The double-edged sword of token launch: premature token launch can be a mistake, but it can also have an incentive effect

author:MASON NYSTROM

Compiled by: Xiaobai Navigation coderworld

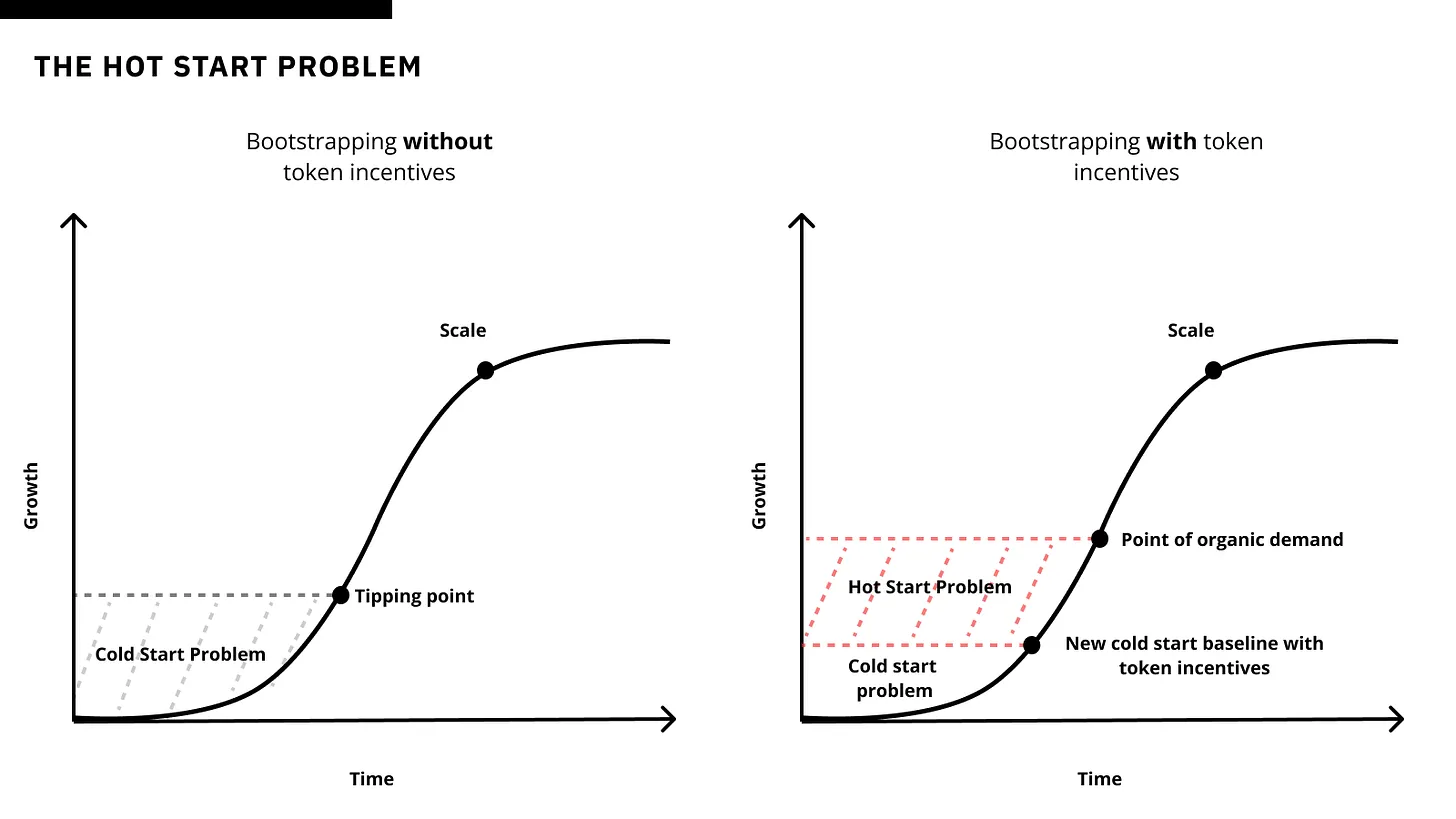

It has been proven that when tokens (or token promises) are combined with new innovative products, they can effectively alleviate the cold start problem. But while speculation can bring benefits to network activity, it can also bring negative effects of short-term liquidity and non-organic users.

Marketplaces and networks that launch tokens from the outset (or before sufficient organic demand is built) must find product-market fit (PMF) within a shortened window, or they will run out of precious token resources.

My friend and investor Tina Call it the “hot start problem,” where the existence of tokens limits the window of time in which startups can find PMF and gain enough organic traction to retain users and liquidity when token rewards are reduced.

Applications released with a points system also suffer from the warm start problem because users now have an implicitTokenexpectations.

I really like the term “hot start problem” because one of the core differences of Crypto compared to Web2 is the ability to use tokens as financial incentives to launch new networks.

This strategy has proven to be effective, especially in markets such as MakerDAO, DyDx, Lido, GMX and other DeFi protocols. Token launch has also been proven to be effective for other Crypto networks, from decentralized IoT networks (such as Helium) to infrastructure (such as Layer 1 Blockchain)以及某些中间件(如预言机)。然而,那些选择通过 Token 进行快速扩展而面临热启动问题的网络面临几种权衡,包括模糊自然牵引力和 PMF、过早用完 Token 资源,以及由于 DAO 治理(如筹款、治理决策等)而增加运营任务的复杂性。

Why choose the hot start problem?

There are two situations where the warm start problem is more favorable than the cold start problem:

-

Startups competing in a highly competitive, red ocean market with known demand

-

Products and networks with passive supply-side participation

Red Sea Market

The core disadvantage of the hot start problem is that it is difficult to judge natural demand, but this problem is alleviated in categories with strong product market fit (PMF). In this case, latecomers may be able to successfully challenge the early movers by launching tokens early. The DeFi field provides many examples of latecomers overcoming the hot start problem by effectively using tokens to launch new protocols. Although Bitmex and Perpetual Protocol were the first to provide perpetualcontractCentralization and decentralizationexchange, but later GMX and dYdX quickly increased liquidity through Tokens,become永续合约市场的领导者。较新的 DeFi 协议如 Morpho 和 Spark 在借贷方面successLaunched with billions of dollars in total locked value (TVL), Aave (formerly ETHlend) still dominates despite early movers such as Compound. Today, tokens (and credits) are the default choice for liquidity launch when the need for new protocols is clear. For example, liquidity staking protocols actively use credits and tokens to increase liquidity in a highly competitive market.

In the consumer crypto space, Blur has demonstrated a strategy to compete in a crowded market, with its market-defining points system and token launch, making Blur the largest cryptocurrency exchange in terms of transaction volume.leadingEthereum NFT trading venue.

Passive and active supply involvement

Compared with the active provisioning network, the hot start problem isPassive supply networkEasier to overcome. A brief history of token economics shows that tokens are useful in launching a network when there are passive tasks to be accomplished, such as staking, providing liquidity, listing assets (like NFTs), or set-and-forget hardware (like DePIN).

On the contrary, although Token is launching active networks such as Axie, Braintrust, Prime, YGG and SteXiaobai NavigationPN has also been successful, but the premature appearance of tokens often obscures the true product-market fit.The warm start problem is more challenging in active networks than in passive networks.

The lesson here is not that tokens are ineffective in active networks, but that applications and marketplaces that launch token rewards for completing active tasks (such as usage, games, gigs, services, etc.) must take additional measures to ensure that token rewards are used for organic usage and drive important metrics such as engagement and retention. For example, the data annotation network Sapien gamifies the annotation task and lets users stake points to earn more points. In this case, users passively staking when performing certain actions may serve as a loss aversion mechanism to ensure that participants provide higher quality data annotations.

Speculation: Feature or Bug?

Speculation is a double-edged sword. If integrated early in the product lifecycle, it can be a flaw, but if done strategically, it can also be a powerful feature and growth tool for attracting user attention.

Rather than solving the cold start problem, startups that choose to launch tokens before gaining natural traction choose the hot start problem. They accept the tradeoff of using tokens as an external incentive to attract user attention while betting on their ability to discover or create natural product utility amidst the increasing speculative noise.

The article comes from the Internet:The double-edged sword of token launch: premature token launch can be a mistake, but it can also have an incentive effect

Related recommendation: SocialFi functional layering: transaction priority or social priority?

SocialFi application developers need to own multiple layers of the SocialFi stack to build the defensibility of the protocol. Author: MASON NYSTROM Compiled by: Xiaobai Navigation coderworld Xiaobai Navigation As the use of encrypted social platforms and financial games increases, the way they are built is also evolving. We can expect to see more in the future…