Web3 Lawyer: How do virtual currency exchanges reap the benefits of issuing coin projects?

Written by: MankiwBlockchainlegal service

In addition to the daily necessities faced by traditional Internet entrepreneurs, Web3 entrepreneurs also face a new hard-mode entrepreneurial challenge: token issuance.

For the masses who do not know the truth, the highlight moment of the Web3 project is to be listed on a certainexchangeAfter all, it is a "listed company" after all, but the bitterness of it can probably only be understood by the parties involved.

作为发币的 Web3 创业者,不仅要提防被监管部门认定为非法发行证券的风险,搭建海外项目架构设立基金会等合规操作,更要当心被上币的交易所来反向收割这个天大的坑。

It is a common practice in the industry that Dogecoin is listed on DEX and serious projects are listed on CEX. Virtual currency exchanges have become the first choice for many entrepreneurs to issue tokens, and they think it is prestigious, but few people know that most virtual currency exchanges are just makeshift teams, with a large number of bugs and human risks of start-ups. The most common one is that internal employees of the exchange may manipulate the token price through false trading volume to harvest project parties and retail investors, which is hard to guard against.

Attorney Liu Honglin from Mankiw Law Firm will share a little bit of the "Dark Forest Law" in the virtual currency exchange circle based on what he has seen, and provide psychological massage and practical prevention suggestions for Web3 entrepreneurs who are preparing to go public on the exchange.

Common harvesting routines in exchanges

Unlike mainland friends who think that it is very difficult to be listed on the A-share market, as a Web3 project party, overall, it is not a particularly difficult thing to be listed on a virtual currency exchange. As long as you have the money and are willing to pay enough listing fees, you can basically go sideways on mainstream exchanges.

In terms of the process, first of all, the Web3 project party needs to connect with the exchange's coin listing team, fill out and submit the coin listing application form, provide a project white paper, introduce the project's goals, technical solutions, team background, market analysis andTokenEconomic model. Second, it is necessary to provide a tested andSafety审计报告,以及由专业律师出具的法律意见书,以确认代币的合法性和合规性。

In terms of fees, Web3 project owners usually need to pay listing fees, which vary from exchange to exchange, ranging from tens of thousands to hundreds of thousands of dollars. In addition, they also need to pay for legal opinions and technical audits, which range from thousands to tens of thousands of dollars depending on the complexity of the service and the provider's charging standards. In addition to the basic listing fees, exchanges will also make up various excuses to get more money from Web3 project owners, such as requiring project owners to provide a certain number of tokens as market-making margin to ensure the liquidity of the crypto market and incentivize exchanges to provide them with a good market environment; for example, they will offer airdrops for listing, do some market promotion activities to reward platform coin holders, and so on.

Do you think these overt revenues are all the revenues of virtual currency exchanges? No, there are also covert robberies.

The main reason is that the CEX that trades these decentralized virtual currencies is actually just a simple centralized company. Friends who are familiar with centralized large companies know that there are naturally problems such as data opacity, internal personnel operations, and conflicts of interest. As a centralized platform, it has a large amount of transaction data and user information and has a strong ability to manipulate the market. The following are some common market operation routines, it can be said that there is always one that can harvest you.

1. Creating fake trading volume: An excellent exchange will never just cut off the project owner, it will choose to cut off retail investors as well. The most common way is for internal employees or related parties of the exchange to create fake trading volume through a large number of buy and sell orders to attract more retail investors to enter the market, thereby manipulating the token price. This behavior is usually called "brushing" or "brushing orders."BlockchainA report released by the Blockchain Transparency Institute (BTI) shows that among the top 25 exchanges in the world, more than 80% of trading volume is created through fake trading volume. The report points out that the actual trading volume of some exchanges is less than 1% of their reported trading volume. Shortly after the report was issued, the head of a leading exchange forwarded it and commented: This is the most accurate and profound ranking of crypto exchanges I have ever seen.

2. Data manipulation: As the saying goes, “I am the boss of my own territory”, exchanges can also directly modify the transaction data of specific projects through backend permissions to affect the market performance of tokens. For example, they manipulate key indicators such as K-line charts and trading volume to mislead investors’ decisions. This operation is often carried out when the market fluctuates greatly to create a false market and induce investors to follow the transaction. Recently, lawyer Honglin noticed that a new project listed on the market was manipulated by the virtual currency exchange. The data was abnormal for many consecutive days. Many investors suspected that this was caused by internal transactions and data manipulation of the virtual currency exchange.

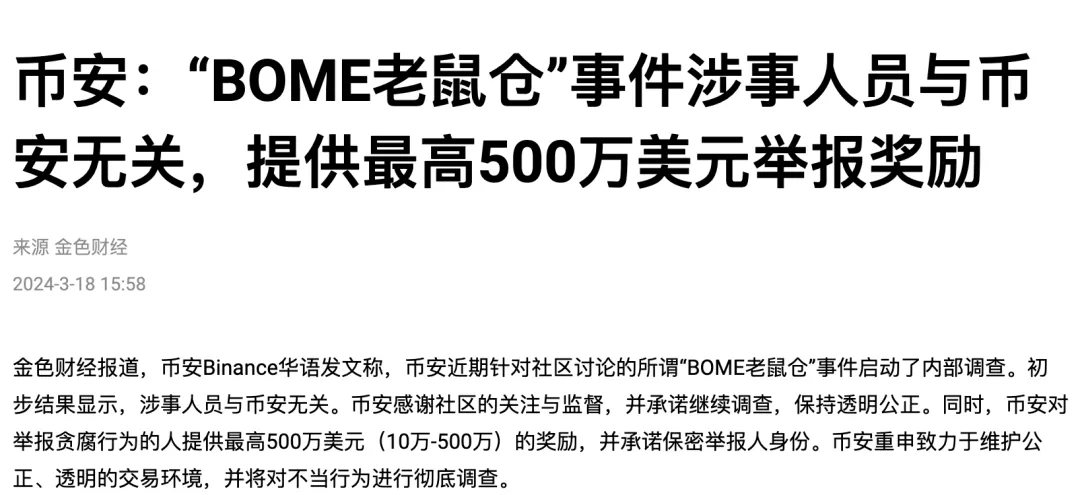

3. Insider trading: Use undisclosed market information to conduct insider trading in order to obtain illegal benefits. Exchange employees or related parties obtain huge profits by knowing major market trends in advance and conducting advance buying and selling operations. For example, when a new token is about to be launched or a major announcement is about to be released, buy or sell related tokens in advance. Just this year, in the BOME (Book of Meme) project that created the fastest listing on a certain exchange, some media suspected that the exchange employees were engaged in insider trading. Before a certain exchange made a statement, an account withdrew about 2.3 million US dollars worth of SOL from the exchange platform and purchased 314 million BOME at a price of 0.0074 US dollars. After that, after BOME was listed on the exchange, the price soared by more than 1500% on the exchange. The exchange then launched an internal investigation, saying that it had nothing to do with the internal employees of the exchange.

4. High-frequency trading and arbitrage: Many exchanges also have their own trading teams or market-making service providers, using high-frequency trading technology to conduct millisecond-level trading operations, obtain tiny price differences, accumulate small amounts to achieve arbitrage profits. High-frequency trading usually uses complex algorithms and high-performance computing equipment to complete a large number of transactions in a very short period of time. In 2017, an exchange attracted widespread attention due to the flash crash of Ethereum (ETH). At that time, the price of Ethereum fell from US$319 to US$0.10 in a few seconds, and then quickly rebounded. Subsequent investigations found that this was because the high-frequency trading algorithm triggered a large number of sell orders and buy orders when the market fluctuated violently, resulting in extreme price fluctuations.

How should entrepreneurs respond?

Finding the reasons for problems from within is a good way for adults to survive. Since external factors cannot be controlled, as entrepreneurs we have to be more careful. In response to the above risks, Lawyer Honglin gives everyone the following suggestions:

1. Choose a reputable exchange: When choosing an exchange, try to choose an exchange with a good reputation and transparent operations, and avoid choosing an emerging or unknown platform. It is recommended that entrepreneurs evaluate the credibility of the exchange by consulting public audit reports, user reviews, and ratings from third-party evaluation agencies. In addition, you can communicate with other project parties to understand their actual experience and feedback on different exchanges. At the same time, try to avoid trading tokens on only one exchange, as this makes it easier for the exchange to conduct shady operations and price manipulation.

2. Sign a detailed listing agreement: When signing a listing agreement with an exchange, the rights and obligations of both parties should be clearly defined, especially the terms on data transparency and operational compliance, to protect their own interests. The agreement should include prohibitions on false trading volume, data manipulation, etc., and set corresponding liability for breach of contract. At the same time, the exchange is required to provide regular transaction data reports to facilitate independent audits by the project party.

3. Real-time monitoring of market trends: Use professional market analysis tools to monitor the market performance of tokens in real time, detect abnormal transactions in a timely manner, and take corresponding measures. It is recommended that entrepreneurs use multiple independent data sources for cross-validation to avoid relying on data from a single platform. At the same time, third-party monitoring services can be introduced to provide 24/7 market monitoring and risk warnings.

4. 法律顾问介入:好的法律合规顾问团队的重要性不亚于做市商,这是很多发币的项目方没有意识到的点。务实的建议是,一旦准备发币,一定要聘请具有区块链和cryptocurrencyLawyers with experience in the field provide professional services. Professional legal advisors in the crypto industry can assist in handling legal affairs related to exchanges and ensure that all operations comply with legal regulations. They can not only participate in the formulation and review of the listing agreement before listing, help identify potential legal risks, but also take legal actions in a timely manner when problems are found. More importantly, they can provide advice on various projects after listing on the exchange to reduce unnecessary public relations crises.

5. CommunityConstruction and user education:CommunityThe winners win the world. Behind every successful Web3 project is a good mass base. It is a routine operation to enhance the cohesion of the community and the investment preferences of users by holding online and offline activities, publishing educational content and interactive communication. When the market is good, community members will definitely be led by the big guys, but once the market deteriorates, it is normal for the community to overturn the table, swear, make personal attacks, and threaten to call the police to protect their rights. Therefore, Lawyer Honglin often tells the Web3 entrepreneurs around him earnestly that they should not be too full of words when talking in the community, otherwise it is a pit they have dug. If they really encounter an emergency such as an exchange or a market maker coming to mess with you, it is recommended to synchronize the event information on the official media account in a timely manner to avoid user panic.Xiaobai NavigationPanic.

Summarize

In general, there are many old scythes who want to make money from Web3 entrepreneurs. For us entrepreneurs, in addition to facing legal and regulatory risks in different countries and regions, we should also be wary of the pitfalls set by business partners such as virtual currency exchanges and market makers. I hope that through this article, everyone can be more aware of the stumbling blocks set by centralized virtual currency exchanges in the process of entrepreneurship, recognize these risks, and be more cautious and prepared in the process of token issuance and trading. The road to entrepreneurship is not easy, and I hope everyone can avoid pitfalls and welcome more opportunities and development.

The article comes from the Internet:Web3 Lawyer: How do virtual currency exchanges reap the benefits of issuing coin projects?

For you: Be careful of single-factor explanations. Written by: Haseeb >|< Translated by: Xiaobai Navigation coderworld Is the market structure broken? Are venture capitalists too greedy? Is this a rigged game against retail investors? Almost all the theories I have seen on this seem to be wrong. But I will let the data speak. Here is a widely circulated table...