The key choice for TON official ecosystem construction: traffic-driven rather than asset-driven

author:@Web3Mario

Summary: I have been studying TON recently. DAppI want to talk about the relevant technologies developed by TON, and try to think about some product design logic. As the popularity of TON increases, some AMA, roundtable discussions and other activities have become more and more frequent. I have also participated in some of them and found some interesting things that I hope to share with you. Let me first talk about the conclusion. In general, I found that the official ecological construction ideas of TON are different from traditional execution layer projects, that is, the so-called public chains. It seems to have chosen traffic-driven rather than asset-driven. This brings a new requirement to developers. If you want to get official endorsement, or more bluntly become a project that the official likes more, the core operating indicators in the cold start phase need to transition from asset-related, such as TVL, market value, number of coins held, etc., to traffic-driven, such as DAU, PV, UV, etc.

Asset-driven development has always been the core of Web3 project development and operation

The core criterion for judging whether a public chain project is successful has always been how many assets have been accumulated, and judging whether it is sustainable and its core competitiveness based on the composition and distribution of assets. In layman's terms, it is how much TVL a chain has, how these TVLs are composed, what is the proportion of native assets, what is the ratio of blue chip coins to altcoins, what is the proportion of voucher assets, the degree of Matthew effect, etc. So what conclusions do these questions correspond to? Let's give a few examples to illustrate:

l Assuming that BTC, ETH and other blue-chip coins account for a high proportion of the total value in a chain, and the top 10% of people own 80% of the assets, it roughly means that the chain has a high impact on traditionalcryptocurrency巨鲸比较友好,或者说其对传统加密货币巨鲸有比较强的吸引力,通常情况下其背后可能会有类似CEX等项目的背书支持。

l Assuming that the proportion of native assets in a chain is high, the distribution is relatively even, and the standard deviation of user assets is small, it generally means that the chain team has good operational capabilities or has relevantCommunityresource,CommunityIt is well built and has an active developer ecosystem. Usually, it is driven by a community with a successful background and has broad community support.

l Assuming that the proportion of voucher assets in a chain is high, it needs to be treated with caution. This roughly means that it is most likely still in the early stage of construction and has not effectively attracted core assets. However, the team will have some whale resources, but the cooperation reached is not close or the attraction is not strong, which makes the whales reluctant to transfer their core assets directly to it. Web3 projects on this chain are easily harvested by whales in a tidal manner.

Of course, there will be different interpretations depending on the situation, but everyone will find that assets are the key to judgment. The reason for this is that the core value of Web3 lies in digital assets. This topic is in my previous articleThe popularity of Runes is a setback for the development of encryption technology, but it is also the best embodiment of the core value of Web3.There has been a complete discussion in the article, and those who are interested can discuss it with me. Therefore, for a long time, Web3 developers have focused on how to create and maintain asset value, or how to effectively attract assets in the process of product design, cold start solutions, and economic model design. Depending on the type of project, the priority of these two issues will vary.

但是TON团队在生态建设的过程中似乎并没有选择遵循这个思路,而是选择Web2项目,或者说传统互联网项目中的常规方式——流量驱动,来引导或扶持产品,建设生态。之所以这么说,理由有两个,首先已经有不少针对TON生态DApp分析的文章,想必大家对TON生态现状应该有一定了解,当前最活跃的APP类别、当数类似Notcoin的流量小游戏。细究其技术架构,其甚至都不能算作一个DApp,因为通常情况下,Web3 游戏有两个显著的特征,资产道具上链,核心算法上链,都是利用BlockchainThe trust-free capability can reduce the trust cost in the game operation process. However, Notcoin does not have such a feature. It only maps the final reward points to a FT token on the TON public chain.Token, and issued an airdrop. You can find many similar examples, and their current status is naturally inseparable from the support of TON. This shows that in the eyes of TON officials, some traditional Web3 values are not important compared to traffic. As long as there are users, you don’t even need to be a Web3 project, and you will get official support.

Secondly, in some public occasions, TON officials also choose to actively guide the community to design products in this direction. Last Friday, I participated in a Twitter space about TON ecology, which included TON foundation officials and some Web3 VCs. My feeling after listening to them was that there was a big gap between their views on TON ecology. Officials seemed to like to compare TON ecology with WeChat mini-program ecology, and tried their best to guide users to associate the two, and encouraged traffic-driven products, while Web3 VCs talked more about digital asset considerations. This also shows that the official is likely to have a relatively large difference from the traditional Web3 model in the process of building the ecology.

So why did TON officials make such a choice? This involves the core narrative logic of TON's ecological construction, which is the potential to break the circle rather than the ability to accumulate assets.

The core narrative logic of TON ecosystem construction: Breakthrough potential rather than asset accumulation ability

怎么来理解这句话呢,我们知道大部分的公链项目的核心叙事逻辑主要还是对数字资产的争夺,即通过某种技术在保证满足Web3核心价值观的基础之上,例如去中心化等前提,极大的提高网络吞吐量,降低使用成本,提高使用效率。其核心价值是在于对数字资产的沉淀能力,一条更便宜,使用起来更快的公链显然将可以吸引更多的数字资产,而更多的数字资产是这些公链项目方商业模式的价值支撑,因为更高的采用率意味着对作为手续费的官方代币的需求更多,这将有利于支撑项目方手中大量代币的价值。

However, the narrative that TON hopes to create is not this, but its potential to break the circle. You can easily find such soft articles or such views on the Internet: Telegram has the highest number of communication application users in the world, up to 800 million people, and TON will have unparalleled advantages in breaking the circle with this large user base. Breaking the circle is the core narrative logic of TON in its ecological construction.

So why is there such a difference? The core involves two issues:

l TON’s core business logic;

The relationship between TON and Telegram;

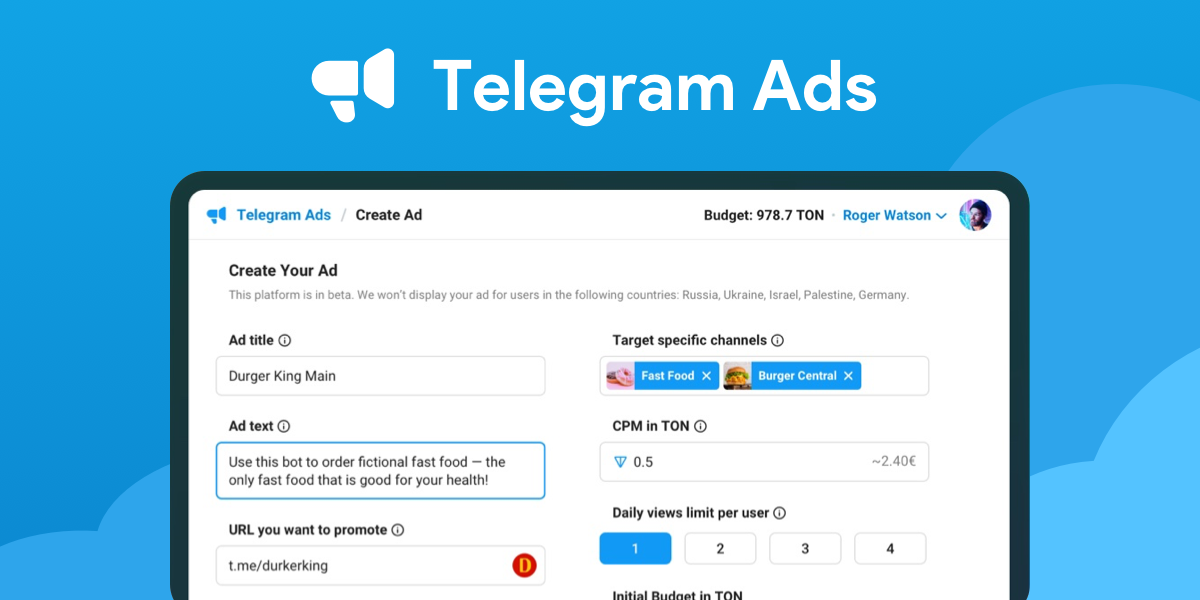

First of all, the core business logic of the TON team is actually similar to that of most public chain projects, all of which are based on maintaining the value of TON tokens. However, compared with other projects, TON has an additional option for maintenance, which is Telegram's advertising system. We know that since the beginning of this year, TON tokens have an important use as a settlement token in Telegram's advertising commission system. Advertisers pay for traffic purchases with TON tokens, and this part of the fee will be paid to the channel owner of the corresponding channel as a commission, and Telegram officials will extract a certain percentage of the fee.

This means that in addition to the handling fee for using the chain, there is a second option for how to support the value of TON tokens, which is to expand the cake of Telegram's advertising system. This is actually a common traffic-driven model for Web2 projects, except that the settlement token has switched from legal currency to cryptocurrency. In order for Telegram to optimize the efficiency of the advertising system, it will specifically involve two aspects: creating more valuable advertising space and labeling Telegram users. The TON team found that an efficient scenario for achieving these two effects is Mini App. First of all, as long as Mini App is used frequently, it can become a high-quality advertising space after the introduction of the advertising commission system.

Secondly, we know that Telegram is an application that emphasizes privacy protection. It is extremely difficult and sensitive to label users and give advertisers the ability to conduct precision marketing. Therefore, Telegram cannot provide advertisers with precision marketing services, such as distributing a dessert brand advertisement to Indian users who like desserts. This affects Telegram's commercialization capabilities. However, in Mini App, since the user's participation is not Telegram, but this third-party application, Telegram is just a carrier, which creates conditions for user labeling. In the process of user participation in Mini App, user's habits and preferences will be labeled, and the whole process is not easy to cause user disgust and is relatively smooth.

The above two aspects also explain the phenomenon mentioned above. TON does not pay much attention to some traditional Web3 values in its choice of project support. As long as there is traffic, it can get official support.

Some people may wonder if the construction process should not be led by Telegram. As a public chain, TON should still follow some traditional Web3 values in order to build a cohesive community. This involves the second question, the relationship between TON and Telegram.I have already introduced the relationship between TON and Telegram in my previous articleIn general, from a phenomenal point of view, TON’s status is actually more like a subsidiary supported by Telegram. The subsidiary has made certain legal isolation, so that it can operate through the subsidiary when dealing with certain risky businesses, thereby reducing its own risks. For Telegram, an APP with such a high adoption rate and emphasis on privacy protection, it is naturally "focused on" by government departments of various countries. In order to explore a more stable and less susceptible to interference profit model, Telegram chose to use cryptocurrency instead of legal currency as the subject of advertising settlement. However, this will bring new risks to some regions that are unfriendly to crypto assets. Therefore, the current architecture can effectively reduce this risk. Based on this relationship, we can easily draw a conclusion.Xiaobai NavigationIn essence, the relationship between the two is still a master-slave relationship. Therefore, when developers are designing applications, in order to more easily obtain official support from TON, it is recommended that they think from the perspective of Telegram rather than the TON public chain.

Finally, in summary, in general, TON's ecological construction path has chosen traffic-driven rather than asset-driven in the short term. This brings a new requirement to developers. If they want to obtain official endorsement, or more directly become a project that the official prefers, the core operating indicators in the cold start phase need to transition from asset-related, such as TVL, market value, number of coins held, etc., to traffic-driven, such as DAU, PV, UV, etc. Of course, regarding this conclusion, or some TON application development issues, as well as some TON product ideas, everyone is welcome toMy TwitterCommunicate with me.

The article comes from the Internet:The key choice for TON official ecosystem construction: traffic-driven rather than asset-driven

Related recommendations: "Skills" in trading, sharing of technical indicator applications

For the secondary market, we can also divide investment into Tao, Fa, and Shu, and none of the three can be missing. Written by: Jian Shu Knowing is not difficult, but doing is not easy. For investment in the secondary market, everyone knows that you can't be greedy, and you can't chase the rise and sell the fall, but how many people can control their hands to achieve unity of knowledge and action? In the Tao Te Ching, Lao Tzu mentioned Tao, Fa, and Shu. Tao refers to rules, natural laws...