Interpreting Universal Protocol: a16z's focus on the packaging asset protocol, allowing tokens to be freely traded across chains

Written by: Xiaobai Navigation Coderworld

When the market cools down, it is better to look for opportunities in new Alpha projects.

Apart fromAIIn addition to Meme, full-chain or chain abstract narrative has always been a hot topic worthy of attention.

In recent days, a new protocol called Universal has emerged that aims to make anyTokenAble to trade on any chain. More importantly, the official Twitter account of the protocol has just been created, and the total number of followers is not large at present; but the attention of a16z is particularly eye-catching.

In the crypto world, there is often no attention without reason, only the alignment of ideas or interests.

Considering that the agreement has not yet announced more information about the investment lineup and listing strategy, it is still in a very early stage and it is unknown whether there is more support from investors behind it; but once there is any sign of movement, paying attention in advance is the right approach to discover opportunities.

Packaging assets + Coinbase custody to achieve full-chain transactions

What problem does Universal solve?

Looking at the current situation of the crypto market, liquidity fragmentation is a long-standing problem, and whether it is chains, projects or users, they are all facing the unspeakable cold start problem:

L1 orL2On the first day of the initial launch, they have no tokens/assets; when the project launches the token, it cannot afford to manage each L1/L2 liquidity on both chains; when using the bridge, users need to lock liquidity on both chains...not to mention the asset transfers between the EVM chain and the non-EVM chain.

Therefore, it is very easy to understand what Universal wants to do - create an asset packaging protocol that enables any token to be traded on any chain. Simplify the above cold start process by providing a seamless on-chain trading experience, eliminating complexity for end users.

To some extent, this can also be regarded as a solution to chain abstraction or asset abstraction.

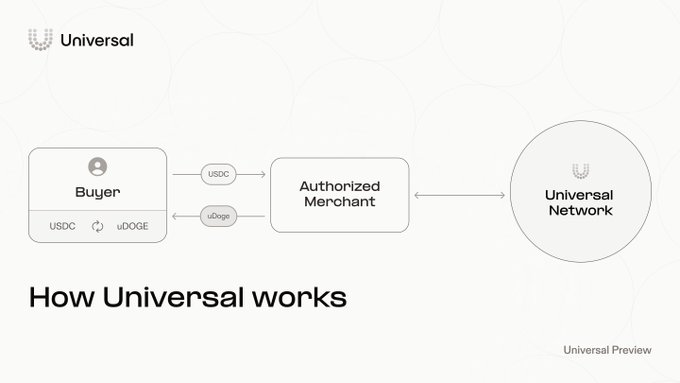

In terms of specific practices, Universal uses apackAsset CustodyIssuing systemTo achieve fast and reliable transactions:

Universal Tokens are a special type of digital asset created by Universal Protocol that represents the value of a native crypto asset (such as Bitcoin, Ethereum, etc.). Each wrapped asset has a 1:1 reserve backing, which means that each wrapped asset has a corresponding amount of native assets as collateral.

For example: uBTC represents wrapped Bitcoin, and uETH represents wrapped Ethereum.

Universal supports issuing and trading assets on EVM (Ethereum Virtual Machine) and non-EVM chains. This means that users canBlockchainSeamlessly trade supported assets between blockchains without the need for cross-chain bridging or transfers to centralizedexchange.

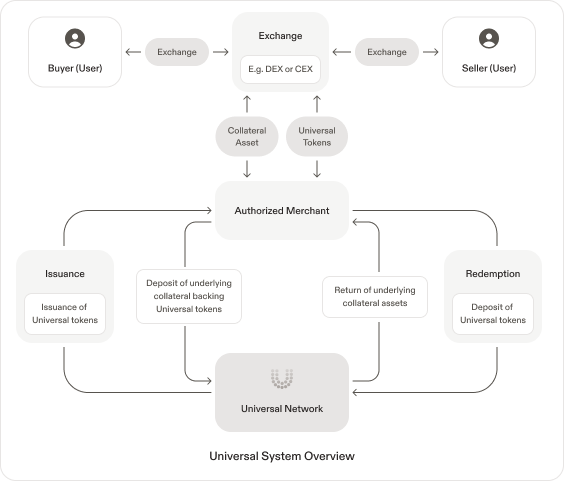

The following figure shows the flow of a packaging asset chain:

-

Issue:

-

Users wish to obtain wrapped assets (e.g. uBTC).

-

The user hands over the native asset (e.g. Bitcoin) to an authorized merchant.

-

Authorized merchants deposit these native assets, and corresponding package assets (uBTC) are issued at a 1:1 ratio based on the deposited amount.

-

Users can obtain uBTC in differentBlockchainOn free trade.

-

Exchange:

-

User inexchangeTrade wrapped assets (e.g. uBTC) on a decentralized exchange (DEX or CEX).

-

买家和卖家通过交易所完成包裹资产的买卖。

-

Redemption:

-

Users want to exchange wrapped assets (such as uBTC) back to native assets (such as Bitcoin).

-

The user hands over the packaged assets (uBTC) to the authorized merchant.

-

Authorized merchants receive package assets and return the corresponding amount of native assets (Bitcoin) to users.

In the above process, a key role is "Authorized Merchants” (Authorized Merchant). When a user purchases Universal Tokens, the authorized merchant will deposit the corresponding native assets as collateral; the corresponding number of Universal Tokens will be issued based on the deposited collateral assets.

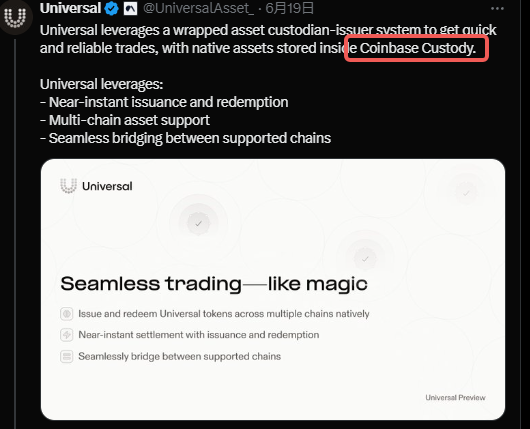

According to public information, Univsersal has currently chosen Coinbase Custody The custodial service is used as the authorized merchant, which means that the original crypto assets will be deposited in the custodial account of Coinbase.

By combining packaging assets with CB custody (merchant authorization mechanism), Universal has achievedBlockchainFreedom betweenSafety, efficiently trade various crypto assets.

Enter DC, early participation method

Currently, the Universal Protocol will be released in three main phases: Developer Preview (now), Universal Testnet, and Universal Mainnet.

For ordinary users, you need to join the official Discord of the protocol to get access to the preview version.

Although the officialXiaobai NavigationThere are no public specific testnet interaction rules and incentive plans, but if you are interested in the project, you can enter the DC before others when it is less crowded.CommunityGetting familiar with people is also a good early choice.

In the official UniversalCommunityCurrently, all newcomers can only speak in the welcome channel regardless of language and country. The official description is that this move is to limit scammers and robots to the greatest extent; real users need to introduce themselves, say hello, and interact with the official account to obtain different DC identity rewards and have the opportunity to enter other channels.

Currently, there are 4 identity designs in the official DC, corresponding to different levels of community participation and contribution. Players interested in the project canVia hereVisit the DC community to start more "killing monsters and upgrading" journeys and obtain preview qualifications for product beta versions.

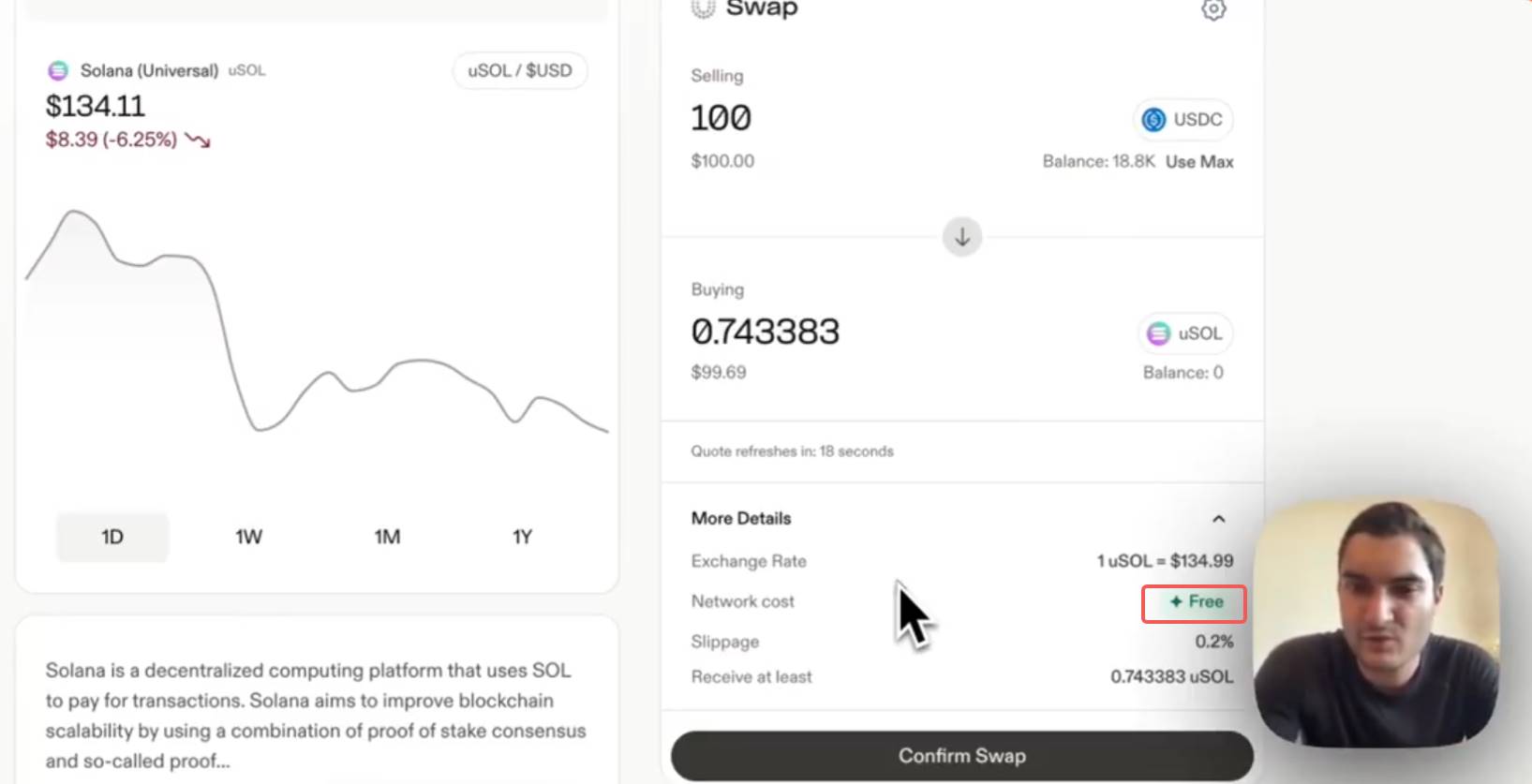

Judging from the demonstration video provided by the official Twitter account, the preview version of the product interface is similar to most DeFi products. Users can choose to use assets on any chain to redeem Universal's wrapped assets (such as uSol in the figure below), and the network fee is free.

Although this does not represent the final effect of the official version, as liquidity fragmentation becomes more and more serious and hot spots on different chains become more and more frequent, a universal asset solution should have its own market.

We will also continue to pay attention to the latest progress and direction of the project, and let us wait and see how it develops in the future.

Welcome to join the official community of Xiaobai Navigation Coderworld

Telegram subscription group:

Official Twitter account:

Twitter English account:

https://x.com/coderworld_Intern

The article comes from the Internet:Interpreting Universal Protocol: a16z's focus on the packaging asset protocol, allowing tokens to be freely traded across chains

CoinEx小白导航成立于2017年12月,始终坚持“用户至上”的品牌理念,提供币币交易、永续合约、杠杆交易、质押借币和策略交易等多种产品及服务。 2024年5月22日,一场由CoinEx在X(CoinEx Global)上发起的题为“以太坊ETF vs高FD…