Lessons from the past: Accepting losses and improving risk management are more important

author:DUO NINE⚡YCC

Compiled by: Xiaobai Navigation coderworld

existcryptocurrencyMaking money from investing is exciting and everyone loves to talk about it. It's not only engaging but also increases engagement. However, when you lose money, few people discuss it.

Anyway, everyonecryptocurrencyYou will experience losing moments in the markets. How you overcome them will determine whether you end up a winner. Below, I’ll share some of my best tips:

-

How to protect profits

-

Buy when no one is interested, sell when the crowds are busy

-

Don't trust altcoins

-

Don't quit your job to do itfull timeCryptocurrency trading

-

Avoid quick profits, they lead to ruin

-

Accept failure and losses

Let’s look at each one.

1. How to protect profits

onlyProfitIt’s not enough to buy and sell, you also need to protect those profits! If you don’t have a clear system,Crypto MarketIt could quickly take away your profits.

There was a recent case of someone who lost $400,000 in one trade. He didn't start with $400,000, he started trading with $500. He lost all his profits in one trade.

Every lucky person, except for greed, will eventually run out of luck and inevitably suffer losses. You will lose everything.

To avoid this, follow these steps:

-

If you are lucky enough to turn $500 into $400,000,Your first priority is to protect those profits.This means that instead of trading these profits, you take them out. You can keep them in cash (more on this later) or buy gold or Bitcoin (BTC). It's that simple!

-

After protecting your profits, continue trading with your principal.In this case, the person mentioned above can continue to trade with $500 or a little more because he can now afford it. In any case, these profits should not touch the market again.

By doing this, even if the market goes against you and you lose your principal ($500), you still have $400,000 in hand, which will make you a better trader/investor over time and refocus faster after a loss.

Only when your strategy produces good results over an extended period of time should you consider adding a small portion of the profits to your trades or portfolio. It’s that simple.

2.Buy when no one is interested, sell when the crowds are busy

You should deploy in a bear market, ideally when people start tweeting “Bitcoin is dead”, that’s the best time to start buying and taking risks. Always aim to maximize your risk/reward ratio, that is, findAsymmetric bets!

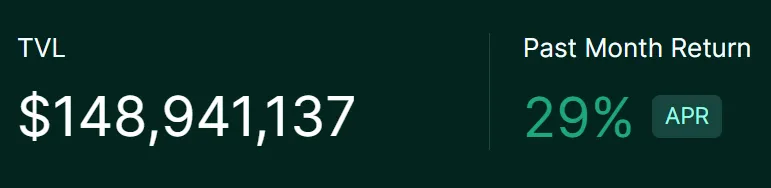

Taking the current market conditions as an example, in the event that Bitcoin shows weakness, I would keep the $400,000 in USDC andgain profit(For example, staking).

At the current rate of return of 29% per year, that $400,000 can generate about $10,000 per month in income without doing anything. This is the real income from transaction fees and liquidation. If the market falls further, his income will be even greater.

I would not buy Bitcoin or any other coin right now. I would wait for a discount as the market continues to fall. Remember, you didn’t lose anything by not buying, you still kept your $400,000 profit! Protect them at all costs.

Once the market shows signs of bottoming, such as in a bear market, you can use these profits to buy Bitcoin through the DCA method. This way, even if the price of Bitcoin falls further or moves sideways, you will reduce your risk and have a good chance of profiting when the price eventually rebounds and hits new highs. If you are patient, a good entry point can easily double that $400,000, or any amount you invested.

Look at the current cycle. If you bought Bitcoin in the last bear market at less than $20,000, you would have beaten most investors in the market. The larger your portfolio, the more you shouldXiaobai NavigationThe more Bitcoins you have.

For example, I used my profits to buy Bitcoin below $20,000 in the last bear market. I didn’t catch the $15,500 bottom perfectly, but looking back, any buy below $20,000 was an excellent entry point.

You can certainly play with altcoins, but they should be a small portion of your total portfolio. It would be irresponsible to have too much and you will lose a lot. In any case, when you find mania in the market, start selling and don't buy back in, protect your profits!

3. Don’t trust altcoins

Altcoins are not sound money! At best, they are just a good technical project. Most altcoins don’t even needToken, and are a very poor store of value over time. You wouldn’t buy $10,000 worth of tomatoes to store your wealth, right?Altcoins are more like tomatoes, which will rot quickly.

A great way to lose money in the cryptocurrency market is to buy the latest altcoin released and hold it for the long term. Please don’t do this. It’s like buying tulips and hoping to get rich.

That's not the case.

Altcoins are good for speculation in the short to medium term. That's it. Beyond a one year time frame, you're likely to lose a lot of money. There are some exceptions, but overall, buying altcoins is not the way to long-term success.

They can make you rich overnight, but if you don't follow the first point of this article, this wealth will not last. Most altcoins will collapse from 90% to 99% in a bear market because the buyers are gone. The reason why altcoins rise and fall quickly is that they have poor liquidity.

This means that insiders can easily push them up. Once they make their profits, no one can stop the price from crashing. Bitcoin does not have this problem because it is the most liquid cryptocurrency.

Fundamentally speaking,Only Bitcoin isReliable Money, and in some ways resembles gold.Ethereum doesn’t fit this criteria either, even though they like to call it “ultrasonic money.” In reality, Ethereum is more like oil, with its price going up and down based on how much usage the network has.

4. Don’t quit your job to trade crypto full-time

95% of traders are losers and only 5% are winners. Trading cryptocurrencies is harder than your job and is 24/7, which is probably a bad choice. Instead, keep your job or find a job you love and invest in cryptocurrencies (mostly Bitcoin).

A good way to avoid massive losses is to not trade cryptocurrencies. Instead, invest in this emerging field. When you invest,buy the casino, investing in its infrastructure with a long-term perspective, rather than trading it.

Ethereum and its decentralized finance (DeFi) derivatives are a great example in this regard. While difficult to predict, DeFi made Ethereum what it is today (the “oil” of DeFi). Similarly, Bitcoin is and will continue to be sound money.

If you want to protect your wealth, buying Bitcoin at a low price is never a bad choice. When you buy it, you don’t buy it to sell it tomorrow. You buy it to hold it for the long term and retire with it.

How do i do this?

You can borrow it or earn interest on your Bitcoin (See), when Bitcoin reaches $1 million in the next 10 years, that's when you retire.

As for altcoins, try to buy into the infrastructure of cryptocurrencies, not the meme. That's where the opportunities are. Don't invest too much in altcoins, but a good bet can bring 10x to 100x returns.

I can’t tell you which coin is the next Ethereum, but I can tell you based on your age.Take some risks at an appropriate ageAs you age and grow wealthier, it may be worthwhile to reduce your altcoin purchases and focus on Bitcoin for the peace of mind you gain.

5. Avoid quick profits, they lead to ruin

A quick 10x gain on a meme can lead to mania and greed, which will likely result in a bad trade later. Don’t go all in on this play. Never go all in on a single altcoin. Speculate, but keep it within a small range of your total portfolio.

Making your annual salary on a single trade could be life-changing, but so could losing it all on a single trade. Meme coins are appealing because of their potential for revenge (or impoverishment). They are highly risky and only worth a try if you have a small portfolio.

In this case, it makes sense to take more risk. If you already have a sizable cryptocurrency portfolio (mostly Bitcoin), then only speculate on meme or similar high-risk coins with a small portion of your total portfolio, and that’s it.

If you make a killing, sell, never look back, and follow the first point of this article. Never sell Bitcoin for altcoins. If you find yourself doing this,There is only one reason for that: greed. This never ends well.

7. Accept failure and losses

Failures and losses are inevitable in this field, but you can definitely reduce them and shrink their size, and that's where you come in. The market works the way it does, and your job is to manage the risk.

make moneyIt shouldn't be your ultimate goal.Instead, you should maximize yourtimeBitcoin is part of the answer. Most people need to lose a lot of money playing with other coins before they realize this.

By accepting losses, you will focus on the important things faster and improve your risk management. The top 5% traders who win in this game do so because they do their risk management job correctly. This means that they lose often, but the losses are small, and they win big a few times a year.

That's all you really need. Accept that losses are part of the process, but make them small enough so that they don't throw you off balance. That takes time and discipline.

Be patient with yourself and find your comfort zone, it might not even be related to crypto!

The article comes from the Internet:Lessons from the past: Accepting losses and improving risk management are more important

Related recommendation: US-China trade tensions and the impact on the crypto market

In the long term, if the dollar depreciates due to increased debt and money supply, Bitcoin may benefit as an alternative currency. Written by: Greythorn The global situation is unpredictable, and although you may have noticed, it is worth sharing some of Greythorn's insights. While we mainly focus on the crypto market, especially after the Bitcoin halving confirmed…