Airdrops are not dead, but don’t chase hot projects too much

author:Axel Bitblaze

Compiled by: Xiaobai Navigation coderworld

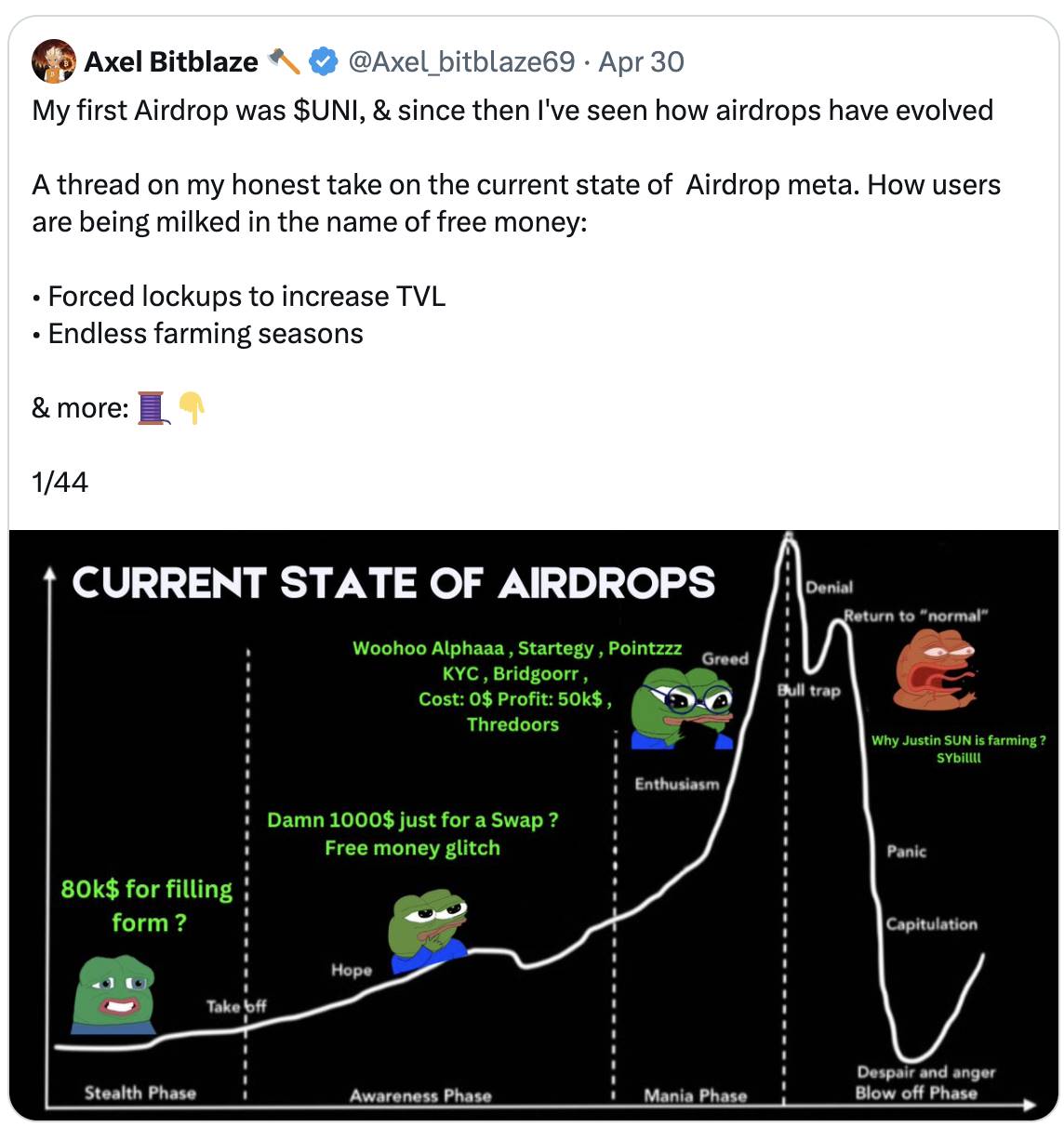

With all major airdrops (such as $ZRO and $) is done, the sentiment around airdrops seems to have cooled down a bit. So, is the airdrop beta over? Are they still worth farming? What’s next for airdrops? I’ll share my thoughts in this post.

What’s next for the airdrop?

A few months ago I wrote an article about “Current Airdrop Betas” where I mentioned that there were three major airdrop projects that had not yet been launched. Now that they have all been completed, here are my thoughts on the upcoming betas.

(SeeTweets)

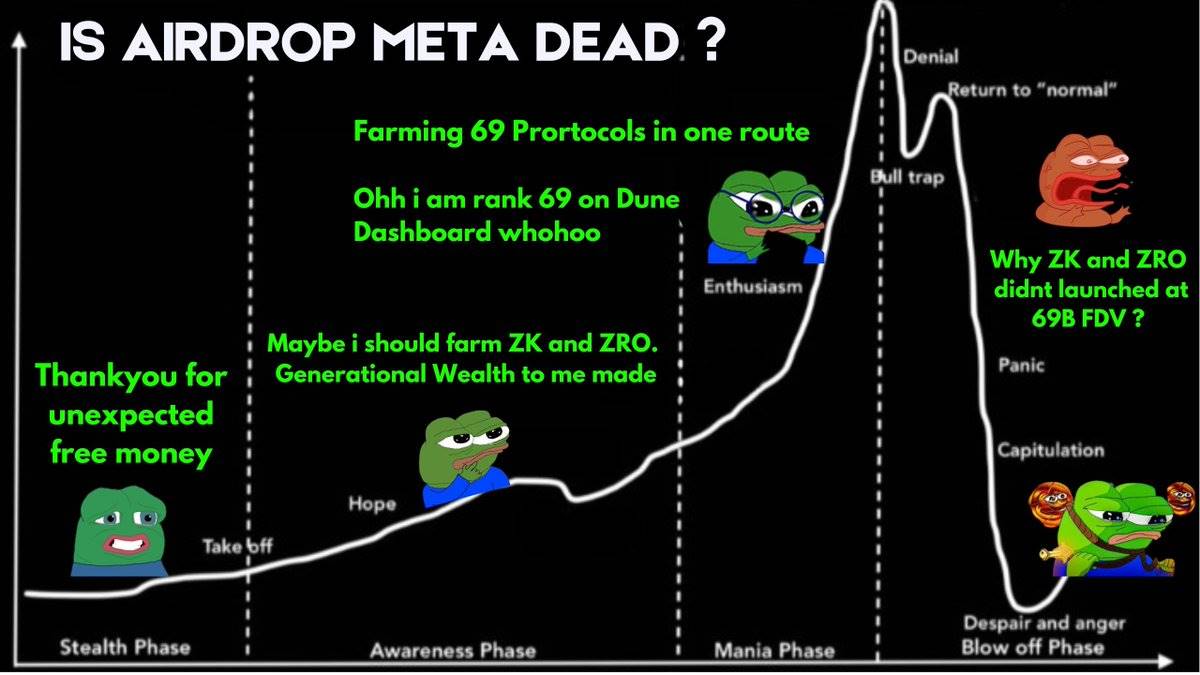

Are airdrops dead?

The short answer is no. The longer answer is that airdrops vary.

It can be understood that in the game, there will always be that kind ofPowerful cheats or strategies that eventually get weakened when too many players start using or abusing them.

The same goes for airdrops, the old methods will be weakened, but it does not mean the game is over.

Before we get started, let’s first analyze which factors have the greatest impact on airdrops and how to use them:

-

Financing and valuation;

-

the extent of hype and dilution;

-

Market sentiment and FDV at the time of release;

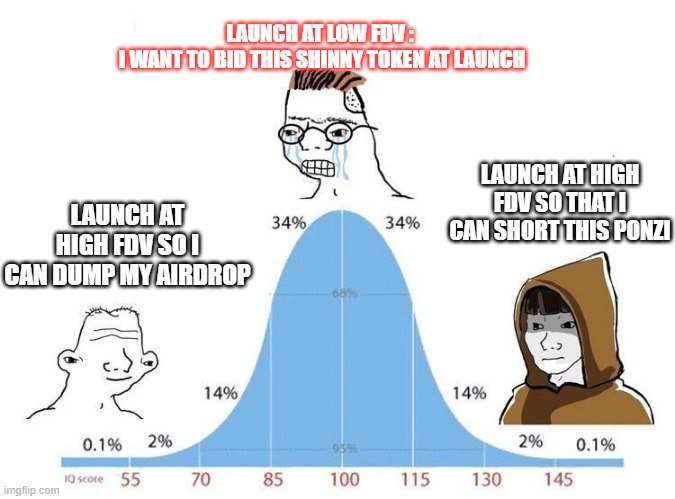

Now, there's a lot of noise about FDV at launch, but I think this is a bigger puzzle:

-

Retail investors want projects to be listed at a lower FDV so they can bid for newTokenAnd profit.

-

The airdrop party hopes to obtain a higher FDV in order toTokenSell at the time of release.

The project is squeezed from two aspects:

-

散户投资者:“你的代币太贵了 我不会为撸毛党提供退出流动性。”

-

Hairy Party/Community"List at a good FDV price, otherwise the airdrop will be peanuts, and we will fool you severely."

The current situation? It's a battle between the project and the hackers.

The project team tried to avoid letting the investors exit easily, while trying to please retail investors by listing the project at a lower FDV.

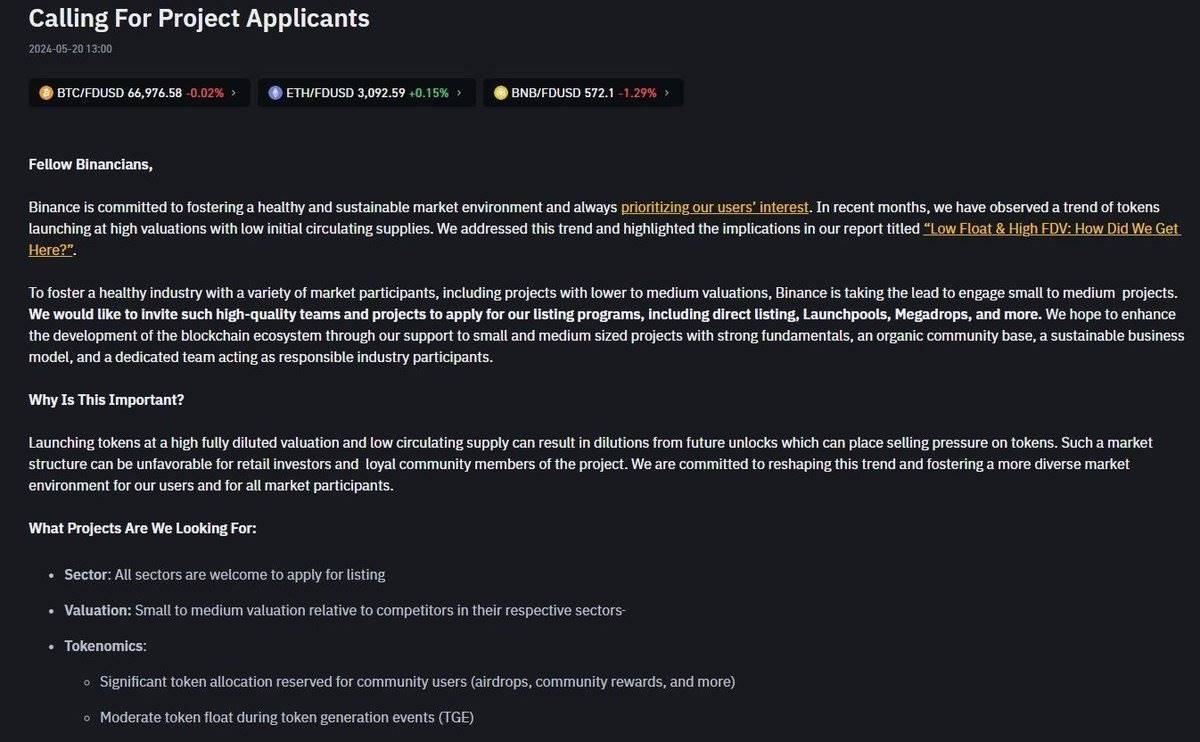

Today, even T1 CEX prefers to release tokens with lower FDV.Retail investors win, you can get VC valuation without vesting.

Recently launched $ and $ZROThat's the situation, and of course there are market conditions.

I think they don't want the investors to have a high exit, but want to sell at a lower valuation and then $SEI and $SUI Then sell it off in bulk later.

Although $W,$DYM and $STRK The situation is different for , which are issued at extremely high FDV (fully diluted valuation) and gradually lose value.

Those who received the airdrop were happy, but there were few market buyers at these valuations. Even staking failed to stop $W The value of fell.

So, factor 1 is actually out of our control. We need to focus on the factors that we can control.

The reason I say this is a good adjustment and a change in strategy is that the current market environment has been severely inflated by certain standards, resulting in an imbalance in the market.

I am reminded of the same situation in the early ICO era, when most IDOs (Initial DecentralizedexchangeThe return on investment of any new token (IPO) can be as high as 100-500 times, and people can make a lot of money with an investment of 50-100 US dollars.

The same thing happened with the early airdrops, where by spending $50-100 in fees, we were able to get a 100x return on the airdropped tokens, equivalent to $5,000 in profits.

Later, this evolved into a pay-to-win situation:

-

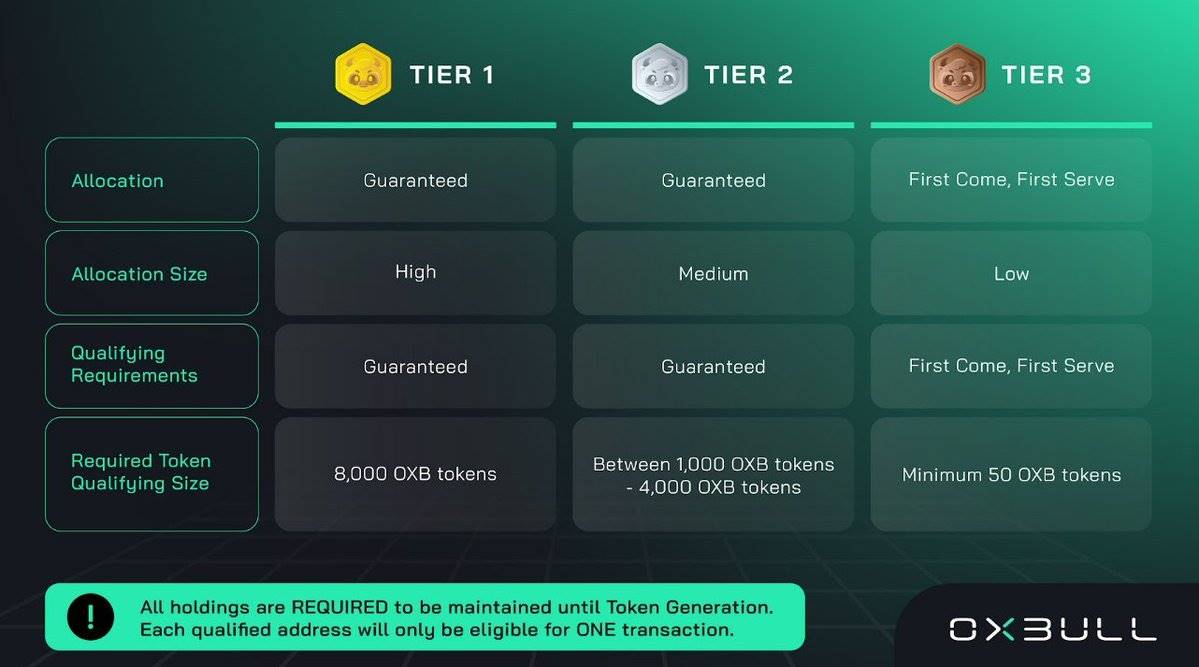

For IDO: Stake our Launchpad tokens to get your allocation.

-

For airdrops: provide liquidity on our chain/protocol and lock up funds.

What are the disadvantages?

With IDOs, when the music stops, the tokens lose value. With airdrops, you need to pray that the protocol doesn’t get hacked.

Anyway, let's move on.

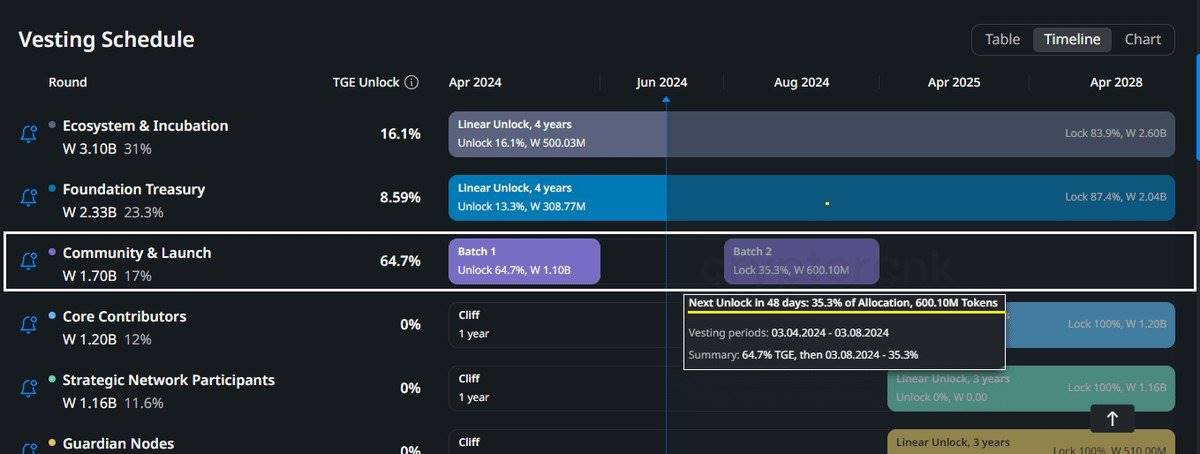

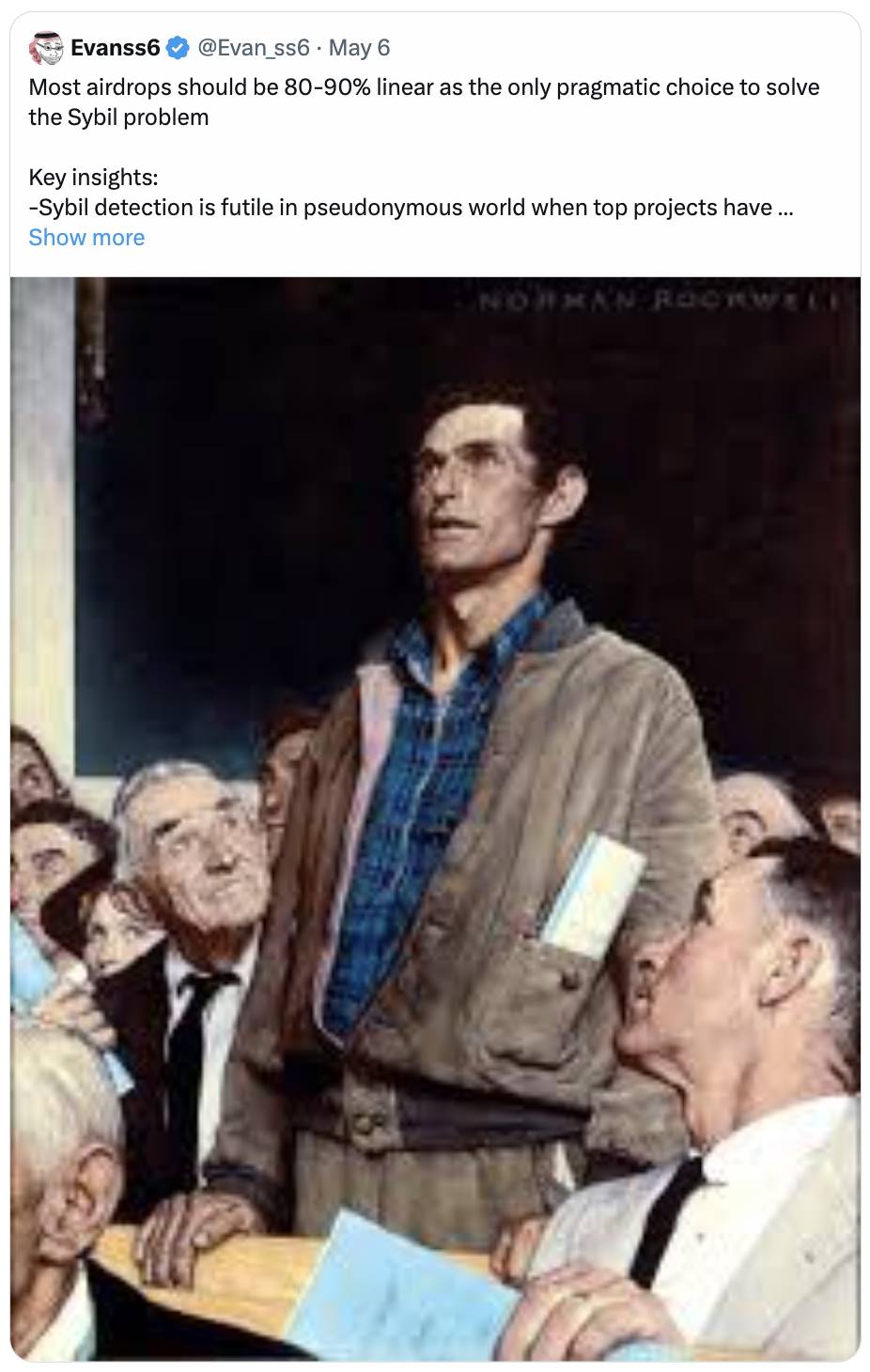

Projects may choose to do linear airdrops, which is not ideal for small-capital investors, so this is another dilemma.

If you have enough funds, then Linear Airdrop might be for you.

(SeeTweets)

For investors with low capital:

As the market environment changes, we need to change some habits:

-

Stop excessively chasing popular airdrops.

-

Stop using those useless Dune dashboards to check rankings, they just inflate random metrics.

None of your favorite protocols use these metrics.

I think these dashboards just put you in a state of mind where you think “I’m not doing my job well” and then you get caught in a vicious cycle of wasting unnecessary money and time trying to meet random criteria in order to rank higher.

For low-capital farmers, there are two strategies:

-

Sybil attack low level allocation: Get small allocations across multiple accounts.

-

Look for projects that are not very popular but have good financing, and participate early.

I think playing with lower tier allocations is a good risk reward strategy where you spend less money and time but still get a good return.

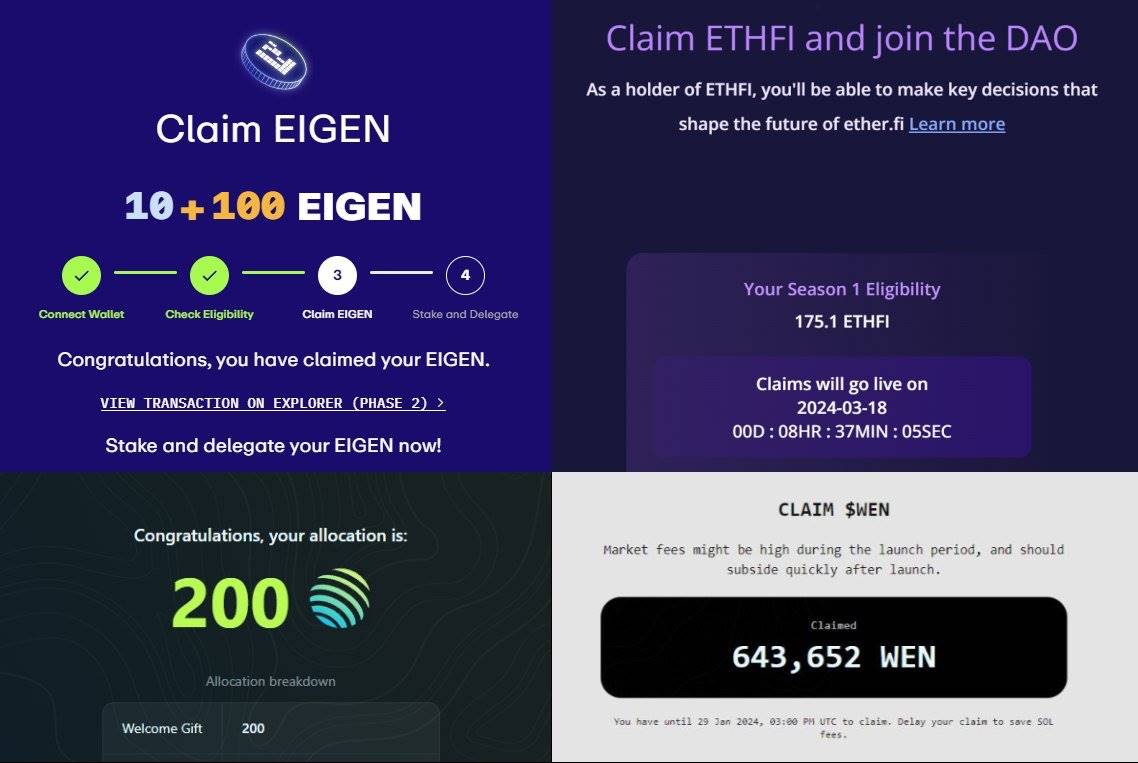

Historically, successful cases of low-level allocation:

-

Etherfi: The last day's deposit earned you $900.

-

Eigenlayer: Invest only $1 in Eigenlayer and get 110 tokens.

-

Jupiter: A few Solana interactions yielded 200 $JUP Tokens and $WEN.

Imagine spending $50 on Pendle YT and being eligible for $800 worth of $ETHFI and 110 $EIGEN.

Even in the worst case scenario, where the items are distributed completely linearly, you haven't wasted much time or money on low-level farming, so the disappointment won't be too great.

For long-term high-level projects (such as $ZRO )

If you end up with someone who has a similar low-level assignment, it might not feel worth it.

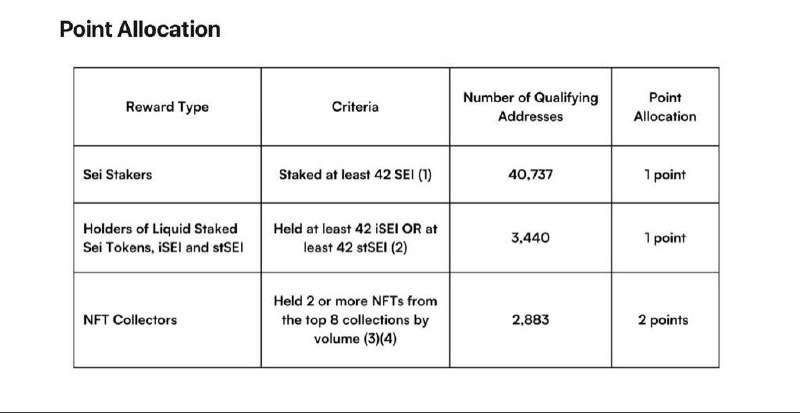

Factor 2: Dilution (or the number of people who buy into the game)

As the number of participants increases, dilution becomes real and rapid.

So the next trend is to farm projects that have raised a decent amount of money but are not very popular (there are many of them).

The fewer the number of Mao Mao Party, the morewalletThe more tokens are allocated, the more

In this case, FDV (fully diluted valuation) is not that important since the tokens are essentially distributed to a small number of farmers.

@KintoXYZ Similar work has been done and may have good results.

Example: Suppose there are two projects that each airdrop 5% of their supply

-

Popular items: Allocated to 100,000 people, a high FDV (fully diluted valuation) is required to satisfy these 100,000 people.

-

Not popular items: To distribute to 10,000 people, only a reasonable FDV is needed.

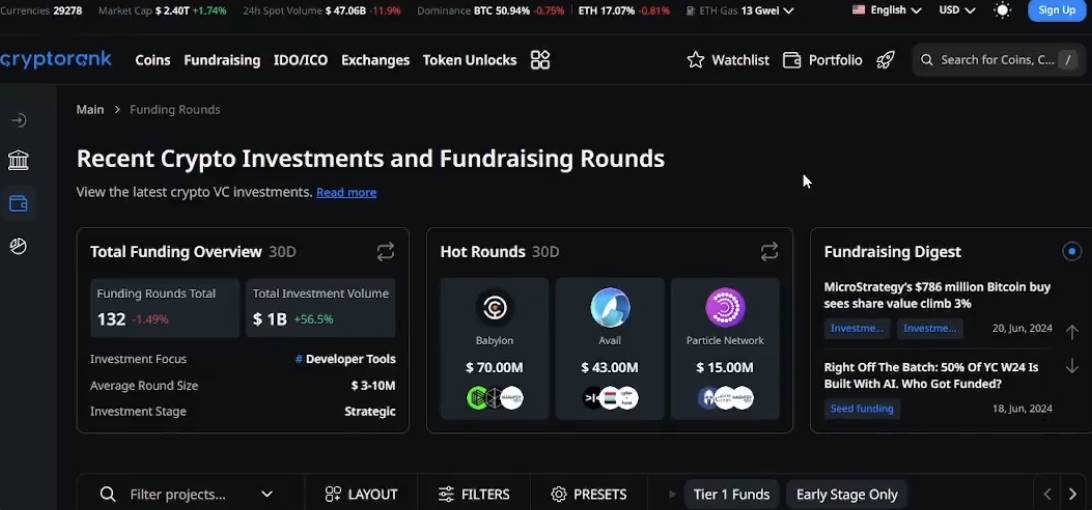

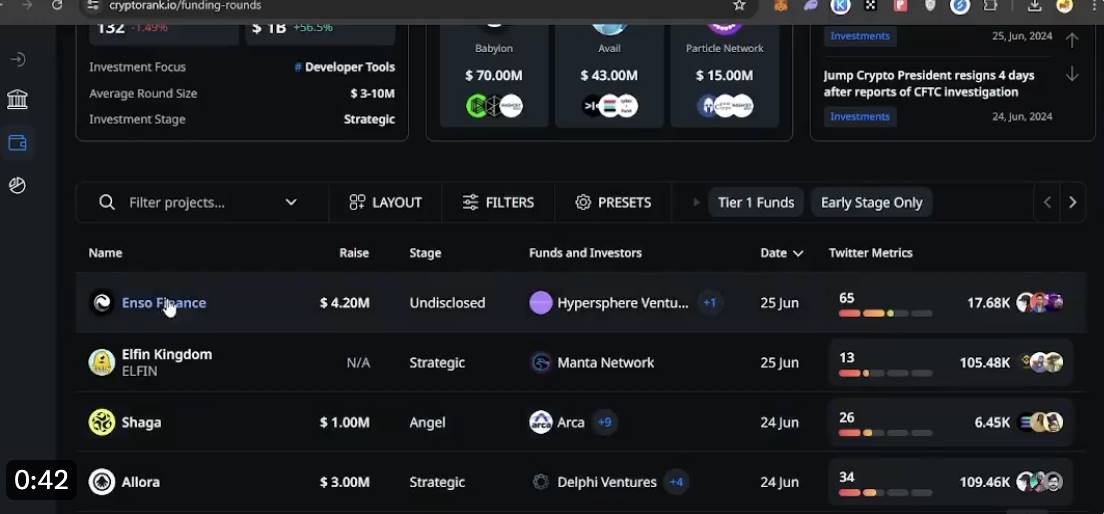

The real question is: How do you find these treasure items?

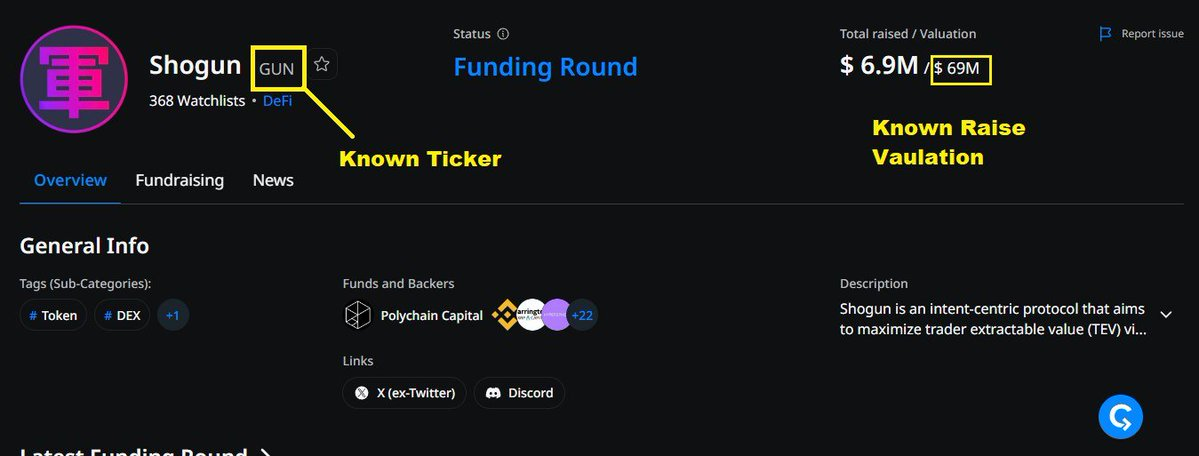

The best tool is Cryptorank.

Use filters, for example, if you want to search for projects that don’t have a token on Solana, go to Filters > Sol Ecosystem.

Now you need to filter further based on the type of protocol you want to farm.

(Seevideo)

I usually filter by: Bridge / Decentralized Finance (DeFi) / Decentralizationexchange(DEX), because these protocols have more on-chain interactions, participating early can leave a good footprint.

(Seevideo)

Once you find a project, check its activity: View their profile activity: Are there any events going on? How many people are involved?

Which projects are most likely to launch a token?

Many protocols have raised significant funding, but their valuations are unknown.

I prioritize them in the following order:

-

Projects with known valuations: This can give you a rough idea of what the FDV will be like at the time of release.

-

Projects backed by specific venture capital firms: More will be discussed in future posts.Xiaobai Navigation

Some VCs are obvious choices. I plan to write a post about this, but from an airdrop perspective, I’m primarily interested in the following VC-backed projects: Jump, Binance, and Multicoin Capital.

Most of these VCs are obviously investing for tokens, and projects backed by Binance have been doing well lately.

Unusual Factoriooo: Second round of airdrop

I don’t think we’ve seen a wave of these types of airdrops yet, but they have the potential and I’ve seen this strategy work well.

80% people left the protocol after the initial token generation event (TGE) because they only received a small amount of tokensBut some people still stayed.

We all laugh at those post-TGE project metrics, but does that mean there are fewer money-grabbing parties now?

Even if the token launch performs poorly, there is still hope like $SEI Just as well bounced back and performed well.

Maybe look for projects that will allocate a large amount of supply to the second round. For example:

-

Parcl: It is very easy to rank up via LP now because PVP is over and if Solana goes up, it can still go up.

-

Wormhole: The next one will be unlocked in a few weeksCommunityAirdrop, trading volume is very low right now.

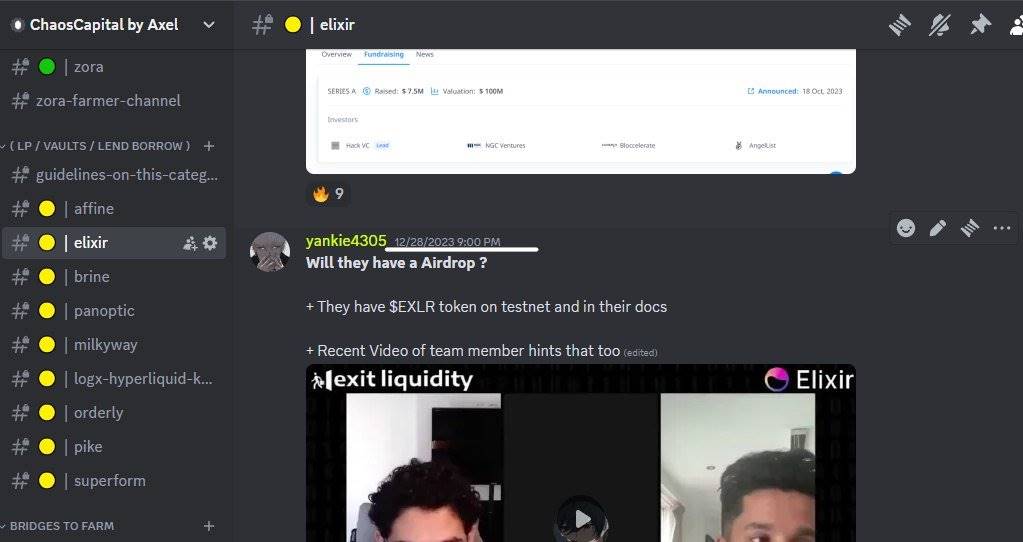

Final Factor: Advantages and Research

Dilution is real now, which is different from the situation during the original airdrop period, when awareness was lower.

It’s best to get involved early, research the project carefully and see if the whitepaper mentions a token. Get some early roles/OATs.

Even if it gets diluted later, it doesn’t matter. We remember when we shared Elixir in Discord, no one was interested in it at the time, but it became popular later. But we got some early roles at that time and left an initial footprint, which may help the airdrop.

For example: Lista DAO Provided a nice airdrop to early OAT holders.

In the current market environment, extracting maximum value is key and there are no shortcuts.Many projects will give you thousands of dollars in airdrops with low investment.

Prioritize projects that are about to start, rather than a two-year medium- to long-term project.

Transferring four-digit gains into hot topics or trends like meme coins and AI, rather than a larger cat-stroking project.

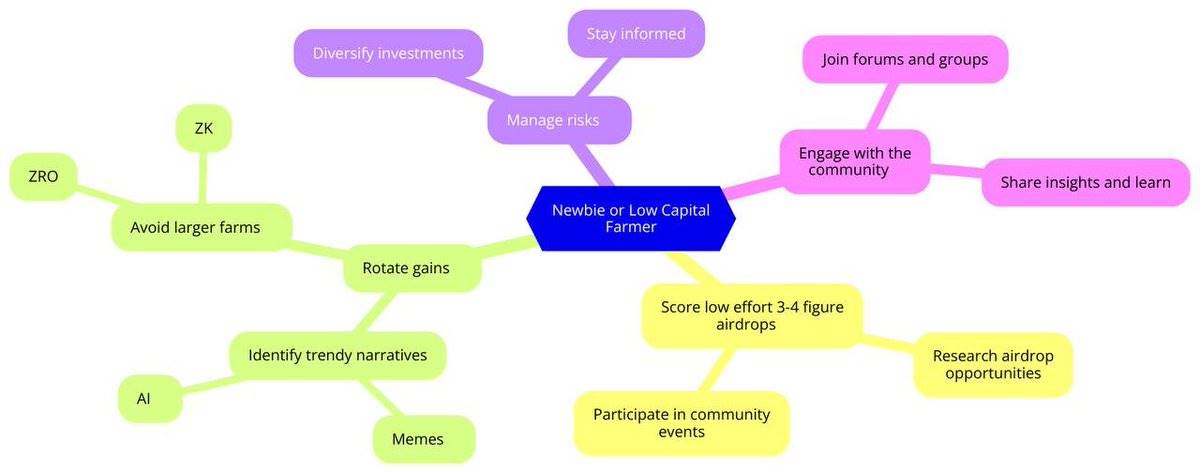

If you are a beginner or a low-capital investor, the best strategy is:

-

Get three to four-digit airdrops with low investment.

-

将这些收益转移到热门话题,如 meme 币、AI 等,而不是更大的空投项目,如 ZRO 和 ZK。

We are near the bottom of the market and altcoins are about to start moving up significantly. Don’t give up and lock up your liquidity in unnecessary long-term gains.

In a unilaterally rising marketmake moneyRelatively easy.

In conclusion, airdrops are not dead.

-

But don’t go overboard chasing hot airdrops just for the Dune dashboard.

-

Try to play low-level allocations (with a good risk-reward ratio).

-

Research projects that are not popular but are well funded and have excellent products, and participate as early as possible.

Welcome to join the official community of Xiaobai Navigation Coderworld

Telegram subscription group:

Official Twitter account:

Twitter English account:

https://x.com/coderworld_Intern

The article comes from the Internet:Airdrops are not dead, but don’t chase hot projects too much

Although Hong Kong has maintained a leading position in the world in Web3 regulation since the declaration was issued, the actual implementation of exchanges and previously approved Bitcoin and Ethereum spot ETFs has always been unsatisfactory. Written by Babywhale, Techub News Just last weekend, the Hong Kong Virtual Asset Trading Platform (VATP) license was approved by the Hong Kong Securities and Exchange Commission (SEC).