Counting the history of Bitcoin billionaires, revealing the secrets of a new round of wealth

Written by:Daniel Phillips & Ali Shutler

Compiled by: BitpushNews Yanan

Many of Bitcoin’s early investors are now billionaires, among the world’s wealthiest people, but their assets may pale in comparison to the vast fortune that Satoshi Nakamoto may have.

比特币及整个加密货币行业的迅猛崛起,成就了数位早期投资者,他们因此一跃成为亿万富豪。

Following the bitcoin price surge at the end of 2020, the Winklevoss brothers once again joined the ranks of bitcoin billionaires.

However, the wealth of Bitcoin's founder, Satoshi Nakamoto, is even more staggering, estimated to be as high as $40 billion, which is far beyond the reach of others.

自 2009 年比特币引领加密货币革命之后,该领域的发展势头迅猛。尽管有些早期用户曾用比特币购买披萨,但加密货币在多数情况下已然成为财富的代称。

It is reported that as of June 2024, 15 of the Forbes billionaires’ real-time rankings have their wealth mainly derived from the cryptocurrency field, a significant increase from 9 in 2023. But it is worth noting that at the beginning of 2024, there were 17 cryptocurrency billionaires on the list, which fully demonstrated the volatility of the cryptocurrency market.

As of the time of this report, Bitcoin's market capitalization has climbed to a staggering $1.3 trillion, accounting for half of the $2.6 trillion global market capitalization of cryptocurrencies. Looking back over the past year, the cryptocurrency market has experienced tremendous growth, with the overall market capitalization soaring by an impressive 134%. As of June 2024, the circulation of Bitcoin has approached 19.7 million, accounting for 94% of its 21 million upper limit, demonstrating Bitcoin's strong market performance.

In this feast of cryptocurrency, early investors play a pivotal role. Many of them keenly grasp the pulse of the market and reinvest their profits in the crypto field, thus achieving an astonishing leap in wealth, from millionaires to billionaires. However, some investors choose to hide their wealth, preferring to quietly enjoy the fruits of this capital feast rather than showing off in the spotlight.

According to authoritative data from BitInfoCharts, there are currently 56 BitcoinswalletThe size of the assets of the world's largest financial institutions has exceeded the 1 billion US dollar mark. However, after an in-depth analysis of these data, we found that the holders of these huge fortunes are not all individual investors, but also companies or enterprises.

In addition, there are several crypto whales who choose to remain anonymous, and some of them have never even touched their huge Bitcoin assets. This makes people wonder if they have lost their private keys?

Reports show that holding Bitcoin can significantly improve the performance of an investment portfolio. Therefore, it is not difficult to infer that many billionaires may have already dabbled in Bitcoin investment. But in this list, we focus on counting the big players who have accumulated wealth mainly through Bitcoin, revealing how they emerged in the tide of cryptocurrency and eventually reached the pinnacle of wealth.

Tim Draper ($2 billion)

Tim Draper, a Silicon Valley venture capitalist, has accumulated his wealth mainly through accurate traditional investments. However, he became famous in 2014 when he bought nearly 30,000 bitcoins seized from the Silk Road dark web at a price of $630 per coin. In the same year, he asserted that Bitcoin would break through the $10,000 mark within three years, and the fact was only one month away from his prediction.

Although his prediction that Bitcoin would reach $250,000 by the end of 2022 did not come true, this did not dampen his enthusiasm for the crypto market. In April 2024, he once again made a shocking statement: "From $250,000 to $10 million, there is no limit to Bitcoin's price."

In addition, DraperBlockchainand intelligencecontractHe has also dabbled in the field and invested in many related companies. In order to further explore the potential of the encryption market, he founded Draper Goren Blockchain (DGB), a venture capital studio focusing on this field, in September 2023.

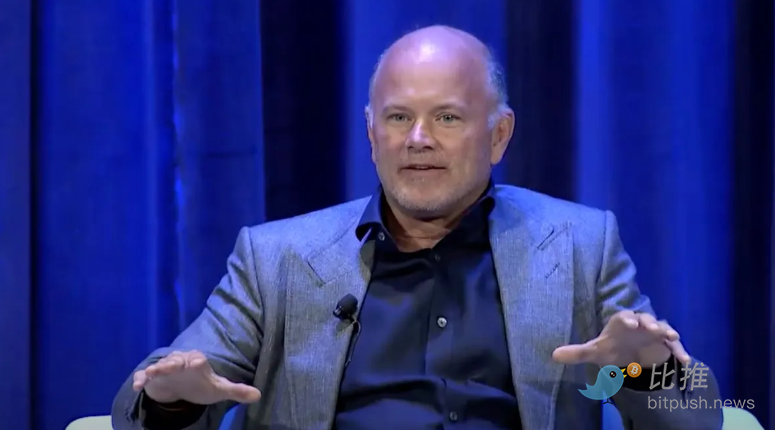

Michael Novogratz ($2.5 billion)

Novogratz started his career at Goldman Sachs in 1989 and became a regular on the billionaires list. However, in 2013, his wealth shrank by two-thirds. It was also in this year that he began to invest in Bitcoin.

Since then, he has devoted himself to the crypto market and invested extensively in start-ups and variousToken, and created digital assets andBlockchainCompany Galaxy.

但他的加密投资道路并非一帆风顺。他曾对与算法稳定币 TerraUSD 相关联的代币 Luna 抱有极大期望,然而,2022 年的市场崩盘对他造成了不小的打击。这场风波可能是导致他身家从 2021 年的 48 亿美元大幅缩水至现今 25 亿美元的重要因素。尽管如此,Novogratz 对加密市场的信心与热情并未受到影响。2024 年 6 月,他信心满满地预测,比特币在年底前有望突破 10 万美元大关。

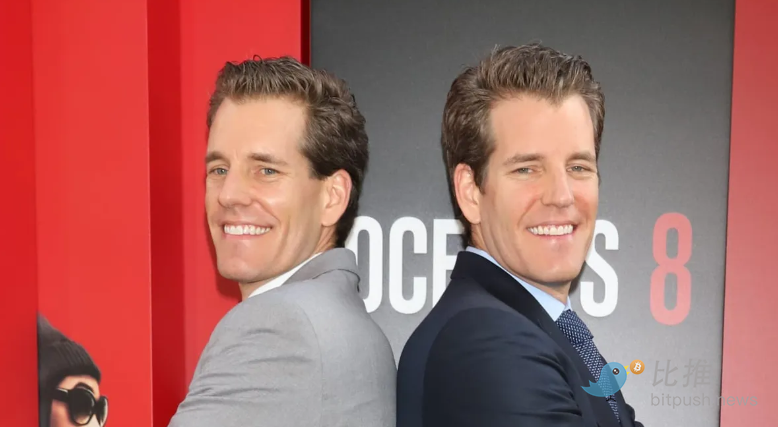

Winklevoss brothers ($2.7 billion)

You may know that Cameron Winklevoss and his twin brother Tyler have accused Mark ZuckerbergstealThey took their idea for Facebook, but you might not know that they also went on to have a new chapter as cryptocurrency evangelists after The Social Network.

Two brothers teamed up to create a cryptocurrencyexchange——Gemini. However, after the crypto market suffered a heavy blow in 2022, Gemini fell into trouble due to the bankruptcy of cryptocurrency lending company Genesi.

Still, they hold about 70,000 bitcoins, enough to make them a multibillion-dollar fortune, some of which they used to invest $4.5 million in ninth-tier American football club Real Bedford.

Jed McCaleb ($2.9 billion)

Soon after Bitcoin was introduced, McCaleb was inspired to create a marketplace for users of Magic: The Gathering and founded the first Bitcoin exchange.exchangeIn February 2011, he sold the startup exchange for an undisclosed price to a developer who could take it to new heights, while retaining a minority stake in the company.

However, in the following years, Mt. Gox suffered a series of hacker attacks and was eventually forced to close in 2014, although at the time, it was still responsible for processing up to 70% Bitcoin transactions.

It is worth mentioning that McCaleb did not stop during his time at Mt. Gox. He founded the Ripple cryptocurrency network in 2011 and co-founded the Stellar cryptocurrency network in 2014.

Matthew Roszak ($3.1 billion)

Matthew Roszak,BlockchainThe co-founder of infrastructure provider Bloq is a pioneer in the field of cryptocurrency. He bought his first Bitcoin in 2012 and praised it as "one of the greatest technological, financial, industrial and humanitarian innovations today." He has since invested in more than 20 Bitcoin startups, including BitFury and BitGo, demonstrating his keen business insight. In addition, Roszak also advocated giving $50 in digital assets to each member of Congress. Although the feedback was mixed, this move undoubtedly made a positive attempt to popularize and promote cryptocurrency.

Jean-Louise van der Velde ($3.9 billion)

After years of working in the tech sector, Jean-Louis van der Velde co-founded the cryptocurrency exchange Bitfinex in 2013, which is still regarded as one of the longest-running and most liquid large exchanges. He also served as CEO of stablecoin issuer Tether until 2023. However, he is rumored to still own about 20% of Tether shares.

Paolo Ardoino ($3.9 billion)

Ardoino took over as CEO of Tether after van der Velde left and became the company's new public spokesperson. He started his career as a programmer and joined Bitfinex as a senior software developer in 2014. As Tether rose to become a top crypto stablecoin issuer, he also began to participate in Tether's operations. Last year, the company's interest income reached $6.2 billion, and as a major shareholder of 20%, Ardoino also reaped significant returns.

Michael Saylor ($4.8 billion)

Saylor is one of the most loyal supporters of Bitcoin. He once vividly compared the cryptocurrency to "a group of network bumblebees serving the goddess of wisdom". He has long been a staunch supporter of Bitcoin, but his attitude towards Ethereum seems to have changed recently.

In 1989, he co-founded the software company MicroStrategy. Subsequently, the company purchased a large amount of Bitcoin as a corporate financial asset. As of March 2024, MicroStrategy reportedly holds Bitcoin worth $13 billion, and Saylor himself holds more than $1.2 billion in cryptocurrencies. It is worth mentioning that he revealed in 2020 that he holds 17,732 Bitcoins.

Giancarlo Devasini ($9.2 billion)

Giancarlo Devasini serves as the CFO of stablecoin issuer Tether and reportedly holds 47% of the company’s shares. Tether is the third-largest cryptocurrency by market cap, with more than 100 billion Tether tokens issued. The company is also one of the world’s largest Bitcoin holders, with Bitcoin holdings worth more than $5 billion.

Brian Armstrong ($10.9 billion)

Brian Armstrong, a former Airbnb software engineer, co-founded the San Francisco-based cryptocurrency exchange Coinbase in 2012. Coinbase is the top crypto exchange in the United States, and he currently owns about 19% of the company. Coinbase successfully went public in 2021 with a valuation of up to $100 billion, but as of June 2024, its valuation has fallen back to about $62.6 billion. Despite this, the exchange still achieved a profit of $273.4 million in the fourth quarter of 2023. In February of this year, Armstrong sold his Coinbase 2% stake, cashing out $53.2 million, which he then injected into some cutting-edge startups, including NewLimit, the life extension company he founded.

Changpeng Zhao (worth $33 billion)

Binance, the world's largest cryptocurrency exchange, is reportedly controlled by founder Changpeng Zhao, who holds a stake in the company 90%. Founded in 2017, Binance quickly raised $15 million through an initial coin offering (ICO) (although this figure has been disputed). Since then, the company has been gaining momentum. By 2023, the exchange has accounted for half of centralized cryptocurrency spot trading. But in the same year, CZ suffered a setback and Binance was forced to pay a $4.3 billion fine due to a settlement with the US government. CZ also resigned as CEO for pleading guilty to money laundering and was sentenced to four months in prison, starting in June 2024. He will become the "richest man" in a US prison.

Satoshi Nakamoto (worth $76.67 billion)

比特币的神秘创始人,化名中本聪(Satoshi Nakamoto),自 2008 年 10 月 31 日发布题为《比特币:点对点电子现金系统》(Bitcoin: A Peer-To-Peer Electronic Cash System)的白皮书以来,便一直未曾公开露面。该白皮书详细阐述了他对基于区块链的数字货币的独到见解。自此,比特币在快速发展的加密货币行业中独占鳌头,然而,中本聪的真实身份依旧是个谜。

值得一提的是,中本聪仍持有约 110 万枚比特币,且从未进行任何交易。这些比特币宛如石沉大海,甚至被外界普遍认为已经遗失。但倘若这些比特币有朝一日从中本聪的钱包中流出,必将掀起轩然大波,这也将成为证明这位神秘的比特币创造者依Xiaobai NavigationStrong evidence of his survival.

The article comes from the Internet:Counting the history of Bitcoin billionaires, revealing the secrets of a new round of wealth

Bitcoin Asia will be held at the Kai Tak Cruise Terminal in Hong Kong from May 9 to May 10. The unprecedented Bitcoin event, Bitcoin Asia, will be held at the Kai Tak Cruise Terminal in Hong Kong from May 9 to May 10. At that time, there will be more than 100 people with global…