After the "618" discount, where will the crypto market go?

Written by:Ansem, encrypted KOL

Compiled by: Felix, PANews

Crypto KOL Ansem made a brief analysis of the current situation of the crypto market, which may help people understand the trends of different altcoins and the current position of the market. The following is the full text.

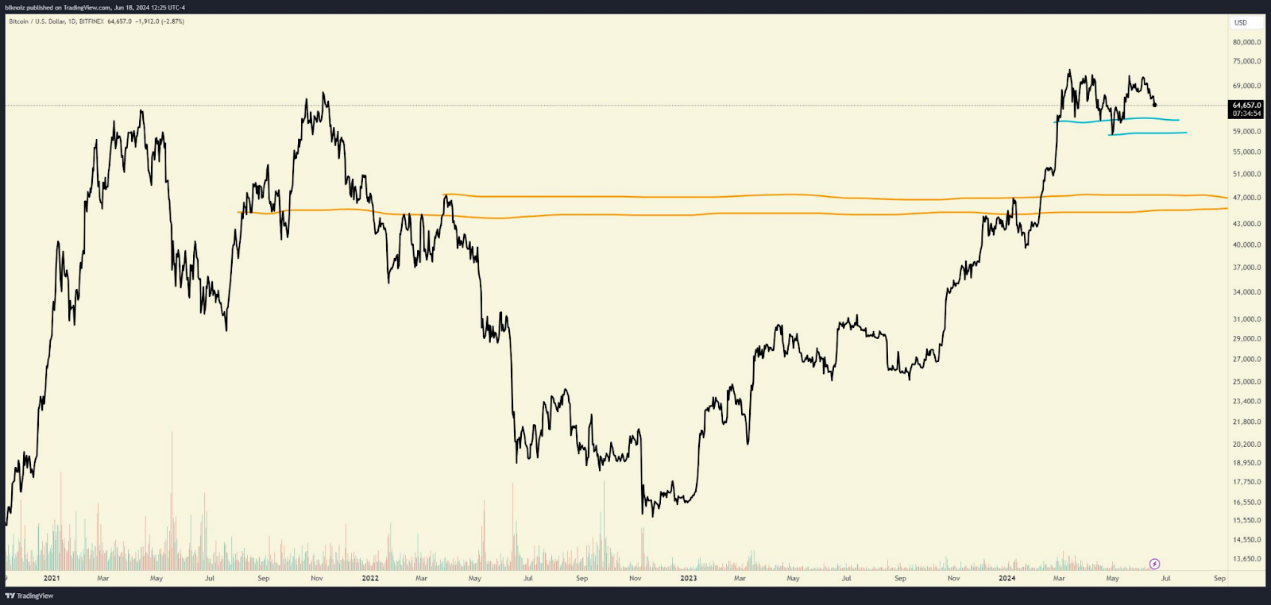

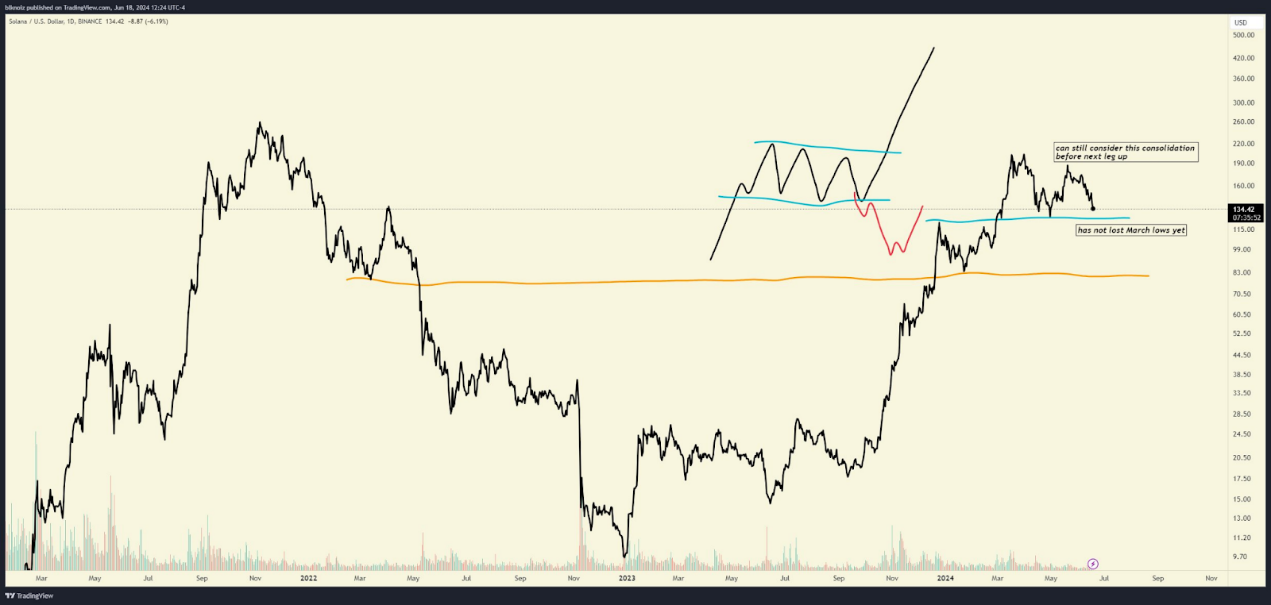

According to the K-line charts of BTC in Figure 1 and SOL in Figure 2, the current prices of BTC and SOL have not fallen below the lows since March 2022, and there is still a possibility of sideways consolidation before the next round of increases.

BTC trend (Figure 1)

SOL trend (Figure 2)

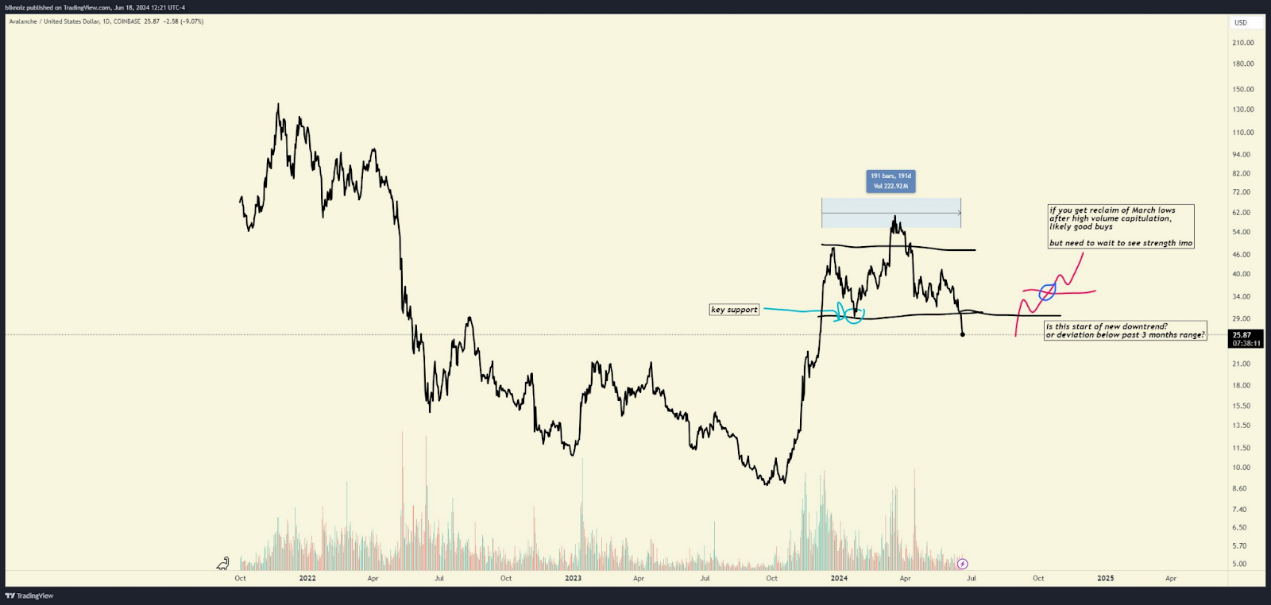

In Figure 3, AVAX (and most altcoins) has traded below its lows from March this year after hovering in a range for about 3 months. Is this the start of a new downtrend? Or is it capitulation before reclaiming key levels? Do you think these altcoins will regain strength and the current sell-off is exaggerated?

AVAX trend (Figure 3)

4) AAVE (older altcoin) has never seen an uptrend in this cycle and remains in the bear market range.

Are you betting that these altcoins will find a new narrative and eventually outperform the rest of the top 100?Token? Or are you betting that they will continue to underperform? What are the catalysts in different scenarios? (e.g. MKR’s Endgame Plan)

AAVE trend (Figure 4)

Most of the high-market-cap Xiaobai NavigationMemes, such as PEPE and WIF, are similar to the trends of BTC and SOL; most newer infrastructures, such as TIA, ALTLAYER, DYM are similar to the trends of AVAX.

Many altcoins peaked in March of this year and have entered a downtrend. It is safe to say that they have already experienced most of the downside and people are only now realizing it. Regardless, a strong narrative is needed for altcoins to outperform from now on.

There are three possible scenarios for the future.

1) BTC and SOL remain strong as outliers, with the current lows remaining unchanged in the past few months of consolidation ($58,000-60,000 and $110-120), while other altcoins digested most of the downside and bottom after the market further consolidated (the author's current view belongs to this situation, and only believes in sideways consolidation/down until the end of Q3/Q4)

2) The second scenario is that BTC and SOL are not outliers, they will eventuallyTokenA similar downward trend is formed.

In this case, we will see a true full-scale "capitulation" in the market, with SOL possibly hitting $85-100 and BTC possibly hitting $48,000-52,000.

3) The possibility of the entire market peaking, which the author believes is very low, but is obviously the worst case scenario. This means that the total market value of all altcoins has only reached 50%, the peak of the previous cycle.

In my opinion, this situation is ridiculous, and the more likely scenario is sideways trading. With the continued flow of BTC and ETH ETFs, and more application development being built across the board, the crypto market is just passively fluctuating with the stock market.

Of course, the above does not include any analysis of the macro economy, nor does it include the situation where stocks are sold off in large quantities, which are also potential risks. Therefore, the above is only the author's personal opinion.

The article comes from the Internet:After the "618" discount, where will the crypto market go?

Well-known companies and products in the financial sector are embracingBlockchain技术和加密货币。 作者:Coinbase 编译:小白导航coderworld 美国顶级上市公司的链上活动比以往任何时候都更加繁忙。 Fortune 100 强公司宣布的链上项目同比增长 39%,并在 2024 年第一季度创…