Liquidade’s Illegal Operations: Canada’s Crypto Asset Regulatory Policy and Market Compliance Challenges

Written by: Aiying

Recently, the British Columbia Securities Commission (BCSC) investigated the Latoken platform operated by Liquida Ltd. and found that it was operating illegally in British Columbia without registration. Users did not actually trade real crypto assets, but contractual rights to these assets. This incident not only revealed irregularities in the market, but also highlighted the importance of crypto asset regulation.

1. Event Review

Liquitrade Ltd. provides crypto asset trading services to users through the Latoken platform, but the BCSC's investigation found that users did not actually buy and sell crypto assets, but traded contractual rights to these assets. These contractual rights were identified as derivatives, and Liquidatrade was not registered with the BCSC, resulting in its operations being judged illegal. The BCSC stated that Liquidatrade did not participate as required throughout the investigation and may face sanctions in the future, including fines and market bans.

Canada has banned four cryptocurrencies as of March 2024exchange, including Catalyx, KuCoin, Poloniex and xt.com exchanges. On the other hand, 15 cryptocurrency trading platforms are approved to operate in the region, including Bitbuy, Coinbase and Fidelity.

The upcoming sanctions against LiquiTrade could range from fines to a ban on services.

Source: bcsc.bc.ca

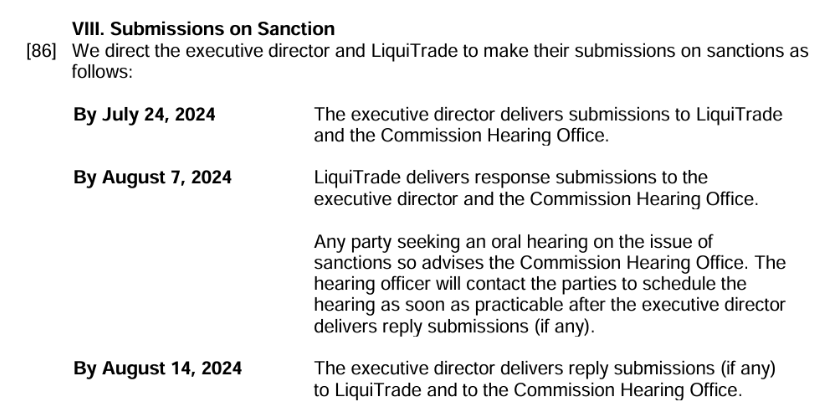

Submit a timetable for sanctions against LiquiTrade. According to court documents, sanctions against LiquiTrade will be completed by August 14. While Canada cracks down on unregistered cryptocurrency exchanges, Aiying has observed that licensed trading platforms continue to thrive.

2. Canadian Crypto-Asset Regulatory Framework

Aiying briefly sorted out Canada's crypto regulatory policy for everyone - Canada's crypto asset regulation is mainly the responsibility of the Canadian Securities Administrators (CSA) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

1. Main regulatory agencies:

CSA (Canadian Securities Administrators):

-

Responsibilities:CSA is responsible for the registration of all companies that provide crypto asset trading, custody, consulting or management servicesXiaobai NavigationThe CSA has developed a number of policy documents and guidelines to help companies understand and comply with relevant regulations. For example, the Regulatory Framework released by the CSA in 2021 clearly states that crypto asset trading platforms must register with the CSA before operating.

-

Licensing System:The CSA does not directly issue licenses, but requires crypto asset trading platforms to register and comply with relevant regulations. Unregistered companies will face severe penalties, including high fines and market entry bans.

FINTRAC (Financial Transactions and Reports Analysis Center of Canada):

-

Responsibilities: FINTRAC is responsible for anti-money laundering and combating the financing of terrorism (AML/CFT), requiring companies to implement strict customer identity verification (KYC) procedures and regularly report suspicious transactions.

-

AML/CFT regulations: In 2019, FINTRAC updated the relevant provisions of the Anti-Money Laundering and Terrorist Financing Act, further strengthening the supervision of crypto asset trading platforms, requiring them to register with FINTRAC and submit anti-money laundering reports.

2. Key regulations and requirements

Registration and licensing requirements:

-

All crypto asset service providers must register and comply with the Canadian Securities Act, which provides that businesses that provide financial services without registration will face severe penalties, including heavy fines and market bans.

Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT):

-

FINTRAC requires businesses to conduct KYC and report suspicious transactions.

-

The Anti-Money Laundering and Terrorist Financing Act, updated in 2019, stipulates that crypto asset trading platforms must register with FINTRAC and submit anti-money laundering reports on a regular basis.

Investor Protection:

-

The CSA protects investors through education and risk warnings and regularly publishes a list of high-risk platforms.

-

CSA’s official website lists all unregistered high-risk crypto asset trading platforms to remind investors to invest with caution.

3. Compliance and penalties

Compliance requirements:

-

Before providing crypto asset services, companies must register with the CSA and FINTRAC and comply with relevant AML/CFT regulations.

-

Companies must establish a robust compliance system, including regular employee training, strict KYC procedures, and ongoing communication with regulators.

Violation Penalty:

-

CSA and FINTRAC can impose severe penalties on unregistered companies, including fines, market bans and criminal liability.

-

For example, Liquidatrade Ltd. was investigated by the BCSC for operating the Latoken platform without registration and may face sanctions including heavy fines and market bans.

Aiying Aiying concluded that Canada has established a relatively complete framework for the regulation of crypto assets, which is mainly supported by the Canadian Securities Act and the Anti-Money Laundering and Terrorist Financing Act, and supervised by CSA and FINTRAC. Although the current policies have achieved remarkable results in protecting investors and maintaining market transparency, they still need to be continuously updated and improved to cope with emerging risks and market changes.

The article comes from the Internet:Liquidade’s Illegal Operations: Canada’s Crypto Asset Regulatory Policy and Market Compliance Challenges

Related recommendations: TRON Hackathon Season 6 concluded with great success

This year's competition attracted 962 teams to participate, bringing together many innovativeBlockchain项目,同时彰显出波场网络的深厚实力。 瑞士日内瓦,2024年5月16日 -TRON DAO宣布由HTX DAO、BitTorrent Chain和JustLend DAO联合主办的波场黑客松第六季圆满落幕。本…