TRUNK:Community经理推出,支持在去中心化交易所 Bark 中使用 $CRED 兑换。

-

AO's social media application AO Twitter is gradually being improved: development functions include chat rooms, avatar settings, bookmark collection, etc., and plans to launch MUD games in the future.

Participation in AO’s staking activities

So how can you participate in AO’s staking activities? Next, we will explain it to you step by step:

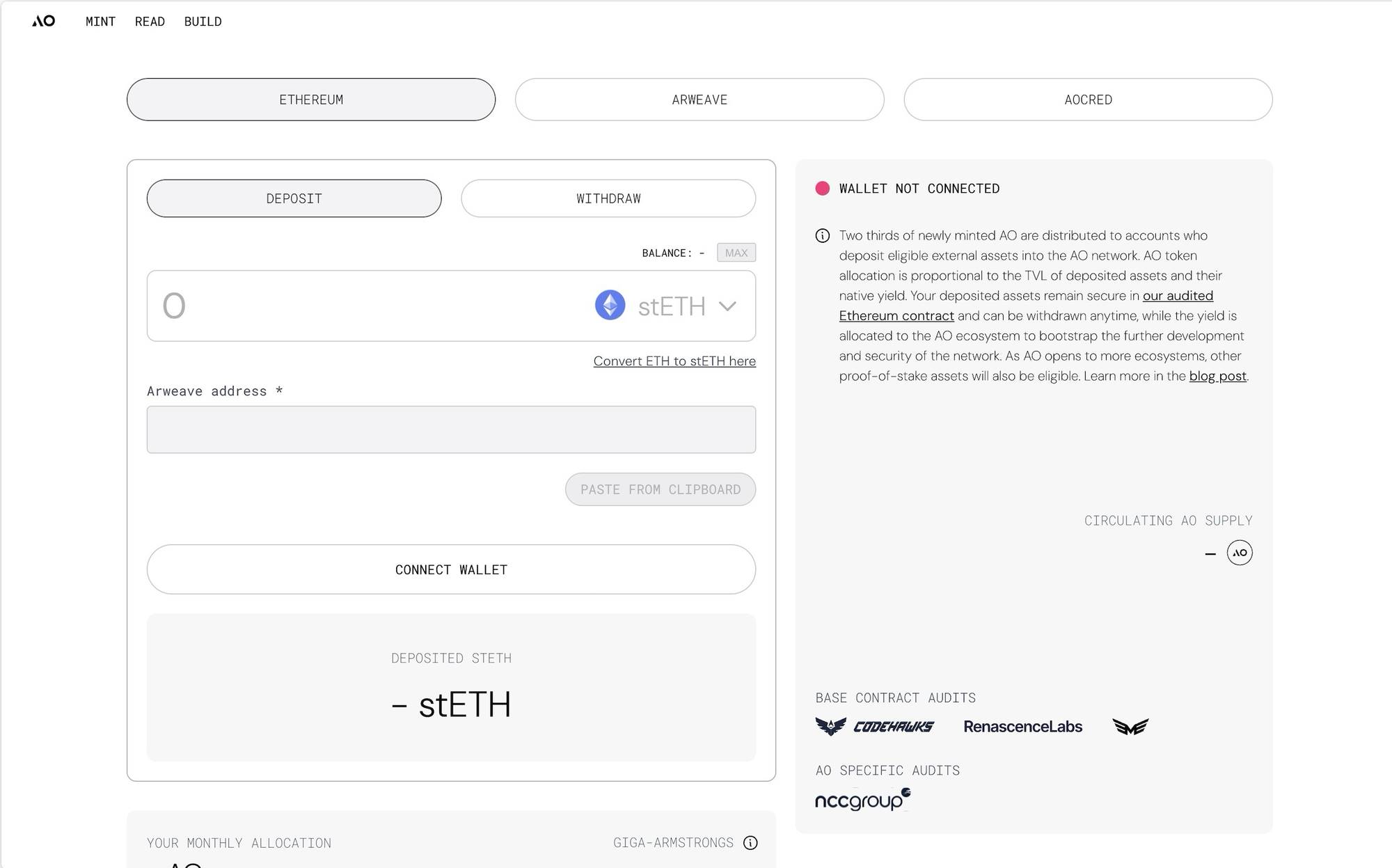

1. Current: Pre-launch stage (staking contract on Ethereum chain)

-

Staking features: deposit and withdraw at any time, income is calculated every 5 minutes, issued every 24 hours (non-transferable), and more types of assets will continue to be opened for staking.

-

Waiting for opening: mainnet application stage.

2. Pre-launch phase participation process

How to deposit stETH to get AO

-

Start time: June 18, 2024 at 11:00 AM EST

-

Rewards: Rewards are issued once a day, and you may need to wait up to 24 hours to receive the first reward

Steps to Participate

-

Go to the coin minting page on the AO website.

-

Click on the Ethereum tab and connect your Ethereumwallet(Metamask or Rabby).

-

输入您想要接收 AO 代币的 Arweave 钱包地址。

-

Deposit stETH into the audit contract by entering the amount you wish to provide. (These tokens will remain in a trustless contract on Ethereum and can be withdrawn at any time. If you do not have stETH in your wallet, you will need to exchange other tokens to get some stETH before making a deposit.)

-

Sign a transaction in your ETH wallet to deposit stETH into the contract.

-

You will receive AO tokens directly deposited into your designated Arweave wallet.

stETH pledge interface Source: AO official website

3. Revenue Estimation

Online valuation:By the time of launch on February 8, 2025, the circulation will be fixed at 15%. In view of the possibility of a bull market, different estimates of APR are made. At the same time, considering the potential appreciation of the AR token itself, the proportion of $AO market value to $AR may be relatively reduced, thus providing a larger APR space.

Influencing factors

-

Released amount: Refer to the official proportion of $AO to the total pledged funds.

-

Total staked: Currently around $100 million, but may increase in the future.

4. Follow-up opportunities

Subsequent stages will continue to open up, and after the permissionless ecosystem financing bridge is launched, developers can attract users to deposit assets in their applications and obtain corresponding AO token rewards. This provides developers with a permissionless, long-term source of income without applying for grants or external investment.

Permaweb Ecosystem Development Association: A number of organizations and builders will share in the native revenue generated by assets stored in the bridge. Funds will gradually decrease over time, consistent with the decay rate of network minting, supporting the bootstrapping of the network while retaining its characteristics of a neutral shared protocol.

Through the above detailed introduction to staking activities, readers can actually participate in AO's staking plan and enjoy the benefits of decentralized computing and storage.Safetyand revenue.

Why choose AO to participate and stake?

After our in-depth analysis of AO’s technical composition and working principles, we are looking forward to the unlimited potential brought by its unique advantages in the field of decentralized computing, which will be analyzed in detail in the third part.

Technical Analysis

1. AO components

The AO system consists of three core units:

1.1 Messenger Unit

-

Function: Responsible for message communication, passing messages to computing units and coordinating computing output results.

-

Function: Ensuring efficient information exchange between Actors is the key to system parallel processing.

1.2 Scheduler Unit

-

Function: Responsible for scheduling and message sorting, and uploading messages to Arweave.

-

Function: Manage the priority and order of messages to ensure the overall coordination of the system and persistent storage of data.

1.3 Compute Unit

-

Function: Responsible for processing calculations and uploading calculation results to Arweave.

-

Function: Executes specific computing tasks and is the core computing capability of the system.

2. How AO works

AO byBlockchainThe technology is orchestrated so that each unit can be used as a horizontally scalable subnet to perform a large number of transactions. This design allows the system to achieve high-performance computing and can theoretically provide nearly unlimited computing performance. The key points are:

-

High concurrency: The Actor model allows a large number of parallel processes to run simultaneously, greatly improving the processing power of the system.

-

Distributed architecture: Each unit operates independently, but the overall consistency of the system is achieved through coordination of message passing and scheduling units.

-

去中心化存储:通过 Arweave 将数据和计算结果永久保存,确保了数据的安全性和可靠性。

3. AO’s core objectives

The core goal of AO is to enable trustless and collaborative computing services without any practical scale limitations. This provides applications with the ability to combineBlockchain技术的全新范式,相比其他高性能区块链(如 Solana、Aptos 和 Sui),AO 具有以下优势:

-

Large-scale data storage: AO supports storing large amounts of data, e.g. AI 模型,这使其在处理大数据和 AI 应用时具有显著优势。

-

High concurrent processing: Unlike Ethereum, which can only use a single shared memory space, AO allows any number of parallel processes to run simultaneously and collaborate with other units through message passing without relying on centralized memory space.

4. AO 与 eth 的对比

AO 与 eth 的对比 Source:WolfDAO 整理

AO Computer and Ethereum EVM each have their own advantages in terms of architecture design, computing model, consensus mechanism, computing logic, redundancy issues, parallel computing and collaboration, and practicality. AO Computer excels in high concurrency, distributed computing, and data storage, and is suitable for application scenarios that require large-scale data processing and high concurrency. However, Ethereum EVM still has important advantages in smart contract execution and Turing completeness, and has been widely used and verified.

因此,AO 计算机和以太坊 EVM 更像是互补的技术,而非竞争对手。AO 计算机可以作为以太坊的强力补充,在特定场景中发挥其独特优势,但尚不足以完全取代以太坊 EVM。未来,随着区块链技术的不断发展,AO 计算机和以太坊将继续在各自领域中发挥重要作用,共同推动去中心化技术的前进。

Tokenomics

AO 是 AR Network 的子网,在其生态中承担应用层的角色。AR 目前市值 $1,843,104,239,上线 Binance/OKX 等全线主流交易所(除 Coinbase)。AO Token ($AO) 全部采用 AR 持仓空投和 ETH 质押完成分发。

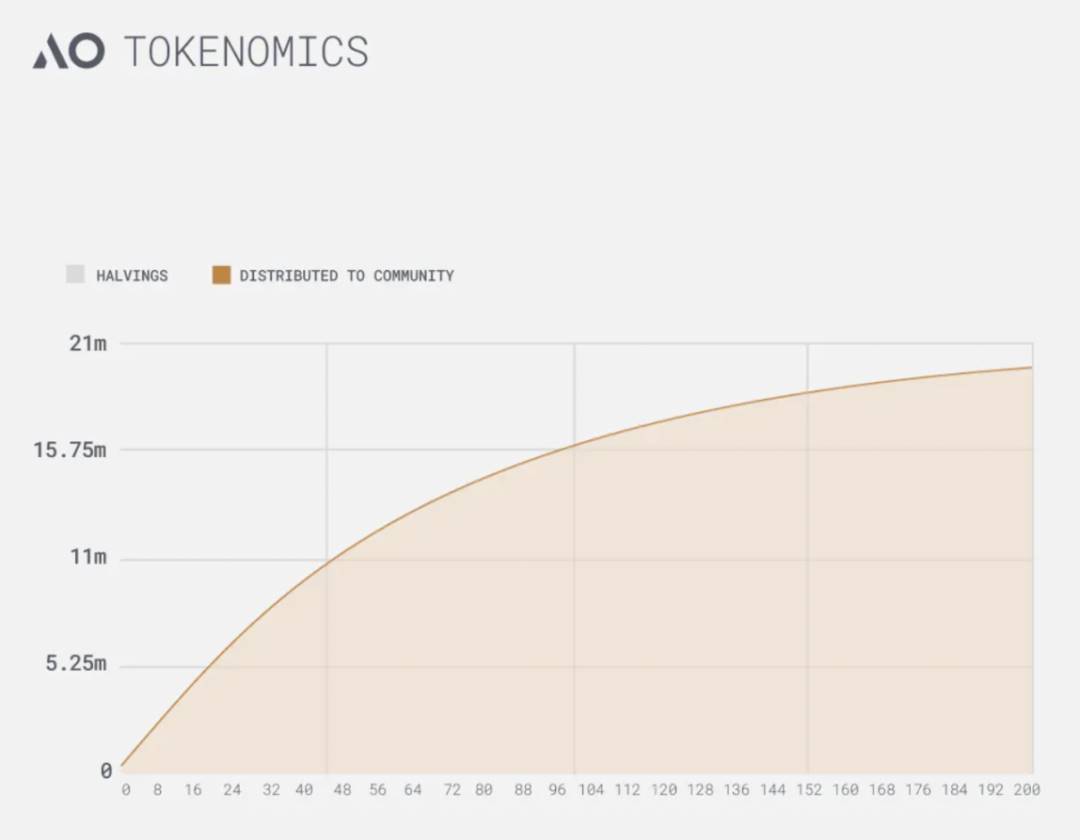

AO has no ICO/pre-allocation, with a total supply of 21 million, which is halved every 4 years. AO is distributed every 5 minutes, and the monthly distribution is 1.425% of the remaining supply. As of June 13, 2024, the stock of AO is 1.0387 million.

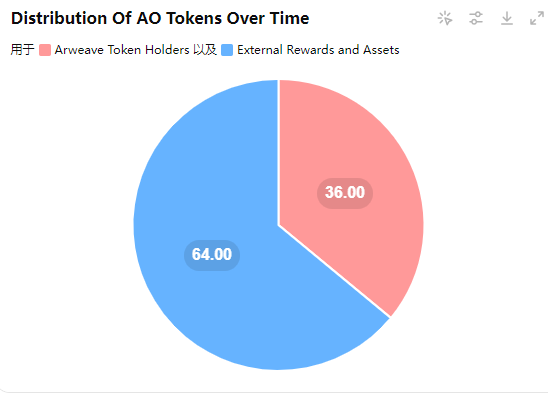

Token Allocation

-

Approximately 36% (100% in the first 4 months + 33.3% thereafter) of AO tokens are minted over time by Arweave token holders, whose tokens incentivize the security of the AO base layer – Arweave.

-

Approximately 64% of AO tokens are minted over time to provide external benefits and bring assets into AO to incentivize its economic growth.

AO Token distribution method Source: AO

Distribution

AO Token unlocking and release mode Source: AO

-

AO will be released starting at 13:00 EST on February 27, 2024, and 1,038,700 $AOs before June 18 will be retroactively allocated to $AR Holders.

-

Retroactive airdrop (completed): 100% AO released from 13:00 EST on February 27, 2024 to 11:00 EST on June 18, 2024 (block 1372724) (the on-chain address holding AR will complete the airdrop based on the balance)

-

Transition phase: Phase 1 airdrop (starting at 11:00 EST on June 18, 2024)

-

10% (315-103.87= 2.1113 million $AO), accounting for the total AO supply, will end around February 8, 2025 and unlock AO.

-

AR holding mining: Holding AR on the chain can obtain a total proportion of 33.3% AO allocation, which is allocated according to the percentage of the holding amount to the total AR amount.

-

ETH mining: Stake stETH to get a total of 66.6% AO allocation, which is based on the percentage of staked stETH to the total amount of stETH.

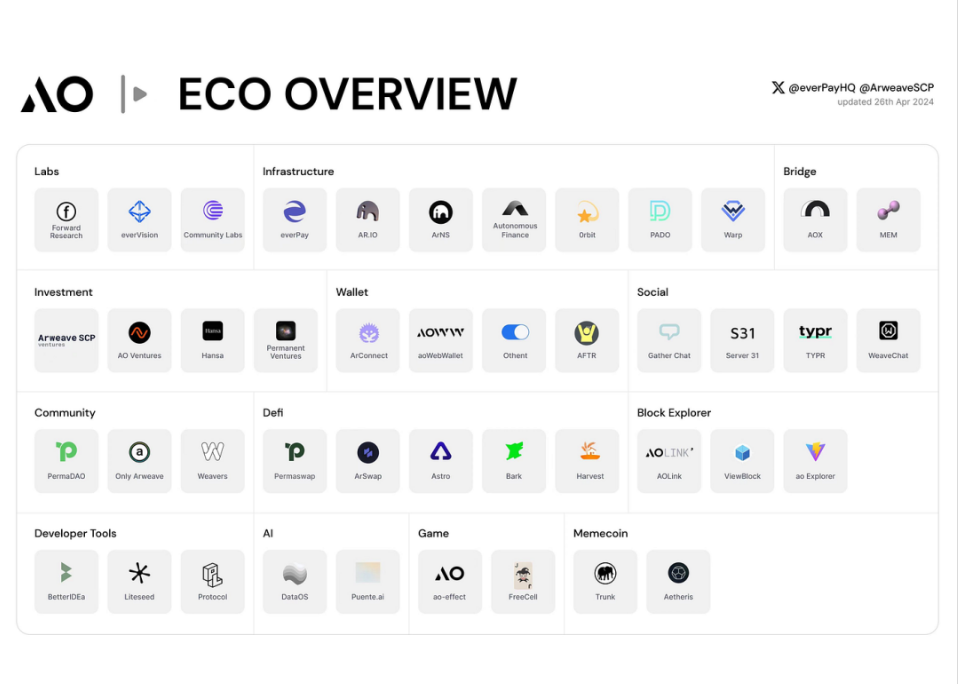

AO Ecosystem Development

AO Ecological Panorama

AO Ecosystem Panorama Source: everpayHQ(x) / ArweaveSCP(x)

From the AO ecological panorama and the main protocol content, the AO ecosystem covers multiple fields and forms a relatively complete blockchain ecosystem. By introducing a wide range of protocols and tools, a multifunctional and interconnected blockchain ecosystem has been built, covering many fields from infrastructure, decentralized finance, social applications, games to prediction markets. Its comprehensive and diversified services can meet the needs of different users and developers, and promote its ecological cycle prosperity and value creation.

Project Advantages

AO is a decentralized computing and decentralized applications. DAppAs an emerging project in the field of blockchain, it has demonstrated unique advantages and development potential compared with other Layer 1 blockchain projects with its advanced decentralized computing and extensive data storage capabilities.

Risk Analysis

1. Security of Smart Contracts

1.1 Code Quality and Contract Logic

Contract address: https://etherscan.io/address/0xfE08D40Eee53d64936D3128838867c867602665c#code#L1

The audit report shows that AO's smart contract code on the Ethereum chain is of high quality, clear logic, follows best practices, and has no obvious loopholes. This provides a firm guarantee for the technical foundation of the project.

1.2 Key findings and recommendations

Permission control: Currently, it is necessary to more strictly control the access rights of key functions to ensure that only authorized users can perform important operations. Unauthorized access may lead to malicious use of the contract.

Boundary condition processing: Some functions are not sufficient in handling abnormal situations, and boundary condition checks need to be added to ensure the stability of the contract under various abnormal situations.

Dependent library version: It is recommended to use the latest version of the dependent library to prevent security issues caused by known vulnerabilities.

2. Authority Dependence and Trust

2.1 Upgradable Privileges

The upgradeability of the contract is retained, which means that the project party can upgrade and modify the contract at a later stage. Although this design is flexible, it also increases the trust and reliance on the project party. If the project party makes some mistakes or malicious behavior, the security and stability of the contract will be threatened.

2.2 Privileged Functions

The Open Access Supercomputing Foundation can return tokens to their original owners in the event of a security incident. This privilege improves the security of the project in an emergency, but it also reflects a certain degree of centralized control. Under the concept of decentralization, the relationship between this risk and security needs to be weighed.

Summarize

The AO project is highly stable and secure at the technical level, but permission control and boundary condition processing still need to be further strengthened. At the same time, the project party should carefully handle the upgradeable permissions of the contract to avoid a crisis of trust. AO has no private placement or any entity investment quota, all of which are released through fair distribution, which has certain advantages in compliance. However, the regulatory environment in countries around the world is becoming increasingly stringent, and projects including AO still need to be closely monitored to ensure continued compliance with local regulations. Its token full fair release plan has been recognized and launched by exchanges such as Binance and OKX, indicating that the project has a good foundation in compliance and market recognition, but it should continue to pay attention to global regulatory trends to ensure that the project is always within the framework of legality and compliance.

The article comes from the Internet:AO Protocol Revealed: A Complete Guide from Technical Core to Staking Participation

Argentina is an outlier market, and many of them just buy USDT. Written by: Javier Paz, Forbes Compiled by: Luffy, Foreisght News In recent years, Argentina has been labeled with inflation, just like their world-famous roast beef. In the past 12 months, the country's cumulative inflation rate has reached 27…