Why does the Bitcoin ETF continue to receive inflows but the price does not rise?

author:flow

Compiled by: Xiaobai Navigation coderworld

Over the past three weeks, BTC ETFs have seen net inflows of over $2.5 billion. But during this period, the price fell from $71,400 (May 20) to $674,000 (June 12). Why did the price not rise when $2.5 billion in new money flowed into ETFs?

On the surface, we thought this recovery in net inflows should be positive for prices. Surprisingly, this was not the case.

A possible answer?Cash andArbitrage Trading.

Let me explain.

ETF Flows

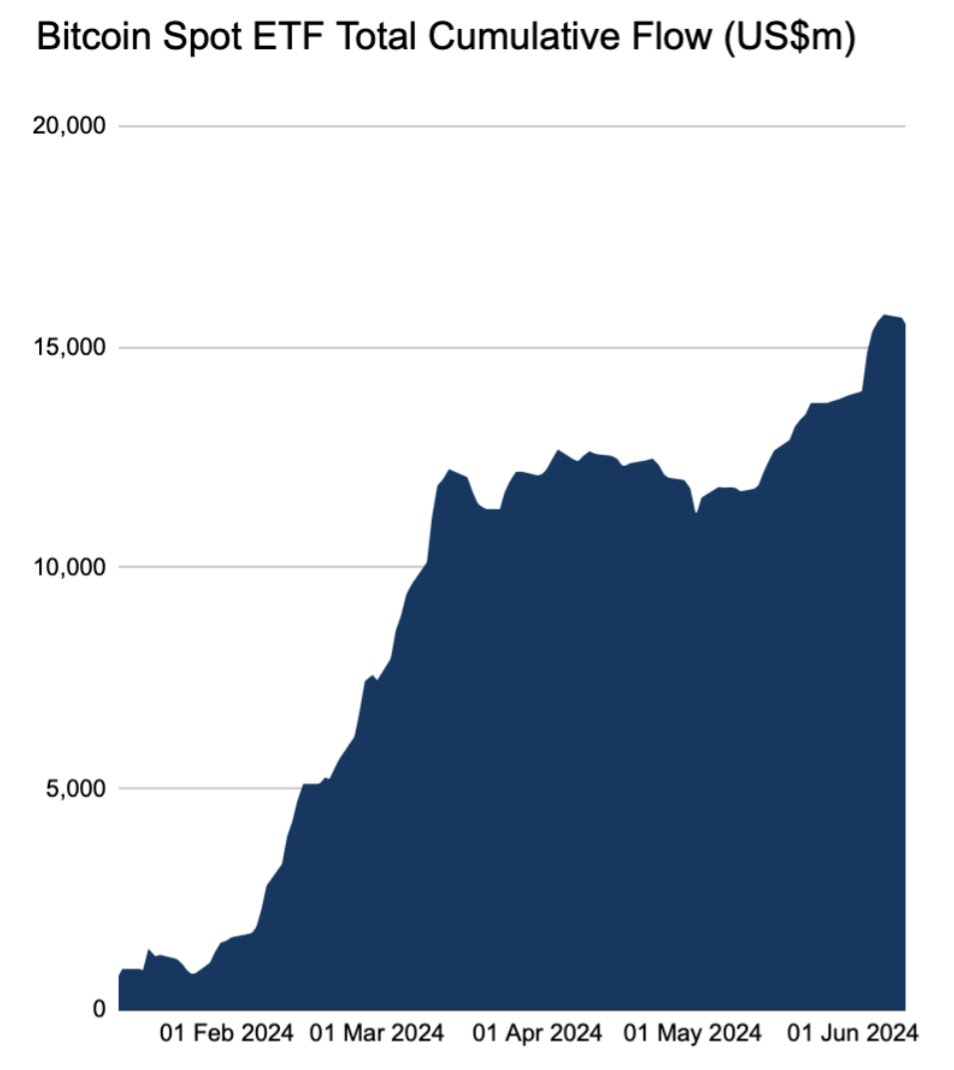

After a long period of consolidation, capital inflows have recently reopened a strong uptrend. But it was followed by a surge in prices. @FarsideUK

Who owns ETFs?

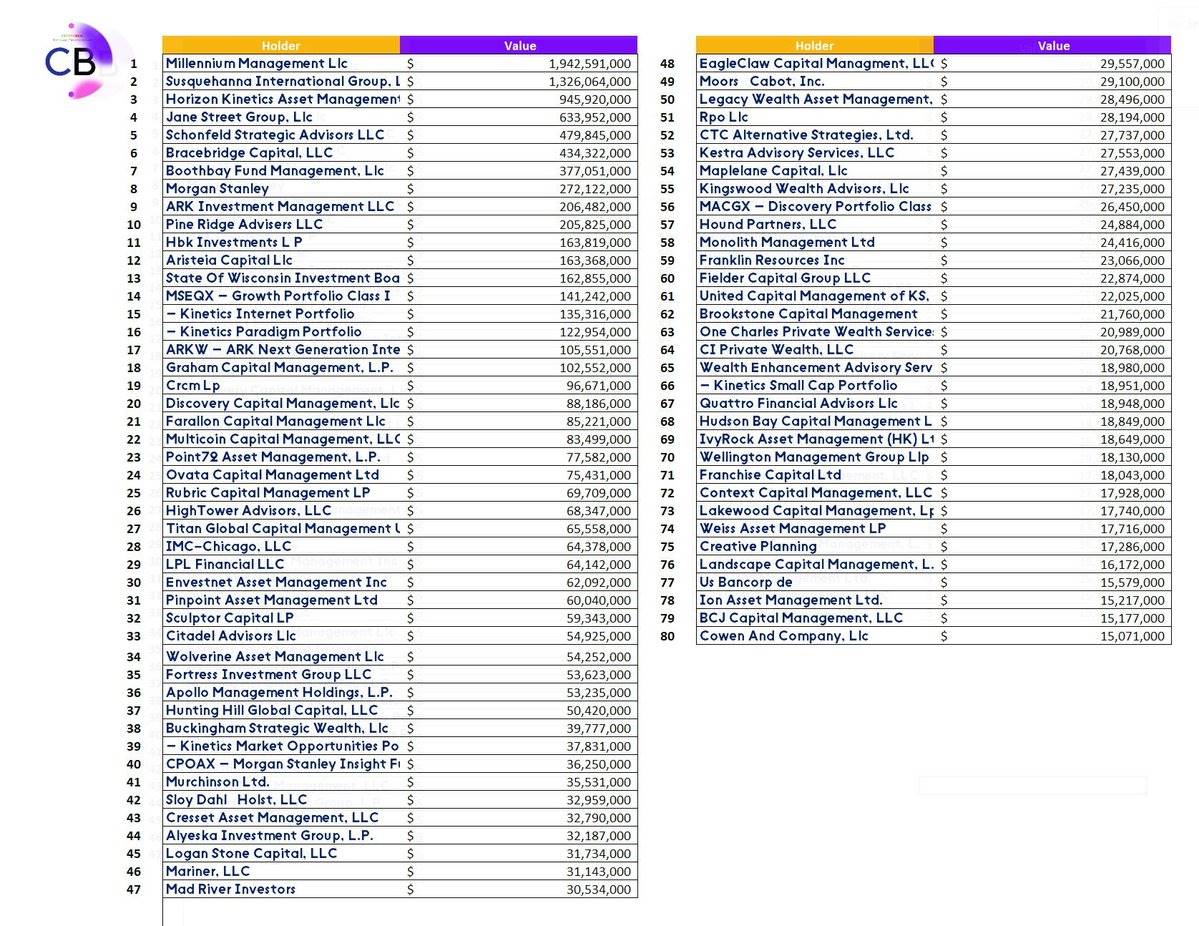

When we look at the top 80 holders of the different BTC ETFs, we see that most of these people are not just “buy and hold” investors. Instead, we see a lot of hedge funds on this list, who often have complex trading ideas. @dunleavy89

CME Futures Market

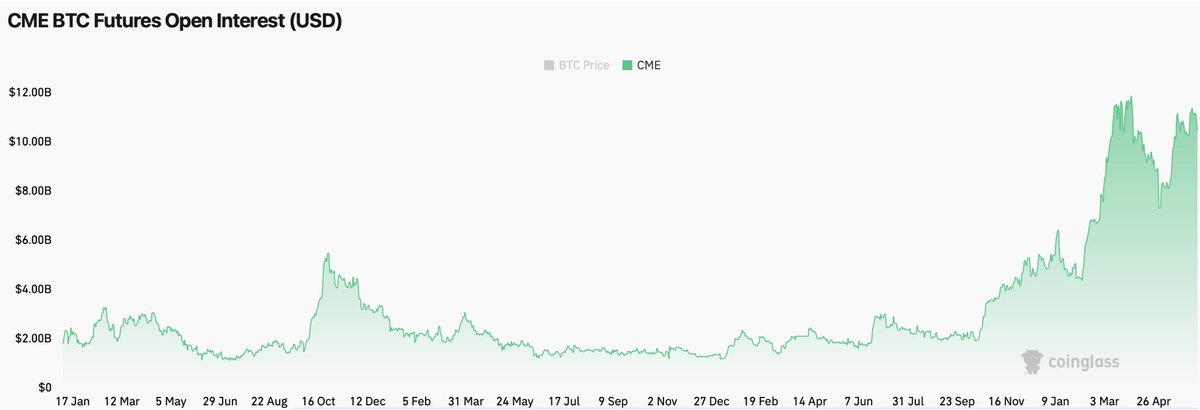

Now on the futures market side, we see that at the same time, the open interest of CME Bitcoin futurescontractIt is also close to the all-time high of $11.5 billion.

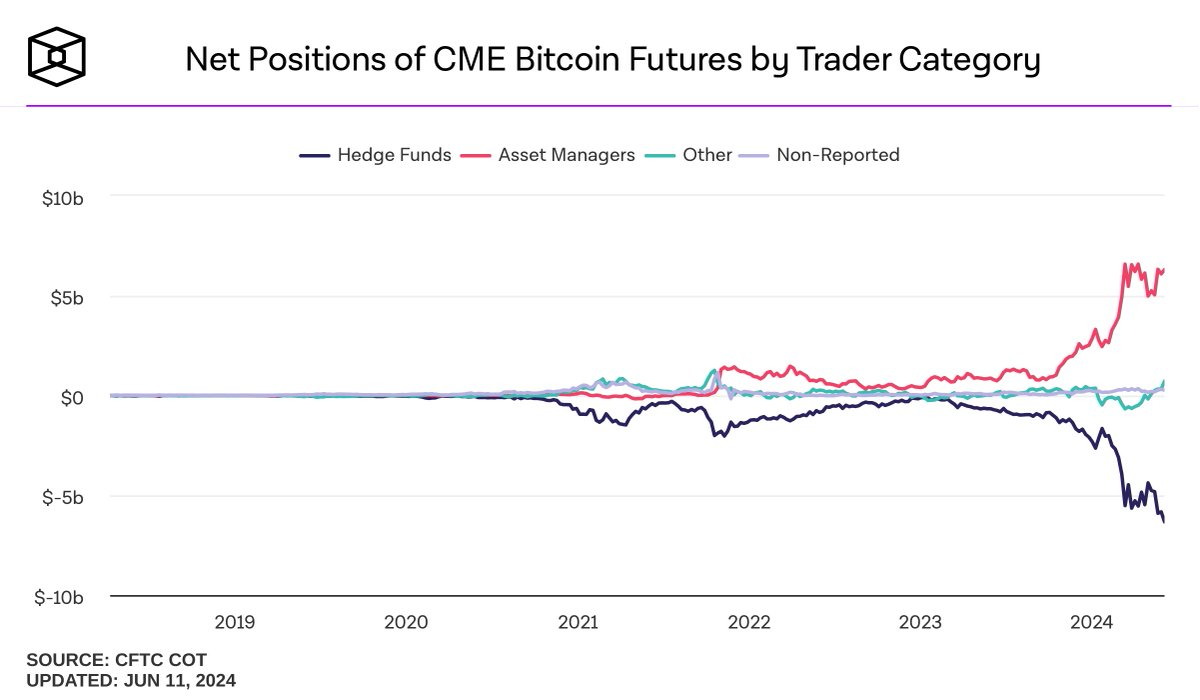

Going a little deeper, we can analyze the net position of CME futures by trader category.

Here we notice that hedge funds have been building up an increasingly large net short position in Bitcoin futures ($6.3 billion net short in CME Bitcoin futures alone).

what does that mean?

One explanation could be that more sophisticated traders are beginning to trade BTC in cash-and-carry transactions, an arbitrage strategy where traders take advantage of the price difference between two similar securities.

Here, it involves going long BTC via the spot ETF and shorting futures by the same amount to capture the basis between the two, thereby establishing a net neutral position.

Therefore, the price risk is zero and the profit potential is huge (theoretically the impact on price is zero).

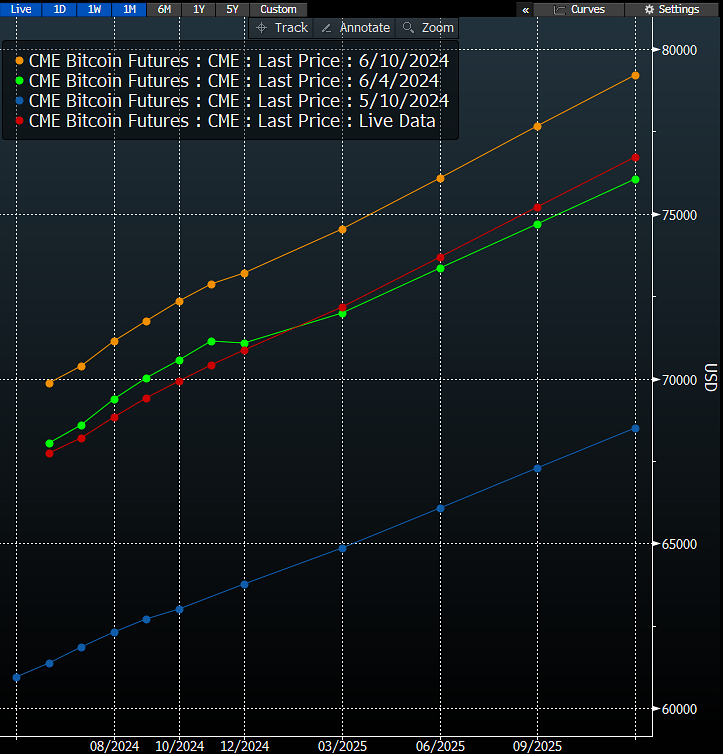

Right now, the returns on this strategy are very attractive and we are seeing strong contango in the market (futures prices are higher than spot prices). @JSeyff

Of course, we don’t know for sure what is happening behind the drawdown, but I think this cash and carry trade is a good explanation for the current situation. If true, it means that a lot of the new money flowing into cash ETFs right now is just a neutral net position (not price-affecting) established by arbitrageurs.

So it's a shame there isn't a ton of new marginal money flowing into the market, which would explain the recent price action. Regardless, it's just an idea that I find attractive. And ideas do change frequently as more data becomes available.

What about you, what do you think about this situation?

The article comes from the Internet:Why does the Bitcoin ETF continue to receive inflows but the price does not rise?

The zkSync system is highly scalable, high performance,Safety性,完全不同于那些不幸被统称为“L2”的其他系小白导航统。 作者:Anthony Rose,zkSync开发者 编译:小白导航coderworld L2 领域在过去几年发生了巨大变化,在以前查看 @l2beat…