Token performance in this round of plunge: nearly 60% of token prices cut in half, the old blockchain is the most resistant to the drop, and blockchain games perform poorly

Written by: Frank, PANews

Recently, the crypto market has experienced a strong correction. The entire market is filled with depression caused by the falling sentiment. However, in the process of market development, ups and downs are the norm, and in the process of overall market downturn, it is a touchstone for many projects. In this process, which tokens are still strong? Which tokens are prone to collapse? PANews has made some analysis on the recent token market performance to unveil the changes in the market.

Nearly 60% of token prices have been cut in half, with blockchain games being the hardest hit

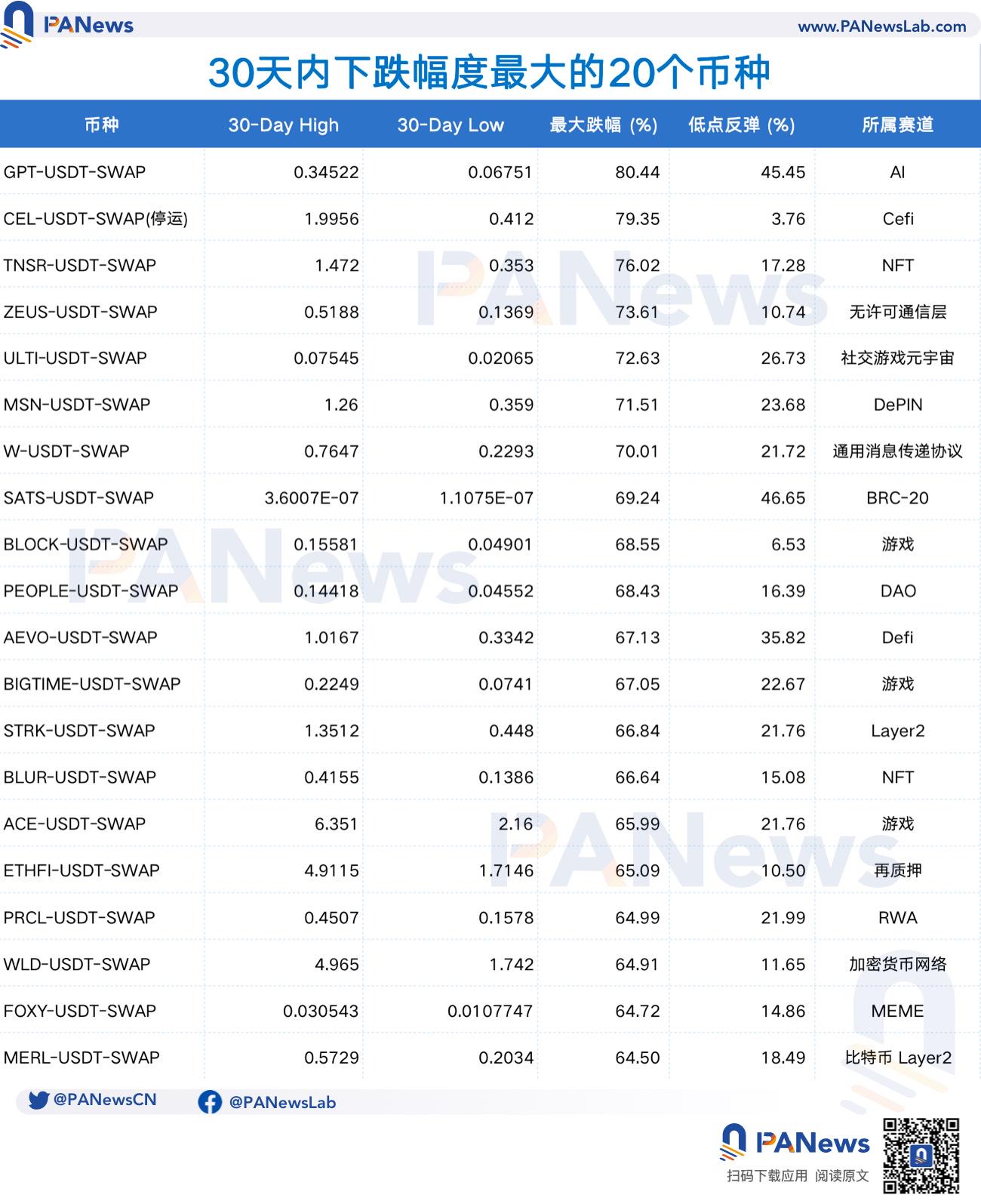

Based on the OKX perpetual trading pair data, PANews lists the highest and lowest points in the past 30 days respectively, calculates the currency with the largest decline in the past 30 days, and also uses the rebound price range from the low point to July 8 to reflect the strength of the token’s rebound.

Among the 20 tokens with the largest decline, GPT suffered the largest decline, with the largest decline reaching more than 80% within 30 days, and GPT also became the only token in the top 20 with the largest decline. AI project.

In addition, blockchain games have become the track with the most appearances. Among the top 20 decliners, there are 4 game-related projects, including BLOCK, BIGTIME, ACE, and ULTI, with an average decline of 68.5%, and the price has evaporated by nearly 70%.

Surprisingly, although MEME coins are known for their high volatility, the list of tokens with the largest declines shows that only one MEME coin is shortlisted, and FOXY is not a very mainstream MEME.

However, in this round of decline, most of the tokens suffered heavy losses. Among the 194 tokens counted, 110 tokens lost more than 50% in 30 days, accounting for nearly 60%.

Layer1 is more resistant to declines and old currencies are more stable?

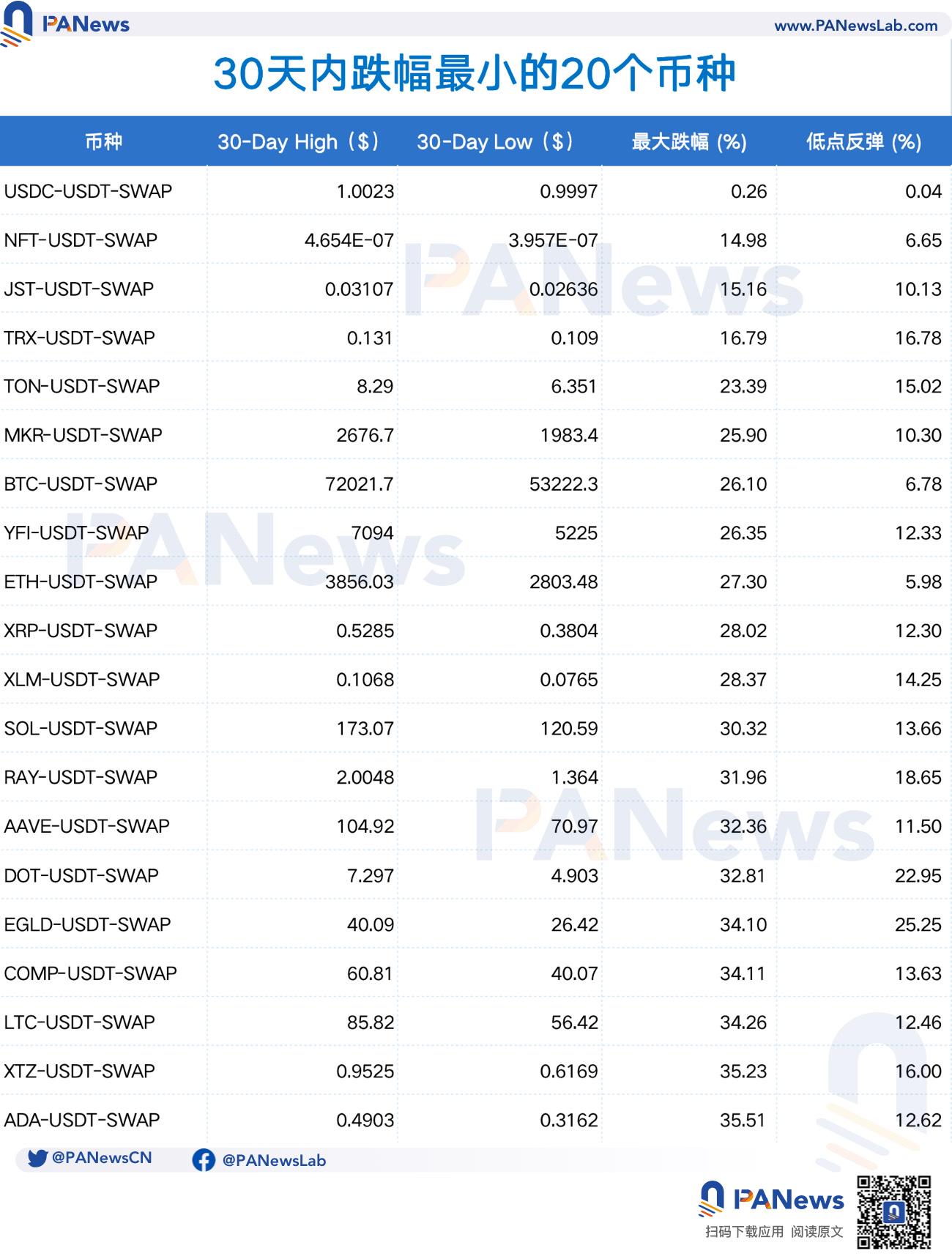

In the top 20 rankings with the smallest declines, the governance tokens of various Layer 1 public chains still show stronger stability. Among them, the declines of TRX, TON, BTC, ETH, SOL, XRP, DOT and other tokens are relatively much smaller. These tokens have existed for a longer time and have a larger market value, which may be why they have maintained better stability.

In addition, the NFT and JST at the top of the list have a smaller decline not because the coin price is strong, but because these two tokens have already fallen and have recently entered a relatively stable price range. In terms of rebound, the rebound of these two tokens is also relatively weak.

In addition, in the overall data, only 27 of the 194 tokens have a decline less than 40%, and these tokens with smaller declines are almost all tokens issued for more than 3 years.

NOT rebounded and was far ahead of the rest. Will the rune track be in turmoil again?

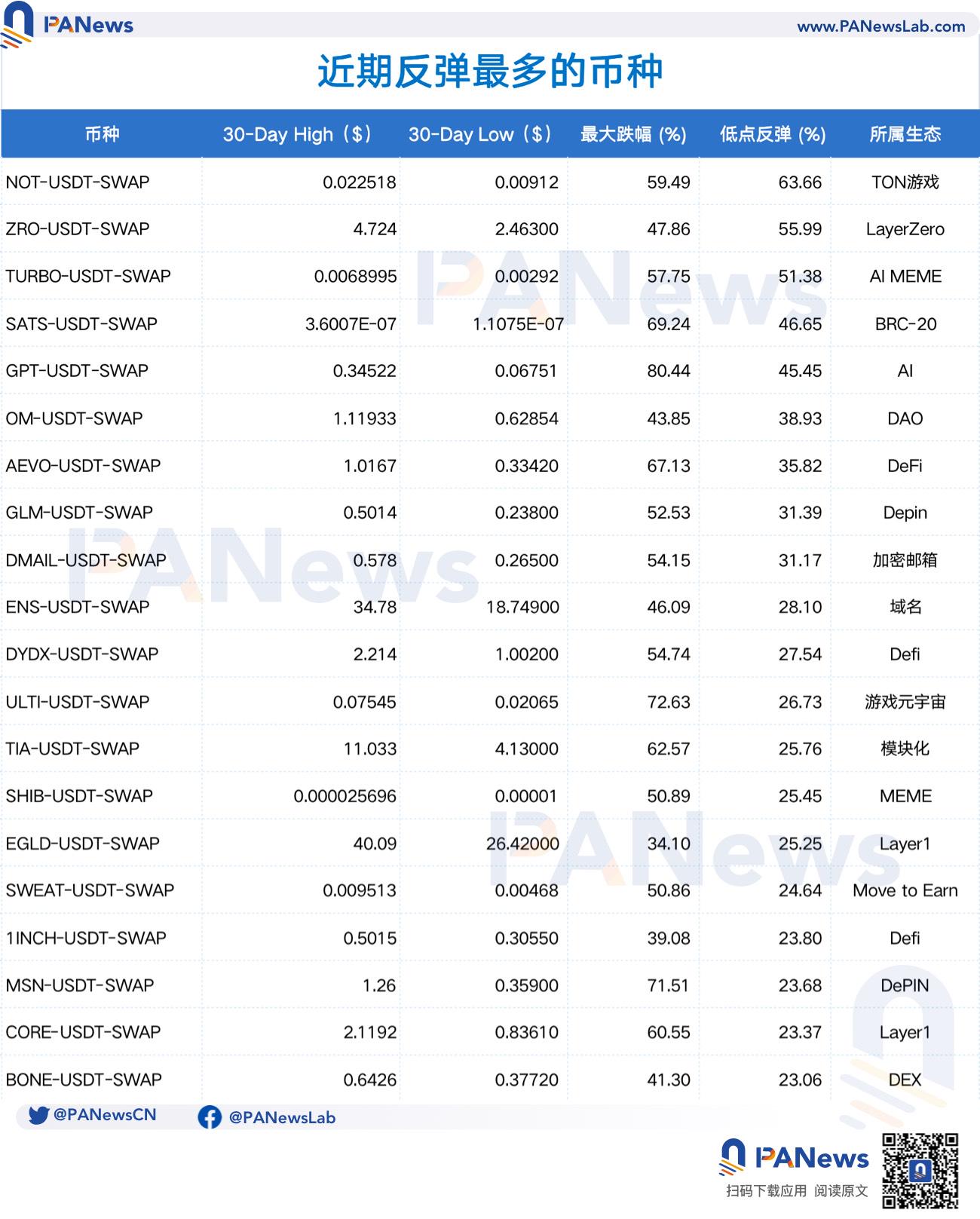

If the decline is inevitable, then the rebound after the decline can better reflect the market's confidence and expectations for the token. From this point of view, NOT is undoubtedly the best performing token at present. In the past 30 days, NOT has fallen by as much as 59% from its high point, but the recent rebound from its low point has reached 63.6%. NOT's strength has also allowed more players to see the potential of TON. Recently, the TON ecosystem's small games that click on the screen have once again ushered in rapid growth.

In addition, LayerZero's token has just been launched. Although it has also caught up with this wave of sharp correction, judging from the market performance, the token ZRO has also rebounded relatively strongly, rebounding 55% from the low point.

In addition, the Bitcoin ecosystem tokens have also rebounded in recent days. SATS rebounded 46.6%. I wonder if the Rune track will continue this momentum.

Overall, among the 195 Xiaobai NavigationAmong the tokens, more than half of them fell by more than 50%. Except for the stablecoin USDC, only three tokens fell by less than 20%. BTC and ETH, which have the highest market capitalization, fell by 26% and 27% respectively, which are relatively small in comparison.

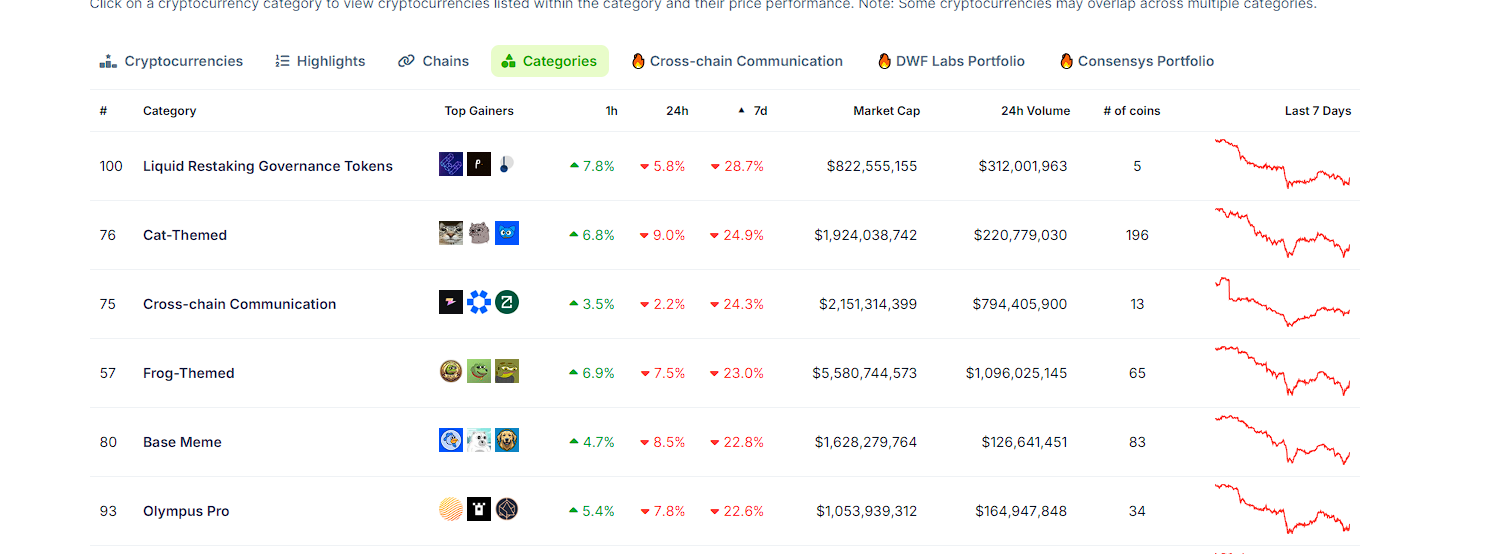

In addition, according to data from coingecko, the worst performing sectors in the past seven days are re-staking governance tokens, cat-themed MEMEs, and cross-chain communication protocols.

Since the analysis results are limited to those that have been launched on the mainstreamexchangeTokens of some chains are not covered. PANews will continue to pay attention to market trends and provide more comprehensive analysis reports. The content of this article is only for industry information and is not intended as investment advice.

The article comes from the Internet:Token performance in this round of plunge: nearly 60% of token prices cut in half, the old blockchain is the most resistant to the drop, and blockchain games perform poorly

Related recommendation: Multicoin leads the investment, how does Arch build Bitcoin infrastructure?

Arch Network 要做的不是比特币的 L2,而是将可编程性直接引入到比特币之上。 撰文:1912212.eth,Foresight News ZK 系产品及相关协议如雨后春笋般不断涌现,甚至连并行化也逐渐成为一种潮流。我们看到该两种概念不断在 L2 以…